The demand for energy continues to grow globally. Solar generation capacity is expected to grow at a compound annual growth rate (CAGR) of 16% by 2032, and Shoals Technologies (NASDAQ:SHLS) is well-positioned to service this dynamic market.

Though the stock has been down almost 57% over the past year, it trades at a relative value, representing an opportunity for investors to gain exposure to the solar and Electric Vehicle (EV) industry via this long-term growth opportunity at a reasonable price.

Shoals Technologies Solar & EV Solutions

Shoals Technologies is a leading electrical balance of systems provider for solar energy, energy storage, and EV charging systems. The company has built “plug-n-play” infrastructure that offers a solution that enhances safety and reliability and reduces the cost of installation across the U.S. solar and EV industry.

The solar market is projected to reach an estimated $837.3 billion by 2032. Similarly, the EV market, a crucial part of Shoals’ business, is set to hit $951.9 billion by 2030. This promising trajectory, along with Shoals’ past performance and its comprehensive system solutions, positions the company to contribute significantly to and benefit from the escalating solar and EV industries.

Shoals’ Recent Financial Performance

Shoals Technologies posted its Q4 FY2023 financial report, demonstrating growth with a 38% increase in revenue year-over-year, totaling $130.4 million. Q4’s performance was driven by a 147% increase in orders, totaling over $128 million. The company’s backlog orders reported a similar surge, up 47% from the previous year to $631.3 million.

However, for the fiscal year 2024, the company forecasts a somewhat softer first half owing to rising interest rates and potential project delays, with projected revenue ranging between $480 million and $520 million. While this mostly aligns with FY23, it falls below consensus expectations of $625.1 million. Q1 FY2024 earnings are just around the corner, and likely to shed more light on the direction things are headed for the year.

Is SHLS Stock a Buy?

Shares of Shoals Technologies have been trending lower, declining over -35% in the past 90 days, and now trade at the low end of the 52-week price range of $8.06-$28.34. The stock demonstrates ongoing negative price momentum, trading below the 20-day ($12.38) and 50-day ($13.37) moving averages. However, the slide in price has dropped the stock into value territory, with an EV/EBITDA of 17.98x compared to the Solar industry average of 20.2x.

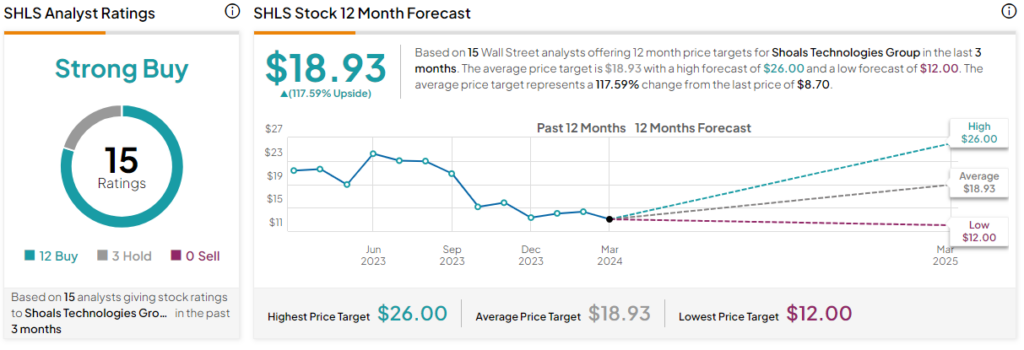

Despite the cascading share price, analysts following the stock have remained mostly bullish. For example, Mizuho Securities analyst Maheep Mandloi recently reiterated a Buy rating on the shares while lowering the price target to $16 from $18. He expects a near-term trough over the first half of the year, though he remains constructive on the longer-term prospects of solar growth.

Shoals Technologies is rated a Strong Buy based on the recommendations and 12-month price targets assigned by 15 Wall Street analysts over the past three months. The average price target for SHLS stock is $18.93, which represents a 117.59% upside from current levels.

SHLS Stock in Summary

Despite missing on recent financial expectations (a trend that may continue for a few more quarters), there is much to like about the long-term upside possibilities for Shoals Technologies. For investors looking to invest in the surging solar and EV markets, Shoals offers an infrastructure play well-positioned to grow with the market. The stock trades at a relative value, though investors may want to wait for more positive price momentum to ensure they are not unnecessarily reaching for a falling knife. The window of opportunity will likely be open for a bit longer, giving investors time to watch for more positive earnings news on the stock.