Elon Musk Called Tesla an Artificial Intelligence (AI) Robotics Company. Does That Make It a Buy?

Tesla (NASDAQ: TSLA) recently reported its results for the first quarter, and the results were not great as the downturn seen in electric vehicle (EV) sales weighed on the company's results. Total deliveries fell 9%, while automotive revenue slipped 13% to $17.4 billion and overall revenue was down 9% to $21.3 billion. Meanwhile, earnings per share fell 47% to $0.45, and it saw cash outflows of $2.5 billion.

That's not a great start to the year. However, Tesla's stock nonetheless jumped 12% on the results.

Why is there a positive reaction to such lackluster results? Because CEO Elon Musk shifted the narrative on what type of company Tesla will become in the future.

Tesla, the AI robotics company

On Tesla's first-quarter earnings call, Musk told investors that Tesla should be viewed as an artificial intelligence (AI) or robotics company and that trying to value it as an auto company is the wrong way to look at it. He added that if you don't think Tesla will solve autonomy that you shouldn't be an investor in the stock.

The term "autonomy" is referring to self-driving vehicles. Tesla's self-driving vehicles will be based on its AI-based self-driving technology called FSD V12. Musk said it has turned on the feature in about 1.8 million of its vehicles on the road, and about half of their drivers are using it.

However, Musk's big plans for Tesla and autonomous driving revolve around creating a large fleet of robotaxis or cybercabs. In its investor presentation, the company said it would look to use a "revolutionary 'unboxed' manufacturing strategy" when it comes to robotaxis that will slash its manufacturing costs. Tesla plans to unveil its robotaxi strategy in a big presentation in August.

Given how much computing power Tesla vehicles have, though, Musk doesn't plan on letting that go to waste just sitting idle. He envisions that when the cars are not in use, they can run distributed inference. Essentially, he thinks Tesla vehicles can be used to run AI models when they are not being driven. He said this would be very powerful when there is a fleet of 100 million Tesla vehicles on the road around the globe.

Musk compared this idea to Amazon and its cloud service business, AWS. He also noted that people didn't expect this to be the most valuable part of Amazon when it was known for selling books online.

Of course, Musk's distributed inference vision does come with some questions. Ownership is a big one, as Tesla does not own its vehicles once they are sold. AI computing power is also very energy intensive, so this may not be economically viable. Also, who is going to pay for this energy consumption? A Tesla-owned robotaxi fleet does solve some of these issues, as Tesla would presumably own the vehicles and be responsible for their energy consumption. However, robotaxis are likely best used in cities, which may not have the most attractive electricity prices.

Tesla's other big venture is a humanoid robot called Optimus. Musk said he thinks the robots will be able to perform useful tasks within its factories by the end of this year and that it could possibly start selling them externally by the end of 2025. On Tesla's conference call, he also said that Optimus could eventually be worth more than everything else from Tesla combined.

Musk, the visionary

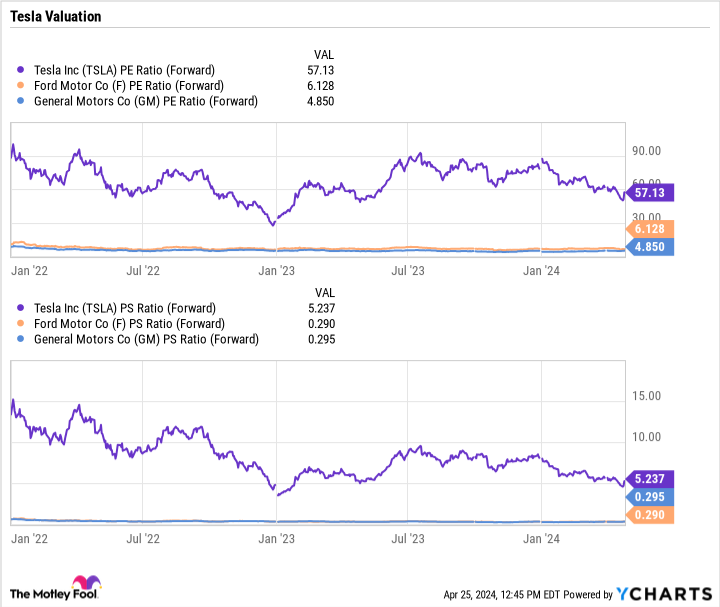

Elon Musk is right about one thing: If you only view Tesla as being an auto company, it probably isn't a great investment. Trading at over 55 times forward earnings and over 5 times sales, the company trades at much higher valuations than traditional automakers like Ford and General Motors. At the same time, upstart EV makers have struggled to even turn a profit.

However, if Tesla is able to transform itself into an AI robotics company, the sky is certainly the limit. An investment in Tesla is an investment in Elon Musk and his vision of the future. EVs are only part of the equation and will play a big role in the company's results in the immediate future, but investing in Tesla is about more than investing in EVs. Not all of Musk's visionary ideas will likely pan out, but if most do, the stock has a bright future ahead.

With Tesla's stock pulling back over 40% from its recent highs, now could be the time to invest in Tesla and Musk's AI robotic vision.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Tesla made the list -- but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of April 22, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Tesla. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.

Elon Musk Called Tesla an Artificial Intelligence (AI) Robotics Company. Does That Make It a Buy? was originally published by The Motley Fool