NIO Inc. was shortlisted for 2020H1 global new energy car brand Top20; news that Taiwan Semiconductor Manufacturing Co Ltd intends to invest in ARM; Tianfeng Securities released a research report that TAL Education Group Q1 net profit increased significantly, business expansion is sound and sustainable.

Us stocks closed higher across the board on Wednesday, with the Nasdaq reaching a new high as the White House and the Democratic Party planned to reach an anti-epidemic rescue agreement by the end of this week, and Johnson & Johnson signed a novel coronavirus vaccine agreement with the US government, but the "small non-farm" ADP employment data fell far short of expectations.

Among the hot Chinese stocks, a total of 23 rose, 7 fell and 2 closed flat.

The specific performances of China-listed stocks are as follows:

Among the well-known Chinese stocks:BABA rose 1.03%, JD.com 1.47%, NetEase 0.22%, Sina Weibo Corp 1.33%, Pinduoduo 3.66%, NIO Inc. 2.05%, iQIYI, Inc. 0.22%, HUYA Inc. 7.77%, Bilibili Inc. 0.73%, Futu Holdings Limited 10.08%.

In other US-listed stocks, those who have increased significantly are as follows:Lightinthebox Holding Co. Ltd was at $2.29, up 44.03%; Dianniu Finance was at $4.29, up 26.55%; Boqi Pharmaceutical was at $2.29, up 14.5%; Ideanomics Inc was at $1.62, up 14.08%. Four Seasons Education (Cayman) Inc was at $1.35, up 13.44%.

On the other hand, the larger decreases are as follows:Puhui Wealth Investment Management Co Ltd was down 24.4% at US $2.82, Jihai Information was at US $2.52, down 14.58%, ZHONGCHAO INC. was at US $2.44, down 14.39%, Tianhua Sunshine was at US $3.72, down 12.47%, and Fang Holdings Limited American Depositary Shares was at US $12.89, down 8.9%.

Focus review

Pinduoduo launched the "10 billion subsidy Festival" today, and iPhone 11 is less than 4000 yuan for the first time.

Pinduoduo will officially launch the "10 billion subsidy Festival" today. According to reports, the activity lasted until August 8. It covers tens of thousands of products in nearly 20 categories, such as digital home appliances, cosmetics, mother and child, food and beverages, clothing bags and so on.

During the event, the iPhone 1164G version will be directly reduced to 3979 yuan, coming to the range of less than 4000 yuan for the first time; Philips electric toothbrush HX9362 only sells 599 yuan, less than 600 yuan to win HX9 series high-end products; 230mL installed SK-II fairy water to the hand price of only 659 yuan, reaching the lowest price in the history of the whole channel.

According to the official statement, this discount price is "unprecedented". Zong Hui, the person in charge of Pinduoduo's 10 billion subsidy, said that during the event, after subsidies, the prices of many big-name commodities will usher in a "historic low."

Li Xiang: most of my colleagues underestimate Tesla, Inc. 's self-built super charging station.

On Tesla, Inc. 's continued high sales of Model 3 in first-tier cities, Li Auto Inc. CEO Li wanted to comment on social software that "most people still don't understand how Tesla, Inc. won." When talking about the impact of Model 3 on other car companies' products, Li even described it as a "disaster to the end".

In his view, even if competitors have won in terms of range, intelligence and performance-to-price ratio, it has not changed Tesla, Inc. 's "monopoly" in terms of sales volume.

He lamented, "almost all enterprises do not know where Tesla, Inc. won, because the reason (Tesla, Inc.) won is too primary, not so glamorous, so it was ignored." "

NIO Inc. was shortlisted for 2020H1 global new energy vehicle brand Top 20.

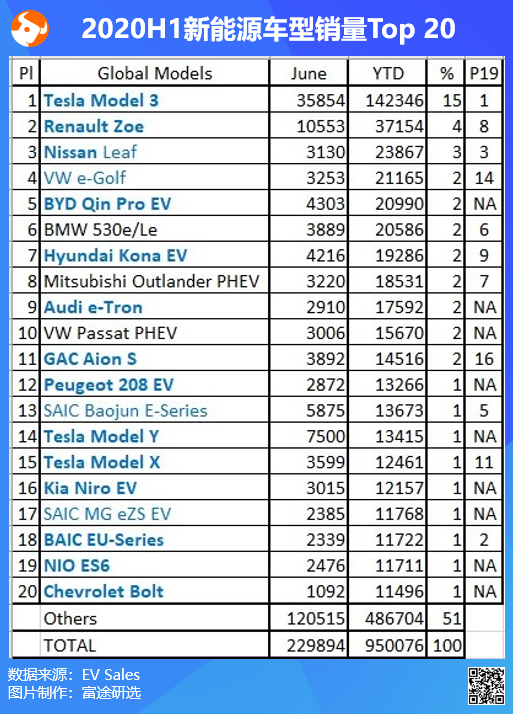

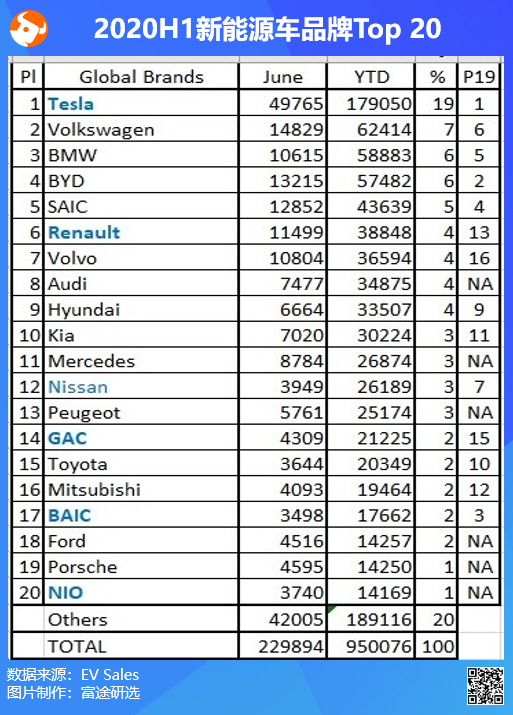

EV sales released the latest global new energy vehicle sales figures, global electric vehicle sales reached 229894 in June, compared with-22% in the first half of 2020, global electric vehicle sales totaled 950076,-16% year on year.

Among them, the number of Model 3 was 35900 in June and 142000 in the first half of the year. In terms of Chinese brands, five models have been shortlisted for TOP 20. Qin pro ranked fifth with 20990 vehicles sold in the first half, while NIO Inc. ES6 ranked 19th with 11711 vehicles sold in the first half.

From the brand dimension, Tesla, Inc. also ranks first, while NIO Inc. ranks 20th.

Sources say that Taiwan Semiconductor Manufacturing Co Ltd and Foxconn are also interested in investing in ARM, and Apple Inc has given up.

Major suppliers of Apple Inc, including Taiwan Semiconductor Manufacturing Co Ltd and Foxconn, are interested in investing in ARM, a British chip design company, several people familiar with the matter said today.

Four years ago, Softbank Corp. Group bought ARM for $32 billion. Now, Softbank Corp. and bankers have approached several technology giants to discuss a potential sale of ARM. In addition to Taiwan Semiconductor Manufacturing Co Ltd, the world's largest contract chipmaker, and Foxconn, the world's largest electronics contract manufacturer, Softbank Corp. also contacted Apple Inc, Qualcomm Inc and NVIDIA Corp (Nvidia), according to people familiar with the matter.

ARM is a key player in the global technology industry, providing the architecture used by more than 90% of the world's mobile chips. Apple Inc, Qualcomm Inc, Samsung, Huawei, and almost all chip developers need ARM's intellectual property to design processor chips for their mobile devices.

Taiwan Semiconductor Manufacturing Co Ltd and Foxconn are closely monitoring the progress of the talks between Softbank Corp. and NVIDIA Corp, according to a person familiar with the deal. "the two companies are still interested but hesitant to make a full acquisition," the person familiar with the matter said. "

Taiwan Semiconductor Manufacturing Co Ltd studied ARM and its business model several years ago and is quite familiar with the British company, another person familiar with the matter said. Other sources said that Taiwan Semiconductor Manufacturing Co Ltd is not considering taking any meaningful action at present.

Tianfeng Securities: TAL Education Group Q1 net profit increased significantly, business expansion is steady and sustainable.

Tianfeng Securities believes that TAL Education Group's performance growth in this period mainly comes from the business drive of learning and thinking about online schools and learning. The performance of learning and thinking online schools is growing rapidly, and the excellent business is also maintaining healthy growth. Public health incidents put some pressure on offline business, but the company is gradually resuming offline business within the limits permitted by the state.

Four sharp weapons drive TAL Education Group into the fast lane of development:

First, standardize products and services, achieve high-quality value delivery at low cost, enjoy the dividend of standardized teaching and research, and support its steady fission.

Second, self-built information service network and word-of-mouth construction to achieve low-cost enrollment; to obtain new customers, TAL Education Group first obtains traffic through the network, sets up small classes to absorb high-quality students, builds word-of-mouth, and then replicates the standardized teaching system to expand rapidly in the local area; consolidate old customers and increase the renewal rate of old customers by improving service quality.

Third, business expansion is steady and sustainable, summer promotion + double-division classroom, expand second-and third-tier cities steadily and steadily urban expansion.

Fourth, the investment layout is forward-looking, both offensive and defensive, and early childhood education / K12 / foreign languages / foreign cutting-edge education and science and technology enrich product lines in all directions.

TAL Education Group's FY21-22 net profit is expected to be US $591 million and US $915 million respectively, corresponding to PE of 80x and 51x respectively.

Edit / Jeffy