Report guide

On July 7, 2020, we published our drug screening industry report “How do you view the future valuation and growth space of early drug screening CRO?” China has analyzed the business model of drug screening platforms. Among them, ViaBio — a “service+capital” two-wheel drive business model, uses incubated investments to bring leveraged income while services bring stable cash flow, achieving a breakthrough in the traditional CRO manpower intensive driving model. In this report, we will mainly address some of the market's confusion about ViaBiotech's future development: 1. Can the company's main business, drug screening service revenue, continue to grow at a high rate? 2. What are the advantages and risks of extending the downstream service chain? What is the quality of Langhua Pharmaceuticals, the target of the acquisition? 3. How is the profit margin of EFS's investment incubation business assessed? 4. What is the company's market capitalization ceiling? This report will provide exploratory answers to the above questions, hoping to resolve investors' doubts about ViaBio's business model and future development space. In summary, we believe that the company's service business industry chain has a good entry point, and at the same time, the business model of using CRO to expand investment incubation business and service chain extension has raised the ceiling and laid the foundation for the company to grow bigger and stronger.

Key points of investment

ViviaBio (01873): A CXO company building a new ecosystem through service+investment

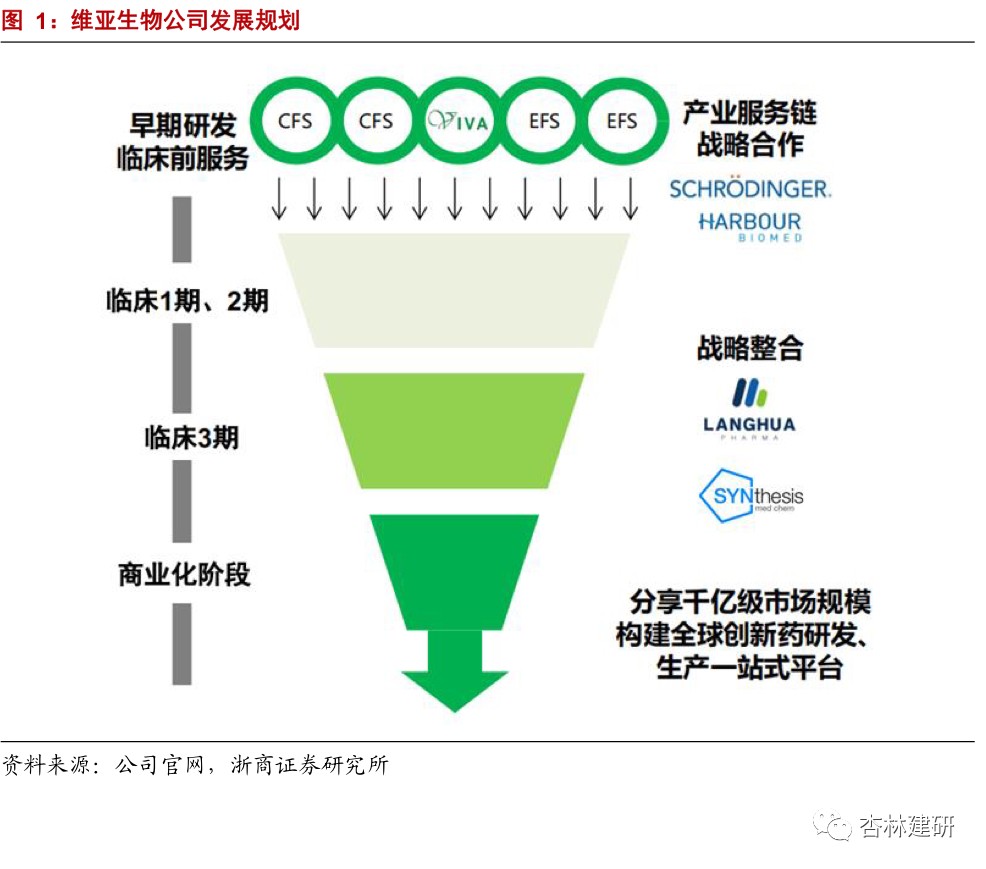

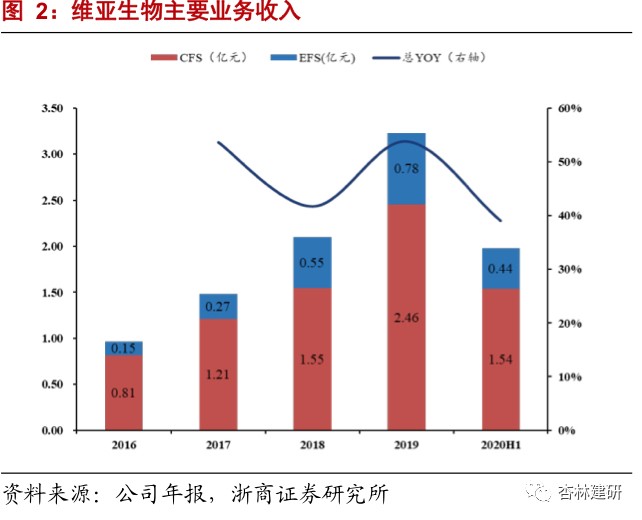

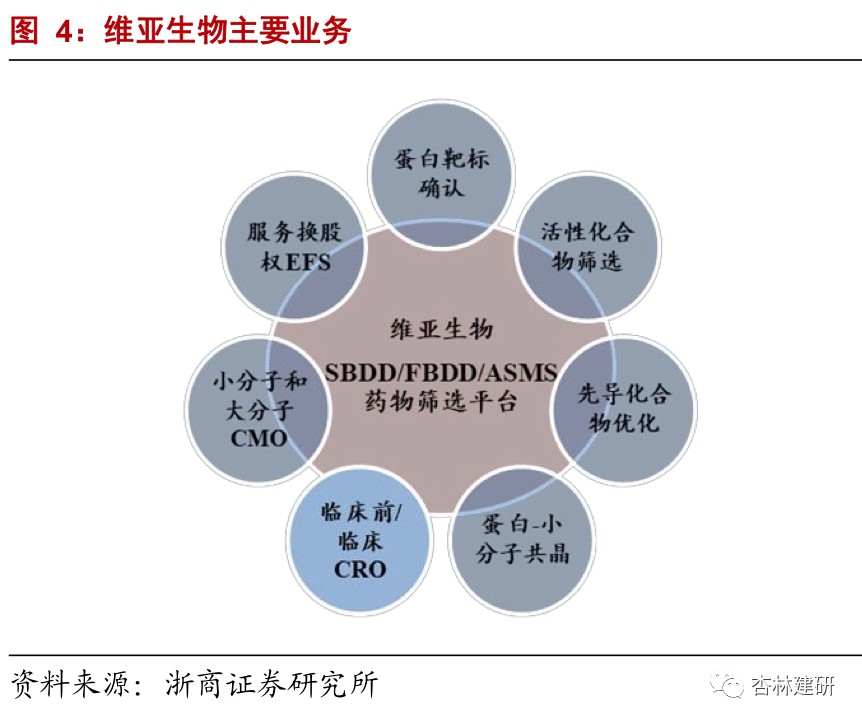

Drug screening CRO enhances the service capacity of the entire innovative drug industry chain by expanding investment and incubation business in customers, and collaboratively complementing downstream services to enhance the service capabilities of the entire innovative drug industry chain. The company mainly provides structure-based drug discovery services, and combines the traditional CRO service for cash (CFS) model with a unique service for equity (EFS) model to achieve high benefits from long-term drug incubation investments while earning fees for short-term drug discovery services. In the second half of 2020, the company successively acquired Reliance Biotech to strengthen its front-end service capabilities; acquired Langhua Pharmaceutical's supplementary back-end service (CMO) to create a one-stop platform; and built an incubation base in Hangzhou to strengthen the CFS+EFS dual-wheel drive synergy. Based on the source traffic of CFS and EFS businesses, strategic cooperation or mergers and acquisitions have been reached with innovative pharmaceutical companies in all parts of the industry chain to build an integrated innovation service platform.

CFS business: expanding from drug screening services (CRO) to full service chains (CRO+CDMO), platform-based construction is expected to continue to exceed expectations

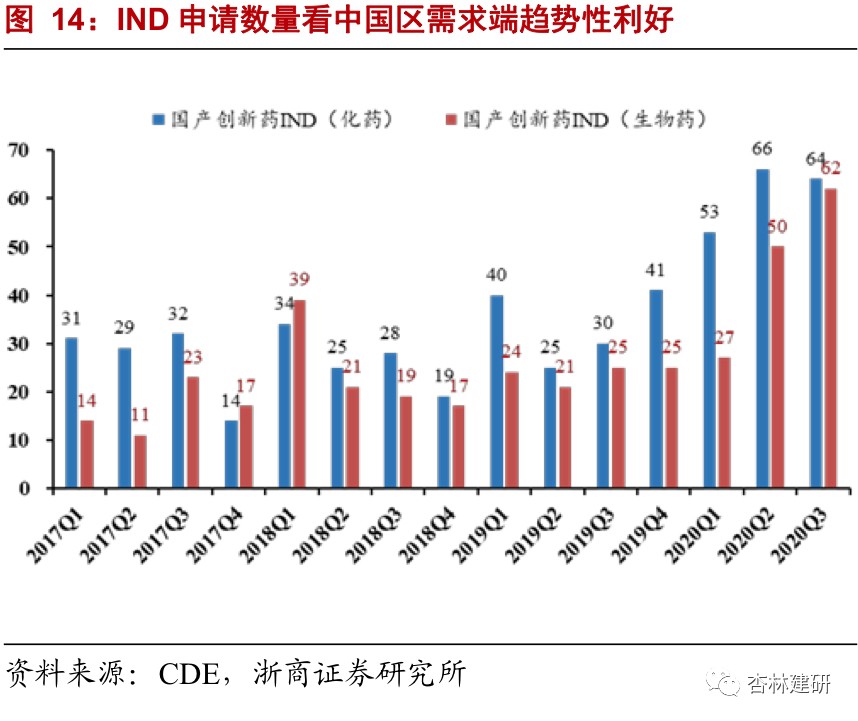

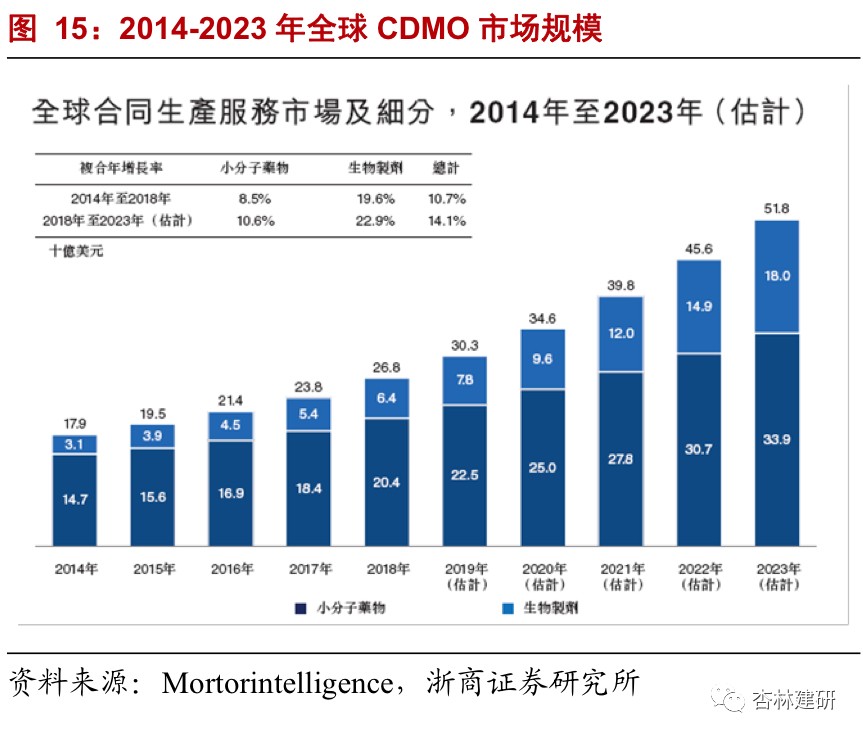

In 2020, the company continued to strengthen the CFS sector from various angles such as technology platforms, customer scope, and service chain extension. We believe that the increase in performance mainly comes from the following two aspects:1) CRO business: Drug screening revenue continues to grow at a high level, and receiving RealBio strengthens front-end capabilities.Ongoing orders for the company's drug screening service in 2020H1 increased rapidly, and performance in the second half of the year is expected to continue to be realized. The acquisition of drug synthesis CRO Reliance Biotech has strong synergy with the original business. It is expected to increase the customer base at the front end of the service chain, achieve a two-way flow between upstream and downstream service chains, improve the company's service chain, and enhance customer stickiness. Looking at the long term, the company's forward-looking introduction of new technology platforms has carried out services based on cryo-electron microscopy technology, continuously consolidating technical advantages in the field of structural chemistry and broadening the moat.2) CDMO business: The acquisition of small molecule CMO companies is expected to be completed by the end of the year. Profitability increased rapidly in the first half of the year, and large molecule CMO continues to be deployed.On August 9, 2020, the company promoted a strategic integration agreement with Langhua Pharmaceutical to acquire 80% of Langhua Pharma's shares for 2,560 billion yuan. Through analysis of the company's financial data, we found that the company's main CDMO business in 2017-2019 was the sale and commercialization of intermediates and APIs. In the first half of 2020, with the construction of CDMO capabilities and the introduction of orders, net interest rates increased rapidly, and per capita income generation and profit generation were at the forefront of the industry.We believe that the company's rich production management experience and certified large-scale production capacity have laid a good foundation for the transformation of CDMO. Cooperation with Viva Biotech is expected to bring more customers to Langhua Pharmaceuticals and strongly promote the development of the CDMO sector.

Overall, we believe there is no doubt that the company's expansion from CRO downstream to improve its ceiling and service capabilities to incubate customers is unquestionable. The competitiveness of both businesses has been relatively well verified. However, as the leader in business development, we believe that the continuous verification of the company's ability to integrate will be an important variable affecting the company's overall competitiveness. In the early stages of the company's accelerated business expansion, this is also the focus of our attention. Once verified, the company's ceiling will quickly open up.

Investment Incubation Business (EFS): Using the Power of CFS to Build an Incubator for Innovative Pharmaceutical Companies

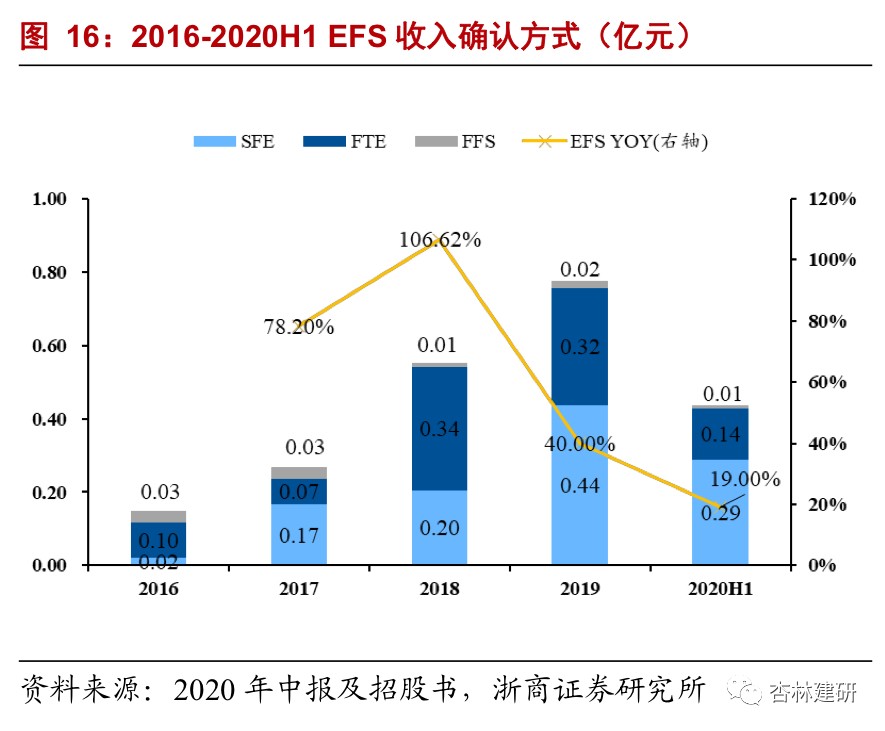

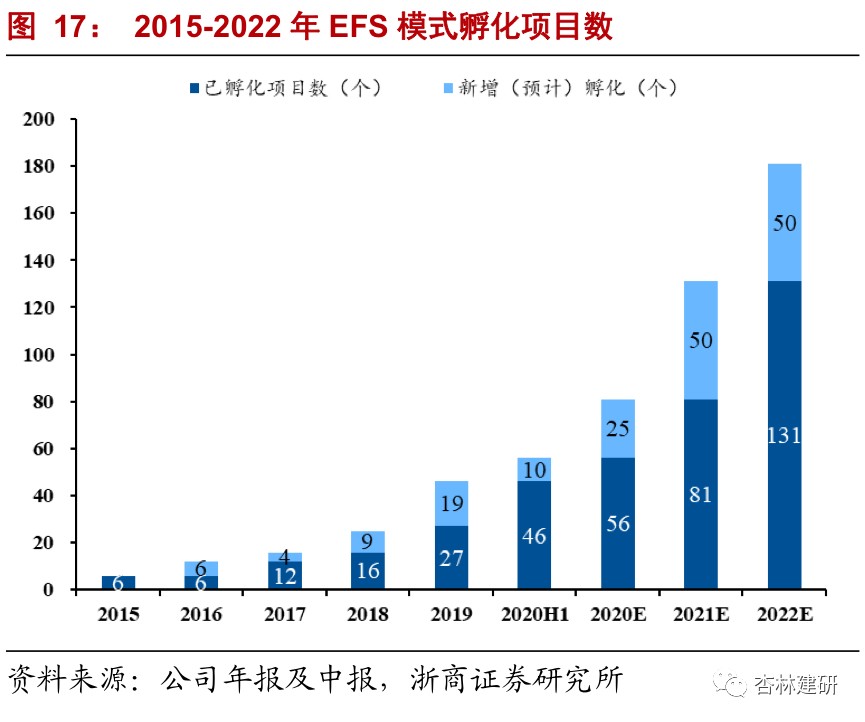

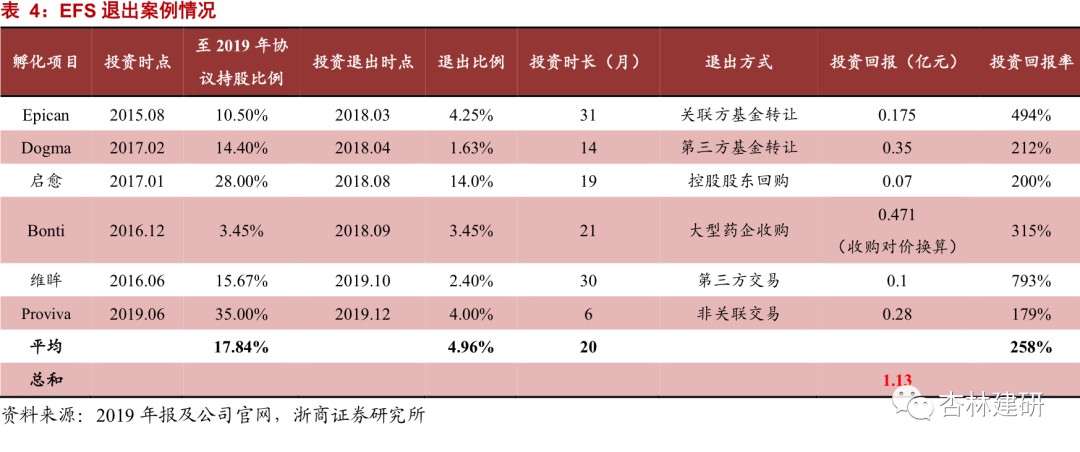

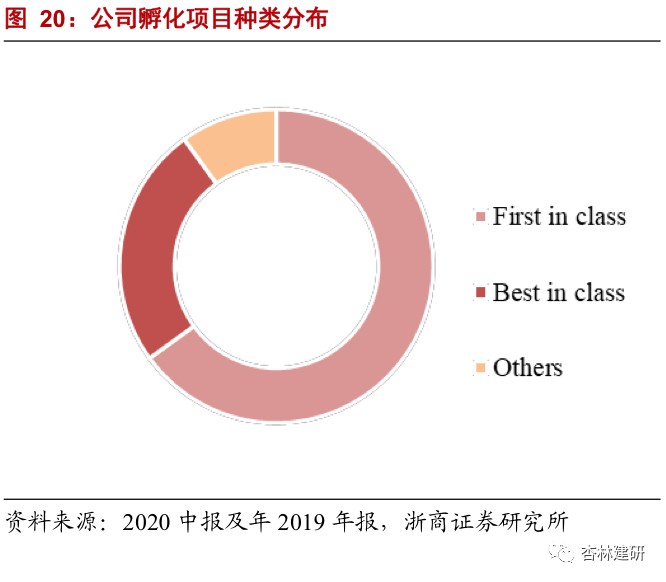

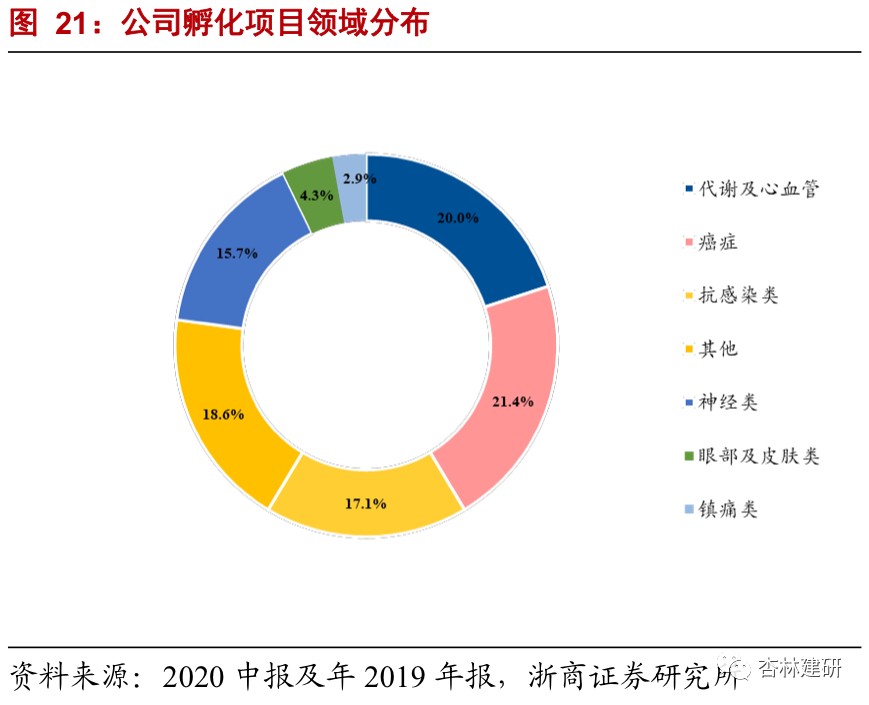

Based on high-quality CFS services, the company expanded its business model to service equity (EFS) in 2015 to share the profit margins brought about by the increase in valuation of Biotech's projects after the project was promoted. As of 2020H1, the company has incubated 56 enterprises, an average shareholding of 21.78%, and the project screening ratio is about 3%. Beginning in 2018, the company successively withdrew from 6 incubation projects and received a total investment disposal income of 113 million yuan, with an average return on investment of 258%. Currently, research and development of incubation projects is progressing smoothly. Of these, 3 are in clinical phase II, 1 clinical phase I, and 1 IND stage. On September 17, 2020, the company's incubator Dogma project was acquired by AZ. We estimate that the project valuation is about 600 million to 800 million, and the return on investment may reach 5000%.We believe this reflects the company's investment logic: 1) The professional team is deeply involved, and incubation projects are strictly screened to reduce risk and increase returns. 2) The company uses services to invest in shares, reduce investment costs for individual projects, better control project progress, and reduce risk. 3) Intervene early, exit early, and less investment in individual projects to better control risks. 4) The company has a broad layout, focusing on First-in-Class projects, solving clinical pain points and improving return on investment.Overall, we believe that ViaBio's investment incubation model is different from ordinary PE/VC investment. It has used CFS's high-quality outsourcing services to better advance project progress, effectively reducing return on investment and investment risk; EFS's earlier investment preferences have also enabled the company to gain a foothold in its most advantageous field and is expected to obtain better investment results. In view of the company's current return on investment, we believe that the company's EFS performance may be independent of the short-term investment and financing boom in the market, and continue to achieve better and faster growth, creating great performance elasticity for the company.

Profit forecasting and valuation

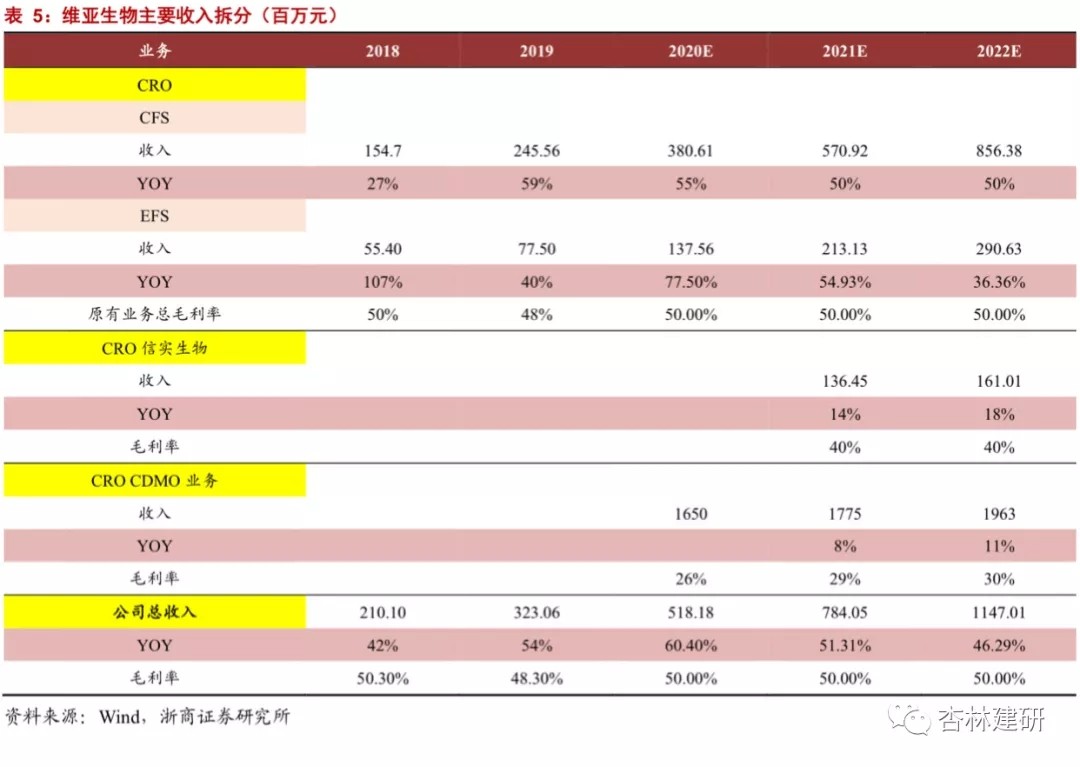

We use a segmented valuation method to value each segment of the company's business:

CFS service business:

1) CRO:The company's original CFS drug screening service had a net profit of 114 million yuan in 2019. Based on the continuous expansion of the company's personnel and the short-term guidance of on-hand orders, we assume that the CRO business will increase 55% year-on-year in 2020, and this part of the company will contribute 178 million dollars in profits in 2020. Referring to comparable companies in the industry, we believe that the reasonable market value of the CRO portion is 13.35 billion yuan (75 times PE).

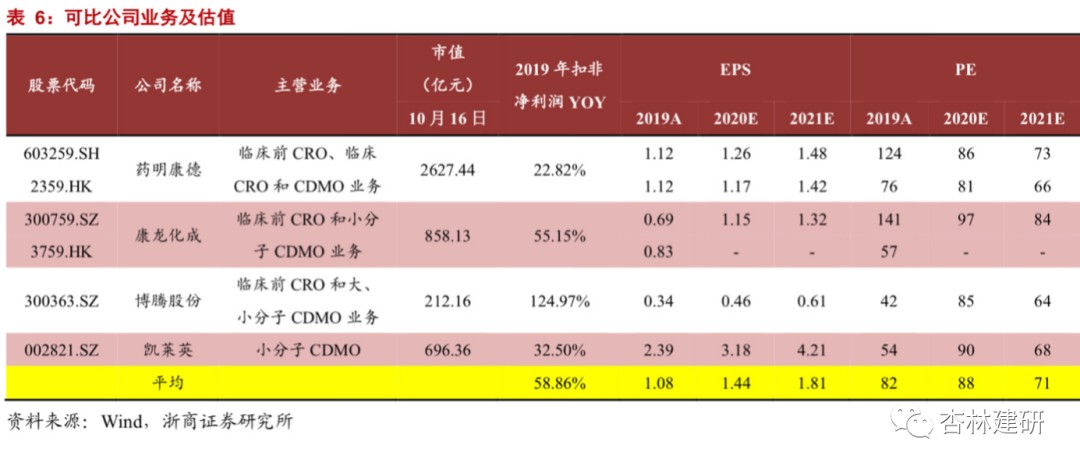

2)CDMO (Langhua Pharmaceuticals): Based on Langhua Pharma's performance in the first half of the year and changes in business structure, we expect Langhua Pharma's net profit to reach 175 million in 2020. Referring to the four comparable A-share and H-share companies, the average PE in 2020 was 88 times. Considering the potential diversion effects of the company's original business, the CDMO business is still in the early stages and the risk of initial business integration. Assuming that the CDMO business is given 50 times PE, the corresponding market value of the CDMO business is 8.75 billion yuan.

EFS business:In order to reduce the annual fluctuations caused by the pace of exits, we use the DCF method to value the EFS business. Referring to the project success rate and return on investment in the drug development market, we believe that Viya's investment experience is still in the early stages of accumulation. Considering the average annualized yield of the industry at the same stage of 45%, under the three scenarios of annualized return: 40% (optimistic)/35% (neutral)/30% (pessimistic), assuming a simplified withdrawal of all relevant shares in five years, the market value of the company's EFS business is about 17.049 billion (optimistic) /13.567 billion (neutral) /10.564 billion (pessimistic).

Regardless of the CDMO business that has not yet been implemented, we believe that the company's reasonable market value is about 26.717 billion dollars.

Investment advice

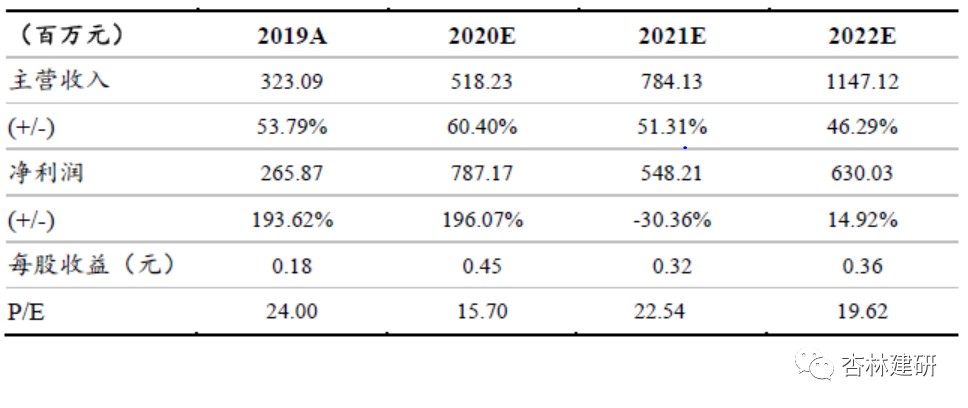

Based on the analysis of the company's core business segments, without considering the CDMO business that has not yet been acquired and showing the impact, we expect the company's EPS for 2020-2022 to be 0.45, 0.32, and 0.36 yuan/share, respectively. The net profit of the CRO business is expected to reach 178 million in 2020. Referring to comparable companies, we believe that the reasonable market value of the CRO portion should be 13.35 billion yuan, corresponding to 75 times PE. In order to reduce annual fluctuations in investment income, we used the DCF method to measure part of the market value of EFS. Under optimistic/neutral/pessimistic assumptions, the market value of the EFS business is approximately 17.049 billion /13.567 billion /10.564 billion. Under a neutral forecast, the company's corresponding reasonable market capitalization is a total of 26.717 billion yuan, which is significantly underestimated, and has been given a “buy” rating for the first time.

Risk warning

Integrated management risks of mergers and acquisitions; CDMO capacity building falls short of expectations; CFS's downstream business diversion effect falls short of expectations; market investment and financing sentiment decline and EFS return on investment falls short of expectations; industry policy changes; decline in innovative drug development sentiment; short-term order volatility; and competitive risk.

Financial Summaries

Main text table of contents

Chart table of contents

On July 7, 2020, we published our drug screening industry report “How do you view the future valuation and growth space of early drug screening CRO?” China has already analyzed the business model of drug screening platforms. Among them, ViaBio — a “service+capital” two-wheel drive business model, uses incubated investments to bring leveraged income while services bring stable cash flow, achieving a breakthrough in the traditional CRO manpower intensive driving model. In this report, we will mainly address some of the market's confusion about ViaBiotech's future development:1. Can the company's main business, drug screening service revenue, continue to grow at a high rate? 2. What are the advantages and risks of extending the downstream service chain? What is the quality of Langhua Pharmaceuticals, the target of the acquisition? 3. How is the profit margin of EFS's investment incubation business assessed? 4. What is the company's market capitalization ceiling?This report will provide exploratory answers to the above questions, hoping to resolve investors' doubts about ViaBio's business model and future development space. In summary, we believe that the company's service business industry chain has a good entry point, and at the same time uses CRO to expand investment incubation business and service chain extension. This business model has raised the ceiling and laid the foundation for the company to grow bigger and stronger.

1. From leading drug screening CRO to full-chain service+investment incubation collaborative companies

Leading CRO drug screening company to raise the ceiling by expanding the EFS business model.Established in 2008, ViviaBio provides global biotechnology and pharmaceutical customers with world-leading structure-based drug discovery services, including target protein expression and structure research, drug screening, and lead compound optimization until clinical candidate compounds are determined. In 2015, it combined the traditional CRO service for cash (CFS) model with the unique service for equity (EFS) model. While earning short-term drug discovery service fees and achieving stable cash inflows, it can also achieve high benefits brought by long-term drug incubation investment and amplify the value of drug screening services.Strengthen front-end services to increase the number of customers, and supplement back-end services to create a one-stop platform.The company announced on August 9, 2020, that it plans to acquire 80% of the shares of small-molecule CMO Langhua Pharmaceuticals and expand downstream services. It is expected to be consolidated in the fourth quarter of 2020. On September 21, it was announced that it would acquire Medicinal Chemical CRO Reliance Biotech, strengthen front-end drug discovery services, and expand customers to achieve a wider range of high-quality traffic guidance.

Build an incubation base in Hangzhou to further strengthen the CFS+EFS two-wheel drive synergy.The company issued an announcement on September 22, 2020 to provide additional laboratory facilities and incubator space for incubating innovative R&D projects in Hangzhou. We believe that the company will strengthen its R&D and production capacity through a series of actions, continue to explore other potential incubation portfolios to meet its future business development needs, and further enhance the collaborative capabilities between CFS and EFS.

2. CFS: Leading CRO in the field of drug screening, focusing on building an integrated service platform

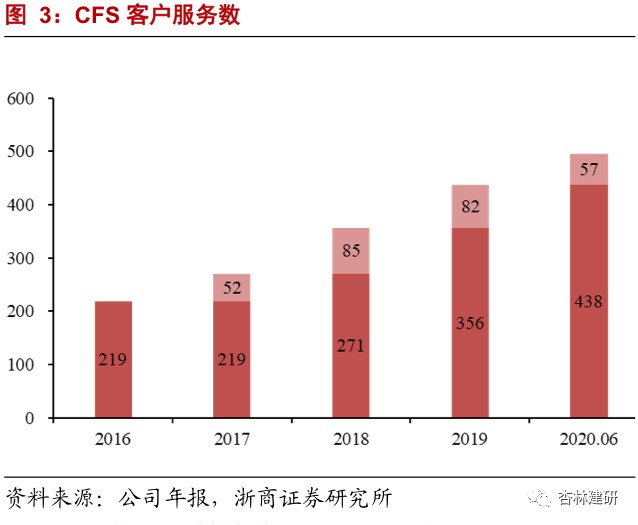

The company has the world's leading four core technology platforms for drug screening. It has a high market share in the outsourced services sector, and has maintained high growth at all times, showing the high prosperity of the industry and the company's good reputation in the industry.The company's core technologies include SBDD platforms, FBDD platforms, ASMS screening platforms, and targeted membrane protein drug discovery platforms. It mainly covers target protein expression and structure research, drug screening, lead compound optimization, and determination of clinical candidate compounds. In 2020 H1, the company's overall revenue was 198 million yuan, up 38.78% year on year; of this, CFS business revenue was 154 million yuan, up 46.1% year on year. Due to its good reputation in the SBDD field and active international and domestic expansion during the public health event, the number of customers and orders of the company increased dramatically. The total number of service customers was 495, and the number of orders in hand was 325 million yuan, a significant increase of 118% over 2019. The revenue share of the top 10 customers decreased by 4 percentage points compared to the same period in 2019, and the customer structure was continuously optimized. The company continues to strengthen the CFS sector from various angles such as technology platforms, number of customers, and service chain extension, and is expected to contribute greatly to performance growth in 2020.The company continued to strengthen and expand the CFS service sector in 2020, introducing new technology platforms such as cryo-electron microscopy to forward-looking future innovative technologies, acquire Reliance Biotech to strengthen the front-end service chain, expand the customer range and service radius, and acquire small-molecule CMO Langhua Pharmaceutical to extend the service chain, and focus on building a one-stop service platform.

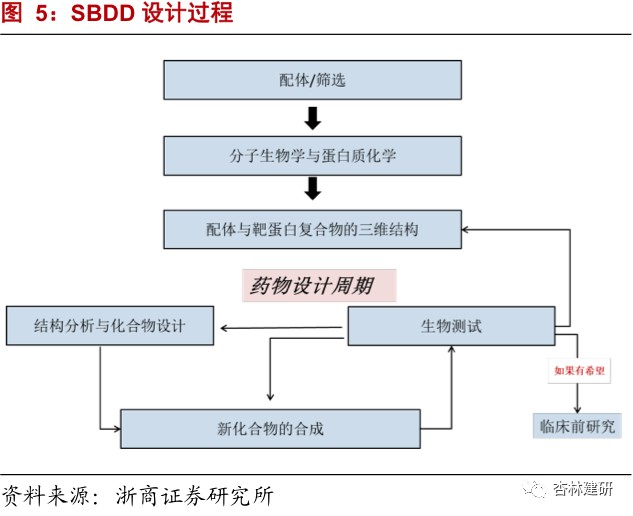

2.1. CRO business: Drug screening revenue continues to grow at a high rate, forward-looking layout expands technology moats

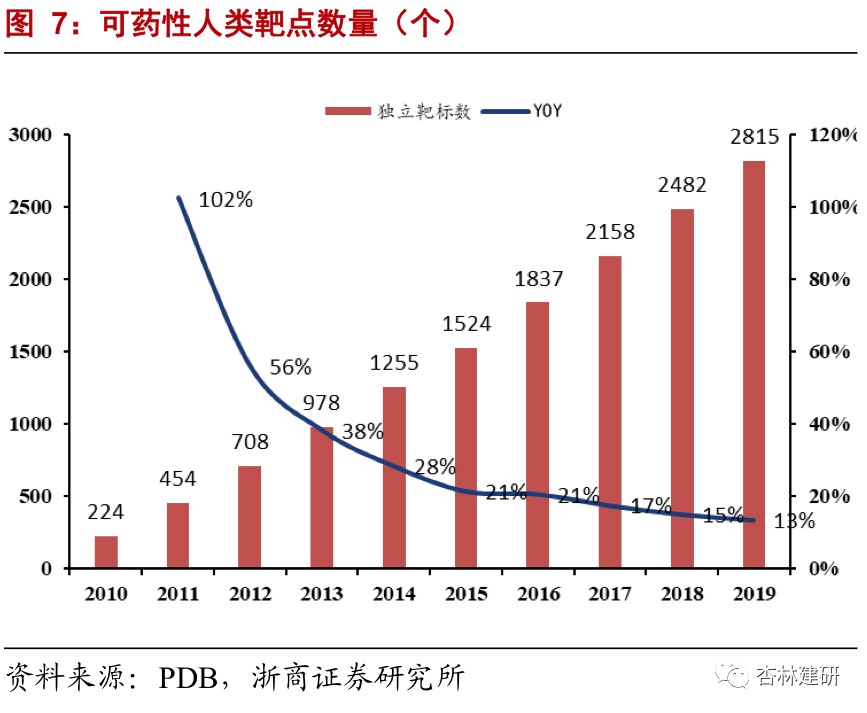

The company's most powerful SBDD is one of the most commonly used technologies for new drug development in recent years. It has the characteristics of low cost and high efficiency, and the market size is constantly growing.Structural analysis is an important way to understand the molecular mechanisms of various basic life processes. Accurate analysis of structural information can provide important basic biological information for new drug development. Structure-based drug design (SBDD) can confirm the binding characteristics of drugs more quickly, can obtain drug candidates from screening a small number of compounds; has low screening costs; significantly increases the hit rate of drug discovery; and can directly predict drug-receptor binding capacity, and has gradually become a mainstream method in drug development. Furthermore, since some other screening methods cannot understand the molecular function and structure of the target in the protein structure, it is still necessary to confirm the structure through X-ray diffraction in the future, such as protein structure analysis, purification, and structure-effect relationships, etc., so using the SBDD method has the characteristics of being more accurate, lower in cost, and higher efficiency, and has a large market space.

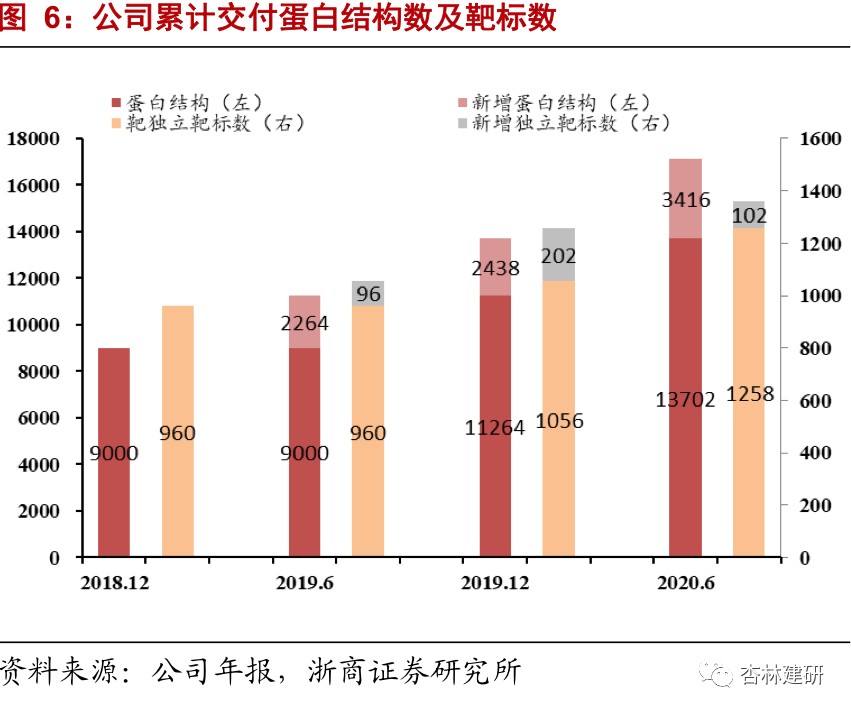

The company is in a leading position in the world in the field of drug target protein structure research. The high growth in on-going orders shows the prosperity of the industry and the company's industry reputation, and performance in the second half of the year is expected to continue to be realized.Proteins are the main molecular mechanism for maintaining the functional order of cells in life, so target protein research is becoming increasingly important in the development of new drugs. The number of new drugs approved by the FDA for marketing in 2015-2017 was 45, 22, and 46, respectively. Among them, there were 22, 8, and 22 new drugs targeting membrane proteins, respectively, accounting for 46% of the total. As of June 2020, the company has provided drug discovery services to 495 biotechnology and pharmaceutical customers around the world, and has delivered more than 17,118 protein structures to customers, of which 3,416 were added in the first half of the year, a significant acceleration compared to 2019. The company has studied a total of 1,360 independent drug targets, accounting for about 48.31% of the total number of independent drug targets, which is at the forefront of the industry; 102 new independent targets were added in 2020 H1, an increase of 29% over the previous year, far exceeding the industry's growth rate. The company's CFS orders in hand for the first half of 2020 were 325 million yuan, a sharp increase of 118% in 2019. Given the relationship between the short order cycle of the company's drug screening business (about 6 months) and the previous good short-term performance, we expect the company's CFS drug screening business to maintain relatively rapid and good growth in the second half of 2020, and is expected to reach a high growth rate of 55%-60% on the revenue side throughout the year.

The company's forward-looking introduction of a new technology platform has carried out services based on cryo-electron microscopy technology, continuously consolidating technical advantages in the field of structural chemistry and broadening the moat.In addition to the four technology platforms with traditional advantages, the company added new technology platforms such as cryo-EM (Cyro-EM), computational chemistry, and hydrogen-deuterium exchange simplicity (HDX-MS) in the first half of 2020. Compared with SBDD, cryo-electron microscopy does not require the preparation of crystals; only a small amount of protein samples is needed to determine the structure of macromolecular complexes. It can also better track the dynamic process, observe the effects of the structure, and obtain more information. It has already provided many high-resolution structures for proteins that were not suitable for crystallization in the past, and may replace SBDD in the long run. The company has now launched services for targets such as soluble protein particles, membrane proteins, and large-scale protein complexes based on cryo-electron microscopy platforms. With further iterative technology upgrades, cryo-electron microscopy will become an effective complement to methods such as X-ray and NMR. The company's extensive research base and technology accumulation on protein expression has also provided a solid foundation for high-quality observation and analysis of cryo-electron microscopy. The high R&D investment and forward-looking layout of multi-technology platforms have continuously consolidated the company's leading position in the field of structural biology and broadened the technological moat.

