Summary

36Kr went public in November 2019, raising $20 million in a U.S. IPO.

The firm provides online digital content services and offline event promotion services to new economy businesses in China.

The COVID-19 pandemic was bad for business but management sees continued recovery, with autos and finance leading the way.

If the firm can continue to recover, with strong Q4 financial results, it may be time to look more closely at the stock. Until then, my outlook is Neutral.

Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Get started today »

Quick Take

36Kr (KRKR) went publicin November 2019, raising $20 million from the sale of 1.38 million ADSs at $14.50 per ADS.

The firm is a diversified digital content and offline event business services provider to new economy companies in China.

KRKR has been negatively impacted by the COVID-19 pandemic and is seeking to recover.

As management proves its optimism with further material financial results improvement for Q4 2020’s results, it may be time to take a look at the stock, but until then I’m Neutral.

Company

Beijing, China-based 36KR was founded in 2010 to provide business services to Chinese companies serving the Internet, hardware and software technologies, consumer and retail and finance industries, which the company refers to as the ‘New Economy’.

Management is headed by CEO Dagang Feng, who has been with the firm since 2019 and is also the CEO of Beijing Duoke.

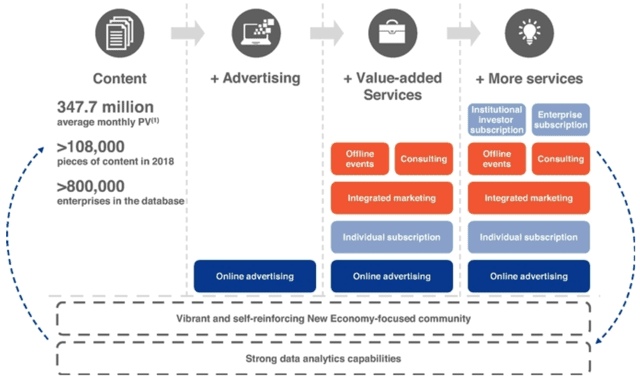

36KR has developed a suite of business services that includes tailored online advertising and subscription services, as well as other enterprise value-added services.

The firm also provides services that help investors identify promising targets, source investment opportunities and connect with startups directly.

36KR has developed a database covering over 800,000 enterprises, through which it is able to gain valuable insights into the New Economy by using data analysis on user and customer preferences and provide tailored services.

Below is an overview graphic of the company’s business model:

Page Views - during the twelve-month period ended June 30, 2019.

Source: Company

Management says that as of the end of 2018, the company provided business services to 23 of the Global Fortune 100 companies and to 59 of the Top 100 ‘New Economy’ companies in China as measured by market capitalization and valuation, according to a 2019 China Insights Consultancy [CIC] report.

Additionally, since the launch of its institutional investors subscription services in Q1 2017, 36KR has already covered 46 of the Top 200 institutional investors in China as of the end of 2018, as measured by assets under management, according to the CIC report.

The firm markets its solutions through an in-house sales teams that consist of 217 employees as of the end of June 2019, with knowledge and expertise of the New Economy sector.

They are tasked with understanding 36KR’s customers' needs as well as to maintain a close relationship with them by providing support and customer services during the course of services.

According to a 2018 market research reportby IBIS World, the IT services market in China had reached a total revenue of $159 billion in 2018, an increase of 6.2% year-over-year.

This represents a CAGR of 7.7% between 2013 and 2018.

36KR operates in the business services subset of the IT services market.

The main factors driving forecast market growth is the increase in IT investments and the growth of China’s information sector.

The China IT services market accounts for about 20% of China's total IT investment, as compared to an average 40% share in other developed countries.

