Cipher Mining Inc (CIFR) Surpasses Analyst Revenue Forecasts in Q1 2024

GAAP Net Income: Reported at $40 million, significantly exceeding the estimated $2.62 million.

Non-GAAP Adjusted Earnings: Reached $63 million, showcasing robust financial performance.

Revenue: Totaled $48 million for the quarter, falling slightly below the estimated $50.75 million.

Earnings Per Share (EPS): Achieved $0.13, surpassing the estimated $0.01.

Hash Rate Growth: Current self-mining hash rate stands at approximately 7.7 EH/s, with a target to increase to about 9.3 EH/s by the end of Q3 2024.

Expansion Plans: Construction at the new Black Pearl data center is progressing, with a full 300 MW capacity expected to be operational by 2025.

Investment in Infrastructure: Continued investment in expansion, including a 30 MW expansion at Bear and Chief JV data centers.

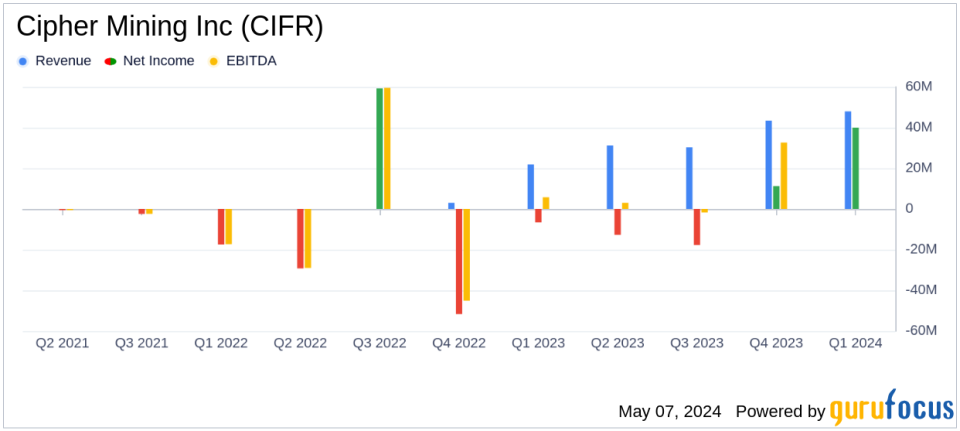

On May 7, 2024, Cipher Mining Inc (NASDAQ:CIFR) announced its financial results for the first quarter ended March 31, 2024, revealing a substantial increase in revenue and net income. The company reported a GAAP net income of $40 million and non-GAAP adjusted earnings of $63 million, with revenues reaching $48 million. This performance significantly exceeds the analyst's revenue estimate of $50.75 million for the quarter. For further details, refer to Cipher Mining Inc's 8-K filing.

About Cipher Mining Inc

Cipher Mining Inc is at the forefront of the Bitcoin mining sector in the United States, focusing on the development and operation of bitcoin mining data centers. The company is committed to enhancing the infrastructure critical to the Bitcoin network, positioning itself as a leader in the cryptocurrency mining industry through strategic expansions and technological innovations.

Q1 Performance Highlights

The first quarter of 2024 was marked by robust financial outcomes for Cipher Mining Inc, with a recorded revenue of $48 million from bitcoin mining, a significant leap from $21.895 million in the same quarter the previous year. The company's strategic expansions, including the ongoing construction of the Black Pearl data center, are set to further enhance its mining capabilities. Cipher's CEO, Tyler Page, highlighted the company's strong financial position and the accelerated construction plans for the new data center, expected to significantly increase the self-mining hash rate capacity in the coming years.

Financial Statements Insight

The balance sheet of Cipher Mining Inc as of March 31, 2024, shows total assets of $677.141 million, up from $566.137 million at the end of 2023. This increase is supported by significant holdings in Bitcoin and derivative assets. The company's liabilities stood at $76.217 million, with stockholders' equity amounting to $600.924 million, indicating a strong equity position.

From the income statement, the company's operational efficiency is evident with an operating income of $46.786 million for the quarter, a stark contrast to a loss of $4.121 million in the prior year. This turnaround is primarily due to gains on the fair value of Bitcoin and effective cost management in operations.

Strategic Developments and Future Outlook

Cipher Mining Inc's strategic initiatives, such as the expansion at Bear and Chief JV data centers and the development of the Black Pearl data center, are crucial to its growth trajectory. These developments are expected to increase the company's self-mining capacity substantially by the end of 2025. The management remains optimistic about maintaining a leading position in the industry, supported by strong unit economics and effective execution of expansion strategies.

Overall, Cipher Mining Inc's Q1 2024 results not only surpassed analyst expectations in terms of revenue but also set a positive tone for its operational and strategic endeavors in the upcoming periods. With a clear focus on expanding its mining capacity and enhancing operational efficiencies, Cipher is well-positioned to capitalize on the growing demand for Bitcoin mining infrastructure.

For detailed insights and further information, investors and interested parties are encouraged to attend Cipher's business update call or access the webcast through their investor relations website.

Explore the complete 8-K earnings release (here) from Cipher Mining Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance