Perella Weinberg Partners (NASDAQ:PWP) Has Announced A Dividend Of $0.07

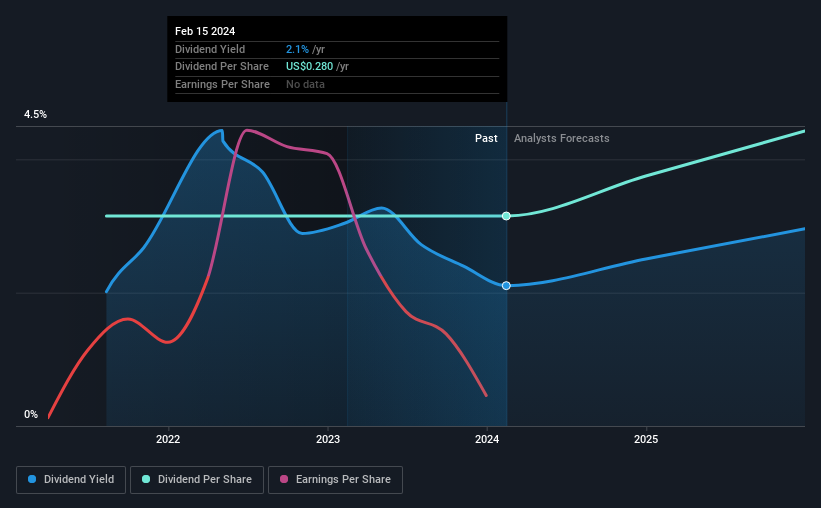

The board of Perella Weinberg Partners (NASDAQ:PWP) has announced that it will pay a dividend on the 11th of March, with investors receiving $0.07 per share. This means that the annual payment will be 2.1% of the current stock price, which is in line with the average for the industry.

Check out our latest analysis for Perella Weinberg Partners

Perella Weinberg Partners' Distributions May Be Difficult To Sustain

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Perella Weinberg Partners isn't generating any profits, and it is paying out a very high proportion of the cash it is earning. This makes us feel that the dividend will be hard to maintain.

Over the next year, EPS could expand by 22.1% if recent trends continue. While it is good to see income moving in the right direction, it still looks like the company won't achieve profitability. Unless this happens fairly soon, the dividend could start to come under pressure.

Perella Weinberg Partners Doesn't Have A Long Payment History

Looking back, the dividend has been stable, but the company hasn't been paying a dividend for very long so we can't be confident that the dividend will remain stable through all economic environments. The last annual payment of $0.28 was flat on the annual payment from3 years ago. Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

The Company Could Face Some Challenges Growing The Dividend

Investors could be attracted to the stock based on the quality of its payment history. Perella Weinberg Partners has impressed us by growing EPS at 22% per year over the past three years. Even though the company is not profitable, it is growing at a solid clip. If the company can turn a profit relatively soon, we can see this becoming a reliable income stock.

Perella Weinberg Partners' Dividend Doesn't Look Sustainable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. Strong earnings growth means Perella Weinberg Partners has the potential to be a good dividend stock in the future, despite the current payments being at elevated levels. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 1 warning sign for Perella Weinberg Partners that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance