Event

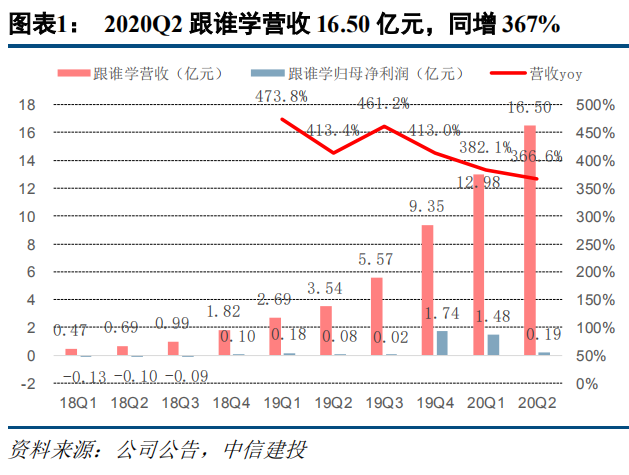

Who to learn from (GSX.US) release the Quarterly report for 2020:As of the second quarter of 2020 in June this year, the company's revenue was 1.65 billion yuan, an increase of 366.6% with an increase of 366.6% with a net profit of 73 million yuan, an increase of 133.0%, a net profit of 19 million yuan, an increase of 143.4%, and a net operating cash flow of 528 million yuan, an increase of 172.4%.

Brief comment

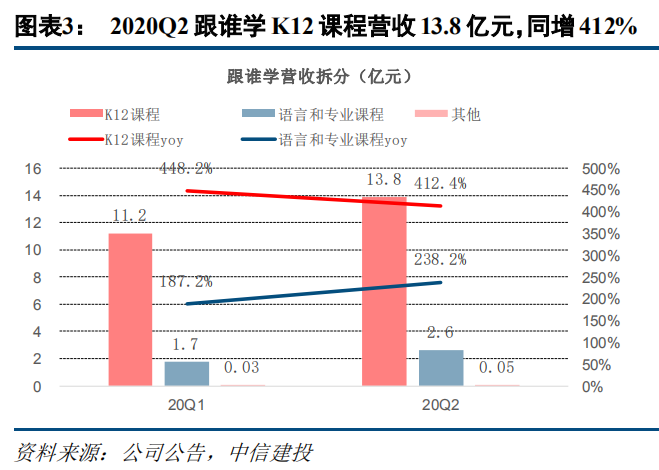

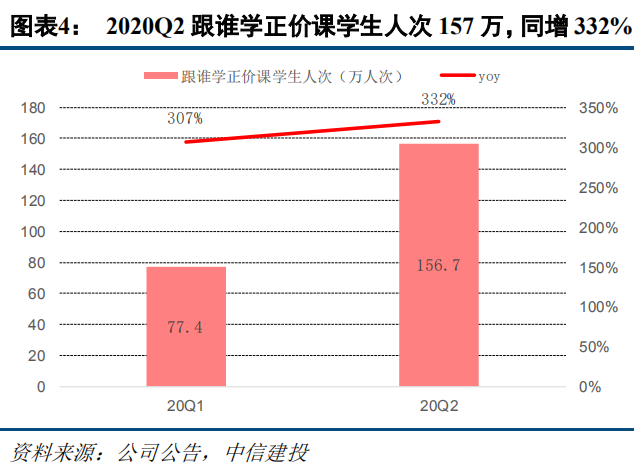

With the rapid development of online education under health events, the number of students in the company increased more than threefold in the second quarter.The number of paid students (more than 99 yuan) by 2020Q2 reached 1.567 million, an increase of 331.7%, and the number of paid students reached an all-time high. Among them, the number of paid students for K12 courses was 1.496 million, an increase of 366.0%, and the number of paid students for foreign language, professional and interest courses was 71000, an increase of 69.0%. The rapid increase in the number of students is mainly due to the transfer of offline training demand for health events to online, increased marketing efforts and the continuation of classes for previous students. The number of students who benefited increased. The income of 2020Q2 K12 courses was 1.385 billion yuan, an increase of 412.4 percent, and that of foreign language, professional and interest courses was 260 million yuan, an increase of 238.2 percent.

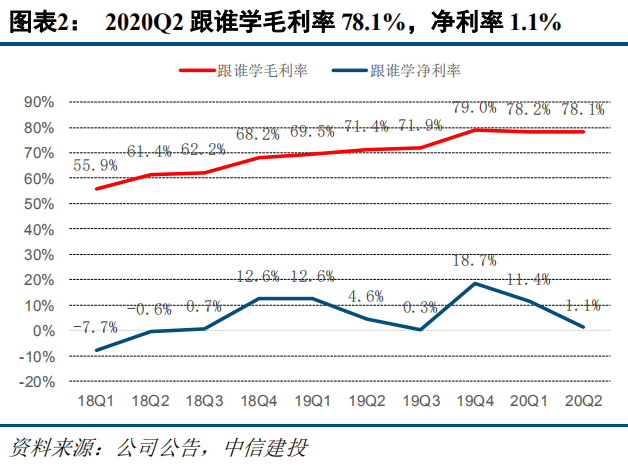

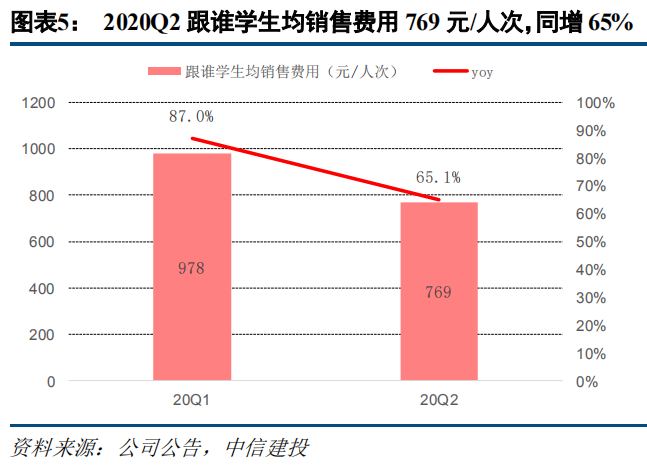

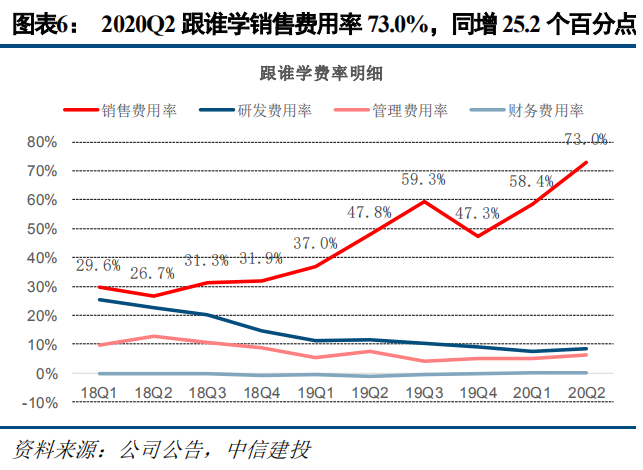

The advantage of economies of scale of large-scale classes is highlighted, and the competition in the industry is further intensified.2020Q2's gross profit margin was 78.1%, an increase of 6.8% over the same period last year, mainly due to the further improvement of the student-teacher ratio of high-quality teachers under the large class model. The rates of sales and marketing, R & D, management and financial expenses were 73.0%, 8.5%, 6.4% and-0.02% respectively, which changed by 25.2%,-3.2%,-1.0% and 1.1% respectively over the same period last year. The average sales cost per student of 2020Q2 was 769 yuan per person, an increase of 65.1%. The sharp increase in the rate of sales expenses over the same period last year was mainly due to the transfer of offline training demand for health events to online. The battle to win customers in the online education industry has been advanced from the past summer vacation to this spring, as the company's course promotion efforts have increased. 2020Q2's other income was 87.72 million yuan, an increase of 87.63 million yuan over the previous year, mainly due to the reduction of corporate value-added tax under health events. Affected by the sharp increase in the rate of sales expenses, 2020Q2's net interest rate was 1.1%, down 3.5% from the same period last year.

The price of summer promotion courses has dropped further, and the number of students is expected to continue to grow at a high rate.In the first half of 2020, the company continued to increase brand exposure by sponsoring "extreme Challenge" and other variety shows, and conducted multi-channel drainage through promotion classes and new media advertising. The sales expenses of 2020Q2 company totaled 1.2 billion yuan, including 35 million yuan for brand promotion, 920 million yuan for traffic acquisition and 250 million yuan for labor services. Entering the summer vacation, the company's marketing focus has been changed from 49 yuan promotion class last year to 9 yuan promotion class, and marketing efforts have been further strengthened. The company expects 2020Q3 revenue to range from 19.36 yuan to 1.966 billion yuan, an increase of 247.6% to 253.0%.

The price of summer promotion courses has dropped further, and the number of students is expected to continue to grow at a high rate.In the first half of 2020, the company continued to increase brand exposure by sponsoring "extreme Challenge" and other variety shows, and conducted multi-channel drainage through promotion classes and new media advertising. The sales expenses of 2020Q2 company totaled 1.2 billion yuan, including 35 million yuan for brand promotion, 920 million yuan for traffic acquisition and 250 million yuan for labor services. Entering the summer vacation, the company's marketing focus has been changed from 49 yuan promotion class last year to 9 yuan promotion class, and marketing efforts have been further strengthened. The company expects 2020Q3 revenue to range from 19.36 yuan to 1.966 billion yuan, an increase of 247.6% to 253.0%.

Risk Tips:The space for the development of online education is not as expected, and the competition is intensified.

暑期促销课价格进一步下降,学生人次有望延续高增长。2020年上半年,公司通过赞助《极限挑战》等综艺节目持续提升品牌曝光度,并通过促销课、新媒体广告投放等进行多渠道引流。2020Q2公司销售费用共计12.0亿元,其中品牌宣传费用0.35亿元、流量获取费用9.2亿元、劳务费等2.5亿元。进入暑假,公司营销重点从去年的49元促销课改为9元促销课,营销力度进一步增强。公司预计2020Q3营收在19.36至19.66亿元之间,同增247.6%至253.0%。

暑期促销课价格进一步下降,学生人次有望延续高增长。2020年上半年,公司通过赞助《极限挑战》等综艺节目持续提升品牌曝光度,并通过促销课、新媒体广告投放等进行多渠道引流。2020Q2公司销售费用共计12.0亿元,其中品牌宣传费用0.35亿元、流量获取费用9.2亿元、劳务费等2.5亿元。进入暑假,公司营销重点从去年的49元促销课改为9元促销课,营销力度进一步增强。公司预计2020Q3营收在19.36至19.66亿元之间,同增247.6%至253.0%。