Niuniu knocked on the blackboard:

Niuniu knocked on the blackboard:

Investors have been fighting with their emotions all their lives.

In the process of a surge, drastic changes in the market have left investors psychologically out of balance and at a loss as to what to do. In order to ease the inner anxiety, there is a "illusion of control", hoping to use "frequent transactions" to control the situation.

The biggest feature of these trades, which are led by emotions, is that they can't hold on to a little profit, which is basically a must-lose in a bull market.

The deeper reason is that the vast majority of retail investors are "emotion-driven traders" and lack of trading plans, which provides excess returns for "logic-driven traders".

Truly successful investors are "anti-emotional" or even "anti-human". Therefore, the most difficult thing to invest is not to find good trading opportunities, but to ensure that these transactions strictly abide by the "logic-driven buy. Logic-driven sell" principle.

Control illusion and frequent trading

When we play flying chess and Monopoly games, we may all have this feeling: if we want to roll a smaller number, our movements will be softer; if we want a larger number, the action will be heavier.

We are not gods of gamblers, and our actions naturally do not affect the results of the dice, but we know this very well and we subconsciously want to control the results.

In order to control some uncontrollable factor, people always want to "add drama" to themselves, such as pressing buttons while waiting for the elevator, as if they can make it faster, and hitting the keyboard while playing games, as if they can increase their strength.

This phenomenon is called the "illusion of control" in psychology, that is, people tend to see the outside world as organized, orderly, controllable, and then overestimate their ability to control the situation-even if your reason knows it's impossible. you still do it subconsciously.

How strong is this tendency?

In one study, researchers sold lottery tickets to subjects. One group could choose its own lottery number (similar to the sports lottery welfare lottery), while the other group could not (similar to the ready-to-open lottery). The price of the lottery ticket is nearly five times that of the latter. In other words, people think that the number they choose is nearly four times more likely to win.

So, does this psychological phenomenon have anything to do with investment?

Yes, and it's too big for you to expect.

Mark Fenton-O'Creevy, a professor at the Open University (The Open University) School of Business, pointed out in a paper that stock traders are prone to "delusions of control" because their work environment has three characteristics:

First, although you have the right to trade, luck accounts for a large proportion of the result, and everyone wants to "beat luck", which is the same as the previous psychology of rolling dice.

Second, under great pressure, traders need to relieve the pressure in some ways, whether it is reading, learning, exchanging gossip, or asking God to worship Buddha and draw lots to make a wish-- trading itself is also a "decompression" method.

Third, most traders turn long-term goals into short-term goals, which look more manageable.

It is these three characteristics that make it easy for individual investors to have a "illusion of control", which results in frequent trading.

Do something, it's better than nothing.

The meaning of "Volume" in Investment Psychology

In the process of a big rally, there will be a sudden and sharp increase in trading volume at some stages of the market, which is usually explained by the entry of new funds.

But from the perspective of investment psychology, there is another view.

The new funds can only be bought, so who is selling it? It can only be the old funds in the market, and no matter how much new money is, compared with the huge amount of funds available in the field, it is only a small part, and the surge in trading volume mainly comes from the original funds.

The real reason is that new funds enter the market, and high positions take away the bargaining chips of old funds, leading to a sharp rise in share prices. After the old money was sold, it found that the share price did not fall and was forced to buy again at a higher position.

Drastic changes in the market so that investors psychological imbalance, at a loss, coupled with the initial stage of the rally, because ordinary investors like to slowly increase positions, insufficient positions led to unable to outperform the market. In order to ease the inner anxiety, there is a "illusion of control", hoping to use "frequent transactions" to control the situation.

Many technical analysis theories regard the "simultaneous increase in volume and price" as a healthy rise. In fact, looking back at the historical peak, there are both quantity and quantity. Therefore, the real meaning of "volume" is that there are a large number of "emotion-driven transactions" in the market at this time. In a very short period of time, some buy, some sell, some buy and sell, some buy and sell, the most typical are the following four kinds of mentality:

Boredom: finally liberated, never play again-- this is the release of the fastening plate after a long period of time

Fear: the previous gains have been on a roller coaster, and this time you have to put everything in the bag first-- these are usually stocks with good performance bought in a bear market.

Regret: sold off, I'm afraid it's really a bull market this time, hurry up to chase it-- this is the mentality of stepping into the air.

Greed: this limit is up, that board is connected, no matter what trading discipline, how many times can you blog in your life-this is a typical emotion to participate in the hype of junk stocks and subject stocks.

The biggest feature of these trades, which are led by emotions, is that they can't hold on to a little profit, which is basically a must-lose in a bull market.

The deeper reason is that the vast majority of retail investors are "emotion-driven traders" and lack of trading plans, which provides excess returns for "logic-driven traders".

Abbreviated as "cutting leeks".

So what is emotion-driven trading? What is a logic-driven transaction?

Emotion-driven trading and logic-driven trading

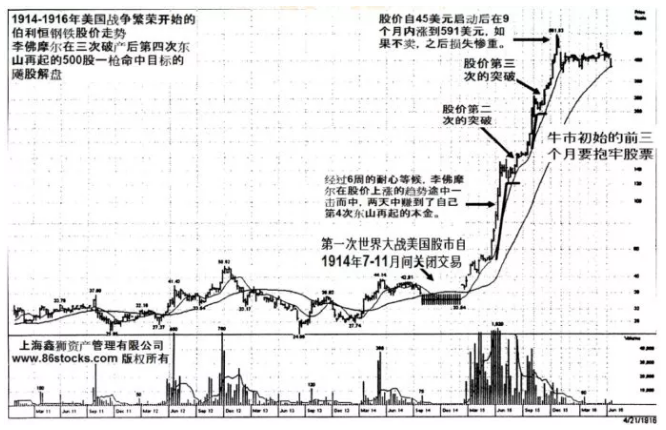

First, let's take a look at the classic World War I of Jesse ▪ Livermore, the most typical ancestor of trend Trading and the protagonist of the Memoirs of the Stock Giant.

After declaring bankruptcy for the third time, Livermore found a brokerage firm, hoping to make credit transactions to buy and sell short. Relying on his previous reputation, the brokerage firm lent him a credit line of 500 shares, and he took a fancy to a stock called Bethlehem Steel, which was the leader of the rally at the time, when the share price was $50 and was slowly rising.

Because it is a credit purchase, he can not have too many floating losses, nor can he use his usual method of rising and adding positions. In other words, Livermore has only one chance to make a profit.

The shuttle will win or lose. What will you do if it is you?

Perhaps the idea of most people is that since it is rising slowly now, buy a little first, earn more or less, and find an opportunity later-but this is precisely the idea of "emotional traders".

Livermore's approach is to "wait".

When the share price rose from 50 to 60, Livermore didn't do it; from 60 to 70, he didn't do it; from 70 to 80, to 90, he didn't do it.

What on earth is he waiting for?

Because there is only one chance, he has to wait for the "best opportunity", a chance to make the biggest profit after a shot.

In his view, the best opportunity is a stock after a period of rise, to 100, 200, 300 integer mark, due to the increase in the number of followers, the emergence of a "trend acceleration" market.

This is one of the classic logic of trend trading.

Bethlehem Steel finally reached 98 yuan. After waiting for 16 weeks, Livermore attacked like a cheetah. Although he could only buy 500 shares, but because the closing price of the day reached 114 yuan, he used floating earnings to win a valuable opportunity to double the position. The next day, the share price soared to 145 yuan, and a few months later, the highest rose to 591 yuan.

The "god of stocks" is back again.

For emotional traders, 99% of people will keep going in and out between 50 and 100 yuan, making a little money or even losing money, and then watch the stock price accelerate from 100 yuan to more than 500 yuan.

Someone must ask, why would Livermore give up a profit margin from $50 to $100?

Someone must ask, why would Livermore give up a profit margin from $50 to $100?