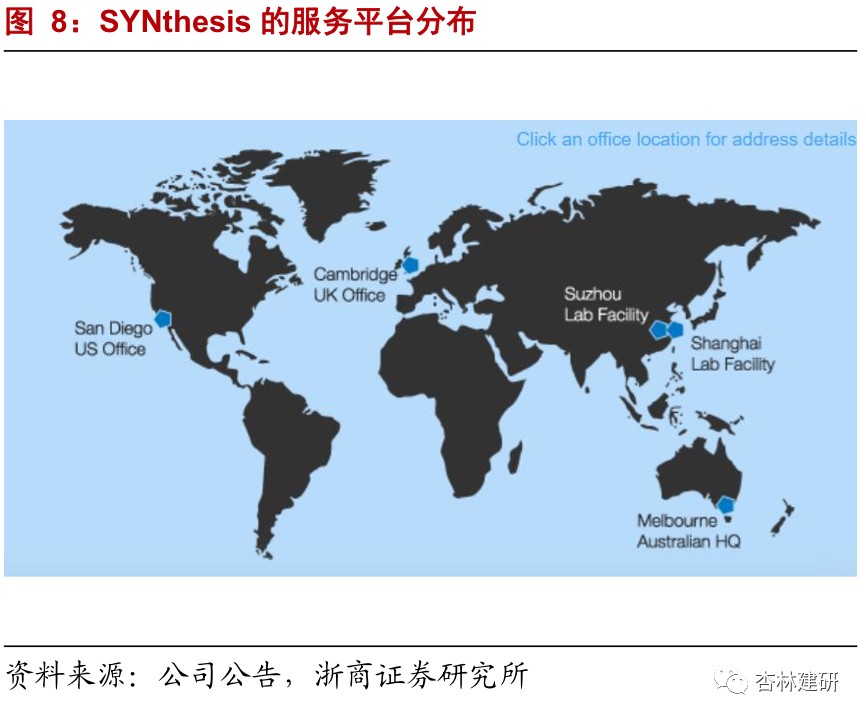

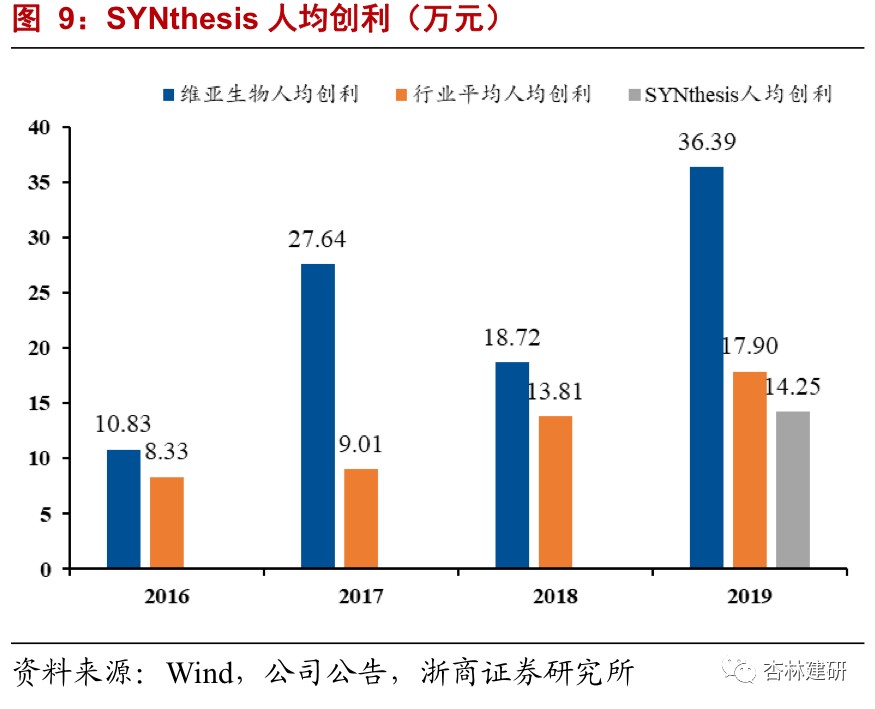

The company acquired Synthesis Med Chem (Synthesis Med Chem), a drug synthesis CRO, to enhance downstream capabilities.On September 21, 2020, the company announced the acquisition of 100% of the shares in preclinical drug synthesis CroSynthesis at a cost of US$80 million. Synthesis focuses on optimization services from emerging compounds and emerging compounds to lead compounds. It also provides drug structure-effect relationship analysis related to drug discovery, ADME optimization, and production of lead drug intermediates and active pharmaceutical ingredients from gram to kilogram grade. Synkinase, a subsidiary owned by its subsidiary, provides customers with academic and commercial kinase inhibitors. Over the past 5 years, Synthesis has successfully developed 5 preclinical candidate compounds for customers, showing strong ability to optimize compounds.By the end of 2019, the company had more than 200 employees, a net asset value of US$144.802 million, and net profit of US$2,9056 million and US$4,073 million in 2018 and 2019, an increase of 40.12% over the previous year, generating profit of US$21,000 per capita, which is at the industry average level.

The acquisition company has strong collaboration with the original business, and is expected to increase the customer base at the front end of the service chain and achieve a two-way flow between upstream and downstream service chains.The Synthesis service platform is located in Suzhou, Shanghai, Australia, and has 250 main customers, distributed in the US, Australia, the UK, etc., and there is little overlap with ViviaBiotech's original customers (mainly distributed in China and the US), which will effectively increase the number of customers and expand ViaBio's service radius. Pharmaceutical synthesis chemistry is at a critical point in drug development. This acquisition will strengthen the connection between the company's original strong service field drug screening business and the expanding CDMO business, upstream and downstream, improve the company's service chain, and enhance customer stickiness.

The payment method shows an extension of the EFS model and is also a recognition of the ability of drug screening.The acquisition is worth 80 million US dollars. The price-earnings ratio is about 20 times based on net profit in 2019. It is expected that they will be merged in early 2021 and will contribute greatly to ViaBiotech's performance flexibility in front-end services. It is worth noting that this payment method is worth 10 million US dollars through the provision of drug discovery services to sellers. We believe that this is the parent company that is the subject of the acquisition's recognition of ViviaBio's drug screening capabilities and an extension of EFS's service stock exchange business. In terms of price adjustments, the company stipulates that the net income level in 2020 and 2021 must not be lower than the 2019 level, otherwise the payment amounts for the second and third installments will be lowered; if the net income in 2021 reaches 120% of 2019 (10% CAGR for 2019-2021) or 135% (CAGR 15%), the company will pay an additional 2 million and 4 million US dollars as performance rewards, showing the confidence and room for cooperation between the acquiring parties for steady future business growth.

We believe that in the first half of 2020, the company continued to strengthen the CRO sector from various angles such as technology platforms, number of customers, and strengthening downstream services, which is expected to contribute greatly to the increase in performance.As a leading SBDD pharmaceutical screening company, the company is expected to continue to maintain high growth on the basis of sharing industry dividends, enhancing its own technology platform, and strengthening downstream services. We believe that the CRO service provided by the company is at the earliest stage of drug development, so controlling the customer base for drug development outsourcing services is the cornerstone of the company's future performance growth. The CRO sector continues to expand customers. Strengthening service capabilities and scope of services will help enhance customer stickiness, provide the possibility to divert CDMO, and attract more outstanding projects into EFS, providing more room for the company's profits.

2.2.CMOBusiness: Small molecule CMO is expected to be merged in 2020Q4, and large molecule CMO is continuing to be deployed

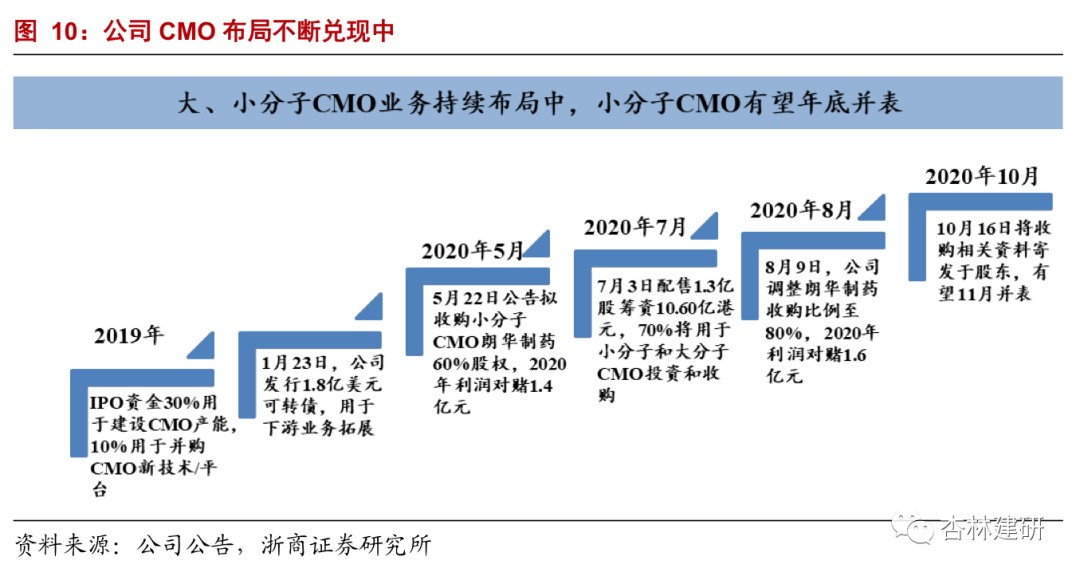

The company has continued to acquire CMO since 2019, and Langhua Pharmaceutical, a small-molecule CMO, is expected to launch by the end of the year. The expansion of downstream CDMO is the direction that the company has been focusing on since its listing.In the 2019 IPO fund-raising plan, 40% of the total capital was set aside for CMO production capacity construction and platform construction; on May 20, 2020, the company announced that it plans to acquire Langhua Pharmaceuticals (CMO) and promised a net profit of not less than $140 million in 2020; on July 3, the company placed 130 million shares to raise HK$1,060 million, of which 70% will be used for CMO investment and acquisition; on August 9, it will further advance the strategic integration agreement with Langhua Pharmaceutical to acquire 80% of Langhua Pharmaceutical's shares for $2,560 billion. According to the 2019 net profit calculation, PE is about 35 times, far below the industry average (PE is about 88). We believe that 2021-2022 will be the main window period for the company's CMO business to rapidly contribute to increased performance. With the construction of the company's CMC capabilities and the gradual introduction of CDMO orders, it will contribute greatly to the performance elasticity of the company's CDMO business sector.

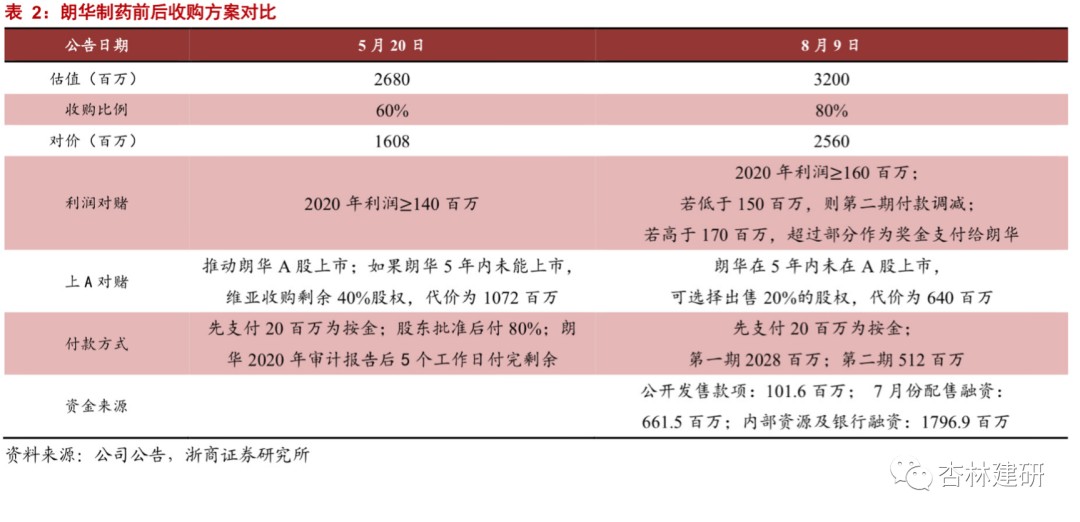

Changes in the acquisition agreement have verified the confidence of the acquirers in each other's abilities.The company issued announcements on May 22 and August 9, reaching a strategic integration agreement with Langhua Pharmaceutical to acquire 80% of Langhua Pharma's shares for 2,560 billion yuan, a further increase in the 60% shareholding ratio compared to the previous agreement to acquire 60% of the shares. Furthermore, Langhua Pharmaceuticals promised a net profit of not less than 160 million yuan in 2020, a significant increase over the previously promised 140 million yuan. The overall valuation also increased from $2.68 billion to $3.2 billion, up 19% from the past. We believe this is the acquiers' confidence in each other's business capabilities and customer transfer effectiveness.

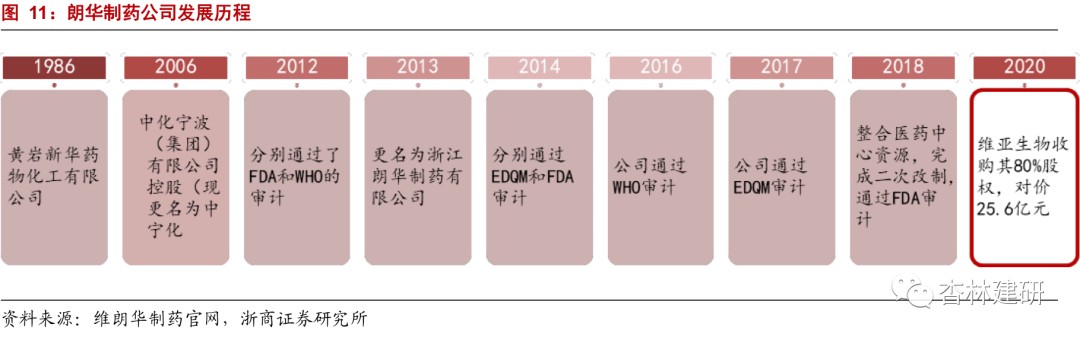

Langhua Pharmaceutical's high-quality small-molecule CMO standard has a complete GMP system, is large in size, and has the potential to carry high-volume CDMO orders.Langhua Pharmaceutical is a small molecule R&D and manufacturing company mainly engaged in the production of small molecule APIs and intermediates and CDMO business. It has obtained GMP certification from NMPA, and has obtained official certification from the FDA, EDQM, WHO, and PSCI. After the merger and acquisition, it will become the only CDMO platform for Viabio's small molecule drugs and intermediates. On June 30, 2020, the company had net assets of 422 million yuan and a total of 498 employees.We believe that compliant production capacity and operation management are the core competitiveness of CDMO at present. The company's rich production management experience and large, certified production capacity have laid a good foundation for the transformation of CDMO. Cooperation with ViviaBio is expected to bring more customers to the company and strongly promote the development of the CDMO sector.

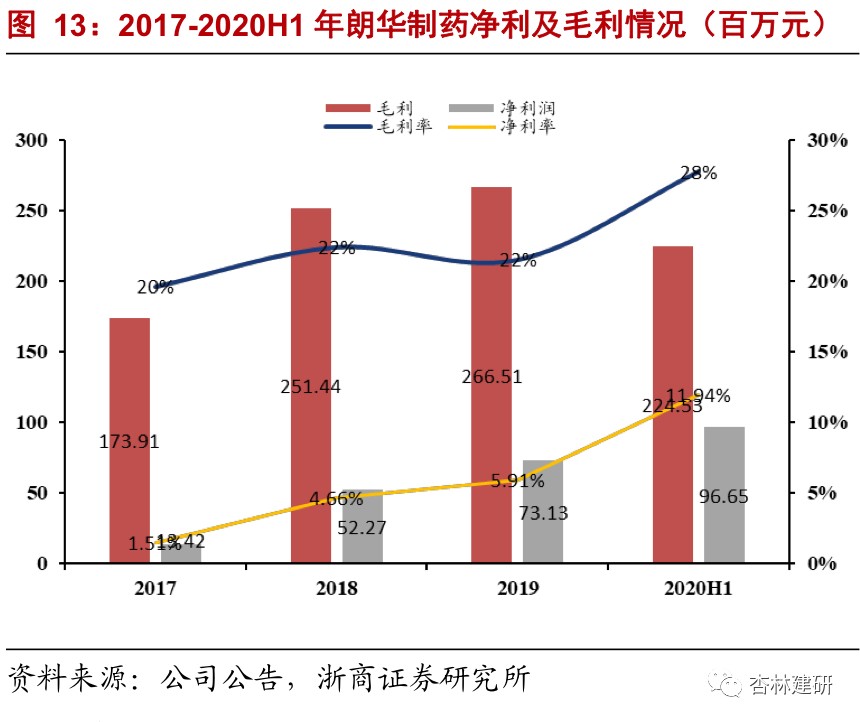

2017-2020H1Langhua Pharmaceuticals's revenue volume and profitability increased rapidly. Due to changes in business structure, net interest rates increased sevenfold.In 2017-2020, Langhua Pharmaceutical's revenue was $89 million, $1,122 million, $1,238 million and $809 million, net profit of 13.42 million, 52.27 million, 73.13 million and 96.65 million yuan respectively. Net profit increased from 1.51% to 11.94%, mainly driven by an increase in CDMO orders with higher added value, showing good growth. Judging from the geographical distribution, the company's revenue mainly comes from Europe and Asia, and there is little overlap with ViviaBiotech's original coverage area, which is expected to contribute to potential customers.We believe that Langhua Pharmaceuticals already has basic compliance production capacity and process development capabilities, and as a complement to ViviaBio's production capacity, it is expected to be of great help to improve Vibio's ability to serve customers and maximize the value of the “circle of friends”. We are also concerned about the progress of acquisitions and the pace of subsequent management integration.

Main business composition analysis: Judging from Langhua Pharmaceutical's net profit, the company's past revenue mainly came from the production and sale of intermediates and APIs and international trade transactions. In 2020, the revenue structure moved in the direction of CDMO, profitability increased rapidly, and future trends are yet to be seen.

According to the 2018-2019 revenue and net profit estimates disclosed by the company, the company's net interest rates for 2018 and 2019 were 4.66% and 5.91% respectively, far below the CDMO industry average. As can be seen from the project completion environmental protection facility acceptance report announced by Langhua Pharmaceutical in early 2019, the company's main production capacity and output in the past focused on the production of quinolone APIs and cyclopropanecarboxylic acid intermediates. Referring to the average sales prices of ciprofloxacin hydrochloride (187.5 yuan/kg) and levofloxacin hydrochloride (290 yuan/kg) from July to December 2018 disclosed in Wind's macroeconomic database, we estimate that the company's sales of quinolone products in 2018 were about 160 million yuan, accounting for 14.55% of total revenue for that year. We believe that the company's main revenue in 2018 and 2019 came from sales of quinolone APIs and cyclopropanecarboxylic acid intermediates and international trade in APIs, intermediates and formulations. There are relatively few orders for CMO and CDMO, so 2019 is probably still in its infancy. With the gradual confirmation of CDMO order revenue, the company's net interest rate rose rapidly to 11.94% in 2020. We believe that it is mainly due to the increase in the proportion of CDMO orders. Production with high added value has led to an increase in profitability and an increase in revenue volume, which dilutes fixed costs.

We believe that Langhua Pharmaceutical's revenue structure is shifting to a CDMO business with high added value, but it is currently in the early stages. The change in business structure will help the company increase profitability in various areas such as return on assets and net interest rates, but whether it can continue to increase the CDMO revenue ratio in the future and accept large orders is yet to be verified.

We believe that ViviaBio's high-quality traffic guidance and the CMC process development team that is currently being actively built will hopefully help Langhua quickly establish and develop CDMO service capabilities.The drug screening services provided by ViviaBio's CFS business are in the earliest stages of drug development, so they control the customer base for drug development outsourcing services. As the size of the company's EFS project pool gradually expands, the pipeline will show an exponential rise. Since EFS projects have strong stickiness and service binding effects, it is expected that the flow of CDMO services will be further enhanced with greater certainty. In the first half of the year, the company actively formed an expanded CMC team to connect R&D and production processes.

We believe that reaching strategic cooperation or mergers and acquisitions with leading companies in all parts of the industry chain with the source traffic of CFS and EFS businesses will help to quickly build a strong and powerful comprehensive R&D/production system to meet the R&D and production needs of customers at all stages.

CDMOThe racetrack is the highest quality track in the field of outsourcing that we continue to emphasize.The shift of global orders to the domestic market will be the main driver of CDMO performance growth, and market dividends and industrial upgrading in China are also expected to contribute significantly to long-term performance elasticity. Currently, the CDMO industry, supported by engineer dividends, is still in the early stages of industrial chain transfer in overseas markets. In the short to medium term, we believe that the core growth logic of the CDMO service sector that the company chose to expand is to rely on the logic of the Chinese manufacturing industry and enjoy the global industrial chain transfer boom.Looking at it in the long term. Performance flexibility brought about by China's incremental business (industrial opportunities under the MAH system) and enhancing competitiveness in the CDMO industry transfer will be an important foundation for the long-term rapid development of the CDMO industry.

3. EFS: Using the power of CFS to build an incubator for innovative pharmaceutical companies

Based on high-quality CFS services, expand the business model to service equity (EFS) and share the profit margins of Biotech's projects after advancing.In 2015, the company extended its business model on the basis of drug development outsourcing services, and expanded the CFS model (cash service) to the EFS model (service for equity), thus sharing the benefits brought by IP value-added in the development of biotech startups. ViviaBiotech provides drug screening services to incubators according to three charging methods: full time equivalent (FTE), project fees (FFS), and service exchange rights (SFE). Among them, the SFE model has gradually matured as incubation projects have gradually matured in recent years, and the amount and share of revenue has increased year by year. 2020 H1's EFS revenue was 43.547 million, up 19% year on year; net profit was 42.55 million, up 5% year on year. EFS has ongoing orders of approximately $168 million (order execution cycle of 2-3 years), an increase of about 190% over 2019.

EFSThe project pool is gradually expanding, and the effects of high return on investment are beginning to show.As of 2020H1, the company has incubated 56 enterprises, with an average shareholding of 21.78%. Due to public health events in the first half of 2020, project due diligence and progress were slightly delayed. As of June 30, 10 new incubation projects were added, 3 were invested in old companies, and 3 incubation projects were planned to be invested in during the SPA phase. In the first half of 2020, the company reviewed 425 projects, with a screening ratio of 2.35%. At present, the company has established a stable project recommendation mechanism with nearly 60 universities, research transformation centers and investment institutions around the world. As of June 30, 2020, the company has invested in 56 companies, covering a wide range of pipeline applications. In terms of mechanism of action, small-molecule drugs account for 60-70%, and macromolecules account for 20-30%. Companies that are unable to provide services such as gene cell therapy or devices will also choose to invest part of their cash in exchange for a small amount of equity.Beginning in 2018, the company successively withdrew from 6 incubation projects and received a total investment disposal income of 113 million yuan, with an average return on investment of 258%.

Research and development is progressing smoothly, close to 1-2Annual investment projects are expected to usher in a harvest period of investment incubation.Currently, R&D and incubation in the company's EFS project are progressing smoothly. In the first half of 2020 alone, Qiyu completed two rounds of external financing, and its dual antibody project is about to enter clinical phase I. Quralis also completed a round A fundraising of 42 million US dollars. According to some disclosures, several EFS programs have entered clinical phase I/II. We believe that the company's EFS business began in 2015, and some projects have gradually reached milestones and been widely recognized by the market under the promotion of the company's high-quality drug screening and pharmaceutical chemical services. The next 1-2 years are expected to usher in a harvest period of investment incubation.

3.1Looking at ViaBio's investment logic from Dogma's acquisition

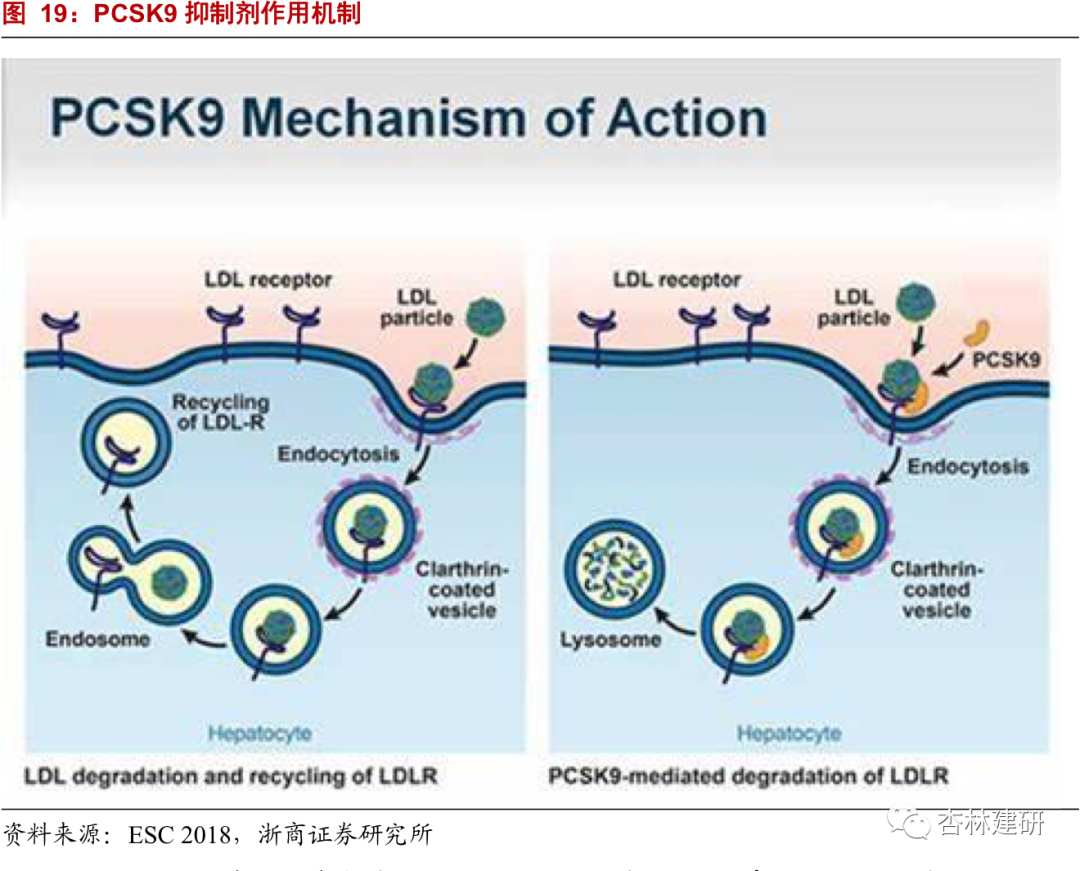

AZThe acquisition of the Dogma PCSK9 project is a double verification of the company's drug screening service capabilities and investment vision.On September 17, 2020, the company announced that Dogma Therapeutics, a biomedical company that it invests in and incubates, has reached an agreement with AstraZeneca to acquire global interests in its oral PCSK9 program. AstraZeneca will make a down payment to Dogma and a milestone payment to Dogma once global regulatory and commercial milestones are reached. ViaBio began investing in the incubation of Dogma in January 2017. Using SFE's fee method, ViaBiotech can obtain up to 14.4% of Dogma's shares (corresponding to $2 million in drug discovery services).

When the PCSK9 project was established in June 2019, Dogma publicly stated that the R&D progress of the project was helped by the unique cooperation model of partners Charles River and ViaBio, which greatly improved R&D efficiency. The company withdrew 1.63% in April 2018, with a return on investment of 500,000 US dollars and a return of 212%. As of 2019, the company held 9.95% of Dogma's shares. It is estimated that the value of this acquisition is about 600 million US dollars to 800 million US dollars, and the return on investment may be as high as 5000%. We believe that this acquisition not only proves the quality service and effectiveness of the company's SBDD drug screening platform, but also proves the forward-looking vision of the company's EFS project screening, becoming another classic case of EFS. We believe that the company's high-quality CFS services may have a stronger synergistic effect with EFS projects in the future. With the acquisition of EFS projects that may continue to come later, the company's ability and vision to screen projects will be further confirmed. Its benefits may be independent of market investment and financing prosperity, and obtain high profits over a long period of time.

Oral administration of PCSK9 addresses clinical unmet needs.PCSK9 inhibitors are a new innovative therapy for lowering blood lipids with small molecules. Mechanistically, they have a synergistic therapeutic effect with statins, and can achieve better clinical treatment results for patients who do not meet the standards of statin treatment and are intolerant to statins. IMS has predicted that 20% of US patients with dyslipidemia will stop using statins and switch to PCSK9 monoclonal antibody inhibitors. This is potential market growth space for such drugs. It is conservatively estimated that the market for PCSK9 inhibitors will exceed $9 billion. Currently, Sanofi/Regenerative and Amgen/Astellas products were launched in July and August 2015, respectively, but the annual cost of using PCSK9 monoclonal antibody for patients is about 350 times that of statins, thus hindering market expansion. Compared with injectable PCSK9 inhibitors already on the market, oral PCSK9 inhibitors have an advantage in terms of cost, and oral administration methods will improve patient compliance and greatly address clinical needs.

The return on investment of this acquisition may reach 50 times, which will contribute greatly to the flexibility of EFS's performance in 2020.As for the specific purchase price of the project, AstraZeneca did not disclose, so we referred to the price of Novartis's acquisition of MIDCO in November 2019. Midco is an RNAi company. It has only one lipid-lowering RNAi drug, inclisiran. It has completed clinical phase III, and Novartis's purchase price is 9.7 billion US dollars. According to Frost & Sullivan's survey, the drug that is about to be submitted to the NDA may be 7 times more than its preclinical drug. Since Novartis is a corporate acquisition and AZ is a project acquisition, we estimate that the price of this acquisition will be about 600 million US dollars to 800 million US dollars. According to the equity agreement, if ViaBio has completed 14.4% (corresponding to 2 million US dollars of service), then the return on investment = project value* (agreed shareholding ratio - withdrawn portion) /service consideration is approximately 5000%. Starting from this acquisition, we believe ViviaBiotech's EFS business model can better control risk and improve return on investment from the following aspects.

1. Professional teams are deeply involved, and incubation projects are strictly screened to reduce risk and increase returns.The company uses “business partner+analyst+master” to collaborate to select EFS projects, and the screening ratio is about 3%. These professional business partners have forward-looking and innovative drug development experience in many therapeutic fields, and their ability to judge project value and professional barriers to R&D prospects have continued to strengthen with their addition. The company added 6 top scientists to H1 in 2020, and the total number of business partners has reached 30, continuing to strengthen the post-investment management system.

2. The company uses services to invest in shares, reduce investment costs for individual projects, better control project progress, and reduce risk.We believe that the company's use of the service equity method has three advantages: (1) Considering the company's high service margin (50.20%, 48.30% and 50.66% in 2018-2020 H1, respectively), the company can use it to obtain higher profits. For example, in the Dogma project, the company invested 2 million US dollars in equivalent services, and the actual investment cost is only about 1 million US dollars. (2) The quality services provided by the company can better promote the development of the project and enhance the return on investment. (3) In 2-3 years of in-depth participation in the company's services, it is possible to better control the progress of incubation project research and development, discover risks, and find appropriate exit points.

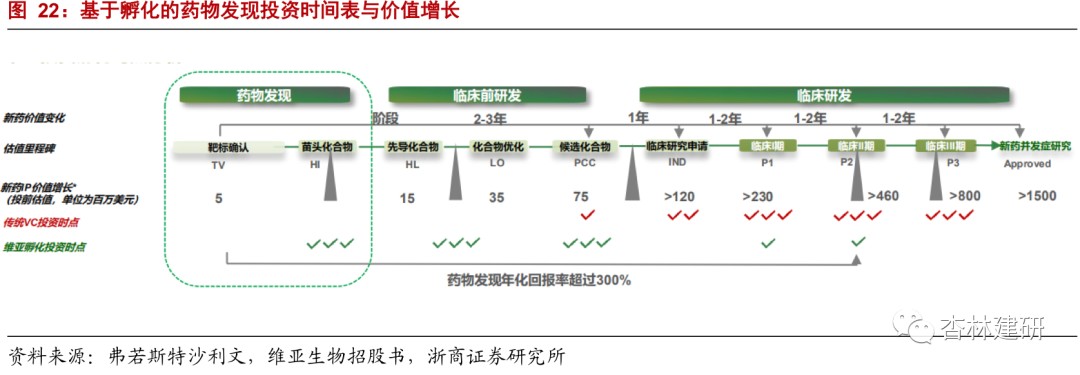

3.Intervene early, exit early, and less investment in individual projects to better control risks.Due to its excellent drug screening platform, VIA Biotech often has access to a large number of potential projects during the period of emerging compounds. Standing at the starting point of drug research and development, it is ready to intervene in incubating investments. The average investment for a single project is 1.5 million US dollars (about 10 million yuan), and it is generally chosen to partially or completely exit after 3-5 years of incubation of the project. This avoids the high failure rate of drugs entering the post-clinical stage, caters to the investment preferences of PE/VC investment, reduces the cash flow shortage caused by the long cycle of innovative drug development, and better controls investment risks.

4. The company has a broad layout and focuses on first-in-class projects to solve clinical pain points and improve return on investment.In terms of the selection of indications for investment incubation, the company avoided the overcrowded cancer field and reduced the proportion of anti-cancer drugs in order to have a better differentiated layout. In terms of the nature of incubation enterprises, the company focuses on pioneering innovative drugs, and the number of first-in-class projects is more than half. In-depth services improve the speed and success rate of research and development while solving clinical pain points. Dogma's oral PCSK9 inhibitor not only satisfies the treatment needs of clinical patients with statin intolerance, but also solves the problems of poor compliance and high cost with traditional injection inhibitors. It is one of the fundamental reasons why it is favored by AZ and has obtained more than 50 times the yield from 43 months of incubation investment.

Overall, we believe that ViaBio's investment incubation model is different from ordinary PE/VC investments. It has used CFS's high-quality outsourcing services to better advance project progress, effectively reducing return on investment and investment risk;EFS's earlier investment preferences also enabled the company to gain a foothold in its most advantageous field and is expected to obtain better investment results. In view of the company's current return on investment, we believe that the company's EFS performance may be independent of the short-term investment and financing boom in the market, and continue to achieve better and faster growth, creating great performance elasticity for the company.

4. Profit forecasting and valuation

4.1. Key Assumptions and Profit Forecasts

1) CFS CRO business:As the market space of the company's SBDD business continues to expand and the market outsourcing rate gradually increases, combined with the growth rate of the company's ongoing orders in the first half of the year and the order completion cycle (about 6 months), we believe that the company's CRO business will continue to grow at a high level. The company's new acquisition of Reliance Biotech will help broaden the number of customers and service radius in the company's drug screening stage and further promote the performance of CFS drug screening services. Assuming that the parent company's CRO business revenue increased by 55%, 50%, and 50% respectively in 20-22, Reliance Biotech began merging in 2021, with revenue of about 13.6 million, and increasing by about 14% and 18% year-on-year in 2021-2022.

2) CFS CDMOBusiness (Langhua Pharmaceuticals):Langhua Pharmaceuticals is expected to be consolidated in November (consolidated table for 2 months in 2020). After that, with the construction of ViaBio's CMC capabilities and cooperation with the parent company's original customers, the company will gradually strengthen its CDMO business and further increase its net profit margin. Referring to the company's acquisition and gambling agreement and the results for the first half of the year, we believe Langhua Pharmaceutical's revenue side is expected to reach $1,650 million in 2020, with a gross profit margin of 26%. Considering the initial business integration of the company's mergers and acquisitions and the diversion effect of CFS and EFS customers over the next two years, we assume that Langhua Pharmaceuticals will grow 8% and 11% in 21-22, respectively.

3) EFSBusiness:Considering the company's service cycle for developing EFS business (2-3 years) and the gradual expansion of the project pool, the confirmed revenue of the EFS business will gradually increase with the number of service projects. In 20-22, the company plans to incubate 35, 50 new projects. The total number of projects is 81, 131 and 181. Based on the 3-year service cycle, there are 71, 110 and 150 ongoing service projects. Therefore, we believe that the company's EFS revenue growth in 20-22 was 78%, 55%, and 36%.

4) Gross profit margin:Considering the strong leading position and rapid growth of SBDD drug screening services, the parent company's original main business, we believe that its original business can still maintain a gross profit margin of about 50%.

5) Fee rate:Regardless of the impact of the acquisition of Langhua Pharmaceutical and Reliance Biotech, which has yet to be implemented, on the company's expense ratio, we believe that the company's R&D expenses in 2020-2022 may increase somewhat in 2020 due to the introduction of technology platforms such as cryo-electron microscopy and computational chemistry, and the CMC team that has continued to be built. Given the stable leading position of the company's SBDD business in the industry, sales expenses are expected to remain stable. Management costs may have increased due to the expansion of personnel and the continuous expansion of the incubation team. We forecast that in 2020-2022, the company's operating expenses will be about 1.11%; management expenses will be about 18%, 16% and 16%; and R&D expenses will be about 50 million, 80 million and 80 million yuan.

6) Changes in fair value:The company began EFS business in 2015, and customer service invested in shares, and the project gradually entered the clinical stage. Considering the investment and financing environment in recent years, the company's exit pace, and the successful acquisition of the Dogma project in 2020, we believe that the changes in fair value between 2020 and 2022 are 500 million, 200 million, and 200 million, respectively.

4.2. Segment Valuation

4.2.1. CFSvaluations

1) CFS CRO: The net profit of the company's original CFS business in 2019 was 114 million yuan. Referring to the growth rate of the industry and orders received in the first half of the year, assuming a 55% increase in 2020, this portion of the company will contribute 178 million yuan in profit in 2020. Considering the key position of the drug screening field in new drug development, the scalability of the SBDD method, and the company's rapid CRO business growth rate, referring to comparable companies (Chengdu Leading PE: 189 times and Pharmaceutical Technology PE: 122 times), we conservatively valued the company's CRO business 75 times, so the market capitalization space for this business is about 13.35 billion yuan.

2) CFS CDMO business: Based on Langhua Pharmaceuticals' profit betting in 2020 and the performance situation of 2020 H1, we believe that the company's business structure is gradually shifting towards CDMO, and profitability continues to rise based on the continuous expansion of revenue volume. We expect Langhua Pharmaceuticals to have a net profit of 175 million in 2020. We selected four comparable A-share and H-share companies. The average PE in 2020 was 88 times. Considering the potential diversion effect of the company's original business on downstream, the CDMO business is still in the early stages and initial business integration risks.Assuming 50 times PE, the corresponding market value of the CDMO business is 8.75 billion yuan.

4.2.2. EFSvaluations

In order to reduce profit fluctuations brought about by the pace of exit during the year, we chose to use the DCF valuation method to estimate the market value space of EFS. The market value estimate is based on the following assumptions:

(1) From the stage of investment in emerging compounds and pilot compounds, the 3-year incubation period of the project progressed to the PCC stage. The value expanded 5 times from the initial stage, progressed to clinical phase I in 5 years, and expanded 15 times from the initial stage:According to Frost & Sullivan's survey, ViviaBiotech generally chooses to invest in the phase of the emerging compound or lead compound, and the project valuation is about 15 million US dollars. With the certainty of the clinical application, it will add value to 75 million US dollars after 2 to 3 years, which is 5 times that of the beginning of the pre-clinical research and development stage. It is also a time point in time when the company chose to partially exit. With the end of the early clinical research and development of the project and entering the clinical trial stage, the valuation also increased the gradual determination of the marketization of phase I clinical drugs to 15 times the valuation during the lead compound period, reaching US$230 million. This is another important point in time for the company to opt out.

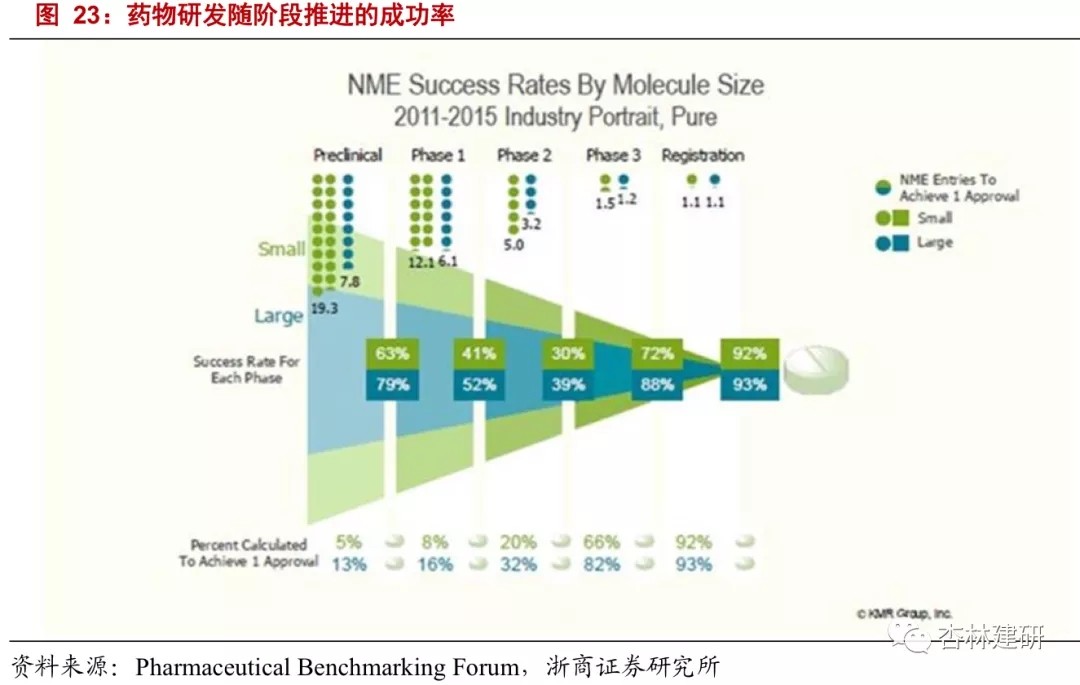

(2) Combined with the 2011-2015 R&D success rate, we believe that according to ViaBio's investment pace, the company's 5-year average annualized yield is 45%.Referring to the latest industry data from the Clinical Benchmarking Forum, the success rates of small molecule preclinical research and clinical phase I promotion in 2011-2015 were 63% and 41%, respectively, and the probability of successful promotion of macromolecules in the two stages was 79% and 52%. Since small molecule drugs account for the main investment direction of new drug development, we assume that from the lead compound to the clinical application stage, the return on investment is 400%, it takes 3 years, and the success rate is 70%; from the lead compound to the clinical phase I stage, it takes 5 years, the return on investment is 1400%, and the success rate is 30%. The calculation shows an average annualized yield of 45% over 5 years.

(3) We assume that the company will withdraw all of its shares after 5 years of service incubation.As the company's EFS project pool gradually expands and the project gradually progresses to the clinical stage, referring to the exit plan of 50% equity withdrawal in 2.5 years and 100% exit in 5.5 years as disclosed in the company's prospectus, we assume that the company will withdraw the project once after 5 years of investment incubation.

(4) The company invests 1.5 million US dollars (10 million yuan) in cash or equivalent services in accordance with each project disclosed in the prospectus.

(5) Referring to the return on investment of the company's existing exit projects and considering that ViaBiotech's EFS business is still in its infancy, and the long-term return is yet to be verified, we have lowered the annualized return on investment from the industry average (45%) to 40% (optimistic)/35% (neutral)/30% (pessimistic).

We expect the company's EFS net profit in 2020-2022 to be 405 million, 526 million and 696 million dollars under neutral assumptions. Judging from disposal income, the disposal income that the company can obtain from EFS business in 2020 = 6 (number of investment projects in 2015) * 0.1 billion (investment amount per project) * ((1 +35%) 5-1), which is approximately $209 million. By analogy, in 2020-2022, investment disposal income was $209 million, $209 million, and $139 million. If the company continues to add 50 new projects every year after 2021, we estimate that in 2025, the company can achieve disposal income > investment amount from EFS business, and provide stable cash flow thereafter. Looking at changes in fair value under a neutral scenario, the company's 2020 fair value changes = (2019 fair value - 2020 equity exit portion) * annualized yield, calculated that the fair value changes were about 196 million, and the fair value changes in 2020-2022 were 196 million, 317 million, and 556 million. As the project pool gradually expands, changes in fair value will continue to be a major component of EFS projects.

Based on the analysis of net cash flow of investment projects,Under neutral assumptions, the DCF valuation corresponds to a market value of 13.6 billion dollars. Considering that EFS earnings may fluctuate greatly from year to year, we use the DCF valuation method to value EFS projects. Under the core assumptions: (1) annualized yield 40% (optimistic)/35% (neutral)/25% (pessimistic) (2) exit all shares in the project at once in 5 years,Estimates show that the market value of the company's EFS business is about 17.0.49 billion (optimistic) /13.567 billion (neutral) /10.564 billion (pessimistic).

Therefore, regardless of the contribution of Langhua Pharmaceuticals's CDMO business, which has not yet been implemented, to the company's market value, we believe that the reasonable market value of the company's CFS and EFS business should be 26.717 billion dollars.

5. Investment advice

Based on the analysis of the company's core business segments, without considering the CDMO business that has not yet been acquired and showing the impact, we expect the company's EPS for 2020-2022 to be 0.45, 0.32, and 0.36 yuan/share, respectively. The net profit of the CRO business is expected to reach 178 million in 2020. Referring to comparable companies, we believe that the reasonable market value of the CRO portion should be 13.35 billion yuan, corresponding to 75 times PE. In order to reduce annual fluctuations in investment income, we used the DCF method to measure part of the market value of EFS. Under optimistic/neutral/pessimistic assumptions, the market value of the EFS business is approximately 17.049 billion /13.567 billion /10.564 billion.Under a neutral forecast, the company's corresponding reasonable market capitalization is a total of 26.717 billion yuan, which is significantly underestimated, and has been given a “buy” rating for the first time.

6.Risk warning

Integrated management risks of mergers and acquisitions; CDMO capacity building falls short of expectations; CFS's downstream business diversion effect falls short of expectations; market investment and financing sentiment decline and EFS return on investment falls short of expectations; industry policy changes; decline in innovative drug development sentiment; short-term order volatility; and competitive risk.