Cabot's (CBT) Earnings Top Estimates in Q2, Revenues Lag

Cabot Corporation CBT recorded second-quarter fiscal 2024 (ending Mar 31, 2024) earnings of $1.49 per share, up from the year-ago quarter's $1.29.

CBT posted adjusted earnings of $1.78 per share, up from the year-ago quarter figure of $1.33. It surpassed the Zacks Consensus Estimate of $1.66.

The company’s net sales in the fiscal second quarter were $1,019 million, which missed the Zacks Consensus Estimate of $1,054.1 million. Net sales decreased around 1.4% from the prior-year quarter.

Cabot Corporation Price, Consensus and EPS Surprise

Cabot Corporation price-consensus-eps-surprise-chart | Cabot Corporation Quote

Segment Highlights

Reinforcement Materials’ sales increased around 0.6% year over year to $676 million in the reported quarter, beating the Zacks Consensus Estimate of $667 million. Earnings before interest and tax (EBIT) in the segment were $149 million, up around 22% from the year-ago quarter. The rise in EBIT was primarily driven by greater unit margins resulting from higher pricing and product mix in 2024 customer agreements, as well as higher volumes in Asia and Europe.

Sales in the Performance Chemicals unit went down around 4.6% year over year to $311 million, missing the Zacks Consensus Estimate of $319 million in the reported quarter. EBIT increased around 10.7% to $31 million. The improvement in EBIT was primarily driven by increasing volumes. Higher volumes were mostly due to growth in the specialty carbons and specialty compounds product lines.

Financials

Cabot ended the second quarter of fiscal 2024 with cash and cash equivalents of $206 million. During the quarter, cash flows from operating activities were $176 million.

Capital expenditures totaled $43 million. During the quarter, cash was also used for dividend payments of $23 million and share repurchases of $24 million.

Outlook

The company anticipates Reinforcement Materials to continue generating strong results. Further, it is witnessing some positive demand signals in Performance Chemicals, CBT noted. The company now expects adjusted earnings per share for fiscal 2024 in the range of $6.65-$6.85.

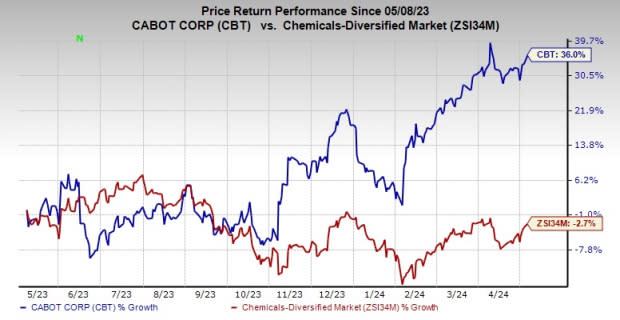

Price Performance

Shares of Cabot have surged 36% in the past year against a 2.7% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

CBT currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth a look in the basic materials space include Gold Fields Limited GFI, sporting a Zacks Rank #1 (Strong Buy), and Valvoline Inc. VVV and American Vanguard Corporation AVD, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GFI’s first-quarter earnings is pegged at 22 cents per share. The figure has been stable in the past 60 days.

Valvoline is slated to report fiscal second-quarter results on May 8. The consensus estimate for VVV’s second-quarter earnings is pegged at 36 cents per share. The company’s shares have rallied around 27% in the past year.

American Vanguard is expected to report first-quarter results on May 14. The consensus estimate for AVD’s first-quarter earnings is pegged at 8 cents per share, indicating a year-over-year rise of 14.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gold Fields Limited (GFI) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

American Vanguard Corporation (AVD) : Free Stock Analysis Report

Valvoline (VVV) : Free Stock Analysis Report