With monetary policy dynamics presenting a complex narrative, investors of gold mining enterprise Newmont (NYSE:NEM) have been left frustrated recently. Nevertheless, the fear trade – or the push to safe-haven assets amid concerns about economic and societal stability – should benefit the precious metals ecosystem over the long run. By logical deduction, then, I am bullish on NEM stock.

Monetary Policy Bingo Stymies NEM Stock

Fundamentally, one of the most powerful catalysts for gold is inflation. Since commodities are priced in dollars, rising consumer costs present a tailwind for the yellow metal. Further, anticipation of higher prices also helps buttress the precious metal. However, the recent monetary policy game of bingo has left many stakeholders of NEM stock seasick.

As society gradually recovered from the COVID-19 malaise, the Federal Reserve had the unenviable task of attempting to unwind the cheap money that had penetrated the financial system. With the benchmark interest rate soaring, gold had nowhere to go but down. Likewise, NEM stock suffered alongside the underlying market.

However, as time went on, it became apparent that even with the Fed’s intervention, inflation was stickier than expected. With the central bank admitting that consumer prices were accelerating beyond its target, NEM stock and other miners responded positively. Then, the latest jobs report dampened the gold bugs’ party.

In April, employers added 175,000 jobs, falling below the 240,000 jobs that economists had forecasted. As well, the latest tally fell well short of March’s gain of over 300,000. Essentially, a soft labor market may mean that the Fed’s prior efforts are beginning to pay off. Subsequently, a disinflationary environment would not be particularly helpful for precious metals.

Still, inflation represents only a partial picture.

Geopolitically Driven Fear Trade Should Boost Newmont

Up until the April jobs report was released, concerns began shifting toward the possibility of future interest rate hikes rather than cuts. Fundamentally, the catalyst for stubbornly elevated inflation was the spike in energy. And that largely has to do with geopolitics.

As TipRanks reporter Paul Hoffman mentioned at the beginning of April, a major contributing force to the energy spike was “Russia’s decision in March to reduce oil production by around 471,000 barrels per day, thereby tightening global oil supply. Analysts, including those at JPMorgan (NYSE:JPM), predict that demand growth will exceed supply, potentially propelling oil prices from $83 to $100 by September.”

On a related note, Russia’s invasion of neighboring Ukraine shows no sign of abatement. Further, with Congress passing a military aid package for Ukraine, tensions will likely only escalate between Russia and the West. It wouldn’t be out of the question for the Kremlin to intentionally disrupt global oil supply chains. If that wasn’t enough, Ukraine has been targeting Russian oil infrastructure, further crimping available supply.

Of course, that’s not the only geopolitical flashpoint. Recently, violence flared in the Middle East, with Iran launching missiles and drones at Israel. In turn, Israel launched its own attack against Iran. To be fair, the overall measured messaging following the missile launches has cooled the temperature. Nevertheless, a miscalculation could easily spiral circumstances out of control.

One of the biggest concerns in the region is that Iran could potentially disturb shipping lanes through the Strait of Hormuz. According to CNN, more than one-quarter of the global maritime oil trade flows through this waterway each day.

Given that neither one of the big geopolitical flashpoints has been resolved, the fear trade is in full bloom. So, irrespective of the Fed, NEM stock will likely rise from this tailwind.

Tangible Projected Benefits for Newmont

Obviously, a key benefit of rising gold prices for NEM stock centers on increased revenue and higher margins. Gold is used in many industries in addition to being a store of value. Further, the industrial use of gold – such as in semiconductors and other electronic components – will likely rise with the ongoing tech boom.

Moreover, the lift in the yellow metal should make less-economical mining projects more viable. That should help the bottom line significantly. Combined with wider investor interest as people seek shelter from uncertainty, NEM stock offers an attractive idea.

As such, Newmont may require a valuation rethink. For instance, NEM stock presently trades at 4x trailing-year revenue. However, the average sales multiple for the gold industry sits at 2.57x.

Still, in 2023, Newmont posted annual revenue of $11.8 billion. However, analysts are calling for a consensus sales target of $16.98 billion, with a high-side estimate of $18.52 billion. With the aforementioned upside catalysts, it’s not at all impossible for Newmont to hit the high target.

If so, NEM stock would be trading at 2.53x projected 2024 sales.

Is Newmont Stock a Buy, According to Analysts?

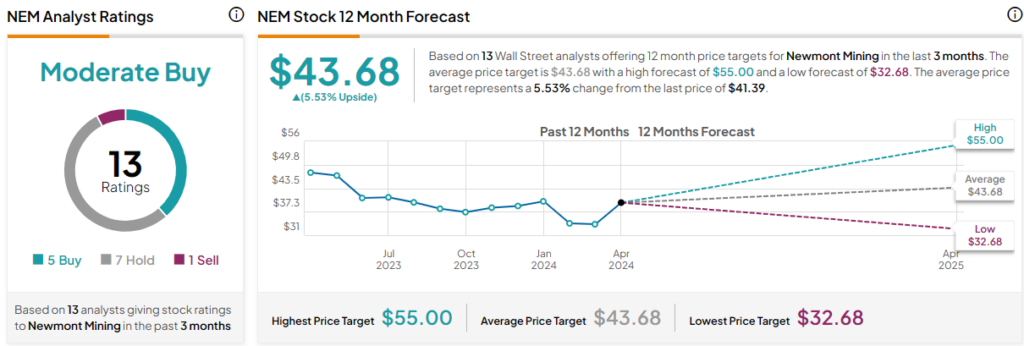

Turning to Wall Street, NEM stock has a Moderate Buy consensus rating based on five Buys, seven Holds, and one Sell rating. The average NEM stock price target is $43.68, implying 5.5% upside potential.

The Takeaway: Rising Fear Should Bolster NEM Stock

Newmont investors have undoubtedly been frustrated with the seesaw effect of monetary policy dynamics impacting the gold market. However, it’s best to focus on the fear trade, which is the more reliable catalyst.

With legitimate concerns tied to geopolitical flashpoints and global energy supply chain disruptions, inflation could easily soar, irrespective of Fed engineering. As such, Newmont could legitimately hit upside revenue targets, which makes NEM stock reasonably valued.