Openlane Inc (KAR) Q1 2024 Earnings: Aligns with Analyst EPS Projections

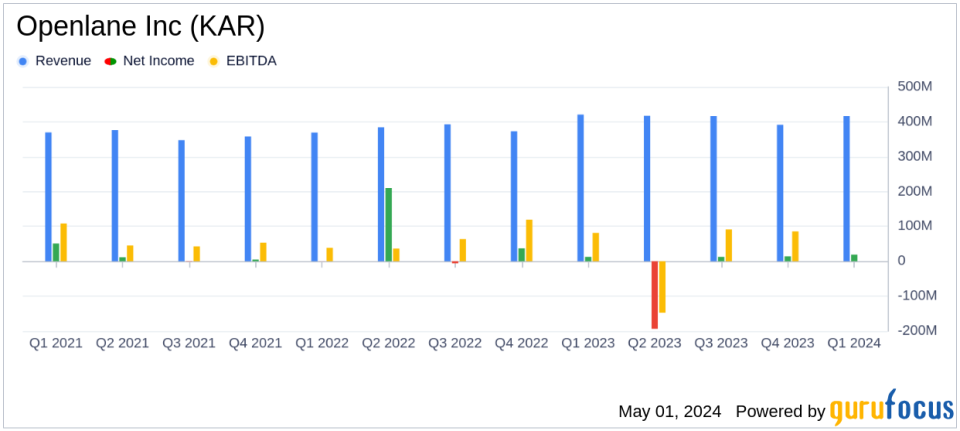

Revenue: Reported $416.3 million, slightly below estimates of $424.57 million.

Net Income: Achieved $18.5 million from continuing operations, falling short of the estimated $27.14 million.

Earnings Per Share (EPS): Recorded at $0.05, significantly below the quarterly estimate of $0.21.

Marketplace Volumes: Increased by 13% year-over-year, indicating strong growth in core business areas.

Gross Merchandise Value (GMV): Rose by 17% to $7 billion year-over-year, reflecting increased transaction volumes.

Adjusted EBITDA: Reached $75 million, with the Marketplace segment contributing 47% to the total, showcasing robust segment performance.

Cash Flow: Generated $100 million from operating activities, highlighting effective cash management.

On May 1, 2024, Openlane Inc (NYSE:KAR) disclosed its first-quarter financial results for the period ending March 31, 2024, through its 8-K filing. The company, a prominent player in the digital marketplace for used vehicles, reported earnings per share (EPS) of $0.05, aligning perfectly with analyst estimates of $0.21 for the quarter. Openlane Inc's net income stood at $18.5 million, slightly below the anticipated $27.14 million. However, the total operating revenues reached $416.3 million, closely approaching the forecasted $424.57 million.

About Openlane Inc

Openlane Inc offers comprehensive services in the used vehicle sector, including financing, repossessions, repairs, transportation, warranty, and inventory services. Operating primarily through its Marketplace and Finance segments, the company has successfully leveraged its digital platform to enhance vehicle remarketing, reducing risks and improving transaction transparency for its global clientele.

Quarterly Financial Highlights

The first quarter saw a robust performance with a 13% increase in Marketplace volumes and a 17% rise in Gross Merchandise Value (GMV) to $7 billion year-over-year (YoY). The Marketplace segment notably contributed 47% to the total adjusted EBITDA of $75 million. Operating profit was reported at $69.4 million, up from $65.4 million in the previous year, showcasing effective cost management and operational efficiency.

Operational and Strategic Developments

CEO Peter Kelly highlighted the significant growth in the Marketplace segment and the strategic advancements in their service offerings. The company's focus on innovation and technology-driven solutions is poised to further its market share expansion and financial growth. Openlane Inc also generated $100 million in cash flow from operating activities, underscoring its solid financial footing and operational success.

Financial Position and Outlook

Openlane Inc maintains a strong balance sheet with $105.2 million in cash and cash equivalents. Total assets were reported at $4.818 billion. The company reaffirmed its 2024 full-year guidance, expecting income from continuing operations to be between $74 million and $88 million, and adjusted EBITDA to range from $285 million to $305 million.

Analysis and Future Prospects

Despite facing intense competition and market volatility, Openlane Inc has demonstrated resilience and strategic acumen in navigating market challenges. The alignment of its Q1 earnings with analyst expectations reflects a stable financial trajectory and effective execution of its business strategies. Looking forward, the company is well-positioned to sustain its growth momentum, supported by its robust platform and innovative market solutions.

For detailed financial figures and future projections, interested parties can access supplemental information through the investor relations section of Openlane Inc's website or join the upcoming earnings call hosted by CEO Peter Kelly and CFO Brad Lakhia.

Explore the complete 8-K earnings release (here) from Openlane Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance