Market review for July 31st

Overnight in US stocks, the NASDAQ rose 0.43%, the S&P 500 index fell 0.38%, and the Dow fell 0.85%. FAANG's five major technology stocks all opened low and closed higher. Qualcomm rose more than 15%, and Ideal Auto rose more than 40% on the first day of listing.

Today, the Hang Seng Index closed down 0.47% to 24,595 points. On the market, wind power stocks continued to be strong yesterday, with Goldwind Technology surging 24% in two days; semiconductor, gold and precious metals, biomedicine, and tobacco concept stocks strengthened, and SMIC rose nearly 6%; dairy products, Hong Kong bank stocks, and petroleum stocks declined significantly, and Australia plummeted by more than 10% after excellent performance.

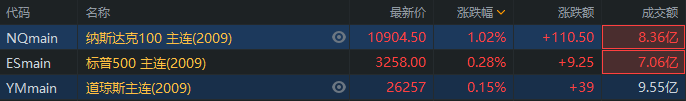

US stocks pre-market: NASDAQ futures rose 1%

The US stock futures index rose before the market. As of press release, NASDAQ futures were up 1.02%, the S&P 500 index was up 0.28%, and the Dow futures were up 0.15%.

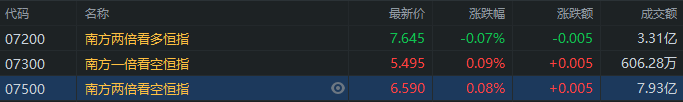

Performance of major ETF products in Hong Kong stocks

The Hang Seng Index closed down 0.47%, and the South was twice as bullish, and the Hang Seng Index fell slightly

The Hang Seng Index closed down 0.47%.$ The South is twice as bullish on the Hang Seng Index (07200.HK) $It fell slightly by 0.07%, and the turnover reached HK$331 million.$ The South is twice as bearish on the Hang Seng Index (07300.HK) $It rose 0.09%, and the turnover reached HK$6.06 million.$ South double bearish Hang Seng Index (07500.HK) $It rose 0.08% to a turnover of HK$793 million.

The Shanghai Index closed up 0.71%, and the South doubled, and the Shanghai and Shenzhen 300 rose nearly 2%

The Shanghai Index closed up 0.71%.$South doubles as long as Shanghai and Shenzhen 300 (07233.HK) $Up 1.83%, with a turnover of HK$77.75 million.$ South doubles short Shanghai and Shenzhen 300 (07333.HK) $It fell 0.6%, and the turnover reached HK$15.7 million.

The top ten ETFs in the Hong Kong stock market

The top ten gains in the Hong Kong stock market today are mainly bullish on gold and NASDAQ related ETFs. Among them$Southern Double Longer Gold (07299.HK) $Up 2.55%, with a turnover of HK$46.34 million.$Huaxia Direxion doubles on the DONASDAQ (07261.HK) $It rose 6.01%, and the turnover reached HK$9.98 million.

Performance of major US ETF products

US GDP fell 32.9% in the second quarter, and the number of initial jobless claims rose for the second week in a row. US stocks had mixed ups and downs overnight, and the NASDAQ eventually changed from decline to rise.$Nasdaq index is three times longer ETF-ProShares (TQQQ.US) $It closed up 1.62%. Yesterday's intraday session fell by more than 3%, with an amplitude of more than 5%.

FANG, the four major US tech giants, announced financial results after the previous trading day, and all exceeded market expectations. In the pre-market period, futures on the three major US stock indexes rose, and NASDAQ futures rose more than 1%.$Nasdaq index is three times longer ETF-ProShares (TQQQ.US) $Up 5.01% in the premarket.

In terms of US stock ETFs listed on the Hong Kong Stock Exchange,$Huaxia Direxion doubles on the DONASDAQ (07261.HK) $Up 6.01%, with a turnover of HK$9.98 million.$FI 2 Huaxana 100 (07522.HK) $It fell 5.74%, and the turnover reached HK$32.78 million.

Performance of ETFs such as energy and precious metals

Overnight, U.S. crude oil plummeted 6%, and shorted energy ETFs by 2 times closed up more than 7%

Overnight, WTI crude oil once plummeted 6%.$2x shorting energy ETF-Direxion (ERY.US) $Closing up 7.72%,$Chicago Board Options Exchange Crude Oil Volatility Index (.OVX.US) $The closing was up more than 6%. WTI crude oil rose during today's pre-market session and is now up 0.53% to $40.13.

According to reports, Vopak (Vopak), the world's largest independent oil storage company, warned of the risk of running out of crude oil storage space again due to weak demand.

Gold and silver picked up, gold futures broke the $2,000 mark, and silver ETFs doubled and rose more than 7% before the market

Gold futures closed down 0.87% yesterday, but today's gold prices rose again. As of press release, gold stocks rose 1.45% in a row to 1995 US dollars, and the intraday price once reached 2005.4 US dollars, breaking through the 2,000 US dollar mark.$GOLD ETF-SPDR (GLD.US) $It rose more than 1% in the premarket.

At the same time, the price of silver has also strengthened, with silver now rising 3.78% continuously.$Silver ETF-ProShares Double Long (AGQ.US) $Up 7.14% in the premarket.

The World Gold Council said that although gold ETF capital inflows in the first half of 2020 have surpassed the record high level of the previous year, three major factors will continue to drive the inflow of safe-haven funds in the second half of the year.

First, there is a growing need to hedge risk. The growing expectation that the global economic recovery will be a “U” rather than a “V” type supports demand for a risk-diversifying asset such as gold. Although global stock markets have recovered from the sharp adjustments in the first quarter, it can be said that there have been some bubbles in valuations in some areas — gold has become the focus of attention as a hedge to balance investment in high-risk assets.

Second, the continuous ultra-low interest rate environment. Collaborative expansionary policy measures and asset purchases by governments and central banks around the world have kept interest rates at historically low levels. On the one hand, this reduces the opportunity cost of holding gold; on the other hand, it also provides a reason for investors concerned about the possible impact of government debt inflation to use gold as a hedge against inflation.

Third, positive price momentum. Gold generated a 17% return in the first half of this year — even considering the sharp pullback in March, when many investors were forced to sell gold to gain liquidity. The price of gold in dollars rose to its highest level in 8 years (reaching record highs in some currencies), and supported by these increases, attracted momentum driven capital inflows, which in turn contributed to the continued strengthening of gold prices.

Other ETF performances

Top ten ETFs with overnight gains in the US stock market

The top ten ETFs with overnight gains in the US stock market were mainly gold, silver, energy, and natural gas-related ETFs. Among them$Direxion Double Daily Bearish Gold Mining Shares (DUST.US) $up 6.69%,$Direxion Doubles Daily Junior Gold Index (JDST.US) $Up 8.52%.

The panic index once surged 17% yesterday, and the VIX short-term futures ETF once rose nearly 14%

After the overnight opening of the US stock market, it suffered a setback and fell.$S&P 500 Volatility Index (.VIX.US) $At one point, it surged 17%, but then the increase narrowed, and eventually closed up 2.74%.$ProShares Ultra VIX Short Term Futures ETF (UVXY.US) $At one point in the intraday period, it rose nearly 14% and closed up 3.44%.

Today's pre-market indices rose.$VIX Index Master Link (2008) (VxMain.us) $fell 0.46%.