Surpassing Expectations: Superior Gr of Cos Unleashes Growth Potential and Rewards Investors

Surpassing Expectations: Superior Gr of Cos Unleashes Growth Potential and Rewards Investors

At the end of December 06, 2023, Superior Gr of Cos (NASDAQ:SGC) will reward its shareholders with a dividend payout of $0.14 per share, demonstrating an annualized dividend yield of 6.93%. Remember, only investors who held the stock before the ex-dividend date on November 21, 2023 will receive this payout.

在2023年12月6日底, Superior Gr of Cos(纳斯达克股票代码:SG 将向其股东支付每股0.14美元的股息,表明年化股息收益率为6.93%。请记住,只有在2023年11月21日除息日之前持有股票的投资者才能获得这笔款项。

Superior Gr of Cos Recent Dividend Payouts

Superior Gr of Cos 最近的股息

| Ex-Date | Payments per year | Dividend | Yield | Announced | Record | Payable |

|---|---|---|---|---|---|---|

| 2023-11-21 | 4$0.14 | 6.93% | 2023-11-06 | 2023-11-22 | 2023-12-06 | |

| 2023-08-24 | 4$0.14 | 6.5% | 2023-08-07 | 2023-08-25 | 2023-09-08 | |

| 2023-05-18 | 4$0.14 | 7.43% | 2023-05-08 | 2023-05-19 | 2023-06-02 | |

| 2023-02-13 | 4$0.14 | 4.67% | 2023-02-03 | 2023-02-14 | 2023-02-28 | |

| 2022-11-17 | 4$0.14 | 5.33% | 2022-11-07 | 2022-11-18 | 2022-12-02 | |

| 2022-08-18 | 4$0.14 | 3.02% | 2022-08-08 | 2022-08-19 | 2022-09-02 | |

| 2022-05-23 | 4$0.14 | 3.6% | 2022-05-13 | 2022-05-24 | 2022-06-07 | |

| 2022-02-11 | 4$0.12 | 2.43% | 2022-02-04 | 2022-02-14 | 2022-02-25 | |

| 2021-11-18 | 4$0.12 | 1.91% | 2021-11-08 | 2021-11-19 | 2021-11-30 | |

| 2021-08-17 | 4$0.12 | 2.19% | 2021-08-06 | 2021-08-18 | 2021-09-01 | |

| 2021-05-27 | 4$0.12 | 1.84% | 2021-05-17 | 2021-05-28 | 2021-06-11 | |

| 2021-02-11 | 4$0.1 | 1.59% | 2021-02-05 | 2021-02-15 | 2021-02-26 |

| 过期日期 | 每年付款 | 分红 | 收益率 | 已宣布 | 记录 | 应付款 |

|---|---|---|---|---|---|---|

| 2023-11-21 | 40.14 | 6.93% | 2023-11-06 | 2023-11-22 | 2023-12-06 | |

| 2023-08-24 | 40.14 | 6.5% | 2023-08-07 | 2023-08-25 | 2023-09-08 | |

| 2023-05-18 | 40.14 | 7.43% | 2023-05-08 | 2023-05-19 | 2023-06-02 | |

| 2023-02-13 | 40.14 | 4.67% | 2023-02-03 | 2023-02-14 | 2023-02-28 | |

| 2022-11-17 | 40.14 | 5.33% | 2022-11-07 | 2022-11-18 | 2022-12-02 | |

| 2022-08-18 | 40.14 | 3.02% | 2022-08-08 | 2022-08-19 | 2022-09-02 | |

| 2022-05-23 | 40.14 | 3.6% | 2022-05-13 | 2022-05-24 | 2022-06-07 | |

| 2022-02-11 | 40.12 | 2.43% | 2022-02-04 | 2022-02-14 | 2022-02-25 | |

| 2021-11-18 | 40.12 | 1.91% | 2021-11-08 | 2021-11-19 | 2021-11-30 | |

| 2021-08-17 | 40.12 | 2.19% | 2021-08-06 | 2021-08-18 | 2021-09-01 | |

| 2021-05-27 | 40.12 | 1.84% | 2021-05-17 | 2021-05-28 | 2021-06-11 | |

| 2021-02-11 | 4$0.1 | 1.59% | 2021-02-05 | 2021-02-15 | 2021-02-26 |

In terms of dividend yield, Superior Gr of Cos finds itself in the middle ground among its industry peers, while Jerash Holdings (US) (NASDAQ:JRSH) takes the lead with the highest annualized dividend yield at 7.02%.

