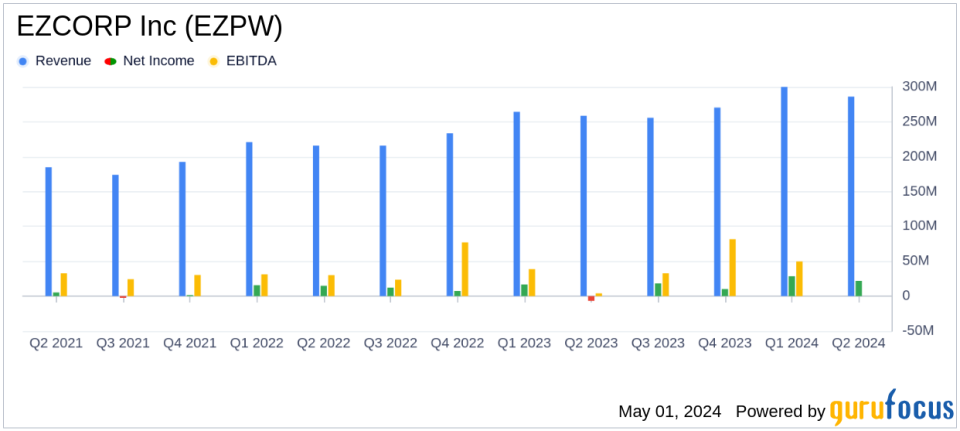

EZCORP Inc (EZPW) Q2 Fiscal 2024 Earnings: Surpasses Revenue Forecasts with Record Results

Net Income: $21.5 million, a significant improvement from a net loss of $6.8 million in the previous year, surpassing the estimated $19.62 million.

Earnings Per Share: Reported at $0.29, up from a loss per share of $0.12 last year, exceeding the estimate of $0.26.

Revenue: Reached $285.6 million, up 11% year-over-year, surpassing the estimated $282.20 million.

Gross Profit: Increased by 12% to $167.6 million, indicating improved operational efficiency.

Pawn Loans Outstanding (PLO): Grew by 14% to $235.8 million, reflecting robust customer demand.

Store Expansion: Net increase of nine stores, enhancing the company's market presence and customer reach.

Share Repurchases: $3.0 million worth of shares repurchased, underlining the company's commitment to returning value to shareholders.

EZCORP Inc (NASDAQ:EZPW), a prominent player in the pawn transactions sector, announced its earnings for the second quarter of fiscal year 2024 on May 1, 2024. The company reported a significant turnaround with a net income of $21.5 million, compared to a net loss of $6.8 million in the same quarter of the previous year. This performance notably exceeded the analyst's net income estimate of $19.62 million. EZCORP's earnings per share (EPS) stood at $0.29, surpassing the estimated EPS of $0.26. The detailed financial outcomes are available in the company's 8-K filing.

Company Overview

EZCORP Inc, based in the United States, specializes in providing pawn loans predominantly in the U.S. and Mexico. The company operates through segments like US Pawn and Latin America Pawn, deriving significant revenue from merchandise sales, primarily from collateral forfeited from pawn lending operations and purchased second-hand goods.

Financial Highlights and Operational Performance

The company's total revenues for the quarter increased by 11% year-over-year to $285.6 million, which is above the analyst's expectation of $282.20 million. This increase was driven by a robust performance in both pawn service charges and merchandise sales, with gross profit rising by 12%. The merchandise sales gross margin remained stable at 35%, aligning with the company's targeted range.

Pawn loans outstanding (PLO) saw a significant increase of 14% to $235.8 million, reflecting strong consumer demand and operational efficiency. The Return on Earning Assets (ROEA) was reported at a strong 165%, indicating efficient asset utilization.

Strategic Expansions and Customer Engagement

Lachie Given, CEO of EZCORP, highlighted the company's strategic initiatives, including the opening of nine new stores in Latin America and the acquisition of six stores in the U.S. during the quarter. The company's EZ+ Rewards program saw a membership increase of 61% year-over-year, reaching 4.6 million members. This surge in membership, coupled with a 72% increase in online payments in the U.S., underscores growing customer engagement and loyalty.

"We achieved record second quarter revenue and PLO, driven by strong consumer demand and excellent customer service," stated Lachie Given, CEO of EZCORP. He also emphasized the company's focus on investing in technology and store expansions to enhance customer experience and shareholder value.

Financial Position and Future Outlook

The company's balance sheet remains robust with cash and cash equivalents of $229.1 million, despite a 6% decrease year-over-year due to strategic investments and share repurchases. The total net inventory increased by 9%, in line with the growth in PLO. Store expenses and general administrative expenses saw an uptick, mainly due to increased labor costs and expansion activities.

Looking forward, EZCORP plans to continue its growth trajectory by further expanding its store network and enhancing digital offerings, aiming to bolster its market position and meet the increasing demand for short-term cash solutions.

Conclusion

EZCORP's impressive second quarter results reflect its resilience and strategic agility in navigating a challenging economic landscape. With its strong financial performance and ongoing strategic initiatives, EZCORP is well-positioned for sustained growth, making it a noteworthy consideration for investors interested in the credit services industry.

For detailed insights and further information, visit EZCORP's investor relations website or access their latest 10-Q report filed with the Securities and Exchange Commission.

Explore the complete 8-K earnings release (here) from EZCORP Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance