TransMedics Group Inc (TMDX) Surpasses Analyst Revenue Forecasts with Stellar Q1 2024 Results

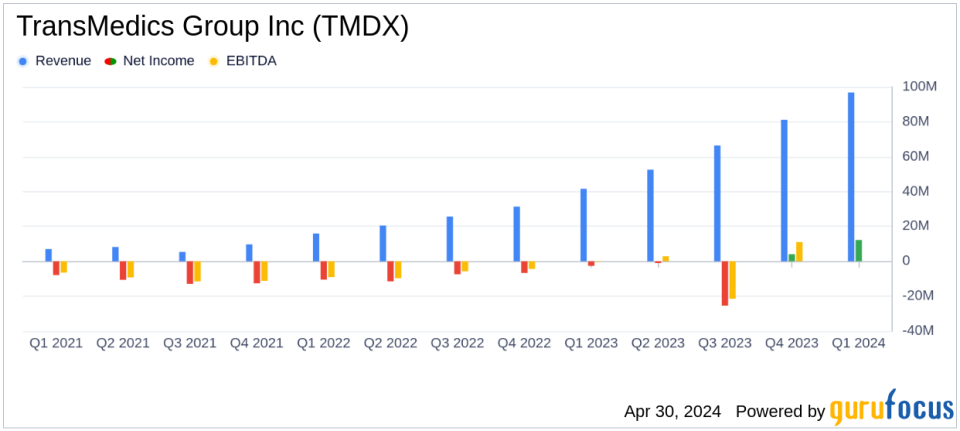

Revenue: Reported at $96.9 million for Q1 2024, a significant increase of 133% from $41.6 million in Q1 2023, surpassing estimates of $83.78 million.

Net Income: Achieved $12.2 million in Q1 2024, compared to a net loss of $2.6 million in Q1 2023, far exceeding the estimated $0.70 million.

Earnings Per Share (EPS): Recorded at $0.35 per fully diluted share, significantly above the estimated -$0.05.

Gross Margin: Decreased to 62% in Q1 2024 from 69% in Q1 2023, reflecting a higher proportion of service revenue.

Operating Expenses: Increased to $47.5 million in Q1 2024 from $30.9 million in Q1 2023, driven by higher research and development investment and organizational growth support.

Cash Position: Ended the quarter with $350.2 million in cash, reflecting strong liquidity.

2024 Revenue Guidance: Raised to $390 million to $400 million, indicating expected growth of 61% to 66% over the previous year.

TransMedics Group Inc (NASDAQ:TMDX) released its 8-K filing on April 30, 2024, unveiling its financial results for the first quarter ended March 31, 2024. The company reported a significant surge in revenue and profitability, exceeding analyst expectations and setting a positive tone for the fiscal year.

Company Overview

TransMedics Group Inc is a pioneering medical technology firm focused on transforming organ transplant therapy for patients with end-stage organ failures such as lung, heart, and liver diseases. The company has developed the Organ Care System (OCS), an innovative platform that maintains donor organs in a near-physiologic state outside the human body, thereby enhancing transplant success rates and organ utilization.

Q1 2024 Financial Highlights

The company's revenue for the first quarter soared to $96.9 million, marking a 133% increase from $41.6 million in the same period last year. This growth was primarily fueled by the expanded use of the OCS across multiple organs and the integration of TransMedics' logistics services. The reported revenue not only surpassed the estimated $83.78 million but also significantly boosted investor confidence.

Net income for Q1 2024 stood at $12.2 million, or $0.35 per fully diluted share, a robust recovery from a net loss of $2.6 million in Q1 2023. This profitability reflects effective cost management and operational efficiency, alongside revenue growth.

Operational and Financial Metrics

The gross margin for the quarter was reported at 62%, a slight decrease from 69% in the previous year, attributed to a higher proportion of service revenue which typically carries lower margins. Operating expenses rose to $47.5 million from $30.9 million year-over-year, driven by increased investments in research and development and organizational growth to support scaling operations.

TransMedics ended the quarter with a strong cash position of $350.2 million, ensuring ample liquidity to fund ongoing operations and strategic initiatives.

2024 Financial Outlook and Strategic Focus

Encouraged by the strong start to the year, TransMedics has revised its full-year 2024 revenue guidance upwards to $390 million to $400 million, anticipating growth between 61% to 66% compared to the previous year. This optimistic outlook is supported by ongoing clinical programs and expected increases in transplant volumes facilitated by the OCS technology.

Management Commentary

We are pleased with our first quarter results as we simultaneously drove continued revenue growth, expanded our infrastructure, and achieved profitability, said Waleed Hassanein, MD, President and CEO of TransMedics. 2024 represents another catalyst-heavy year for TransMedics, and we are focused on executing across the board to drive further growth for our business and the overall transplant volumes to help patients in need of organ transplants.

Conclusion

TransMedics' Q1 2024 performance not only demonstrates the company's robust growth trajectory but also underscores the effectiveness of its innovative OCS technology in the organ transplant market. With increased revenue guidance and strategic investments in technology and infrastructure, TransMedics is well-positioned to sustain its growth momentum and enhance shareholder value in the upcoming periods.

For more detailed information and updates, investors and interested parties are encouraged to access the webcast and conference call hosted by the TransMedics management team.

Explore the complete 8-K earnings release (here) from TransMedics Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance