Alliant Energy Corp (LNT) Q1 Earnings: Consistent with Analyst Projections

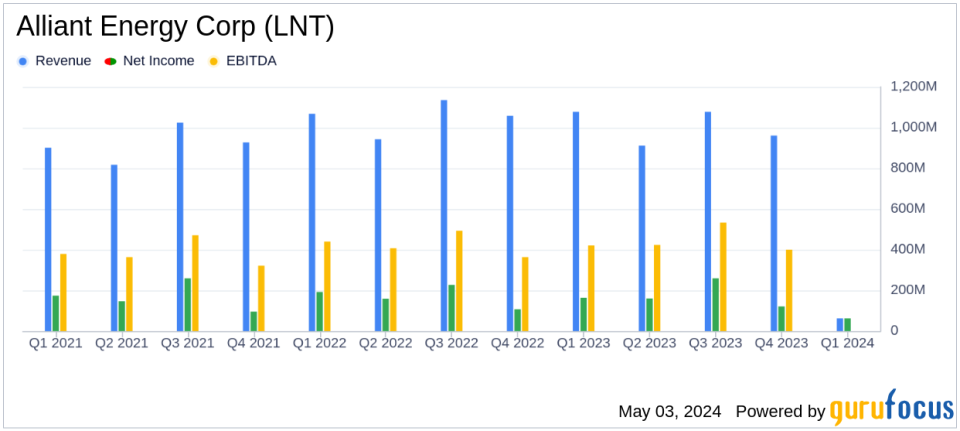

Earnings Per Share (EPS): Reported at $0.62 for Q1 2024, meeting the estimated EPS of $0.62, stable compared to the estimate but decreased from $0.65 in Q1 2023.

Net Income: Reached $158 million in Q1 2024, slightly below the estimate of $164 million and down from $163 million in Q1 2023.

Revenue Impact: Influenced by higher revenue requirements from capital investments at Wisconsin Power and Light Company, contributing an increase of $0.11 per share.

Weather Impact: Warmer than normal temperatures reduced retail electric and gas sales, impacting earnings by approximately $0.04 per share.

Financial Expenses: Increased financing and depreciation expenses negatively impacted EPS by $0.08 per share.

2024 Guidance: Reaffirmed earnings guidance for 2024, projecting an EPS range of $2.99 to $3.13.

Investment in Renewables: Noted significant progress in diversifying energy mix, with the commissioning of a major 1.1 gigawatt solar investment project in Wisconsin.

Alliant Energy Corp (NASDAQ:LNT) released its 8-K filing on May 2, 2024, announcing first-quarter earnings that aligned closely with analyst expectations. The company reported a GAAP earnings per share (EPS) of $0.62, consistent with the estimated earnings per share of $0.62. This performance reflects a slight decrease from the previous year's EPS of $0.65. Alliant Energy, the parent company of Interstate Power and Light and Wisconsin Power and Light, serves nearly 1 million electric customers and 425,000 natural gas customers, while also holding a 16% interest in American Transmission Co.

Performance Insights

Alliant Energy's Utilities and Corporate Services segment reported a $0.62 per share, which is a $0.03 decrease from the first quarter of 2023. The primary factors influencing this year's performance were lower retail electric and gas sales due to warmer than normal temperatures and increased financing and depreciation expenses. These were partially offset by higher revenue requirements from capital investments at Wisconsin Power and Light Company (WPL).

Significantly, WPL recognized a $0.11 per share increase due to higher revenue requirements following a rate review that authorized annual base rate increases. This adjustment reflects Alliant Energy's ongoing investments in solar generation and battery storage, highlighting the company's strategic shift towards renewable energy sources.

Challenges and Strategic Focus

The mild weather conditions presented a challenge by reducing demand for heating, which impacted retail electric and gas sales. However, Alliant Energy is navigating these challenges by focusing on long-term growth and diversification of its energy mix. President and CEO Lisa Barton emphasized the successful commissioning of a major solar project, marking a significant milestone in the company's renewable energy investments.

"We had a solid start to the year in light of historically mild weather," said Lisa Barton, Alliant Energy President and CEO. "Our results were in line with our expectations, allowing us to reaffirm our 2024 earnings guidance and positioning us well to reach our long-term growth objectives."

Financial Health and Future Outlook

Alliant Energy reaffirmed its 2024 earnings guidance range of $2.99 - $3.13 per share. The guidance assumes normal weather conditions, timely regulatory outcomes, and successful execution of capital expenditure and financing plans among other factors. This outlook supports the company's strategy to maintain stable financial performance while transitioning to more sustainable energy sources.

The company's commitment to strategic capital investments and cost control measures is crucial for sustaining profitability and competitiveness in the regulated utilities sector. As Alliant Energy continues to invest in renewable energy and infrastructure upgrades, these efforts are expected to contribute positively to long-term shareholder value and customer satisfaction.

Conclusion

Alliant Energy's first-quarter performance demonstrates a steady execution of its strategic plans despite some natural and economic challenges. With a clear focus on expanding its renewable energy portfolio and maintaining robust financial health, Alliant Energy remains poised to meet its future goals, benefiting both shareholders and the communities it serves.

For more detailed information and to participate in the upcoming earnings conference call, interested parties can access the webcast through Alliant Energy's investor relations page.

Explore the complete 8-K earnings release (here) from Alliant Energy Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance