Recently, National Healthcare Security Administration Medical Price and bidding Purchasing guidance Center issued a document on entrustment.National Organization purchase Program for centralized carrying capacity of Coronary Stents (draft for soliciting opinions),National levelFor the first time将Similar to the high-value consumables of the drug "4o7".Bring volume purchase on the agenda.According to the analysis of industry insiders, the national mining of high-value consumables will start in September as soon as possible.

Photo source: insignt database, Futu Securities arrangement

Some people say that the coronary stent field will face the biggest "impact event" in history. What does this mean for hospitals, manufacturers and patients? Who will take advantage of the counterattack and who will lose the market?

This article will briefly introduce the coronary stent, historical development and market competition pattern, and then further analyze the successful purchasing opportunities of the major coronary stent manufacturers in this round.

I. definition of coronary stents

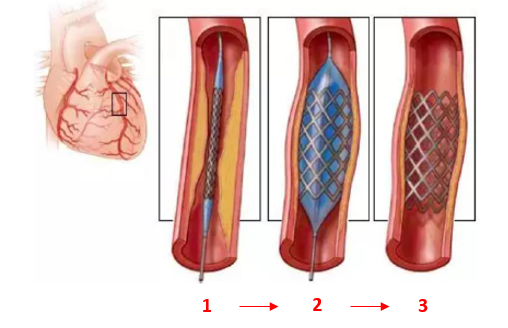

Coronary stent implantation is a mechanical interventional therapy, which mainly treats coronary heart disease. the metal stent is permanently placed in the coronary artery lesion and supported the vessel wall by balloon dilation or self-expansion. in order to keep the coronary artery lumen open and reduce the mortality of acute myocardial infarction.

Data source: Alphabet Inc-CL C photos, Futu Securities collation

Second, the historical development of coronary stents:

Because the barriers to coronary stents are relatively low, we can basically achieve localization without relying on imports.Domestic coronary stents have mainly experienced three technological revolutions:

The first revolution: the balloon catheter was delivered to the coronary artery stenosis, and the narrow blood vessel was dilated by inflating the balloon (PTCA) to restore its vascular function. However, some patients will face the problem of restenosis after vascular dilatation.

The second revolution: using stainless steel, cobalt alloy and other metal materials to make bare metal stents, but the compatibility is poor, after implantation to stimulate vascular proliferation, or will encounter the problem of re-stenosis.

The third revolution:Covering the surface of the stent with drugs such as rapamycin and paclitaxel (an anticancer drug) can significantly reduce stent stimulation to vascular endothelium and reduce proliferation, but there is a risk of stent fracture.

The fourth revolution: using biodegradable materials to make stents, which are completely absorbed after supporting blood vessels. This reduces the problem of thrombosis and restenosis.

From the first generation to the fourth generationThe problem we're all dealing with is reducing proliferation and restenosis.. At this stage, our country is mainly second-generation and third-generation coronary stents, with a market share of 99%. The fourth generation biodegradable stent Lepu Medical was approved to go on the market in February 2019.

III. Competition pattern

At present, the domestic replacement rate of coronary stents has reached 70% (red is the procurement product for this round). The technical barrier of coronary stents is relatively low, but the industry is large. At this stage, the proportion of the second and third generation coronary stents is as high as 99%, the competition pattern is stable, and the market concentration is also steadily increasing. But from the beginning of this year's volume procurement, maybe the pattern will change.

According to the chart below, we can see the changes in the market share of coronary stents in China. Four major domestic suppliers: Lepu Medical, minimally invasive Medical, Geway Medical and Saino Medical.

Data sources: Sainuo Medical, Huajing Intelligence Network, Futu Securities

Minimally invasive has always maintained the leading position of coronary stents, but the gap between minimally invasive and second and third does not seem to be big. But it's worth noting thatThe products of Saino Medical are all made of stainless steel and do not meet the purchasing conditions.The other three companies are qualified to participate in the collection of their main products.

In addition, in terms of price, in the face of the national market, we can refer to the price of consumable materials in Beijing: at present, the unit price of domestic coronary stents is about 7000 yuan, the import is more than 10000 yuan, and the proportion of medical insurance payment is not less than 70%. If the reduction in this round of collection is more than 50%, patients may only have to pay less than 1000 yuan themselves, which is absolutely good news for patients.

China Coronary Stent Corporation

1) minimally invasive medicine

Minimally invasive Medical is a global layout of innovative high-end medical device enterprises, after years of development, the layout of products covering orthopaedics, cardiovascular intervention, large arteries and peripheral vascular intervention and other 10 major areas, a total of about 300 products listed, sold to nearly 10,000 hospitals in more than 80 countries and regions around the world.In addition, minimally invasive medical treatment is the leading medical device in China, and it is also one of the companies with heavy positions in Hillhouse Capital.

Minimally invasive coronary stent is the earliest listed company in China.Four kinds of drug-eluting stents have been put on the market in the past ten years, in which the first generation of drug-eluting stents, Firebird, has been eliminated, and its second-generation Firebird2 has initiated the application of cobalt-chromium alloy, which is widely used in domestic and foreign markets.

Data source: Guolian Securities, Futu Securities

Cardiovascular intervention of minimally invasive medical care accounts for about 1% of total revenue, and the proportion of revenue from this business continues to rise to 33.4% in 2019, with a growth rate of 33%.The income of coronary stents in 2019 is about 1.5 billion yuan, accounting for about 27% of the total income.。

Data source: minimally invasive Medical Annual report, Futu Securities arrangement

According to the data of Guohai Securities Research Institute, the sales of Firebird2TM coronary rapamycin eluting cobalt-based alloy stent (Firebird) is about 500 million yuan in the first half of 2019, and the annual income is expected to be 1 billion yuan in 2019. FirehawkTM Crown Rapamycin targeted Shifei (Firehawk) earned about 300 million yuan in the first half of 2019 and is expected to earn 600 million yuan in 2019.

Minimally invasive medical has three coronary stents, Firebird2, Firehawk and FireCondor, which account for about 29% of the company's revenue, and its market share and revenue are expected to further increase after entering the national collection in the future.

2) Lepu Medical

Lepu Medical started with cardiovascular stent business, has a comprehensive layout of cardiovascular coronary stents a series of products. After 20 years of development, Lepu Medical has become one of the few enterprises that can compete strongly with imported products in the field of high-end medical devices in China.

The following are the core products of Lepu Medical Coronary Stent, of which Partner and Nano Plus do not meet the procurement criteria.Only GuReater this product meets the standardBut the bracket accounts for a relatively small share of the overall income

Data source: Guolian Securities, Futu Securities

Among them, the Neo Vas product launched by Lepu Medical in February 2019 is the fourth generation product, which is the first fully degradable coronary stent in China, with strong innovation ability and high price.

In recent years, revenue has continued to grow and gross profit margin has remained stable. The company's revenue from the stent system in 2019 is about 1.8 billion yuan, an increase of 27% over the same period last year.The income of stent system mainly comes from low-end Partener products.The significant increase in income in 2019 is mainly due to the fourth generation of bioabsorbable stent NeoVas. Lepu Medical may not have an obvious advantage in the process of this collection.

Source: wind, Futu Securities

3) Blue Sail Medical

Lanfan Medical acquired Parkson International in nearly 6 billion in December 2017. Jiwei Medical, a Chinese subsidiary of Parkson International, has about 20 per cent of the domestic stent market, including about 15 per cent of coronary stents. Jiwei's main products listed in China include Excel and EXCROSSAL, of which Excel may not meet the target of this purchase, and EXCROSSAL meets the requirements of this purchase, but its overall market share is less than 1 per cent.

Data source: Guolian Securities, Futu Securities

Summary:Lepu Medical's coronary stent income is mainly second-generation stainless steel, the core products do not meet the procurement scope, only GuReater meets the requirements, but the stent accounts for a very small proportion of the overall income. The stainless steel coronary arteries of Blue Sail Medical's Excel also do not meet procurement standards, but EXCROSSAL has a market share of less than 1 per cent. Saino Medical's product line is all stainless steel coronary stents, which are not shortlisted.

Minimally invasive Healthcare has about 29% of the company's revenue with Firebird2, Firehawk and FireCondor coronary stents, and its market share and revenue are expected to increase further after entering the national collection in the future.

Summary

According to the analysis of industry insiders, the medical devices of high-value consumable coronary stents will be launched in September as soon as possible. A number of domestic coronary stent companies hope to take advantage of this round of national talent to take advantage of counterattack, perhaps this will not be the case.

Only GuReater meets the requirements of Lepu Medical, and the stent accounts for a very small proportion of the overall income, so the advantage in this collection is not obvious. Blue Sail Medical's EXCROSSAL has less than 1% of the market, and Saino Medical's products are not listed.

In this wheel volume procurement, the biggest winner may be minimally invasive medical care. At present, the company's three coronary stents meet the procurement standards, and its market share will further increase after entering the limited scope of national collection in the future.

Suggest to pay attention to

Hong Kong stock: minimally invasive medical treatment

Edit / elisa