SheIn, a cross-border e-commerce company, issued a statement on May 28, 2021, saying that it has no plans for an IPO (initial public offering) in the near future.

Earlier, there were media reports that SheIn was preparing to go public, and the underwriters in talks were Goldman Sachs, Morgan Stanley, Merrill Lynch and Bank of America. SheIn also denied the financing plan in a statement, saying the valuation of 300 billion yuan was inaccurate.

SheIn, founded in Nanjing in 2014, is a cross-border B2C Internet brand focusing on women's fast fashion. The company's main business is fast fashion women's wear, the market is mainly in Europe, the United States and the Middle East. Its subordinate enterprise is Nanjing lead Tim Information Technology Co., Ltd.

Photo Source: SheIn official website

Enterprise check data show that SheIn has completed the E round of financing, valued at more than $15 billion. In 2013, SheIn received round An investment of US $5 million from Asia; in 2015, series B investment of Shein in IDG and Jinglin valued SheIn at RMB 1.5 billion; in 2018, SheIn received round C investment from Sequoia Capital and other investment institutions with a valuation of US $2.5 billion; a year later, SheIn received more than US $500m of D-round investment, Sequoia Capital continued to invest in, Tiger Global and other investment institutions also participated in the investment, when SheIn was valued at more than $5 billion.

In about 7 years since its establishment, SheIn's overseas main business has developed rapidly. As of May 17, SheIn ranked first in iOS shopping APP in 54 countries, ranked first in Android shopping APP in 13 countries, and once surpassed established foreign e-commerce giant Amazon, according to app tracking companies App Annie and Sensor Tower. In the United States, its Google search has more than three times as many users as global fast fashion giant ZARA.

SheIn has two brands, including SheIn, the main brand, and ROMWE, a sub-brand acquired in 2014. In addition to self-management, SheIn also operates on overseas e-commerce platforms such as Amazon to reach more overseas users.

In 2020, SheIn had revenue of nearly $10 billion, growing more than 100 per cent for the eighth year in a row, with more than 20 million users.

SheIn focuses on fast fashion women's wear, with parity, many styles, new fast and other characteristics. The prices of the products on Shein's official website range from $2 to more than $70, mainly in the range of less than $20. And its styles are also rich and varied. Last year, SheIn's new SKU was 150000, with an average of more than 10, 000 new SKU per month. Its annual new SKU can reach 7 to 10 times that of ZARA's annual new SKU.

As a fast fashion brand, SheIn can capture the trend by establishing a tracking system, which can crawl the products of various clothing sales websites and summarize the crawled data, so as to predict the fashion trend for a period of time in the future. In addition, SheIn's own team of designers and buyers also search for information through various channels to reassemble the design.

In terms of supply chain speed, the process of SheIn from proofing to production can be shortened to 7 days as soon as possible, which is still 7 days less than the 14 days when ZARA was the fastest. According to the SheIn business plan, the supply chain of SheIn from 2018 to 2019 will focus on the transformation of fabrics, printing and dyeing and other core links. In addition to ensuring the stability of the supply, the high supply turnover speed also shortens the production cycle, improves the production efficiency, and further reduces the production cost. Shangxin Express also improves the repurchase rate of SheIn users and increases user stickiness.

In terms of marketing, SheIn promotes on overseas Internet social platforms through cooperation with a large number of KOC (key of consumer). Currently, SheIn has tens of millions of fans on social networks, including 15 million on Facebook and 11 million on Instagram.

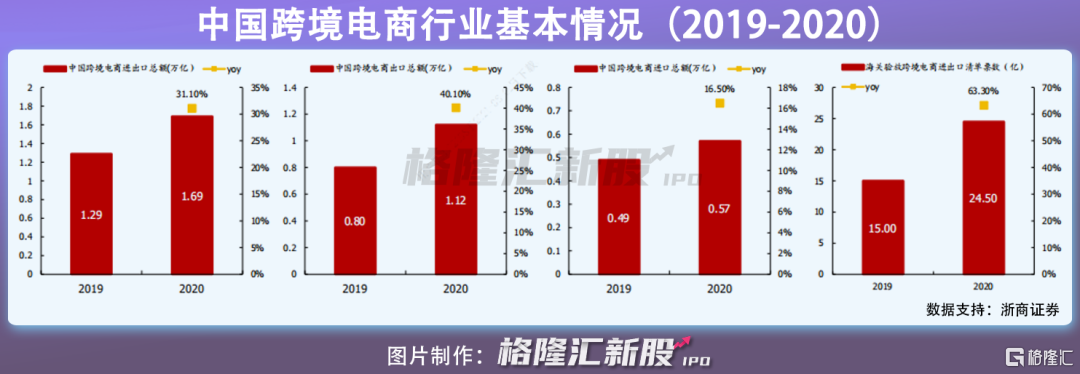

Last year, affected by the overseas epidemic, China's cross-border e-commerce business grew rapidly. Customs data show that China's cross-border e-commerce imports and exports totaled 1.69 trillion yuan in 2020, an increase of 31.1 percent. Of this total, exports totaled 1.12 trillion yuan, up 40.1 percent over the same period last year; the import and export list through the customs cross-border e-commerce management platform reached 2.45 billion, an increase of 63.3 percent over the same period last year. SheIn, one of the leading cross-border e-commerce companies, earned nearly $10 billion last year.

In contrast, affected by the epidemic, traditional fast fashion brands declined due to losses in offline stores. In fiscal year 2020, ZARA parent company Inditex Group's revenue fell 27.9% year-on-year to 20.402 billion euros; net profit plummeted 69.6% to 1.106 billion euros; Himm net sales fell 18% to 1.87 billion Swedish kronor, with a pre-tax loss of 1.39 billion Swedish kronor; Uniqlo sales fell 12.3% year-on-year to 2 trillion yen, while net profit plunged 44.4% to 90.3 billion yen.

Although the growth of cross-border e-commerce business brought about by the epidemic is good for SheIn, there are still some risks in going out to sea. Risk one is logistics. Compared with the European and American markets, the logistics infrastructure in the Middle East and India is not perfect, and the online payment business is also weak. In the sparsely populated Middle East market, SheIn needs to face the problem of last kilometer distribution and return rate of cash on delivery. Similarly, these problems occur in India. The second risk is the uncertainty of international trade in the political environment. At present, there are still geographical frictions in international trade from time to time, or affect the sea business of SheIn.

Conclusion

SheIn combines the advantages of domestic low-cost and efficient supply chain with the high marginal utility of cross-border e-commerce to create a model that is less profitable and more profitable than traditional fast fashion brands. At the same time, under the influence of the epidemic, overseas store business continues to be hit in the short term, further benefiting domestic cross-border e-commerce enterprises. As one of the leading cross-border e-commerce enterprises, SheIn has a certain growth bright spot. At the same time, we should also guard against the landing and policy risks related to going to sea.