Core points:

Huoyan Holdings (1909), a mobile equipment and web developer, was established in March 2011. it is owned by Shenzhen Fire Element. it is a "young" new force in the Chinese market. It only launched its first "call of Kings" in 2014 and achieved great success, providing certainty for future revenue sources. In the stock market, many hand-held stocks were not sold for a while, but later became popular. For example, IGG (0799), a famous broker, has seen its income drop in recent years when its income has fallen. Therefore, the stability and multi-source of combined income is more important than the short-term and high income of "popular style". Not only that, Huoyan is the "Foxconn" of the industry, "tailor-made" products for downstream consumer developers, and Huoyan can disperse the products through the networks of different developers, creating strong growth.

Huoyan Holdings (1909), a mobile equipment and web developer, was established in March 2011. it is owned by Shenzhen Fire Element. it is a "young" new force in the Chinese market. It only launched its first "call of Kings" in 2014 and achieved great success, providing certainty for future revenue sources. In the stock market, many hand-held stocks were not sold for a while, but later became popular. For example, IGG (0799), a famous broker, has seen its income drop in recent years when its income has fallen. Therefore, the stability and multi-source of combined income is more important than the short-term and high income of "popular style". Not only that, Huoyan is the "Foxconn" of the industry, "tailor-made" products for downstream consumer developers, and Huoyan can disperse the products through the networks of different developers, creating strong growth.

Huoyan (1909) is constantly using the system and updating its content, so that its brand name can prolong its life, and at the same time, it launches a certain number of new products every year to increase its dynamic strength and keep its combined income from growing continuously, so as to avoid a cliff-like decline. Of course, slowing the decline of existing systems will not increase the volume of business. Therefore, in addition to determining the combined income, the contractor needs to constantly promote innovation in order to promote the growth of the company. Huoyan (1909) has only one model since 2014. In a short period of 6 years, it has developed to a total of 20 handset combinations, with an average annual growth rate of 63%, and has successfully established a growing portfolio.

According to the analysis of the relationship between revenue and cost of Huoyan (1909), Huoyan (1909) has entered the model effect. With the increase of the scale effect, there will be a significant growth and growth rate in the future.

Huoyan Holdings (1909) was listed on the Hong Kong Stock Exchange in the form of placing, raising only HK $32.8 million. However, Huoyan (1909) grew stronger after listing and successfully applied for the motherboard license last year. Recently, it was announced that one share would be split into three shares, with the aim of increasing the liquidity of shares in the market.

Huoyan (1909) business model

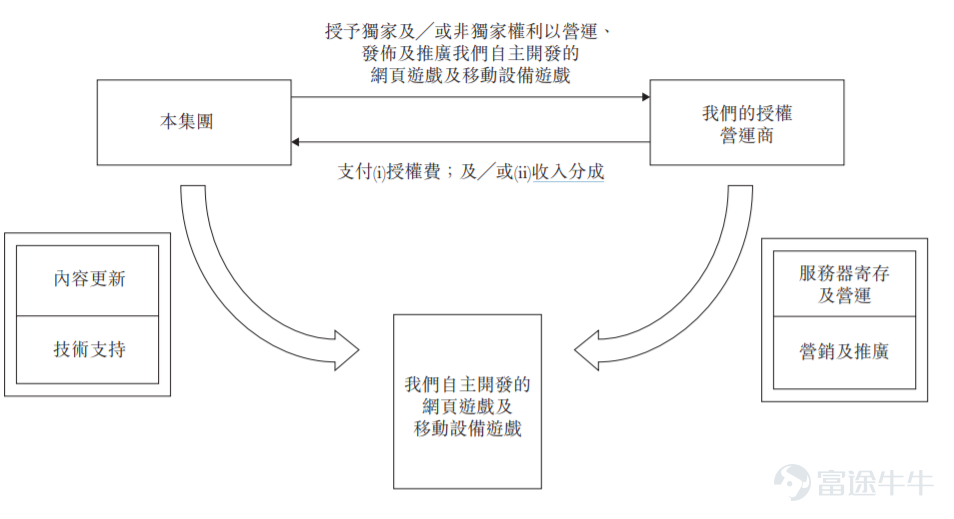

Huoyan (1909) is a mobile equipment and web server developer and grants its rights to a number of mobile phone operators. The listing document of Huoyan (1909) points out that its players come from many different countries and regions, including, but not limited to, China, North America, the Pacific region and Asia. From the establishment of Huoyan (1909) to 2019, it has not launched, developed and promoted independent development projects on its own. As for their licensees, they can launch licenses on third-party platforms such as Facebook Inc, Fruit App Store, Alphabet Inc-CL C App Store and other mobile development platforms.

Data sources: listing documents

Data sources: listing documents

The independent development and mobile equipment of Fire Rock (1909) is free to users, but if you want to upgrade the equipment and equipment system, you can grant the license to the contractor, and you can later become the Fire Rock (1909) license. The post-sale products can be used to buy all kinds of goods and upgrade functions.

While the income is divided into entitlement and revenue sharing, the license fee is negotiated and referred to the agreed terms and conditions; the revenue-sharing payment is calculated on the basis of approximately 5.0% to 52.5% and about 15.0% to 50.0% of the resale account for the licensee, respectively.

In addition, the projects independently developed by Huoyan Holdings (1909) all grant rights to different regions and cities in different language versions. In 2013, 2014 and the first seven months of 2015, 85.7%, 82.4% and 54.1% of Huoyan Holdings (1909)'s total revenue came from regions outside China, respectively. However, according to the annual report in 2019, 95.4 per cent of the income comes from China, while only 4.6 per cent of the income comes from overseas regions. It can be seen that in terms of recent economic development, Huoyan (1909) has become more important to China.

There is a radiation increase in Huoyan (1909):

Huoyan (1909) is committed to developing some sticky networks and mobile phones to extend the subscription period. Huoyan (1909) is located in the upper reaches of the industry, equivalent to EA, Activision Blizzard, Nintendo and SEGA in Japan. However, there is a fundamental difference from them, the role of Huoyan (1909) is to assist downstream developers in the research and development of business, to help them "grow bigger and stronger", not to argue with them. In this fierce industry, this positioning is very beneficial to Huoyan (1909), because it can avoid getting involved in the dilemma of excessive consumption and save a lot of money. According to the list, Huoyan (1909) is a rare "contract manufacturer" in the mobile market. It can be "tailored" to any environment in the store according to the requirements of the dealer. For example, one of Huoyan (1909)'s "snack bar" has been put on the shelves with more than 30 different versions. If customers are very popular in the market, developers of all sizes will appoint similar products for the development of igneous rock (1909). In addition, they are more willing to share their preferences and consumption according to firerock (1909) for development purposes. Through the first-hand data of cooperative dealers, Huoyan (1909) is more able to accurately design and use beloved customers, and over time, it has formed the Yancheng River.

Data sources: friends and friends

Data sources: friends and friends

From the previous time, we can see that on the platform, the number of times of hunting zombies (that is, Huoyan snacks) exceeded 78 million, while that of hitting zombies (Huoyan snacks) exceeded 59 million times. This number of words is only a simple business, which shows the power of its radiation expansion mode.

Chinese handheld market

In 2019, the illegal model of China's mobile market was 151.37 billion yuan, with an increase rate of 13 percent in 2018. There are too many people in the mobile phone industry, and the demand of the consumer not only changes, but also changes from time to time. As a result, the life span of the mobile phone is very short, and it is very obvious that there is an "evergreen" crisis. According to GNC statistics, the average life span of inland mobile games is only 6 to 12 months.

Nevertheless, thanks to the ability of Huoyan (1909) to integrate and prolong its life cycle, Huoyan (1909) successfully reversed the rapid growth of the market at the time of market release. From 2015 to 2019, the annual growth rate of igneous rock (1909) increased by 63%. Although the income of China's market began to release in 1909 due to domestic policy, this did not affect the growth of Huoyan (2015). To some extent, large mobile phones could not be sold on the shelves due to batch numbering problems, resulting in a shortage of supply in the market. in turn, it has increased the living space of small-scale manufacturers. Huoyan (1909) is a typical example of passenger transportation.

Single product trump card is upgraded to trump card combination

From 2014 to 2016, it has been shown from above that the growth of Huoyan (1909) is mainly driven by a single cycle. In 2014, the "King's call" spent 100% of its income, reaching 22.81 million yuan. By 2015, the "King's call" had dropped to 52.5%. Instead, the new growth engine moved to the "crown of heroes", generating 45.5% of the 2015 harvest. As for 2016, the income of the Hero Crown increased by 9.973 million, while that of the King of Kings fell by 475.3 million to 11.044 million. After deducting the drop in revenue from "call of Kings", the revenue of "Crown of Heroes" still increased by 5.22 million. In addition, in 2016, Huoyan (1909) launched "No Thrones", "cute Immortals" and "avenging Road" at the same time, accounting for 21.5% of the total revenue in 2016, or about 9.694 million, enabling 2016 to maintain continuous growth.

It is precisely because the 1909 season demonstrated the importance of portfolio integration and diversified income that Huoyan (2016) has brought about revolutionary changes that have directly led to new highs. The current China-China relationship is to launch three or more products every year to balance the income fluctuations generated by the replacement of new taxes, and to make the income of the joint venture healthier and stronger, and continue to grow.

Since 2017, Huoyan (1909) has accelerated the development of commercial products, combining them from 6 to 14 models. The "snack bar" continues to grow, accounting for 35% of the total revenue in 2017, while the "King of Kings" and "Hero Crown" still set the total revenue of 29.7%. As for 2018, Huoyan (1909), at the request of merchants, stopped the sale of three kinds of food, and the total number of products was increased to 14, which means that three models of food were added in 2018, and the total revenue of "snacks" reached 40.9% in 2018, while that of snacks increased by 32.2%. However, it can be analyzed from the previous analysis that the number of "snacks" is actually still growing, but the growth of "snacks" is too strong, so that the proportion of "snacks" has declined in 2018. In 2018, the income even exceeded 160 million yuan for the people.

In the latest 2019 year, it was pointed out that 20 items had been accumulated. In addition to the popular styles "snack bar" and "snack bar", which together account for 77.2% of the total income, the number of snacks is still close to 1%. According to the listing documents, it is estimated that the life span of the "King call" is only about 2 years. However, after eight years, the "call of Kings" still makes a difference in the income of Huoyan (1909) in the mobile market. This is enough to show that Huoyan (1909) has excellent ability in updating the content and using the system, which can prolong the product life and enhance the overall profitability.

In the first half of 1909, Huoyan mentioned that its income increased from 120 million yuan to 285 million yuan in the six months ended June 30, 2019, an increase of 177.4%. It was once again confirmed that Huoyan (2020) had entered a period of rapid growth. Once again, the combination of Indian fire rock (1909) and its ability to sustain the development of fire rock (3 models are launched and launched every year) have made the fire rock (1909) close to the harvest period. As long as there is a new "popular style" in the new fashion, there is a new high in the new "popular style".

In addition, the latest series of "Royal tycoon" and "Royal Catcher" are sold independently by Huoyan (1909) overseas subsidiaries for the first time, and we expect to generate greater operating profits. As a result, the income of Huoyan (1909) will increase again under the existing growth.

A different period of life

Of course, the success of the development of "popular style" products is of course an indispensable factor, but what is more important is that a high-quality market and customer-to-customer feedback can make the market successful. We have found from the statistics that Huoyan (1909)'s sales of snacks and catchers are not the same as those of the brand name brands.

As shown above, it is clear that the new trump card is increasing rapidly over the years, which is different from the rule that we used to know that most of the earnings come from the first 6-12 months. Normally, an event is like the life cycle of the "King's call". The worst time is usually when the market is officially launched in the first year, and then the revenue goes by year by year. However, since the launch of the arrogant series, earnings have risen with the passage of time, which has changed the rules of life. The radiation pattern of Huoyan (1909) should play an important role.

With the help of the data available in Huoyan (1909), the development equipment can be more sophisticated in the design of the equipment. It was launched as a commercial product in 2017 and has been well received. In the six months ended June 30, 2020, this company's revenue accounted for 40.1% of the total revenue, making it the most expensive in Huoyan. In view of this, one of Huoyan (1909) is working on one of its products, which is based on the popular "catch big fish", and launches an extended series of "catch big fish family secrets", which will continue the tide of this series, and strengthen the profit-making ability and the life cycle of the series.

The scale effect produced by the combination of components.

From the analysis of common benefit ratio, it is concluded that Huoyan (1909) has entered the model effect. As shown in the table above, direct costs accounted for 20.8% of profits in 2015 to 6.5% in 2019, and the reduction in the share of expenditure directly translated into an increase in gross profit margin of 14.3%. By the same token, the other largest share was administrative expenditure in 2014, accounting for 46.8%. Due to the rapid growth of combined income, administrative expenditure dropped to 9% in 2019. Similarly, the proportion of provincial administrative expenditure directly increases to the profit-making rate. Direct costs and administrative expenses cannot be defined as fixed costs, but after these two costs have reached a certain standard, the international cost will be lower and the international cost will increase. From the statement of common benefits, it can be seen that the share of costs and profits is decreasing, while the share of international income is rising at a higher rate.

Therefore, it can be inferred that if there are two or more models in the financial organization, the international cost will become apparent and directly converted into greater benefits. From the beginning of 1909, we can see that most of the "snack food", "catch big fish" and "super hamster fish" of Huoyan (2019) have produced most of their income, and they are still in a period of rapid growth, so it can be expected that the profit growth of 2020 will be even brighter.

Autonomy becomes the next bright spot.

In the six months ended June 30, 2019, Huoyan reported an increase of 177.4% from RMB 10.2 million to RMB 2.85 million in the six months ended June 30, 2019. With the trump card brand entering the harvest period and the contract manufacturing business model of Huoyan (1909), coupled with the fact that the number of employees has greatly increased as a result of the epidemic, we expect that the income of the factory will continue to grow rapidly in the past year. In addition, Huoyan (1909) is trying to diversify its income sources, and since the beginning of last year, it has tried to sell its own company independently in overseas markets. The half-year survey in 2020 shows that the proportion of self-employment has risen to 9.5%. The main force of Huoyan (1909)'s independent customer service model is the overseas market, and the merchants will separate their own customers through the cooperation platform. As a result of skipping traders, the gross profit margin of trading will be even higher. And the quickest way to open up overseas business is to close it. Since Huoyan (1909) is originally a private developer, it is intended to distribute its own high gross profit margins to overseas markets and copy its radiation growth to overseas markets. therefore, we expect that Huoyan (1909) will actively engage overseas developers, and overseas earnings will be able to achieve rapid growth in the near future, making it the next growth engine for Huoyan (1909).

In addition, Huoyan (1909) also starts from the income analysis. It has launched the "General Framework for Fire element Mobility equipment" and "Fire element Integrated Workbench system" computer tools, which can be licensed to partners to help them develop and manage the back stage of customer service, and improve the efficiency of customer service. This can not only stabilize downstream contractors and deepen cooperation, but also help to secure the source of income. According to the latest survey, sales revenue and licensing services account for 4.5% of the total income, which is hardly a task to drive revenue growth, but it is of great benefit to the revenue base of solid fire rock.

Valuation

After moving to the motherboard, more investors will pay attention to the development of Huoyan (1909). In the past, investors from institutions with restrictions on investment to the board have also become able to invest in Huoyan because of Huoyan (1909) to the motherboard.

The situation is just like that of Hypebeast (0150). After the board was transferred to the main board, it received the attention of investors in the institutions, which led to a higher valuation in the market.

According to the latest profit growth forecast, profit growth will increase by more than 200% in 2019. According to this projection, after the share split in 2020, the earnings per share will reach 0.65 yuan per share, and the average valuation of the main board handheld shares ranges from 15.4x to 15.9x, with an increase of 359% UV 371%, and the target stock will be HK $11.2 million 11.6.

Cymbals

It is too much to do business on a single basis.

The appointment of an executive director may affect the ability to develop in the future

Players' acceptance of new development products may not be as good as expected.

It may be possible to close the domestic policy on foreign exchange.

火岩控股(1909)為移動設備及網頁遊戲開發商,於2011年3月成立,旗下營運方為深圳火元素,在中國遊戲市場上,是一間頗為「年青」的新力軍。它於2014年才推出首款遊戲《王者召喚》,並取得巨大成功,為日後遊戲組合收入來源提供穏定性。在遊戲市場中,很多手遊股風頭曾一時無兩,但後來卻無以為繼,例如著名遊戲商IGG(0799),近年當皇牌遊戲《王國紀元》收入出現下跌時,表現便一蹶不振。故此,遊戲組合收入的穏定性及多源性,遠比「爆款」帶來的短暫高收益重要。不僅如此,火岩更是行業的「富士康」,為下游遊戲發行商「度身訂造」產品,而火岩更可藉著不同發行商的網絡將產品幅射式擴散開去,締造強勁增長。

火岩控股(1909)為移動設備及網頁遊戲開發商,於2011年3月成立,旗下營運方為深圳火元素,在中國遊戲市場上,是一間頗為「年青」的新力軍。它於2014年才推出首款遊戲《王者召喚》,並取得巨大成功,為日後遊戲組合收入來源提供穏定性。在遊戲市場中,很多手遊股風頭曾一時無兩,但後來卻無以為繼,例如著名遊戲商IGG(0799),近年當皇牌遊戲《王國紀元》收入出現下跌時,表現便一蹶不振。故此,遊戲組合收入的穏定性及多源性,遠比「爆款」帶來的短暫高收益重要。不僅如此,火岩更是行業的「富士康」,為下游遊戲發行商「度身訂造」產品,而火岩更可藉著不同發行商的網絡將產品幅射式擴散開去,締造強勁增長。