Because he is waiting for the logic of "trend acceleration" to be established, and this is the period with the strongest "certainty", the biggest increase, and the most worthwhile heavy position in the stock rally, because most stocks with bad trends rise from 50 yuan to 70 yuan at most.

Trend traders are usually short-term trading, but not "frequent trading", its logic is very strong, every move must strictly meet the marginal conditions, everywhere should be "anti-mood".

And emotional traders call themselves "short-term", "trend", "technical analysis", in fact, based entirely on feelings, meaningless frequent moves, kill in and out, just become the opponent of trend investors.

Let's take a look at value Investor.

The logic of value investors is actually very simple: after repeatedly studying a company, it is believed that in the next few years, the performance will grow by 25% a year, and the certainty is very high, and the current valuation is in a reasonable position, which means that for every year held, under the same valuation, the stock price will rise by 25%.

So no matter what subject matter or concept the market speculates, no matter whether the market is growth style or value style, I only want my 25%.

This is the "transaction-driven logic" of value investors.

Therefore, although value investors often buy more and more after they take a fancy to a stock, and they are not as "timing" as trend traders, because they are too strict in their judgment of value, they have very high requirements for the margin of safety. actually, there will be fewer cell phones.

Buffett has a famous "punching theory":

Suppose you have a card that can only be punched with 20 holes, representing the investment you can make in your lifetime, then you must seriously consider every investment you make.

Livermore and Buffett, a master of trend trading and a master of value investment, have completely opposite approaches, but see eye to eye on "logic-driven, anti-emotional trading". This metaphor, most familiar to value investors, explains Livermore's most classic trend trading case.

However, the result of the "illusion of control" is not necessarily "frequent trading", and another equally common psychology is the opposite-unresponsive to accumulating risks and falling.

Turn a blind eye to the real danger

After "frequent trading", investors look back and find that all the stocks they have sold have gone up to the sky, and it is better to keep their shares still than to get in and out. Then they begin to sum up their experience and put forward that "stocks should be covered in a bull market." do not even sell, "do not be afraid of rising, are not afraid of rising, afraid of not rising" …...

The decline in the operation frequency of retail investors and the mentality of covering stocks are reflected in the market, that is, after the index jumps up and down for a while, the trading volume usually shrinks slowly, coming out of the "slow bull trend" that is slowly rising at the bottom.

Relatively skyrocketing, this trend often makes people feel at ease to "cover stocks".

Is this a change of mindset for everyone? No, it's just numb to risk and takes high valuations for granted. In fact, there is no essential difference between shrinking slow cattle and soaring volume, both valuations are rising and risks are gathering.

As mentioned earlier, the principle of the illusion of control is to "overestimate one's ability to control the situation". Then, the habit of "covering stocks" formed in a long-term bull market makes investors ignore the systemic risk of overvaluation and turn a blind eye to the real danger coming. it's also a "control illusion"--

At first, when the market dived from the highest point, everyone was not surprised and thought it was still washing the plate.

Then it continued to fall, and after holding up 20%, it began to rebound, and people thought that another bull market had begun.

After that, it still fell, and the money halved, and everyone finally admitted that winter had come, but did not forget to comfort themselves: so is spring still far behind?

In fact, the decline that really tortures the will and consumes energy has only just begun.

The life of an anti-emotional trader

Truly successful investors are "anti-emotional" or even "anti-human". Therefore, the most difficult thing to invest is not to find good trading opportunities, but to ensure that these transactions strictly abide by the "logic-driven buy. Logic-driven sell" principle.

Take the trading frequency as an example, when the market volume is large, can you actively reduce the trading frequency and think calmly about your shareholding strategy? When the market shrinks and rises, do you lose your guard against the rising stocks?

Do you like to predict the rise and fall of the index and, after being tested in the short term, firmly believe that you are right? Have you ever had the idea that "the way to invest is very simple, but it is actually very easy to make money" after several times of making money?

……

It is difficult to get rid of emotional control, so Livermore went bankrupt several times in his life, so Munger, who is "good at value discovery but impulsive", can become a master of value investment only after finding Buffett.

Investors have been fighting with their emotions all their lives.

Edit / Viola