Xtant Medical Holdings Inc (XTNT) Reports Record Revenue in 2023, Outpacing Analyst Estimates

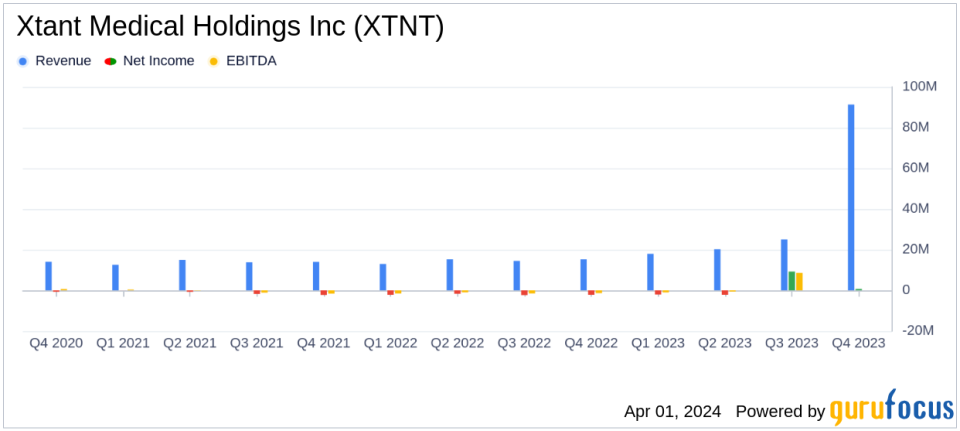

Revenue: XTNT reported a record full-year 2023 revenue of $91.3 million, a 58% increase from the previous year, surpassing the estimated revenue of $27 million for the quarter.

Net Income: The company posted a net income of $0.7 million for 2023, a notable recovery from a net loss of $8.5 million in 2022, defying the estimated net loss of $1.6 million.

Earnings Per Share (EPS): XTNT reported an EPS of $0.01 for 2023, contrasting with the estimated EPS loss of $0.015.

Gross Margin: Gross margin improved to 60.8% for the full year 2023 from 55.4% in 2022, reflecting better product mix and production efficiencies.

Adjusted EBITDA: The company achieved three consecutive quarters of positive adjusted EBITDA, totaling $1.0 million for 2023, up from a loss of $3.0 million in 2022.

2024 Revenue Guidance: XTNT projects full-year 2024 revenue to be between $112 million and $116 million, indicating a 23% to 27% growth year-over-year.

Xtant Medical Holdings Inc (XTNT) released its 8-K filing on April 1, 2024, revealing a remarkable financial turnaround with record revenues and a return to profitability for the full year ended December 31, 2023. The medical technology company, known for its orthobiologics and spinal implant systems, reported a significant year-over-year revenue increase, primarily driven by independent agent and private label sales, as well as strategic acquisitions.

Financial Performance and Strategic Acquisitions

XTNT's transformative year was marked by a 58% increase in annual revenues, reaching $91.3 million, with organic growth contributing 15% compared to the prior year. The company's gross margin saw a substantial increase due to product mix improvements and greater scale, partially offset by higher product costs. Operating expenses rose to $65.6 million for the full year, up from $38.9 million in 2022, largely due to sales commissions, employee compensation, and legal expenses.

Despite a net loss in the fourth quarter of 2023 amounting to $4.3 million, or $0.03 per share, XTNT reported an annual net income of $0.7 million, or $0.01 per share, a significant improvement from the net loss of $8.5 million, or $0.09 per share, in 2022. This performance indicates a resilient recovery and a strong execution of the company's growth strategy.

Looking Ahead: 2024 Revenue Guidance

Looking forward to 2024, XTNT has set a revenue guidance range of $112 million to $116 million, representing a robust annual growth forecast. This guidance includes contributions from the acquisition of Surgalign, signaling confidence in the company's continued growth trajectory.

The company's President and CEO, Sean Browne, expressed optimism about building upon the current momentum and executing strategic initiatives to drive long-term sustainable growth. XTNT's focus on integrating its acquisitions and improving profitability has positioned it well for the future.

Investor Relations and Conference Call

XTNT will host a webcast and conference call to discuss the full year 2023 financial results, providing an opportunity for investors to gain deeper insights into the company's performance and future plans. The call will be accessible via the company's website under the "Investor Info" section.

Value investors and potential GuruFocus.com members interested in the medical technology industry and companies like XTNT, with a strong recovery and positive outlook, may find this earnings report particularly compelling. The company's ability to surpass analyst estimates and provide a strong revenue forecast for 2024 suggests that XTNT is a company to watch in the coming year.

For more detailed financial information and the full earnings report, visit the SEC website to view XTNT's 8-K filing.

Explore the complete 8-K earnings release (here) from Xtant Medical Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance