Oracle (ORCL) Q3 Earnings Beat Estimates, Revenues Rise Y/Y

Oracle ORCL reported third-quarter fiscal 2023 non-GAAP earnings of $1.22 per share, which beat the Zacks Consensus Estimate for earnings by 1.67%. The bottom line was up 13% year over year at constant currency or cc.

Management had guided non-GAAP earnings per share (EPS) to grow between 4% and 8% and be between $1.17 and $1.21 in USD.

Revenues increased 18% (up 21% at cc) year over year to $12.39 billion and beat the Zacks Consensus Estimate by 0.03%. The top-line performance was mainly driven by strength in infrastructure and applications cloud businesses.

For the fiscal third quarter, Oracle had anticipated total revenues to grow in the range of 21-23% in cc and 17-19% in USD.

Revenues from the Americas added $7.67 billion to total revenues. Europe/Middle East/Africa added $3.06 billion, while revenues from the Asia Pacific came in at $1.66 billion.

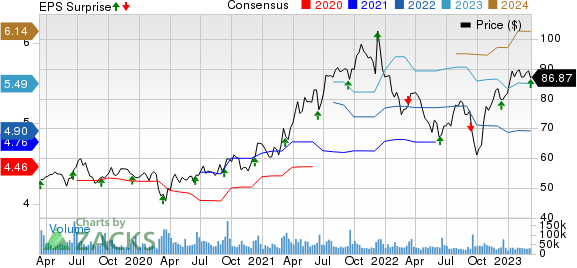

Oracle Corporation Price, Consensus and EPS Surprise

Oracle Corporation price-consensus-eps-surprise-chart | Oracle Corporation Quote

Revenues by Offerings

Oracle’s Cloud services and license support revenues were up 17% in USD and up 20% in cc to $8.9 billion. Cloud license and on-premise license revenues were unchanged in USD and up 4% in cc to $1.3 billion. For the third quarter of fiscal 2023, Cerner contributed $1.5 billion to total revenues.

The upside can be attributed to continued strength in the Fusion, Autonomous Database and Oracle Cloud Infrastructure (OCI) services.

Cloud revenue (IaaS plus SaaS) came in at $4.1 billion, up 45% in USD and 48% in cc. Cloud Infrastructure (IaaS) revenue came in at $1.2 billion, up 55% in USD and 57% in cc. Cloud Application (SaaS) revenue of $2.9 billion increased 42% in USD and 44% in cc.

Fusion Cloud ERP (SaaS) revenue came in at $0.7 billion, up 25% in USD and 28% in cc. NetSuite Cloud ERP (SaaS) revenue of $0.7 billion soared 23% in USD and 26% in cc.

Breakup of Cloud Services & License Support Revenues

Applications revenues amounted to $4.16 billion, up 31% year over year (up 33% at cc).

Infrastructure-related revenues were $4.75 billion, up 7% on a year-over-year basis (up 10% at cc).

Hardware revenues were $811 million, which increased 2% year over year (up 4% at cc).

Services revenues rose 74% (up 80% at cc) to $1.37 billion.

Expanding Clientele Remains Noteworthy

Management noted that strategic back-office SaaS applications now have an annualized revenue of $6.2 billion and grew 25% in cc, including Fusion ERP, up 28%, and NetSuite ERP, up 26% this quarter.

Excluding legacy hosting services, infrastructure cloud services revenues grew 65%, with an annualized revenue of $4.4 billion, including OCI consumption revenue, which was up 86%, cloud and customer consumption revenue, up 73%, and autonomous database, up 50%.

As of Feb 28, 2023, Oracle has 41 public cloud regions around the world, with another eight being built. In addition, 12 of these public cloud regions interconnect with Azure, giving customers true multi-cloud capabilities.

Operating Details

The non-GAAP total operating expenses increased 27% year over year (up 29% at cc) to $7.2 billion.

The non-GAAP operating income was $5.18 billion, up 8% in USD and up 11% in cc. The GAAP operating margin was 26%, and the non-GAAP operating margin was 42%.

Balance Sheet & Cash Flow

As of Feb 28, 2023, Oracle had cash & cash equivalents and marketable securities of $8.21 billion compared with $7.3 billion as of Nov 30, 2022.

Operating cash flow and free cash flow for the trailing 12 months ended Feb 28, 2023, amounted to $15.5 billion and $7.29 billion, respectively.

Share Repurchases & Dividends

This Zacks Rank #3 (Hold) company repurchased 1.8 million shares, worth approximately $150 million, during the fiscal third quarter.

Oracle also announced that its Board of Directors declared a quarterly cash dividend of $0.40 per share of outstanding common stock, reflecting a 25% increase over the current quarterly dividend of $0.32. This increased dividend will be paid to stockholders of record as of the close of business on Apr 11, 2023, with a payment date of Apr 24, 2023.

Q4 Guidance

Total revenues for Q4, including Cerner, are expected to grow from 17% to 19% in cc and thus are expected to grow from 15% to 17% in USD. Total cloud growth, including Cerner, is expected to grow from 51% to 53% in cc and 49% to 51% in USD.

The company expects total cloud growth for Q4, excluding Cerner, will be above 30% in cc. Oracle expects growth in operating profit to be double digit.

Non-GAAP EPS is expected to grow between 3% and 5% and between $1.59 and $1.63 in cc. Non-GAAP EPS is expected to grow between 1% and 3% and between $1.56 and $1.60 in USD.

Zacks Rank & Stocks to Consider

Oracle presently carries a Zacks Rank #3 (Hold).

Oracle shares are up 11.7% in the past year compared with the Zacks Computer – Software industry’s fall of 7.5% and the Computer and Technology sector’s decline of 12.2%.

Some better-ranked stocks from the broader Computer and Technology sector are Airbnb ABNB, Baidu BIDU and Fabrinet FN, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Airbnb’s first-quarter 2023 earnings has been revised northward from breakeven to 14 cents per share over the past 30 days. For 2023, earnings estimates have moved up by 52 cents to $3.38 per share in the past 30 days.

ABNB's earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 57.2%. Shares of the company have declined 19.3% in the past year.

The Zacks Consensus Estimate for Baidu’s first-quarter 2023 earnings has been revised 15 cents northward to $2.43 per share over the past 60 days. For 2023, earnings estimates have rose by 6.4% to $11.62 per share over the past 60 days.

BIDU’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 45.5%. Shares of the company have lost 3.1% in the past year.

The Zacks Consensus Estimate for Fabrinet's third-quarter fiscal 2023 earnings has been revised 7 cents upward to $1.90 per share over the past 30 days. For fiscal 2023, earnings estimates have moved north by 24 cents to $7.71 per share in the past 30 days.

FN’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, missing once, the average surprise being 5.1%. Shares of the company have jumped 22.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Fabrinet (FN) : Free Stock Analysis Report

Airbnb, Inc. (ABNB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance