Author: Qiu Liting

There is an obvious periodicity in the development of semiconductors, the prevalence of large-scale computing and the popularity of personal computers, including the explosion of mobile terminals represented by smartphones, all of which can be counted as a cycle.

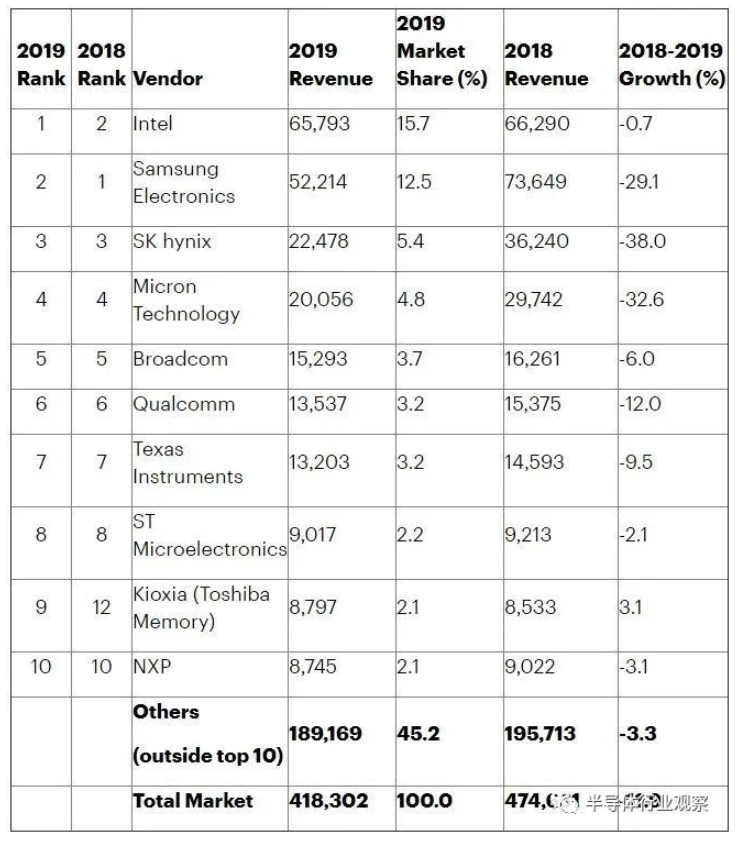

Of course, the division of the times is often impossible to have only one label, in the semiconductor industry, mergers and acquisitions can also be counted as a distinctive label. In this decade, the head semiconductor manufacturers achieved Evergrande through mergers and acquisitions, gradually forming a situation of oligarchs in today's semiconductor industry. The following picture shows the data released by Gartner, a well-known research organization:

Sales ranking of global semiconductor manufacturers in 2019 Source: Gartner

Taking years as a unit, by peeling cocoons and reading the mergers and acquisitions of the top ten semiconductor manufacturers over the past decade, you can discover a lot of unknown secrets.

Intel Corp who embraces the change

Over the years, Intel Corp in addition to insisting on doing CPU, but also through mergers and acquisitions to explore various frontier areas, different from the traditional semiconductor companies, basically only mergers and acquisitions peers. Intel Corp, an elegant giant, is very interested in crossing the border, acquiring areas including wireless technology, data center chips, and emerging areas such as artificial intelligence and self-driving.

Through these mergers and acquisitions, Intel Corp has been able to enter many emerging areas and seek market growth in the next decade. Embracing change is a feature of Intel Corp, a 50-year-old manufacturer, and today's proud processor business is also a new business developed by Intel Corp, who started with memory at that time. Therefore, Intel Corp's foreign mergers and acquisitions in recent years have largely demonstrated this point.

Intel Corp bought McAfee, a security software giant, for $7.68 billion in August 2010. the original intention was to integrate network security functions into a chip to detect cyber threats at a deeper level.

Also in 2010, Intel Corp bought Infineon's mobile chip business for $1.4 billion. It should be noted that at this time, the era of mobile intelligence is just emerging, personal tablets are a strong growth point, and the other is smartphones. Intel Corp obviously doesn't want to miss the opportunity at that time.

On November 21, 2012, Intel Corp and Creative Technology reached an agreement to acquire ZiiLabs, the UK subsidiary of the latter, for US $50 million, while obtaining ZiiLabs's license for high-performance graphics processor (GPU) chip technology. ZiiLABS, a wholly owned subsidiary of Creative Technology, is a leader in rich media application processors, high-end software and hardware platforms.

In 2013, Intel Corp acquired Mashery and Fujitsu Semiconductor Wireless products Company (Fujitsu Semiconductor Wireless Products) to enhance CPU strength and expand its capabilities in the mobile field. Intel Corp is reported to be entering the mobile communication transceiver field.

In 2014, Intel Corp acquired Basis Science, the network division of Anhua Hi-Tech, which lays out the wearable market and enriches its processor product line.

In 2015, Intel Corp acquired Recon, a maker of head display devices, Altera, an advocate of programmable chip systems (SOPC) solutions, and Saffron, an artificial intelligence company, and began to lay out the Internet of things market.

In 2016, Intel Corp acquired Italian semiconductor manufacturer Yogitech, computer vision (CV) algorithm startup Itseez, deep learning startup Nervana Systems, and computer vision company Movidius, which believes that machine learning will be the next significant growth point in the data center and strengthens its strength in the field of computer vision applications.

In 2017, Intel Corp acquired a 15 per cent stake in HERE, a mapping service, and Mobileye, an Israeli self-driving technology company, was able to lay out the field of self-driving in advance. Relying on Mobileye's core strengths in ADAS algorithms and hardware, Intel Corp was able to quickly enter the market. Intel Corp can quickly enter the market.

In 2018, Intel Corp announced the acquisition of semiconductor design company eASIC, Vertex.ai, a start-up that develops artificial intelligence model components, and NetSpeed Systems, a supplier of system-on-chip (SoC) design tools and interconnect architecture IP, to further realize flexible deep learning for edge computing and accelerate chip design.

In 2019, Intel Corp acquired Omnitek, a manufacturer of Ineda Systems,FPGA, a low-energy chip company, Pivot Technology Solutions, an infrastructure and service provider of network chip startup Barefoot Networks Inc,IT, and Habana Labs, a manufacturer of deep learning accelerators, to continue to promote the field of AI, but also to develop better in the cloud platform.

A technology may make an enterprise a giant in the industry, but if an enterprise is to become an evergreen tree, innovation is the key. X86 is a killer mace that allows Intel Corp to lead the computing world for 30 years, and then all kinds of chips emerge one after another, and there are many giants in the semiconductor industry. They have challenged Intel Corp's position. Intel Corp is not the first in the ranking of global semiconductor giants in recent years. This is also because they spend more money on future layouts. Generally speaking, one of Intel Corp's principles of M & An is to enhance the original business strength, and the other focus is on emerging technology.

Samsung Electronics which invests crazily

From today's point of view, Samsung, this huge enterprise does not seem to have much to do with mergers and acquisitions. Samsung with deep pockets should not kill others with money or be killed by others with money. However, when you trace the source of Samsung Semiconductor, you will still have the shadow of mergers and acquisitions.

In 1974, Lee Kun-hee used his own funds to buy Korea Semiconductor Company under the unfavorable conditions of policy and public opinion, focusing on the storage business that Samsung made a lot of money today. since then, countless times of high-risk code has finally won the first position in the industry from here.

Samsung has also made several mergers and acquisitions in the past decade, but most of them have invested.

In 2017, Samsung acquired Harman,Harman, a leading global provider of advanced audio and infotainment solutions. Samsung Electronics said the deal will help Samsung enter the automotive electronics sector and expand into the car networking market.

In 2018, Samsung wholly acquired Kngine, an Egyptian artificial intelligence search engine, according to The Investor. It is reported that the acquisition is in line with Samsung's efforts to develop artificial intelligence mobile solutions, including upgrading its intelligent voice assistant Bixby.

In 2019, South Korean media said that Samsung Electronics acquired the semiconductor packaging PLP business of Samsung Motor, a subsidiary, and developed the semiconductor packaging business. The report pointed out that Samsung attaches importance to this technology and believes that its subsidiary Samsung Motor has insufficient investment power, so it hopes to inject resources into the group after Samsung Electronics acquires the Samsung Motor Semiconductor Packaging PLP business, and allows technology and productivity to improve rapidly.

SK Hynix who strives to build the factory

February 2012 SK Group, the third largest chaebol in South Korea, joined Hynix and changed its name to SK Hynix. Since then, SK Hynix has been looking for acquisitions to continue to expand its influence in the storage industry.

In June 2012, SK Hynix acquired LAMD of the United States. LAMD is one of the leaders in SoC solutions for data storage systems. SK Hynix said that through the acquisition of LAMD, their NAND flash memory products will be further enhanced.

During the same period, SK Hynix acquired the Italian company Idea flash S.r.l and announced the establishment of a research and development center in Italy, "SK Hynix Italy Co., Ltd. (SK hynix Italy S.r.l.)". SK Hynix CEO Quan Wuzhe said at the opening ceremony: "the Italian R & D Center will work closely with the Korean headquarters to play a central role in the development of NAND Flash." SK Hynix will join hands with excellent experts to further strengthen global R & D capabilities. "

In 2013 and 2014, it acquired the eMMC controller department of Taiwan Yincan Technology, the Violin Memory PC Iecard department of the United States, and the firmware department of Belarus Softeq Development FLLC, aiming to enhance its competitiveness in the field of NAND flash solutions.

In addition, in 2014, SK Hynix also acquired CIS enterprise Siliconfle, which became a 100%-owned subsidiary of SK Hynix; in October 2016, SK Hynix further incorporated Siliconfle's CIS business management rights; since 2017, SK Hynix has invested more resources into its CIS department.

According to South Korean media reports this year, buyers, mainly SK Hynix, are buying MagnaChip wafer foundry business, which may be coming to an end. It is reported that the total purchase price of the transaction is about 400 billion won.

SK Hynix continues to strengthen the competitiveness of its NAND flash solutions by way of acquisition. Although there is relatively little news about the acquisition of SK Hynix, SK Hynix made a lot of moves to invest in the plant between 2015 and 2020.

Micron Technology Inc with a clear aim

Meguiar, as the top three DRAM factories in the world and the top four NAND chip manufacturers, has also stepped up its layout in storage in the past 10 years.

In July 2012, Meguiar acquired ELPIDA. Micron Technology Inc owns 89 per cent of Roxchip and 100 per cent of the product supply after the acquisition, which is the only Japanese company that makes dynamic random access memory (DRAM) such as computers.

In 2015, Micron Technology Inc paid $3.2 billion for a 67 per cent stake in Taiwan's Huaya Technology that he did not yet own. It is reported that Huaya Technology will supply all its DRAM computer chips to Micron Technology Inc. With the formal merger of Micron Technology Inc and Huaya Technology in 2016, Micron has become the largest foreign investor in Taiwan.

In October 2018, Micron Technology Inc announced the acquisition of Intel Corp's stake in IMFT because the two sides broke up because of differences over the development of memory chips. In November 2019, Micron Technology Inc announced that he had completed the acquisition and paid Intel Corp a $1.25 billion break-up fee. After the completion of the transaction, IMFT also became a wholly owned subsidiary of Micron Technology Inc.

Indulge in buying Broadcom Ltd.

When it comes to semiconductor acquisitions, Broadcom Ltd must be regarded as one of the most active manufacturers, whether it is the previous Avago or today's new Broadcom Ltd, and Broadcom Ltd's road to mergers and acquisitions will continue. Of course, it could also be a merger.

In September 2011, the former Broadcom Ltd bought NetLogic Microsystems for $3.7 billion. Through this acquisition, Broadcom Ltd has enriched his product lineup, including knowledge-based processors, multi-core embedded processors, digital front-end processors and so on.

Between 2013 and 2015, Avago, which launched the acquisition of Broadcom Ltd, acquired optical components company CyOptics, wireless communications company Javelin Semiconductor, storage company LSI,PLX Technology and Emulex. It strengthens its strength in the field of wireless communication and storage.

In 2016, Avago announced the acquisition of Broadcom Ltd for a total of US $37 billion and changed its name to the new Broadcom Ltd.

In 2017, Broadcom plans to buy Qualcomm Inc for $130 billion. But the deal did not succeed-Broadcom Ltd announced in 2018 that it had withdrawn and terminated its offer to buy Qualcomm Inc.

After the failed acquisition of Qualcomm Inc, Broadcom Ltd quickly adjusted his development strategy. Broadcom Ltd CEO Chen Fuyang (Hock Tan) believes that infrastructure software companies are similar to the highly differentiated semiconductor industry seven years ago. Therefore, starting from 2018, Broadcom Ltd's acquisition targets began to favor software companies.

In the same year, Broadcom Ltd bought CA Technologies, a software company, for $18.9 billion. Tom Krause, chief financial officer of Broadcom Ltd, revealed that Broadcom Ltd is committed to creating great value for shareholders, and this strategy is more widely applicable to the infrastructure market, and the acquisition of CA Technologies is an extension of this strategy.

Broadcom Ltd announced another software acquisition in August 2019, which will buy the enterprise security business of cyber security company Symantec for $10.7 billion in cash.

Analysts at the Topu Industrial Research Institute believe that Broadcom Ltd's achievements in overall financial performance, in addition to the fact that the company plays a very important role in communications infrastructure and enterprise IT equipment, in fact, to a large extent, comes from the company's continuous acquisition of chip suppliers. In the future, in order to win the trust and favor of investors, Broadcom Ltd's mergers and acquisitions will continue, and will become more and more crazy.

Qualcomm Inc, the darling of the mobile era

Qualcomm Inc is the protagonist in the two most important acquisition scandals in semiconductor history. Whether Qualcomm Inc plans to buy NXP or Broadcom Ltd plans to buy Qualcomm Inc, people lament the madness of his acquisition idea. Qualcomm Inc is one of the leaders in the era of mobile smart terminals in the past decade and one of the biggest beneficiaries.

As an aside, Qualcomm Inc's Snapdragon processor has shone brilliantly in the Android mobile phone market over the years, leading the way in innovation for a long time. And there is a component in Qualcomm Inc's chip that comes from the acquisition, that is, Adreno GPU.

In 2009, Qualcomm Inc bought AMD's mobile equipment assets for $65 million and acquired AMD's intellectual property rights related to vector graphics and 3D drawing technology, eliminating the need to pay technology license fees to AMD. Since then, Qualcomm Inc combined with AMD's mobile phone graphics technology to further develop his own "Adreno" GPU, that is, Adreno GPU.

In March 2011, Qualcomm Inc bought Atheros, a supplier of Wi-Fi wireless chips, for $3.2 billion. The acquisition increased Qualcomm Inc's share of the Wi-Fi market and intensified the competition between Qualcomm Inc and Broadcom Ltd.

In October 2014, Qualcomm Inc bought British chip maker CSR for $2.5 billion. As mentioned in Qualcomm Inc's statement at the time, CSR has a technical leadership position in Bluetooth, "Bluetooth Intelligence" and audio processing chips, and the acquisition of CSR has strengthened Qualcomm Inc's market position and expanded the high-access Internet of things chip business, including portable audio devices, in-car systems and wearable devices.

In September 2019, Qualcomm Inc officially announced the acquisition of the remaining interest in RF360 Holdings Singapore Co., Ltd. RF360, a joint venture between Qualcomm Inc and TDK in Japan, produces radio frequency front-end (RFFE) filters. Qualcomm Inc said that the acquisition will strengthen the company's RF business and help support the company's transition to 5G.

In fact, Qualcomm Inc also thought about buying NXP and getting into the car race track, but the deal was finally cancelled for various reasons. Otherwise, this can be called the most important transformation of this century.

"once and for all"Texas Instruments Inc of

Texas Instruments Inc is one of the world's top 10 semiconductor companies and the world's largest manufacturer of analog circuit technology components. Prior to this, Texas Instruments Inc has also experienced many mergers and acquisitions, but in the past decade, other semiconductor giants are busy with mergers and acquisitions, Texas Instruments Inc is in the old god. The industry all believe that Texas Instruments Inc will be in the simulated market once and for all through mergers and acquisitions, that is, Texas Instruments Inc's merger and acquisition of National Semiconductor (NS).

In April 2011, Texas Instruments Inc acquired National Semiconductor for about US $6.5 billion. Before the acquisition of National Semiconductor, although Texas Instruments Inc was the boss of Analog IC, it was difficult to increase his share. After the acquisition of National Semiconductor, Texas Instruments Inc's market share in general analog devices quickly rose to about 17%, leaving his competitors far behind.

Italian semiconductors addicted to gallium nitride

In recent years, Italian Semiconductor has invested a lot in the third generation semiconductor devices, especially in the field of gallium nitride. Italian Semiconductor has announced a number of cooperation plans and acquisition plans.

In 2011, STMicroelectronics (ST) completed the merger and acquisition of Arkados and the transfer of semiconductor assets and intellectual property rights (IP). Arkados is a leader in the field of HomePlug, a new industry standard, dedicated to accelerating the development and market introduction of converged digital home networks. This merger will further enhance the technical strength of STMicros in power line communications (PLC).

In July 2016, STMicroelectronics announced on its website the acquisition of all assets of Austrian microelectronics company (AMS) NFC and RFID reader and access to all relevant patents, technologies, products and businesses to strengthen ST's strength in secure microcontroller solutions and to assist ST in the development of mobile devices, wearable, finance, identity authentication, industrialization, automation and the Internet of things.

In December 2019, STMicroelectronics completed the overall acquisition of Norstel AB ("Norstel"), a Swedish silicon carbide (SiC) wafer maker. The overall acquisition of Norstel will help strengthen the SiC ecosystem within ST.

In March this year, STMicroelectronics announced that it had signed a merger agreement to acquire a majority stake in Exagan, a French gallium nitride innovator. At the same time, Italian Semiconductor also aimed at gallium nitride and reached a cooperation with Taiwan Semiconductor Manufacturing Co Ltd. These actions all reveal the determination of Italian semiconductors to distribute the gallium nitride market.

Toshiba, which sells itself frequently.

Toshiba memory Co., Ltd. was established in 2017, the company is an independent branch (Toshiba Infrastructure Systems Co., Ltd., Toshiba Electronic components and Storage Devices Co., Ltd., Toshiba Digital Solutions Co., Ltd.). In June 2017, the company split its storage business, which includes solid-state drives and image sensors, into Toshiba Storage (Toshiba Memory Corporation).

In 2018, Toshiba sold its stake to Pangea (Pangea), a special purpose company formed and controlled by a consortium led by Bain Capital's private equity. As of August 2018, Pangea and TMC merged. Pangea changed its name to Toshiba memory, and Bain Capital of Pangea also owns 49.9% of Toshiba memory. Since October 2019, Toshiba Storage has changed its name to "Kioxia" and its Chinese name to "Leather Man Co., Ltd.".

The acquisition follows a more than $100 million acquisition by Toshiba in August 2019, when Toshiba signed an agreement with LITE-ON to buy LITE-ON 's SSD solid-state drive business for $165 million. From the market point of view, Jianxing has mature experience in the field of personal computer and data center SSD, the OEM market has a lot of share, and the retail market also has Pucote, a high-end SSD brand. Toshiba Storage can enhance their leading position in the SSD market through the acquisition of Jianxing.

Toshiba Storage's acting President and CEO Nobuo Hayasaka said, "Jianxing's solid state drive business will be fully integrated with Toshiba Storage, expanding our leadership in the SSD industry, and this acquisition will help them meet current expectations of SSD demand growth in PC and data centers and strengthen their cloud services business. "

Others buy and buy, and then increase their market share, while Toshiba sells. Most of the recent news about Toshiba is that Toshiba is selling the industry, selling its chip business to a consortium led by Bain Capital, selling its white power business to Midea, selling its American LNG project to ENN shares, and so on. We don't know where the company, which has a history of more than 140 years, will eventually go.

Buy the famous NXP.

When it comes to NXP, the first thing that comes to mind is automotive semiconductors, which actually dabble in intelligent identification, wireless infrastructure, lighting, industry, mobile, consumer and computing. However, NXP is indeed the strongest in the field of automotive semiconductors. NXP has today's market position, and mergers and acquisitions undoubtedly play a significant role, especially its successful acquisition of Freescale.

In 2015, NXP bought Freescale Semiconductor for a whopping $11.8 billion. Freescale, which consists of the operating assets and liabilities of the former Motorola Semiconductor Division, is a company engaged in the production and research and development of microcontrollers and digital network processors. In addition, the company provides customers with a differentiated semiconductor product portfolio that complements its embedded processors. The merger of the two companies has created one of the world's top suppliers in areas such as MCU, mixed-signal and automotive semiconductor solutions.

In March 2015, NXP announced the acquisition of Athena SCS. Athena SCS is a solution provider dedicated to securing a fast-growing connected world. The acquisition strengthens NXP's ability to provide security solutions for many applications, including the Internet of things, portable and wearable, and automotive.

In September 2018, NXP acquired OmniPHY. OmniPHY's expertise includes automotive Ethernet, which enables the fast data transmission needed for autopilot. NXP said that by combining OmniPHY's advanced high-speed transmission technology with NXP's leading product portfolio and extensive experience in in-vehicle networking, NXP will take the lead in providing next-generation data transmission solutions for automakers.

At the end of May 2019, NXP announced that it would acquire the communications chip business of semiconductor manufacturer Marvell for $1.76 billion in all-cash, including Marvell's WiFi connectivity business unit, Bluetooth technology portfolio and related assets. The company said that through this acquisition, NXP can enhance its wireless connectivity competitiveness in the automotive, communications and industrial sectors and deliver complete and scalable processing and connectivity solutions, including customized security, as well as a complete set of wireless connectivity products across Wi-Fi, Bluetooth, low-power Bluetooth, Zigbee, threading and near Field Communication (NFC) to customers across its entire end market.

Summary

Through the summary, we find that M & A plays an important role in the development of semiconductor manufacturers, and it is a shortcut to expand the market, enrich product lines and enhance technology in the semiconductor industry. these manufacturers have gradually established their hegemony through continuous mergers and acquisitions.

For Chinese semiconductor manufacturers, the current international situation is not conducive to domestic semiconductor manufacturers to carry out large-scale cross-border mergers and acquisitions, but internal integration is also a way of M & A.

Edit / lydia