July 28 Market Review

Us stocks closed higher on Monday, with the Dow up 0.43%, the s & p 500 up 0.74% and the Nasdaq up 1.67%. Apple Inc rose by more than 2%, Tesla, Inc. by more than 8%, Taiwan Semiconductor Manufacturing Co Ltd by more than 12%, Sohu.com Ltd by 40% and Sogou by 48%.

Today, the Hang Seng Index closed up 0.69% at 24772. In the market, star stocks rose collectively, Tencent rose 4.5%, Meituan rose more than 3%; semiconductor plate rose in the afternoon, Semiconductor Manufacturing International Corporation rose nearly 6%; BYD Electronic rose 12%; spot gold and silver prices fell, gold and precious metal stocks plunged. Zhaojin Mining fell more than 12%, Shandong Gold Mining fell 6.8%.

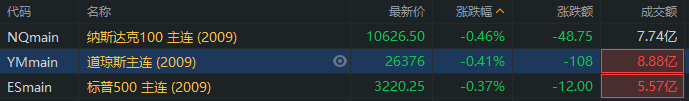

Us stocks pre-market: futures index fell

Us stock futures fell before trading. As of press time, Nasdaq futures fell 0.46%, Dow futures fell 0.41%, and the S & P 500 index fell 0.37%.

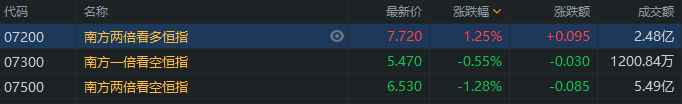

Performance of major ETF products in Hong Kong stocks

The Hang Seng Index closed up 0.69%, while the southern double bullish Hang Seng Index rose more than 1%.

The Hang Seng Index closed up 0.69%.$South double bullish Hang Seng Index (07200.HK) $Up 1.25%, the turnover reached HK $248 millionSouth double bearish Hang Seng Index (07300.HK) $Down 0.55%, the turnover reached HK $12 million$South double bearish Hang Seng Index (07500.HK) $The turnover fell 1.28% to HK $549 million.

The Prev index closed up 0.7%, while the southern index doubled to do more than 300% in Shanghai and Shenzhen by nearly 2%.

Prev index closed up 0.7%.The South is twice as long as Shanghai and Shenzhen (07233.HK) $It rose 1.93%, with a turnover of HK $24.35 million.South double shorting Shanghai and Shenzhen 300 (07333.HK) $The turnover fell by 1.23% to HK $8.58 million.

Hong Kong stock market rose by the top 10 ETF

Today, the top 10 gains in the Hong Kong stock market are mainly electric vehicles, cloud computing, biotechnology-related ETF, of which$GX China Tramway (02845.HK) $涨6.43%,$GX China Cloud Computing (02826.HK) $涨4.17%。

Performance of major ETF products in US stocks

Republicans in the US Senate proposed a COVID-19 epidemic assistance plan agreed with the White House on Monday at a cost of about $1,000bn. The three major indexes of US stocks closed up overnight.$NASDAQ triple long ETF-ProShares (TQQQ.US) $It closed up by over 5%.

The pre-market index fell slightly today, while the long index fell before the ETF.

ETF of US stocks related to listing on the Hong Kong Stock Exchange$Huaxia Direxion double look at the 07261.HK (Donna Index) $Up 2.91%, the turnover reached HK $7.28 million$FI2 Warsaw 100 (07522.HK) $The turnover fell by 3.51% to HK $20.65 million.

ETF performance of energy and precious metals

Us oil futures closed up 0.7% yesterday, and the double long crude oil index ETF rose more than 2%.

The main company of WTI crude closed up 0.75% yesterday.Crude Oil Index ETF-ProShares DJ-UBS double long (UCO.US) $It's up more than 2%. Before today's trading, US oil futures fell slightly and are now down 0.24% at US $41.5.$double long Energy ETF-Direxion (ERX.US) $It was down more than 2% before trading.

In the early hours of tomorrow morning, API will release US crude oil stocks. The market expects API crude stocks to fall by 2.088 million barrels in the week to July 24.

According to foreign media reports, due to the sharp decline in global oil demand caused by the COVID-19 epidemic, Schlumberger, the world's largest oil field services company, announced that it would lay off 21000 people and pay more than $1 billion in severance pay. Schlumberger announced layoffs accounted for about 1/4 of the total employees.

The gold price dived twice after breaking the peak, and the intraday amplitude of silver was nearly 15%.

Gold futures rose sharply in the morning, rising 2% at one point, and some gold futures contracts were quoted above the $2000 mark. But then the prime time consignor dived twice in a row, not only giving up the increase in this period, but also falling nearly $30 at one point.As of press time, prime-time shippers have narrowed their decline and are now down 0.26% at $1926.

Before the session, as gold prices fell, bullish gold fell before ETF trading.Double long gold ETF (ProShares) (UGL.US) $It fell 1.79% before trading and rose 3.24% yesterday.

In additionSilver also fell, falling 8 per cent in intraday trading after rising nearly 7 per cent.As of press time, silver fell 2% to $24.01.Silver ETF-ProShares double long (AGQ.US) $It was down more than 5% before trading and rose more than 14% yesterday.

Arbitrage positions in COMEX gold futures options held by hedge funds and asset management products jumped 1.7301 million ounces and 1.6492 million ounces in the week ended July 21 from the previous week, according to the latest data from the US Commodity Futures Trading Commission (CFTC), highlighting their growing concern that gold prices are likely to fall after hitting record highs.

UBS had previously raised its target price for the second half of the year from $1900 to $2000 and from $1800 to $1900 in June next year, while maintaining the view that gold prices would peak within six months. UBS said that gold prices have been supported by the uncertainty of the epidemic and changes in international relations, while rising oil prices and stronger-than-expected oil demand have raised investors' concerns about inflation. coupled with the weakening dollar, gold prices have been rising all the way. However, as the global economic recovery will accelerate next year, coupled with the introduction of vaccines and central banks will eventually tighten easing measures, these will lead to gold ETF capital outflows, leading to gold prices peaking.

In addition, Samy Chaar, chief economist of Lombard Odier, told CNBC on Monday that his team had sold half of its gold position. Although gold prices are at record highs, real interest rates in the US are disjointed, which means that the current price level of gold is still somewhat fragile.

The agency believes that negative real interest rates are the main driver of gold prices. As a result, the 10-year real interest rate in the United States is now basically minus 1%. Such severe negative real interest rates usually indicate that the US economy will continue to contract without an economic recovery coming, which Lombard Odier economists believe is not feasible or sustainable.

Other ETF manifestations

Overnight US stock market rose by the top 10 ETF

The ETF of the top 10 gains in the overnight US stock market are mainly silver, gold and semiconductor-related ETF, of whichSilver ETF-iShares (SLV.US) $Up 7.64%, with a turnover of $2.15 billionDirexion daily gold miners see twice as much stock (NUGT.US) $It rose 9.55%, with a turnover of US $669 million.

Us stocks collectively closed higher overnight, with the panic index falling more than 4%.

Us stocks closed higher overnightS & P 500 volatility Index (.VIX.US) $跌4.26%,$ProShares Ultra VIX short-term futures ETF (UVXY.US) $Received 4.7%, down 0.15% before trading.