Allstate Corp (ALL) Reports Significant Turnaround in Q1 2024 Earnings, Surpassing Analyst ...

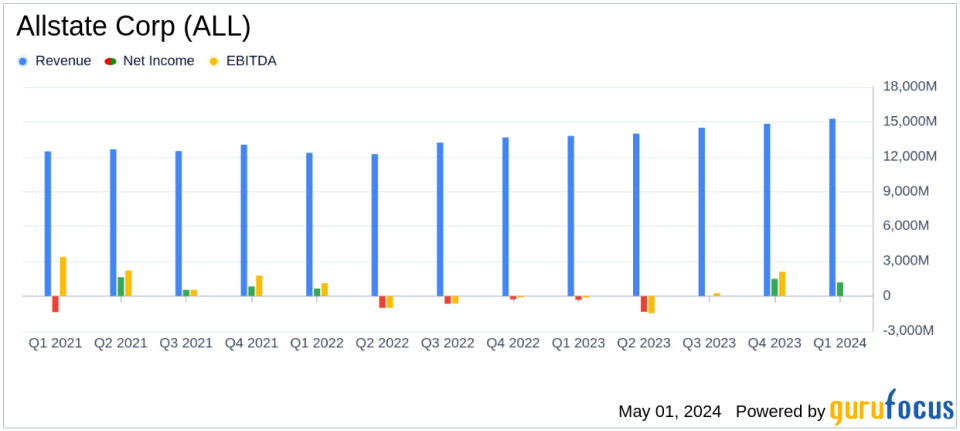

Revenue: Reached $15.3 billion in Q1 2024, marking a 10.7% increase from the previous year, surpassing the estimated $12.88 billion.

Net Income: Reported at $1.2 billion for Q1 2024, a significant recovery from a net loss of $346 million in Q1 2023, surpassing the estimated $1.025 billion.

Earnings Per Share (EPS): Achieved $4.46 per diluted share, significantly higher than the estimated $3.94 and a recovery from a loss of $1.31 per share in Q1 2023.

Property-Liability Insurance: Premiums earned increased by 10.9% to $12.9 billion, driven by higher average premiums from rate increases.

Combined Ratio: Improved to 93.0 from 108.6 in the previous year, indicating better profitability in underwriting activities.

Catastrophe Losses: Decreased by 56.8% to $731 million, contributing to improved profitability.

Investment Income: Grew by $189 million to $764 million in Q1 2024, reflecting higher yields and improved performance-based income.

Allstate Corp (NYSE:ALL) released its 8-K filing on May 1, 2024, unveiling a remarkable recovery in its financial performance for the first quarter of 2024. The company reported consolidated revenues of $15.259 billion, a significant increase of 10.7% compared to $13.786 billion in the same quarter of the previous year. This performance notably exceeds the estimated revenue of $12.875 billion projected by analysts.

Allstate, a leading U.S. property and casualty insurer known for its extensive portfolio including personal auto and homeowners insurance, demonstrated a comprehensive improvement across its major segments. The firm's net income applicable to common shareholders dramatically improved to $1.189 billion from a loss of $346 million year-over-year, with earnings per diluted share rising to $4.46. Adjusted net income also saw a substantial increase to $1.367 billion, or $5.13 per diluted share, surpassing the estimated earnings per share of $3.94.

Operational Highlights and Strategic Achievements

The first quarter results were primarily driven by a $1.3 billion increase in Property-Liability earned premiums, reflecting higher average premiums from rate increases. The Property-Liability segment posted underwriting income of $898 million, a stark contrast to the $1.001 billion loss recorded in the prior year. This improvement was attributed to enhanced premiums earned, better underlying loss experience, and significantly lower catastrophe losses.

Allstate's strategic initiatives, including increased investment in brand advertising and expansion of its protection offerings, have started to yield positive outcomes. The Allstate brand and National General reported growth in premiums written, up by 11.9% to $13.183 billion. Notably, National General's premiums written surged by 28.7%, driven by higher average premiums and policy growth through independent agents.

Challenges and Market Position

Despite the positive quarter, Allstate continues to navigate challenges such as regulatory changes and market competition. However, the company's proactive strategies in rate adjustments and cost management have positioned it well to tackle these hurdles effectively.

Investment and Financial Strength

Allstate's investment portfolio also performed well, with net investment income increasing by $189 million to $764 million, primarily due to higher yields and performance-based income. The company's focus on diversifying its investment and enhancing returns has contributed positively to its financial robustness.

CEO Tom Wilson commented on the results, stating, "Allstates broad-based profitability reflects the benefits of strong operating capabilities, decisive actions to improve shareholder value, and lower catastrophe losses." This statement underscores the company's strategic direction aimed at long-term growth and shareholder value enhancement.

Outlook and Forward Movements

Looking forward, Allstate appears well-positioned to continue its growth trajectory through strategic investments in its core business segments and expanding its market share in auto and home insurance sectors. The company's robust balance sheet and effective capital management also provide a solid foundation for sustaining its growth initiatives and facing potential market volatilities.

For detailed information about Allstates financial performance and strategic initiatives, investors and stakeholders are encouraged to visit Allstate's investor relations website.

Allstate's impressive turnaround in the first quarter of 2024 not only highlights its resilience but also its ability to adapt and thrive amidst challenging market conditions, signaling a positive outlook for the future.

Explore the complete 8-K earnings release (here) from Allstate Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance