Olaplex Holdings Inc (OLPX) Q1 Earnings: Misses on EPS and Revenue Projections

Revenue: Reported at $98.9 million, a decrease of 13.1% year-over-year, exceeding the estimated $95.25 million.

Net Income: Dropped significantly by 63.1% to $7.746 million, well below the estimated $18.82 million.

Earnings Per Share (EPS): Recorded at $0.01, significantly below the estimated $0.03.

Gross Profit Margin: Improved slightly to 72.1% from 71.0% in the previous year.

Adjusted EBITDA: Decreased by 29.1% to $35.484 million, with the margin also reducing from 44.0% to 35.9%.

International Sales: Experienced a sharp decline of 24.3%, contrasting with a modest increase of 2.5% in the United States.

Cash Position: Strengthened to $507.5 million, up from $466.4 million at the end of the previous quarter.

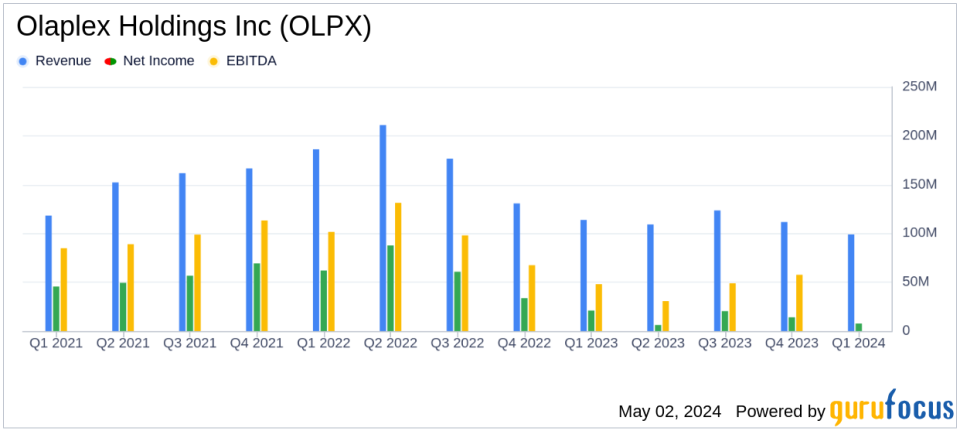

Olaplex Holdings Inc (NASDAQ:OLPX) disclosed its financial outcomes for the first quarter of 2024 on May 2, 2024, revealing a downturn in both earnings and revenue. The company released its 8-K filing which showed a significant decline compared to the same period last year, with net sales and net income falling short of analyst expectations. This report comes as the company continues to implement its business transformation plan aimed at revitalizing its operational and financial performance.

Company Overview

Olaplex Holdings Inc is a prominent player in the beauty industry, known for its innovative technology that enhances hair health. The company operates globally, offering its products through various channels including professional hairstylists, specialty retail, and direct-to-consumer platforms. Despite its strong market presence, the company faces challenges in maintaining its growth trajectory amidst shifting consumer preferences and competitive pressures.

Financial Performance Analysis

For Q1 2024, Olaplex reported net sales of $98.9 million, a decrease of 13.1% from $113.8 million in Q1 2023. This decline was primarily seen in the Professional and Direct-To-Consumer channels, which dropped by 19.9% and 15.7% respectively, while Specialty Retail saw a minimal decrease. Notably, sales in the United States increased slightly by 2.5%, but international sales plummeted by 24.3%, reflecting significant market challenges outside the U.S.

The company's net income took a sharp decline, falling 63.1% to $7.7 million from $21 million in the previous year, with diluted earnings per share (EPS) also decreasing from $0.03 to $0.01. Adjusted net income and adjusted EPS were $20.6 million and $0.03 respectively, both showing declines from the prior year's figures. These results fell short of the analyst estimates which had projected an EPS of $0.03 and net income of $18.82 million for the quarter.

Balance Sheet and Cash Flow Highlights

As of March 31, 2024, Olaplex's balance sheet showed $507.5 million in cash and cash equivalents, an increase from the end of 2023. The company's inventory levels slightly decreased to $94.6 million from $95.9 million. Long-term debt remained substantial at $647.7 million, reflecting ongoing financial commitments.

The company generated $43.7 million in cash from operating activities during the quarter, a decrease from $48.1 million in the previous year, indicating a tighter cash flow situation amid declining profitability.

Outlook and Strategic Initiatives

Despite the downturn, CEO Amanda Baldwin remains optimistic about the company's strategic direction, emphasizing progress in the ongoing business transformation plan. Olaplex is focusing on enhancing its operational efficiencies and product offerings to better meet consumer demands and drive future growth.

For the full fiscal year 2024, Olaplex has reiterated its guidance, expecting net sales between $435 million and $463 million, and adjusted net income between $87 million and $100 million. These projections reflect management's expectations based on current market conditions and planned strategic initiatives.

Investor and Analyst Perspectives

The first quarter results have likely raised concerns among investors and analysts regarding Olaplex's ability to navigate current market challenges effectively. The significant declines in key financial metrics and the miss on earnings expectations highlight the hurdles the company faces in its recovery and growth efforts.

Olaplex's journey through 2024 will be closely watched as it strives to implement its transformation strategies and improve its financial health. Investors and stakeholders will be keen on observing how the company adapts to ongoing industry changes and whether it can successfully turn around its performance in the competitive beauty market.

Explore the complete 8-K earnings release (here) from Olaplex Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance