Shopify Unusual Options Activity For March 24

Shopify Unusual Options Activity For March 24

A whale with a lot of money to spend has taken a noticeably bearish stance on Shopify.

一條有很多錢要花的鯨魚已經採取了明顯看跌的立場 Shopify。

Looking at options history for Shopify (NYSE:SHOP) we detected 38 strange trades.

查看 Shopify(紐約證券交易所:SHOP)的期權歷史記錄,我們發現了 38 個奇怪的交易。

If we consider the specifics of each trade, it is accurate to state that 26% of the investors opened trades with bullish expectations and 73% with bearish.

如果我們考慮每筆交易的細節,可以準確地說明 26% 的投資者以看漲期望和 73% 的看跌打開交易。

From the overall spotted trades, 21 are puts, for a total amount of $3,263,772 and 17, calls, for a total amount of $947,494.

從整體被發現的交易來看,21 個是看跌期權,總金額為 3,263,772 美元和 17 美元,電話總額為 947,494 美元。

What's The Price Target?

什麼是價格目標?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $35.0 to $80.0 for Shopify over the last 3 months.

考慮到這些合同的交易量和未平倉利息,在過去的 3 個月中,鯨魚的價格範圍從 35.0 美元到 80.0 美元的 Shopify。

Volume & Open Interest Development

成交量及開放興趣發展

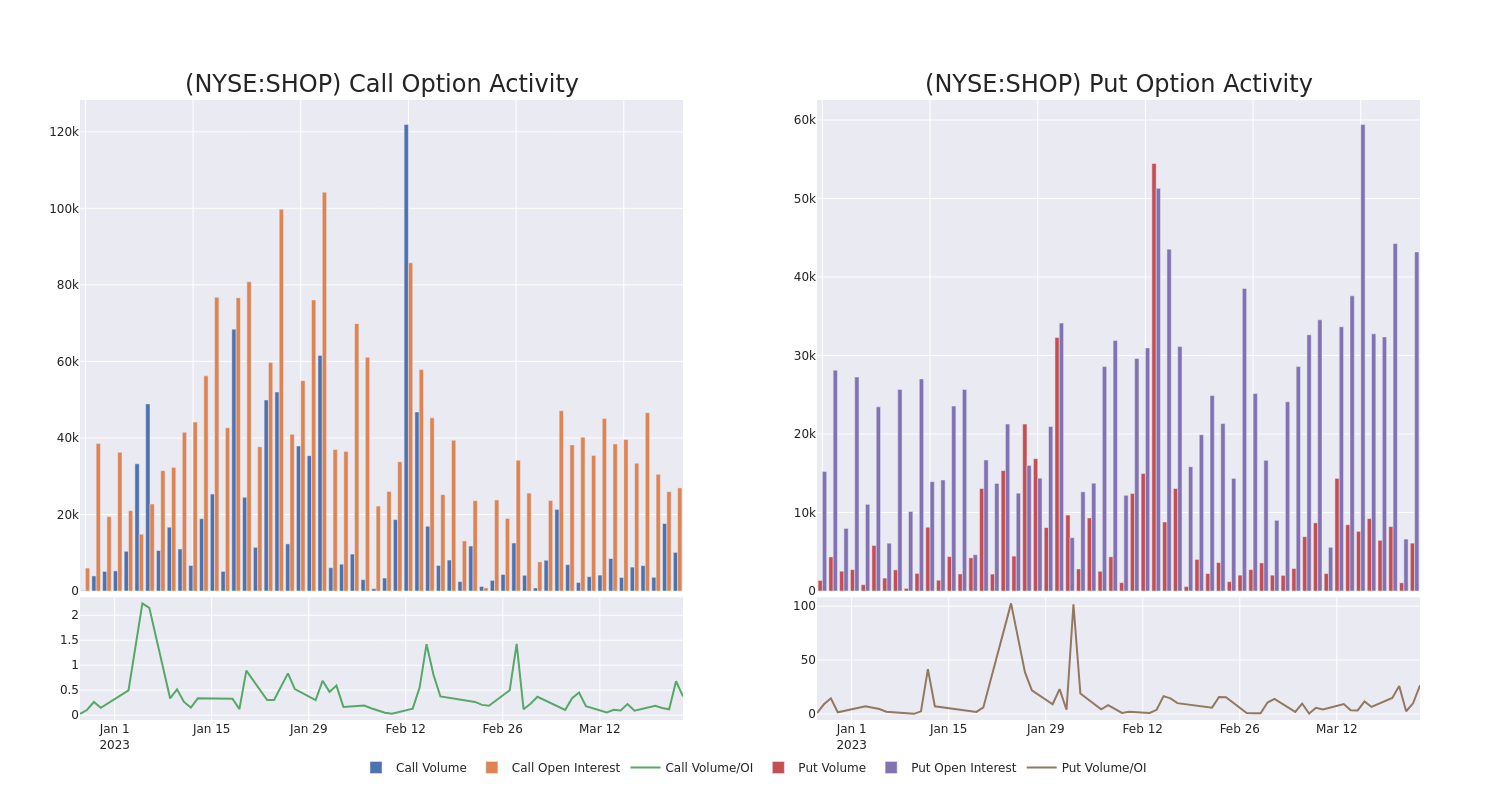

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Shopify's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Shopify's whale trades within a strike price range from $35.0 to $80.0 in the last 30 days.

在交易期權時,查看交易量和未平倉興趣是一個強大的舉動。此資料可協助您以指定行使價追蹤 Shopify 期權的流動性和興趣。下面,我們可以分別觀察 Shopify 在過去 30 天內行使價範圍從 35.0 美元到 80.0 美元之間的所有鯨魚交易量的發展以及通話和看跌期權的開放興趣。

Shopify Option Volume And Open Interest Over Last 30 Days

Shopify 過去 30 天的期權交易量和未平倉利息

Biggest Options Spotted:

發現最大的選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| SHOP | PUT | TRADE | NEUTRAL | 01/19/24 | $40.00 | $1.5M | 6.8K | 2.4K |

| SHOP | PUT | SWEEP | BEARISH | 01/17/25 | $35.00 | $664.9K | 4.1K | 1.0K |

| SHOP | CALL | SWEEP | BEARISH | 04/21/23 | $35.00 | $149.9K | 2.3K | 227 |

| SHOP | PUT | TRADE | BEARISH | 01/17/25 | $50.00 | $145.0K | 2.4K | 1 |

| SHOP | CALL | TRADE | BULLISH | 03/31/23 | $45.50 | $125.0K | 495 | 2.8K |

| 符號 | 放/呼叫 | 交易類型 | 情緒 | 經驗值。日期 | 行使價 | 總交易價格 | 開放興趣 | 磁碟區 |

|---|---|---|---|---|---|---|---|---|

| 商店 | 放 | 貿易 | 中性 | 01/19/24 | $40.00 | 1.5 米 | 6.8 公里 | 2.4K |

| 商店 | 放 | 掃 | 看跌 | 01/17/25 | 35.00 美元 | 九千 | 4.1K | 1.0K |

| 商店 | 呼叫 | 掃 | 看跌 | 04/21/23 | 35.00 美元 | 九千 | 2.3K | 227 |

| 商店 | 放 | 貿易 | 看跌 | 01/17/25 | $50.00 | $145.0K | 2.4K | 1 |

| 商店 | 呼叫 | 貿易 | 充滿信心的 | 03/31/23 | $45.50 | 一千五百萬 | 495 | 2.8 公里 |

Where Is Shopify Standing Right Now?

Shopify 現在站在哪裡?

- With a volume of 11,134,917, the price of SHOP is down -1.79% at $44.97.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 41 days.

- 商店的交易量為 11,134,917 美元,價格下跌了 -1.79%,價格為 4.97 美元。

- RSI 指標暗示標的股票可能接近超買。

- 預計下一筆收益將在 41 天內發布。

What The Experts Say On Shopify:

專家們在說什麼 Shopify:

- Stifel downgraded its action to Hold with a price target of $45

- 斯蒂菲爾將其行動降級為 45 美元的目標價格

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每天進行自我教育,擴展和縮小交易,遵循多個指標以及密切關注市場來管理這種風險。

If you want to stay updated on the latest options trades for Shopify, Benzinga Pro gives you real-time options trades alerts.

如果您想隨時了解 Shopify 的最新期權交易,Beninga Pro 會為您提供實時期權交易警報。

譯文內容由第三人軟體翻譯。