Ryan Specialty Holdings Inc (RYAN) Q1 2024 Earnings: Aligns with EPS Projections, Surpasses ...

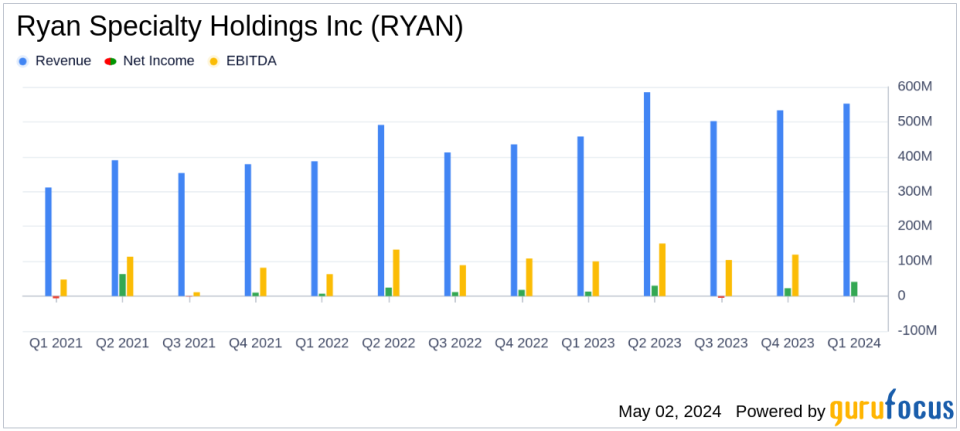

Revenue: Reached $552.0 million, marking a 20.6% increase year-over-year, surpassing the estimated $549.14 million.

Net Income: Grew to $40.7 million, up 11.6% from the previous year, far below the estimated $94.71 million.

Earnings Per Share (EPS): Reported at $0.13 per diluted share, below the estimated $0.35 per share.

Adjusted EBITDAC: Increased by 25.8% to $157.2 million, with the margin expanding to 28.5% from 27.3% year-over-year.

Adjusted Net Income: Rose by 32.9% to $95.4 million, with earnings per diluted share up 34.6% to $0.35, meeting the estimated EPS.

Organic Revenue Growth: Reported a solid rate of 13.7%, slightly outperforming the previous year's rate of 13.4%.

Dividends: Announced a regular quarterly dividend of $0.11 per share, payable on May 28, 2024.

Ryan Specialty Holdings Inc (NYSE:RYAN) released its 8-K filing on May 2, 2024, detailing its financial results for the first quarter ended March 31, 2024. The company reported a significant 20.6% year-over-year increase in total revenue, reaching $552.0 million, surpassing the estimated $549.14 million. Adjusted net income also saw a robust increase of 32.9% to $95.4 million, precisely aligning with the estimated earnings per share of $0.35. These figures highlight Ryan Specialty's effective strategy and operational efficiency in the specialty insurance sector.

Ryan Specialty, established in 2010 and headquartered in Chicago, operates as a prominent service provider of specialty products and solutions for insurance brokers, agents, and carriers. The company excels in distribution, underwriting, product development, administration, and risk management services, acting as a wholesale broker and a managing underwriter with delegated authority from insurance carriers.

Financial Highlights and Strategic Achievements

The first quarter of 2024 was marked by a 13.7% organic revenue growth rate, slightly higher than the previous year's 13.4%. This growth was driven by new client acquisitions and the expansion of existing relationships, particularly in the property and casualty lines. Ryan Specialty's adjusted EBITDAC grew by 25.8% to $157.2 million, with a margin improvement from 27.3% to 28.5%, reflecting enhanced operational efficiencies and successful integration of recent acquisitions.

Adjusted diluted earnings per share increased by 34.6% to $0.35, demonstrating the company's ability to enhance shareholder value effectively. The total capital return to shareholders and LLC unit holders amounted to $45.6 million, including $27.1 million in special dividends and $18.5 million in regular dividends and distributions.

Operational and Financial Challenges

Despite the positive growth metrics, Ryan Specialty faced increased operating expenses, which rose by 23.7% to $479.4 million. This increase was primarily due to higher compensation and benefits expenses linked to revenue growth and restructuring costs associated with the ACCELERATE 2025 initiative. Additionally, general and administrative expenses surged by 46.7%, driven by higher professional services costs, travel expenses, and acquisition-related expenses.

Looking Ahead: 2024 Strategic Outlook

Ryan Specialty maintains a positive outlook for 2024, projecting an organic revenue growth rate between 12.5% and 14.0% and an adjusted EBITDAC margin between 31.0% and 31.5%. These targets are supported by the company's strategic initiatives, including the ACCELERATE 2025 program, which is expected to generate significant cost savings and drive long-term growth.

The company's robust performance in Q1 2024, combined with strategic acquisitions like Castel, positions it well for sustained growth in the specialty insurance market. Investors and stakeholders can anticipate continued progress as Ryan Specialty leverages its market-leading capabilities to deliver superior results.

For more detailed information and to join the upcoming earnings call, please visit Ryan Specialty's investor relations page on their website at ryanspecialty.com.

Explore the complete 8-K earnings release (here) from Ryan Specialty Holdings Inc for further details.

This article first appeared on GuruFocus.