RLJ Lodging Trust Q1 2024 Earnings: Revenue Surpasses Estimates Despite Net Income Decline

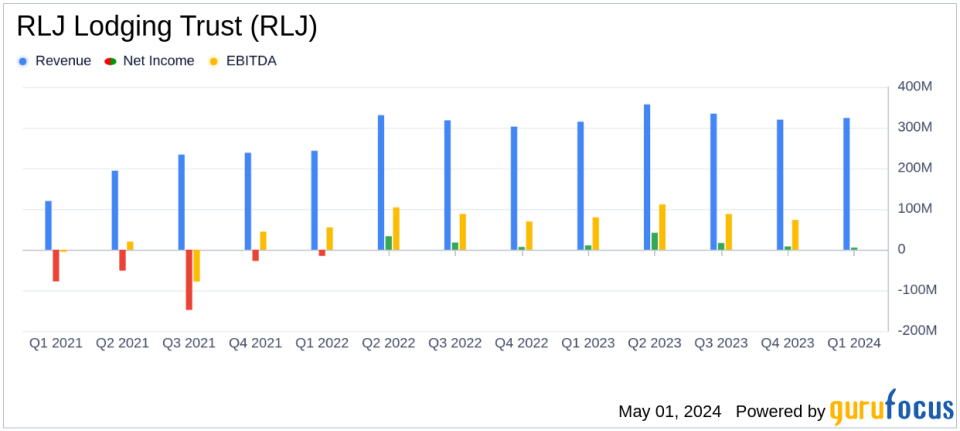

Revenue: Reported at $324.4 million, marking a 3.1% increase from the previous year, slightly above the estimated $322.76 million.

Net Income: Recorded at $4.7 million, significantly below the prior year's $10.5 million, and exceeded the estimated -$0.05 million.

Adjusted FFO Per Diluted Share: Reached $0.33, down from $0.35 last year, indicating a decrease of 5.7%.

Comparable Hotel EBITDA: Totaled $88.9 million, a decrease of 2.3% from the previous year's $90.9 million.

RevPAR: Increased by 1.0% to $137.88, showing modest growth in revenue per available room.

Acquisition: Purchased Wyndham Boston Beacon Hill for approximately $125 million, expanding the portfolio and conversion pipeline.

Dividends: Declared a first quarter cash dividend of $0.10 per common share and $0.4875 on Series A Preferred Shares.

On May 1, 2024, RLJ Lodging Trust (NYSE:RLJ), a prominent real estate investment trust specializing in premium-branded, urban-centric hotels, disclosed its financial results for the first quarter of 2024 through its 8-K filing. The company reported a notable increase in total revenue, reaching $324.4 million, which represents a 3.1% rise from the previous year and surpasses the analyst's revenue estimate of $322.76 million. Despite this revenue growth, net income saw a significant decline to $4.7 million, a 54.9% decrease from the prior year's $10.5 million, underperforming against the estimated net income of -$0.05 million.

Company Overview

RLJ Lodging Trust acquires focused-service and compact full-service hotels primarily under the Marriott, Hilton, and Hyatt brands. With a portfolio spread across various states and the District of Columbia, RLJ's properties are strategically located in urban and dense suburban markets which attract business, leisure, and other travelers.

Financial and Operational Highlights

The first quarter saw RLJ's Comparable RevPAR (Revenue Per Available Room) increase by 1.0% to $137.88, reflecting modest growth in occupancy rates from 68.5% to 69.3%. However, the company faced challenges as Comparable Hotel EBITDA decreased by 2.3% to $88.9 million, and the EBITDA margin contracted by 152 basis points to 27.4%. Adjusted Funds From Operations (FFO) per diluted share also decreased to $0.33 from $0.35 in the previous year, marking a 5.7% decline.

Strategic Developments and Market Position

According to Leslie D. Hale, President and CEO of RLJ, the company's strategic positioning and ongoing initiatives continue to drive its market performance. The acquisition of the Wyndham Boston Beacon Hill and the advancement in the company's conversion pipeline are expected to bolster growth. Hale highlighted the positive trends benefiting urban markets and expressed confidence in the company's robust balance sheet and conversion strategy.

Balance Sheet and Future Outlook

As of March 31, 2024, RLJ reported about $1.0 billion in total liquidity, with a significant portion of its debt addressed by drawing on its revolving credit facility. Looking forward, the company reaffirms its full-year outlook, projecting a Comparable RevPAR growth of 2.5% to 5.5% and an Adjusted FFO per diluted share ranging from $1.55 to $1.75.

Investor Considerations

While RLJ's revenue outperformance indicates robust operational capabilities, the decline in net income and Adjusted FFO highlights potential areas of concern regarding profitability and cost management. Investors should consider both the strategic achievements and financial health indicators when evaluating RLJ's investment potential. The company's focus on strategic acquisitions and conversions, combined with its solid liquidity position, suggests a proactive approach to growth and operational optimization in a competitive market.

For detailed financial figures and operational metrics, investors and stakeholders are encouraged to review the supplemental information provided through RLJ's investor relations website.

Explore the complete 8-K earnings release (here) from RLJ Lodging Trust for further details.

This article first appeared on GuruFocus.