Russia’s invasion of Ukraine set off a cascade of events, injecting price volatility across commodities markets, including industrial metals like aluminum. Kaiser Aluminum (NASDAQ:KALU) has successfully navigated the dynamic market, recently beating revenue and earnings estimates. While the stock shows positive momentum, climbing 62% in the past six months, shares appear overvalued.

Investors looking for an income-generating basic materials stock with long-term growth potential might want to hold off and look for a more reasonably priced window of opportunity.

Kaiser Aluminum’s Footprint

Kaiser Aluminum manufactures and sells semi-fabricated specialty aluminum products, including plate, sheet, coil, extrusions, rod, bar, tube, and wire. Its operations cover a national and international footprint, serving customers in multiple sectors, including aerospace and defense, general engineering, automotive, and custom industrial applications.

While the spot price of aluminum can be volatile, the company claims it has maintained pass-through pricing of more than 95% on finished products, protecting it from price spikes in the metal.

Due to the growing demand for solar energy, EV batteries, 3D printing, and aluminum packaging, the aluminum market is projected to grow at a CAGR of 6.2% into a $393 billion market by 2032.

Kaiser’s Recent Financial Results & Outlook

The company recently reported Q1 financial results. Net sales slightly decreased to $738 million compared to $808 million in the previous year, though it exceeded the estimated revenue of $736.19 million. Adjusted net income was $17 million or $1.02 per diluted share, handily beating expectations of $0.59 and more than doubling the adjusted net income per diluted share of $0.42 in Q1 2023.

The company ended the quarter with $102 million in cash and equivalents, alongside an available borrowing facility of $517 million. Further, a quarterly cash dividend of $0.77 per share was announced, payable in May 2024.

Looking forward to the remainder of 2024, Kaiser Aluminum’s management is projecting a 2-3% improvement in conversion revenue and an increase of 70-170 basis points in adjusted EBITDA margins. The optimistic forecast stems from ongoing cost reduction measures, enhanced manufacturing efficiencies, and strategic growth initiatives.

What Is the Price Target for KALU Stock?

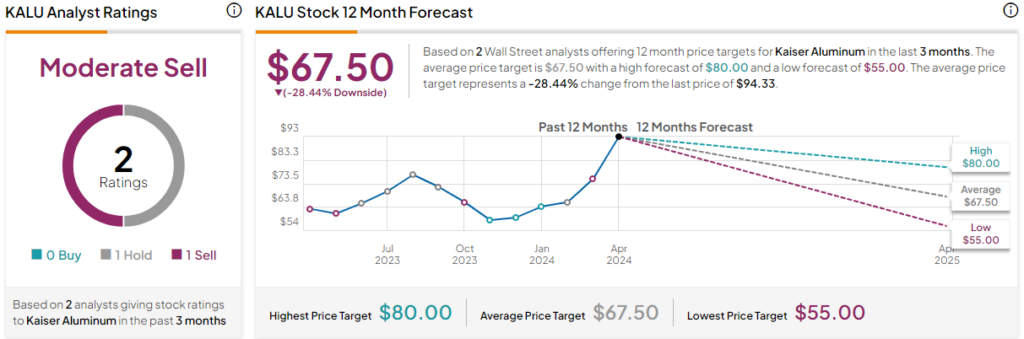

Analysts following the company have been mixed on the stock. Kaiser Aluminum is rated a Moderate Sell based on the recommendations and 12-month price targets two analysts issued in the past three months. The average price target for KALU stock is $67.50, which represents 28.44% downside risk from current levels.

The stock has been trending upward recently, climbing over 49% in the past 90 days. It continues to demonstrate positive price momentum, trading above the 20-day (87.25) and 50-day (79.89) moving averages.

It’s worth mentioning that KALU stock trades at the top of its 52-week price range of $53.66-$96.41. As a result, it looks to be richly valued on a relative basis, sporting a P/E ratio of 27.32x compared to the basic materials sector average of 17.4x and the aluminum industry average of 9.8x.

Investors May Want to Wait for More Reasonable Price Levels

Kaiser Aluminum has shown resilience, successfully navigating global geopolitical tensions and a volatile aluminum market to deliver strong returns. However, while the stock price demonstrates positive momentum, it is currently richly valued, prompting a call for investor caution.

The projected growth in demand for aluminum products, the company’s forward-looking strategy, and its solid footprint make it an appealing prospect. Yet, finding the right entry point is vital in maximizing returns in this dynamic market. Savvy long-term investors may want to wait for more reasonable price levels on the stock.