在股息收益率方面,Superior Gr of Cos发现自己在行业同行中处于中间地带,而 Jerash Holdings(美国)(纳斯达克股票代码:JRSH) 位居榜首,年化股息收益率最高,为7.02%。

Analyzing Superior Gr of Cos Financial Health

分析 Superior Gr of Cos

Companies that pay out steady cash dividends are attractive to income-seeking investors, and companies that are financially healthy tend to maintain their dividend payout schedule. For this reason, investors can find it insightful to see if a company has been increasing or decreasing their dividend payout schedule and if their earnings are growing.

支付稳定现金分红的公司对寻求收入的投资者具有吸引力,而财务状况良好的公司往往会维持其股息支付时间表。出于这个原因,投资者可以深入了解一家公司是增加还是减少了股息支付时间表,以及他们的收益是否在增长。

YoY Growth in Dividend Per Share

每股股息同比增长

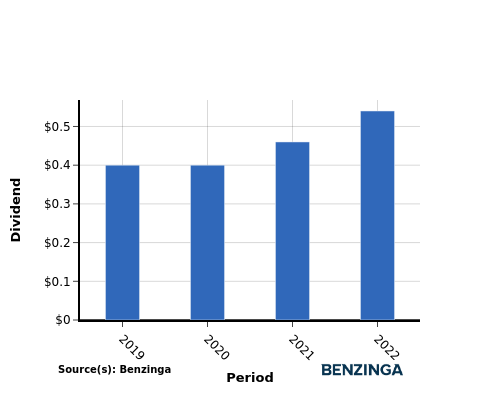

Investors witnessed an upward trajectory in the company's dividend per share between 2019 and 2022. The dividend per share rose from $0.40 to $0.54, indicating the company's dedication to enhancing shareholder value through increased dividends.

投资者见证了该公司在2019年至2022年间每股股息的上升趋势。每股股息从0.40美元上升至0.54美元,这表明该公司致力于通过增加股息来提高股东价值。

YoY Earnings Growth For Superior Gr of Cos

Superior Grof Cos的同比收益增长

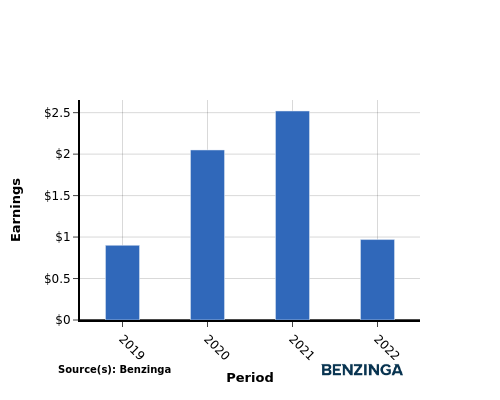

The earnings chart above shows that from 2019 to 2022, Superior Gr of Cos has experienced an increase in their earnings from $0.90 per share to $0.97 per share. This positive earnings trend is promising for income-seeking investors as it suggests that the company has more potential to increase its cash dividend payout if the trend continues.

上面的收益图表显示,从2019年到2022年,Superior Gr of Cos的收益从每股0.90美元增加到每股0.97美元。这种积极的收益趋势对寻求收入的投资者来说很有希望,因为它表明,如果这种趋势持续下去,该公司更有可能增加现金分红支出。

Recap

回顾

In this article, we delve into Superior Gr of Cos's recent dividend payout and examine how it impacts shareholders. The company has announced a dividend distribution of $0.14 per share today, resulting in an annualized dividend yield of 6.93%.

在本文中,我们将深入探讨Superior Gr of Cos最近的股息支出,并探讨它如何影响股东。该公司今天宣布股息分配为每股0.14美元,年化股息收益率为6.93%。

In terms of dividend yield, Superior Gr of Cos finds itself in the middle ground among its industry peers, while Jerash Holdings (US) takes the lead with the highest annualized dividend yield at 7.02%.

在股息收益率方面,Superior Gr of Cos发现自己在行业同行中处于中间地带,而杰拉什控股公司(美国)则以最高的年化股息收益率为7.02%,位居榜首。

Given that Superior Gr of Cos has experienced an increase in dividend per share from 2019 to 2022 along with an increase in earnings per share, it could signal that the company is in good financial standing and that they could be positioned to continue distributing their profits back to their investors.

鉴于Superior Gr of Cos从2019年到2022年每股股息有所增加,每股收益也有所增加,这可能表明该公司的财务状况良好,他们可能有能力继续将利润分配给投资者。

Investors are encouraged to closely track the company's performance in the upcoming quarters to stay informed of any updates in financials or dividend disbursements.

鼓励投资者密切关注公司在未来几个季度的业绩,以随时了解财务状况或股息支出的最新情况。

\To stay up-to-date with the companies that are announcing their dividends, click here to visit our Dividends Calendar.

\ 要了解宣布分红的公司的最新情况,请点击此处访问我们的股息日历。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自动内容引擎生成,并由编辑审阅。

译文内容由第三方软件翻译。