Saba Capital Management, L.P. Bolsters Portfolio with New America High Income Fund Inc (HYB) Shares

Introduction to the Transaction

Saba Capital Management, L.P. (Trades, Portfolio), a prominent investment firm, has recently expanded its investment portfolio by adding shares of New America High Income Fund Inc (NYSE:HYB). This move, executed on November 14, 2023, signifies a strategic addition to the firm's diverse holdings. The transaction details reveal a purchase of 520,314 shares at a price of $6.71 each, increasing the firm's total share count in HYB to 1,710,066. This trade has a moderate impact on the firm's portfolio, reflecting a 0.09% change.

Profile of Saba Capital Management, L.P. (Trades, Portfolio)

Based in New York, Saba Capital Management, L.P. (Trades, Portfolio) is a firm with a keen focus on value investing. The firm's investment philosophy is centered around identifying undervalued assets and leveraging market inefficiencies. With top holdings that include Templeton Global Income Fund (NYSE:GIM) and BlackRock Capital Allocation Trust (NYSE:BCAT), Saba Capital Management has a significant presence in the financial services and technology sectors. The firm manages an equity portfolio worth $3.84 billion, with 624 stocks in its current roster.

Overview of New America High Income Fund Inc

New America High Income Fund Inc is a diversified, closed-end management investment company based in the USA. The fund's primary objective is to generate high current income while preserving shareholder capital, focusing on high-yield fixed-income securities. With a market capitalization of $156.845 million, HYB's investment portfolio spans various sectors, including energy, financial, and healthcare. The stock's current price stands at $6.71, with a PE percentage of 8.49, indicating profitability.

Transaction Specifics

The recent trade action by Saba Capital Management, L.P. (Trades, Portfolio) on November 14, 2023, saw an addition of 520,314 shares in New America High Income Fund Inc. This trade has increased the firm's position in HYB to 7.32% of the traded stock, accounting for 0.3% of the firm's total portfolio. The acquisition price of $6.71 per share reflects the firm's confidence in the stock's potential.

Stock Performance and Valuation Metrics

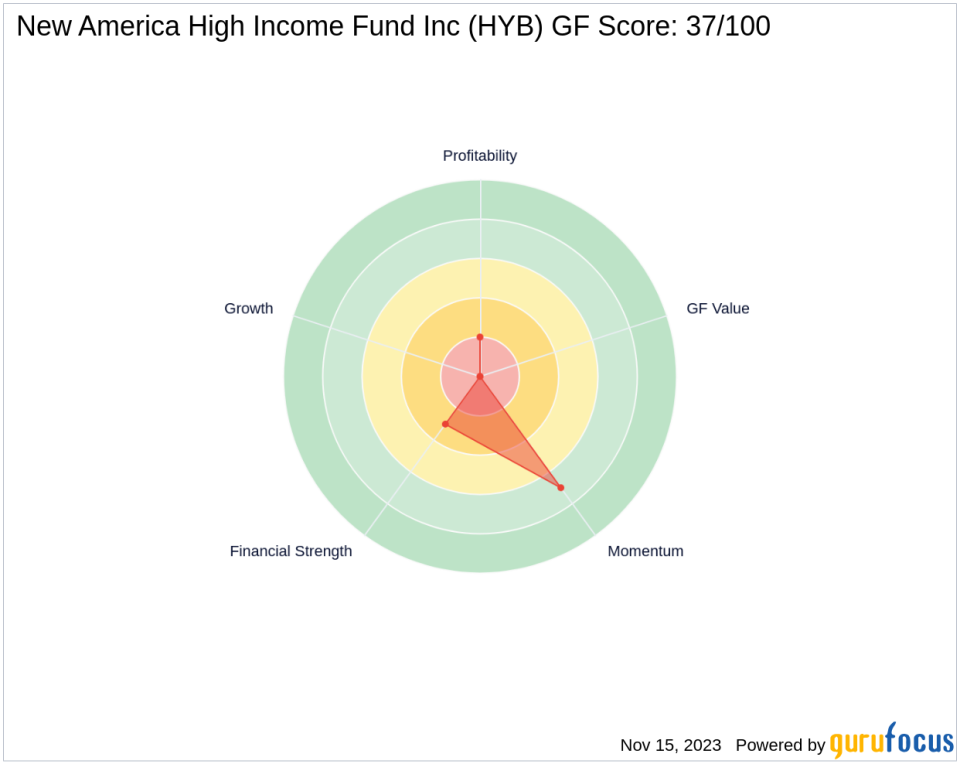

HYB's stock performance has been a mix of highs and lows. Since its IPO, the stock has seen a decline of 31.6%, yet it has managed a year-to-date increase of 1.05%. The stock's GF Score stands at 37 out of 100, suggesting poor future performance potential. However, due to the lack of sufficient data, the GF Value and the stock's valuation relative to it cannot be evaluated.

Financial Health and Growth Prospects

Examining HYB's financial health, the balance sheet rank is 3 out of 10, and the profitability rank is 2 out of 10, indicating room for improvement. The growth rank is not applicable, and the cash to debt ratio is a low 0.02. Despite these figures, the firm's return on equity (ROE) and return on assets (ROA) are at 10.38% and 7.04%, respectively, which are relatively healthy indicators within the asset management industry.

Market Reaction and Future Outlook

The market has shown a mixed reaction to HYB, with RSI levels indicating a potential overbought condition in the short term. The momentum index rankings over the past months have been negative, suggesting that the stock may face challenges in maintaining its current momentum. However, the firm's recent investment could be a sign of confidence in the stock's future performance.

Conclusion

The recent acquisition of shares in New America High Income Fund Inc by Saba Capital Management, L.P. (Trades, Portfolio) is a noteworthy development for both the firm and the stock. While HYB's financial health and growth prospects present a mixed picture, the firm's investment could signal a belief in the stock's potential for high income and capital preservation. Investors will be watching closely to see how this addition impacts Saba Capital Management's portfolio and whether HYB can overcome its current challenges to realize growth.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.