On the evening of February 25, Buffett, the "god of shares", released his 52nd letter to Berkshire Hathaway shareholders.

Warren Buffett's Berkshire Hathaway (Berkshire Hathaway) released a letter to shareholders on Saturday. The company's annual shareholder letter is watched not only by Berkshire Hathaway's own shareholders, but also by the entire investment community, who wants to know what Buffett, the world's third-largest billionaire investor, thinks.

The following is a summary of Berkshire Hathaway's letter to shareholders:

What do we hope to accomplish?

My partner, Berkshire Hathaway Deputy Chairman of the Board Charlie Munger (Charlie Munger) and I want the company's continuing earnings per share to grow every year. Of course, because of the cyclical weakness of the US economy, the company's real earnings may sometimes decline, and it may also reduce the company's profits because of major disasters in the insurance industry and other industries, but no matter what difficulties we encounter, our job is to drive the company's performance to grow dramatically over time.

Berkshire's profit rose 15% in the fourth quarter

Berkshire Hathaway's net asset income reached $27.5 billion in 2016, with a 10.7 per cent increase in book value per Class An and B share. Over the past 52 years, the company's book value per share has risen from $19 to $172108, a compound annual growth rate of 19%.

Berkshire's fourth-quarter profit rose 15%, thanks to an increase in investment income. Net income climbed to $6.29 billion, or $3823 per share, compared with $5.48 billion, or $3333 per share, a year earlier. Excluding some of its investment income, operating profit was $2665 a share, while three analysts surveyed by Bloomberg expected an average of $2717 a share.

Immigration makes America great.

When it comes to immigration, Buffett did not directly comment on US President Donald Trump's immigration policy, but he said that even economists should understand that one of the key factors that make America great is immigration.

Buffett pointed out that U. S. economic growth has always been incredible, one of the main reasons is the large number of talent and ambitious immigrants to the United States.

Optimistic and cautious about the future

In his letter to shareholders, Buffett remained optimistic about the U. S. economy. He believes that because of innovation, increased productivity, entrepreneurial spirit and abundant capital, American industry and corresponding stocks will almost certainly rise in value in the future.

However, Buffett is more cautious than before about what might happen to the market in the next few years. He believes that falls and even panic in major markets may occur from time to time in the next few years, which will affect all stocks.

But he thinks there's no need to be afraid. Yes, the accumulation of wealth may be interrupted briefly from time to time, but not stopped.

Both large and small investors should insist on investing in low-cost index funds.

Buffett said it is almost certain that the US business and a portfolio of stocks will be more valuable in the coming years; it is likely that hedge fund investors will continue to be disappointed; in the long run, only about 10 industries are expected to "outperform" the S & P 500, and both large and small investors should stick to low-cost index funds.

Stock repurchase

In the investment world, discussions about share buybacks are often hot, but Buffett advises enthusiasts to take a deep breath-assessing the demand for buybacks is not complicated: for shareholders who continue to hold shares, all you need to do is to pay attention to whether the repurchased stock is lower than its intrinsic value.

Keep in mind that share buybacks should never occur in two situations: first, companies need all the existing money to defend or expand their business, and are uncomfortable with new debt; second, buying other companies is more valuable than buying back undervalued shares.

Buffett's advice to companies on share buybacks is that before discussing buybacks, the CEO and the board of directors should say in unison: "it's wise to do this at the same price, but it's stupid to do another thing." "

Insurance

Property / casualty insurance has been Berkshire Hathaway's main growth engine since 1967, when it acquired National Insurance and its sister company, National Fire and Maritime, for $8.6 million. Today, national insurance is the world's largest property / casualty insurance company in terms of net assets. In addition to the three main insurance businesses of GEICO, General Re and Berkshire Hathaway Reinsurance Group (Berkshire Hathaway Reinsurance Group), we also have many small companies that specialize in commercial insurance. Over the past 14 years, profits of these companies have increased to $4.7 billion and assets held have increased from $943 million to $11.6 billion.

Investment

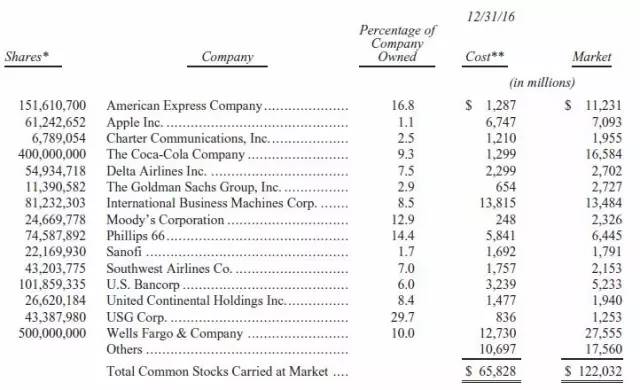

As of December 31, 2016, Berkshire listed 15 top common stock investments, some of which are as follows:

1. Wells Fargo, with a stake of 10%, has an initial investment of US $12.73 billion and a market capitalization of US $27.555 billion.

2. Coca-Cola, with a shareholding ratio of 9.3%, with an initial investment of US $1.299 billion and a market capitalization of US $16.584 billion

3. IBM, with a shareholding ratio of 8.5%, an initial investment of US $13.815 billion and a market capitalization of US $13.484 billion

4. American Express, with a stake of 16.8%, an initial investment of US $1.287 billion and a market capitalization of US $11.231 billion

5. Apple, with a shareholding of 1.1%, has an initial investment of US $6.747 billion and a market capitalization of US $7.093 billion.

Investment list of Berkshire's top 15 common shares

Buffett made a paper profit of $1.6 billion on his investment in Apple last year.

Berkshire Hathaway made a paper profit of more than $1.6 billion on its purchase of Apple shares last year, thanks to a rise in Apple shares.

Berkshire Hathaway bought about 61.2 million Apple shares last year at a cost of $6.75 billion, with an average purchase price of about $110.17, according to Berkshire Hathaway's annual report on Saturday. Based on Apple's closing price of 136.66 on Friday, the stake is worth more than $8.3 billion.

Berkshire Hathaway was one of Apple's top 10 investors in 2016, buying more than 9 million shares in the first quarter and then increasing its positions in the fourth quarter. Previous regulatory filings from one of its insurance subsidiaries revealed that the initial purchase price averaged $99.49 a share, but Saturday's Berkshire Hathaway annual report revealed more details of the overall investment as of December 31.

Annual shareholders' meeting

Last year we teamed up with Yahoo to broadcast the annual shareholders' meeting live for the first time. The event was so successful that a total of 1.1 million people signed up to watch the live broadcast, which was then replayed 11.5 million times. As a result of webcasting, the number of people attending shareholders' meetings fell by about 10 per cent last year to about 37000. Berkshire Hathaway's shareholders' meeting this year will be held on May 5 local time and will end on May 6. Yahoo will broadcast the whole process of the shareholders' meeting live on the web, and users can visit https://finance.yahoo.com/brklivestream to watch the live broadcast. All meetings and interviews will also be interpreted simultaneously in Chinese.

Buffett is known for his stock-picking talent, and Berkshire Hathaway earns most of its revenue from businesses that Buffett has bought over the past 50 years. Dozens of subsidiaries include Geico, a car insurer, BNSF, a railroad company, a network of car dealerships, retailers and power utilities.

Buffett, 86, is still investing. Last year, he completed a deal between battery maker Duracell and Precision Castparts, an aviation supplier, which also helped boost his company's manufacturing profits.