Recent Performance

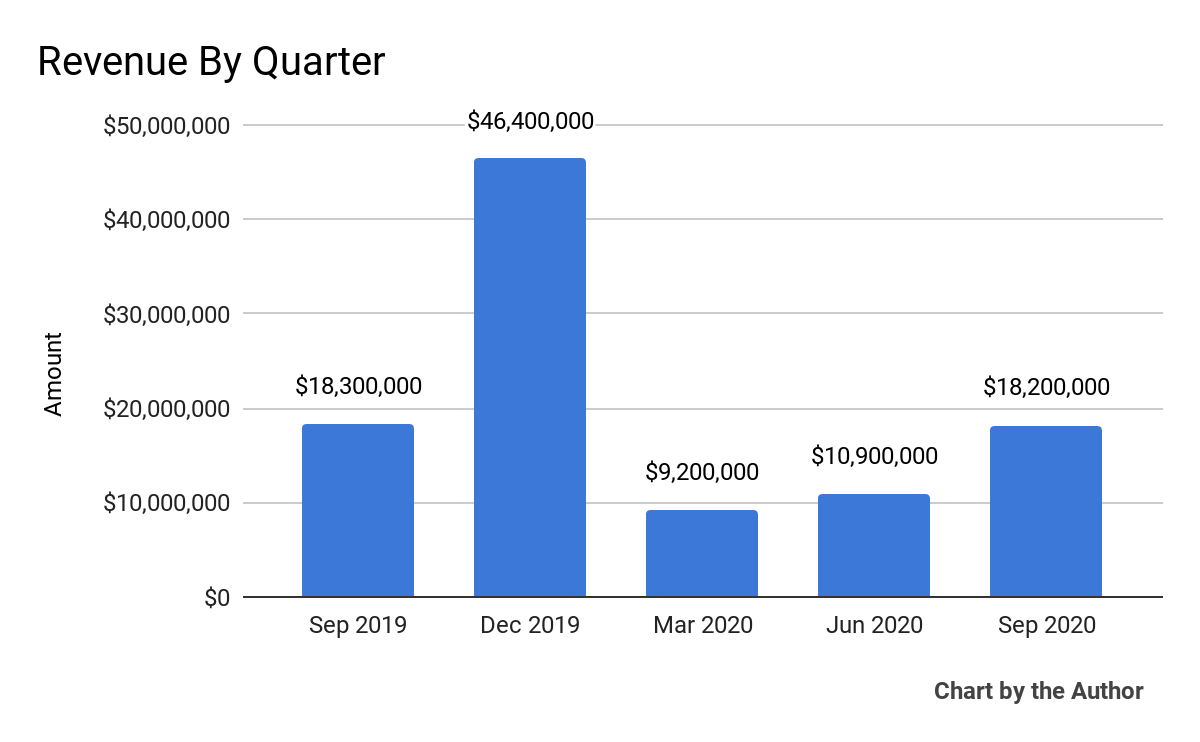

Topline revenue by quarter has been highly variable, with Q3 2020’s results 5.5% below that of Q3 2019, as the chart shows here:

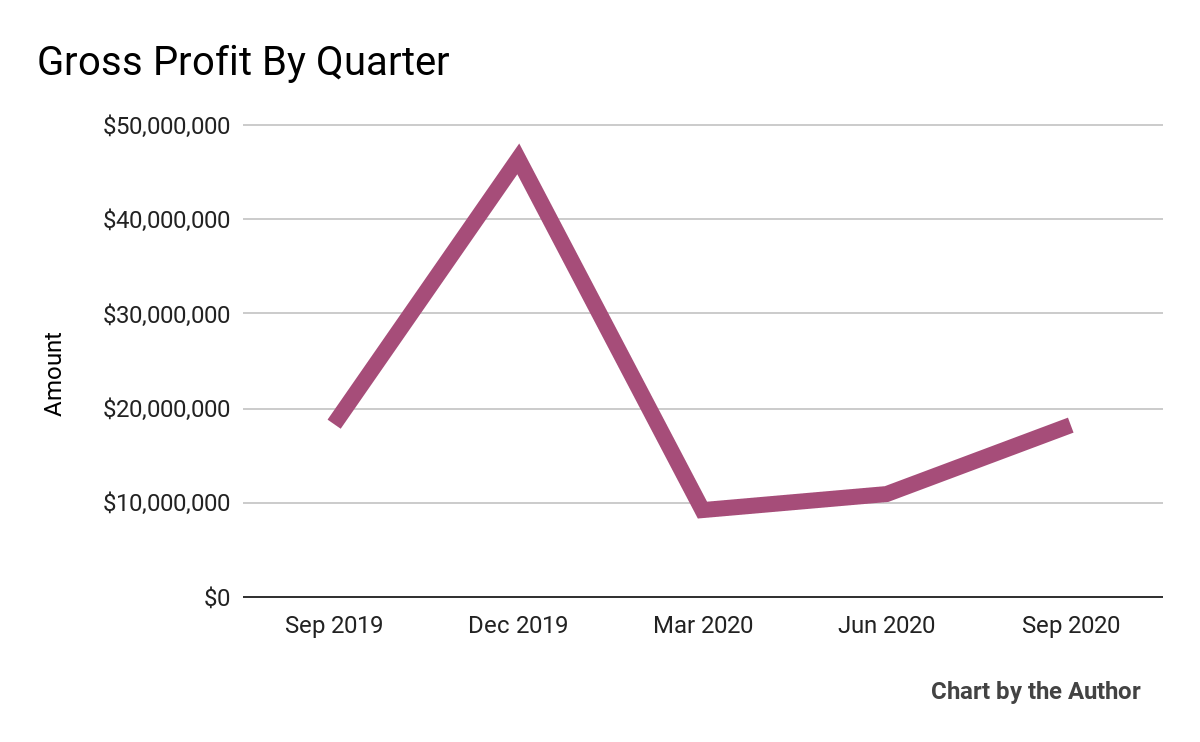

Gross profit by quarter has followed a similarly fluctuating trajectory:

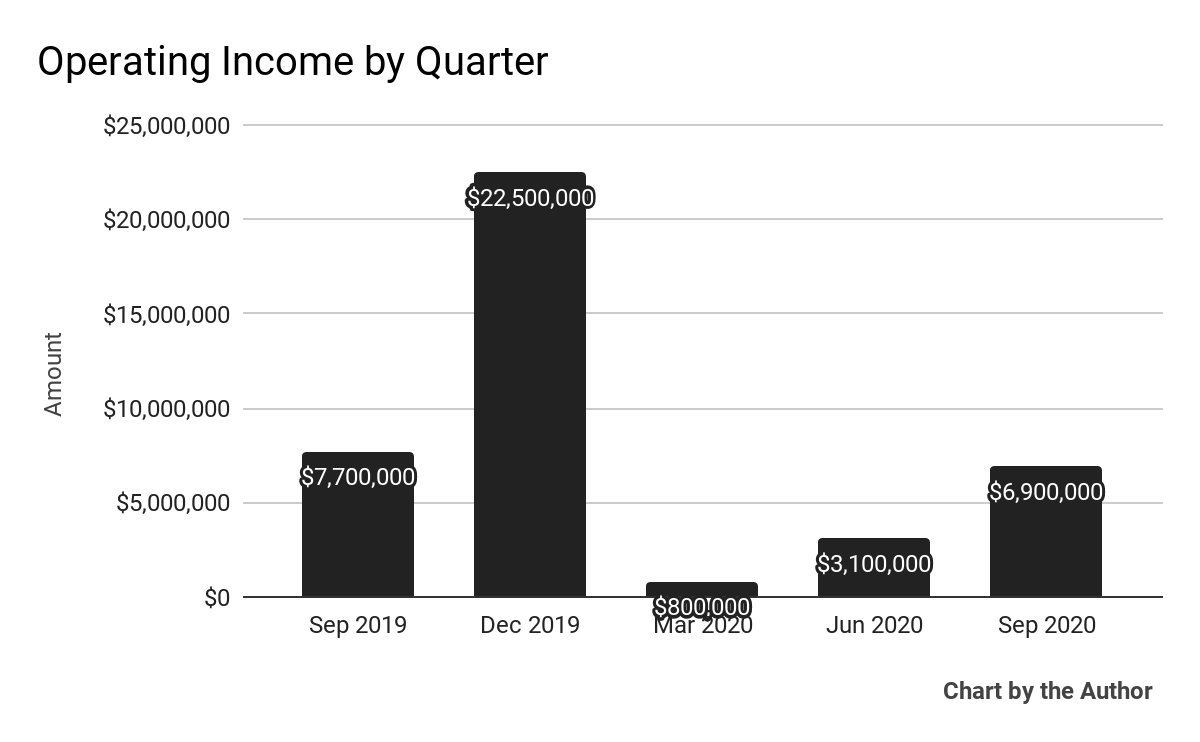

Operating income by quarter has remained positive, although highly variable, also:

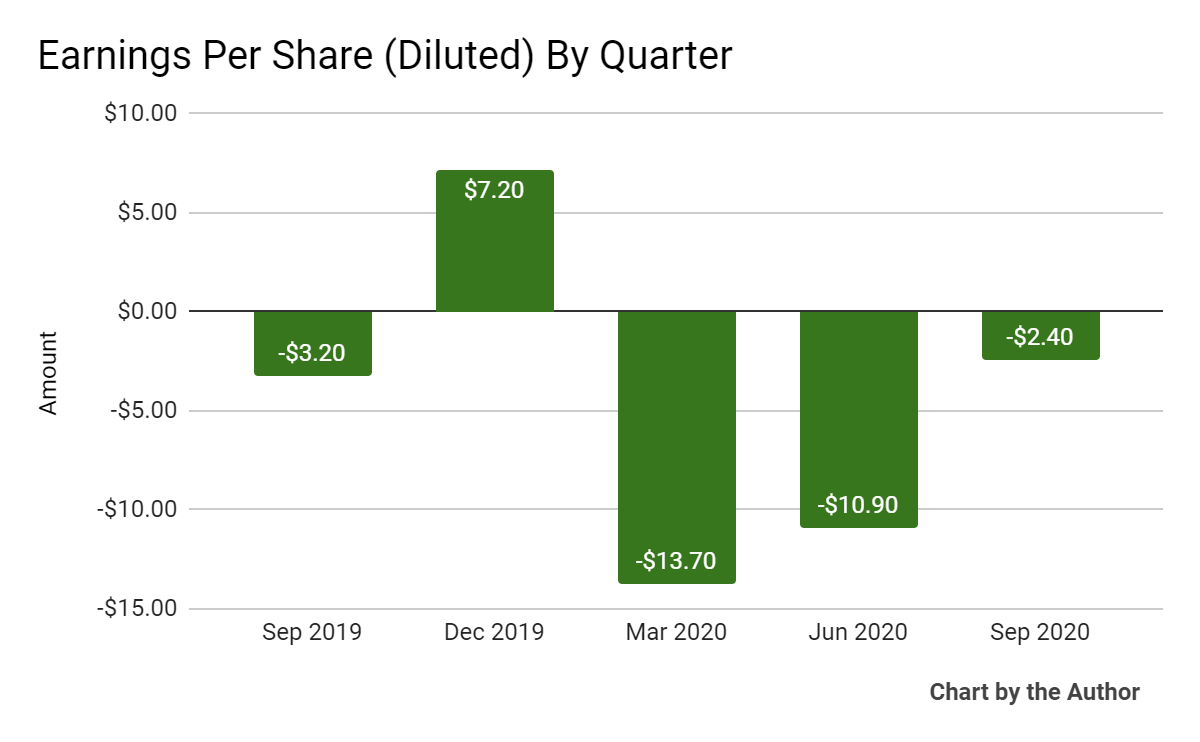

Earnings per share (Diluted) have been negative in four of the last five quarters:

Source for chart data: Seeking Alpha

In the past 12 months, KRKR’s stock price has dropped 12.3 percent vs. the U.S. Interactive Media and Services index’ rise of 45.8 percent and the overall U.S. market’s growth of 29.0 percent, as the chart below indicates:

Source: Simply Wall Street

Valuation Metrics

Below is a table of relevant capitalization and valuation figures for the company:

Measure | Amount |

Market Capitalization | $184,470,000 |

Enterprise Value | $160,810,000 |

Price / Sales | 2.10 |

Enterprise Value / Sales | 1.86 |

Enterprise Value / EBITDA | 1.12 |

Revenue Growth Rate [TTM] | -60.78% |

Earnings Per Share | -$19.80 |

Source: Company Financials

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Commentary

In its last earnings call, covering Q3 2020’s results, management highlighted its strategic efforts to ‘expand and diversify’ its content production and distribution for both PGC (Professional Generated Content) and UGC (User Generated Content).

The firm also inked a partnership deal with Youku Tudou to create co-produced programs covering ‘financial and industry specific topics.’

The company also ‘hosted more than 200 live streaming events every month’ during Q3 2020 around specific themes such as finance, career and new economy industries.

As to its financial results, the firm was impacted negatively by the COVID-19 pandemic relative to its offline activities of investor summits.

Management said the customer demand has been showing ‘signs of further recovery’ from industries including autos, 3C (Computers, Communications and Consumer electronics) and real estate.

Additionally, the firm is seeking to expand its service to government clients at the local level for cities that are prioritizing industrial development activities.

Management essentially stated that the firm is in a recovery phase as the effects of the pandemic become less pronounced and businesses once again seek their service offerings.

Risks to the company’s outlook include a resurgence of the pandemic or its variant viruses as well as permanent damage to its client base, resulting in a slow process of recovery that continues throughout 2021.

Management believes that recovery will continue, with special improvement from the automobile and finance sectors.

I’m in more of a wait and see mode for 36Kr. The stock is down 66% from its IPO price more than one year after the IPO, so management will have quite a big lift to show strong growth and catalyze the stock higher.

At $5.00, my outlook is Neutraluntil the firm shows continued improvement across all major financial metrics.