Amgen (NASDAQ:AMGN) surged in pre-market trading following updates about its weight-loss drug and an updated forecast. The biopharmaceutical company has forecasted FY24 total revenues in the range of $32.5 billion to $33.8 billion, compared to its prior forecast between $32.4 billion and $33.8 billion.

Adjusted earnings in FY24 are likely to be in the range of $19.00 to $20.20 per share, which are higher than its previous estimate of $18.90 to $20.30 per share. Analysts have projected the company to report adjusted earnings of $19.53 per share on revenues of $32.95 billion.

Amgen’s Weight Loss Drug Update

Amgen also gave an update regarding its injectable obesity treatment, MariTide. The company stated that a Phase 2 study was currently ongoing in overweight or obese adults with or without type 2 diabetes mellitus, with topline data anticipated later this year. The company’s plans for a comprehensive Phase 3 program for MariTide remains on track.

However, the company’s management stated that it was discontinuing its oral drug, AMG 786 after completing a Phase 1 study of the drug. This is Amgen’s second weight loss oral drug to be discontinued over the past year.

Amgen’s chief scientific officer Jay Bradner stated during the earnings call that they will halt further development of the oral drug due to its profile. Instead, the company will focus on investing in MariTide and other preclinical assets to treat obesity.

Amgen’s Q1 Results

In the first quarter, Amgen’s revenues increased by 22% year-over-year to $7.4 billion. This fell slightly short of analysts’ estimates of $7.45 billion. The company reported Q1 adjusted earnings of $3.96 per share, a decline of 1% year-over-year, and above analysts’ estimates of $3.87 per share.

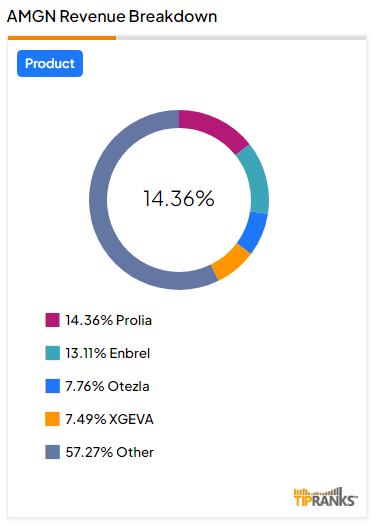

Ten of Amgen’s products delivered volume growth in double-digit in the first quarter. These products include Repatha (evolocumab), Tezspire (tezepelumab-ekko), Evenity (romosozumab-aqqg), Blincyto (blinatumomab), and Tavneos (avacopan). Amgen’s Prolia contributed more than 10% in terms of sales in the first quarter.

Is AMGN a Good Stock to Buy?

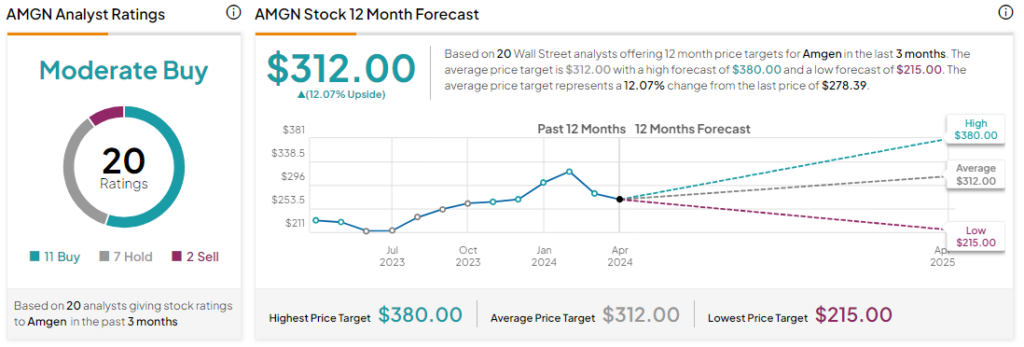

Analysts remain cautiously optimistic about AMGN stock, with a Moderate Buy consensus rating based on 11 Buys, seven Holds, and two Sells. Over the past year, AMGN has increased by more than 20%, and the average AMGN price target of $312 implies an upside potential of 12.1% from current levels.