July 27th Market Review

Us stocks closed lower on Friday, with the S & P 500 down 0.62%, the Dow Jones down 0.68% and the Nasdaq down 0.94%. Intel Corp plummeted 16% and Taiwan Semiconductor Manufacturing Co Ltd rose nearly 10% against the market. It is worth noting that this week will usher in Apple Inc, Amazon.Com Inc, Alphabet Inc-CL C and other giants financial reports.

Today, the Hang Seng Index closed down 0.41% at 24603 points. On the market, most star stocks closed down, XIAOMI and Meituan fell about 3%; gold and precious metals plates were strong, Shandong Gold Mining rose more than 12%, Zhaojin Mining rose more than 9%; Tesla, Inc. concept, military stocks led the decline, China Shipbuilding Defense fell 14%.

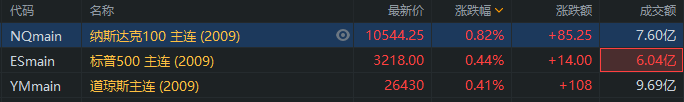

Before the US Stock Market: futures Index rose

Us stocks rose before the index. As of press time, Nasdaq futures rose 0.82%, S & P 500 index rose 0.44%, and Dow futures rose 0.41%.

Performance of major ETF products in Hong Kong stocks

A-share leverage and reverse ETF entered the Hong Kong stock market, and the southern twice as long as Shanghai and Shenzhen 300ETF first traded more than HK $26 million.

The Prev closed up 0.26% today. The Hong Kong market today launched A-share leverage and reverse products for the first time. South Dongying's two Shanghai and Shenzhen 300 related ETF landed in the Hong Kong stock market after receiving market attention, the transaction is hot.

First day on the marketThe South is twice as long as Shanghai and Shenzhen (07233.HK) $The turnover reached HK $26.51 million to close at HK $7.77.South double shorting Shanghai and Shenzhen 300 (07333.HK) $The turnover was HK $18.33 million, closing at HK $7.74.

Nanfang Dongying said that at the beginning of its establishment in 7233 and 7333, it attracted a total of about US $270 million (about HK $2.1 billion) in initial investment. Ding Chen, CEO of Southern Dongying, pointed out that the market demand is huge and he is full of confidence in the listing of China's A-share leverage products.It is estimated that in the next 1 to 2 years, the size of the A-share leverage counter-product market will be 2 to 3 times that of the existing HSI counter-products, with a total size of more than US $3 billion (about HK $23.4 billion).。

Nanfang Dongying is the leader in Hong Kong's leveraged and reverse products market, and its products contribute more than 90% of the asset management scale and turnover to Hong Kong's local index leveraged and reverse market. As of June 30, 2020, the total size of Southern East British leverage and reverse products has reached HK $8.78 billion. Among them, the Southern East British Hang Seng Index Daily reverse (- 2x) product (7500.HK) was launched in May 2019 as the first double reverse product in Hong Kong, with a size of HK $6.31 billion, up 13.8 times from HK $457 million at the beginning of the issue.

In additionHong Kong Exchanges and Clearing said that A-share leveraged and reverse products are welcome to list in Hong Kong for the first time.Luo Boren, head of trading products at Hong Kong Exchanges and Clearing Exchange, said: "the listing of A-share leverage and reverse products in Hong Kong is a golden opportunity, which coincides with the accelerated inflow of international capital into the Chinese stock market, and Hong Kong Exchanges and Clearing's northbound trading volume of the Shanghai-Shenzhen-Hong Kong Stock Connect has repeatedly hit record highs, reflecting the growing market demand for Chinese investment. The listing of A-share leverage and reverse products will help promote the development of A-share products in Hong Kong and strive to develop Hong Kong into an Asian ETF centre in line with Hong Kong Exchanges and Clearing's latest strategic plan. "

The Hang Seng Index closed down 0.4%, while the southern double bearish Hang Seng Index rose 0.5%.

The Hang Seng Index fell more than 100 points today, closing down 0.41%.$South double bearish Hang Seng Index (07500.HK) $The turnover increased by 0.53% to HK $815 million.South double bearish Hang Seng Index (07300.HK) $The turnover increased by 0.09% to HK $17.74 million.$South double bullish Hang Seng Index (07200.HK) $The turnover fell by 0.52% to HK $415 million.

Hong Kong stock market rose by the top 10 ETF

The top 10 gains in the Hong Kong stock market today are mainly gold-related ETF, of which$South double long gold (07299.HK) $涨3.54%,$value gold (03081.HK) $涨2.11%。

Performance of major ETF products in US stocks

Last Friday, all three major indexes of U. S. stocks closed lower, while long index ETF closed lower collectively. Before today's trading, the three major futures indexes of US stocks rose, while the long index rose before ETF trading.$NASDAQ triple long ETF-ProShares (TQQQ.US) $、Direxion see more than 3 times more than S & P 500 per day (SPXL.US) $They all rose by more than 1% before the session.

ETF performance of energy and precious metals

Last week, US oil rose 1.4%, and US crude oil funds rose more than 1%.

Last week, WTI crude oil as a whole maintained a narrow volatility trend, last week.$WTI crude Oil main Company (2009) (CLmain.US) $涨1.4%,Us crude Oil Fund (USO.US) $The cumulative increase reached 1.17%. WTI crude fell slightly before the day's trading and is now down 0.39% at $41.13.

Us drilling companies have cut the number of oil and gas rigs to an all-time low for the 12th consecutive week, according to the latest data from Baker Hughes. But the total number of oil rigs in the United States in the week to July 24 increased from the previous week for the first time since March.

JPMorgan Chase & Co: the gold price still has at least two years of bull market space, and the $2000 mark is only a small goal in stages.

Gold prices continue to strengthen today$Gold main Company (2008) (GCmain.US) $At one point, it was close to $1940 in intraday trading, breaking the previous high of $1923 in September 2011 and setting a new all-time high. It is now up 1.89% at $1933. At the same time, silver prices are also stronger.Silver main Company (2009) (SImain.US) $It is up 6.17% to $24.26.

JPMorgan Chase & Co pointed out that the current gold price rally is mainly driven by the increase of ETF holdings, while the purchase demand of retail and business investors is relatively low, but this distorted market allocation will not last. Under the background that the great bull market of gold is a foregone conclusion, the willingness of individual investors to enter the market is bound to rise, and even the physical demand restrained by the epidemic will gradually become ready to move under the stimulation of the sharp rise in gold prices. All this will open up more upside for spot gold prices.

Analysts predict that compared with the trend after the global economic crisis in 2008, spot gold prices have at least two years of bull market room in the future, and after breaking the previous all-time high of $1921, the $2000 mark is only a small phased target. Until the Fed's unlimited QE comes to a halt, no one can guess the upside potential of gold.

Other ETF manifestations

Last Friday, the US stock market rose by the top 10 ETF.

The ETF of the top 10 gains in the US stock market last Friday were mainly gold mines, weighted index of small cap companies, Russell 2000 index, semiconductors and other related ETF.Direxion daily gold miners see twice as much stock (NUGT.US) $It closed up 4.29%, with a turnover of US $505 million.$Direxion twice daily long Junior Gold Index (JNUG.US) $The number increased by 4.34%, and the turnover was 263 million US dollars.$Direxion is bearish on three times the stock (TZA.US) $The turnover increased by 4.56% to US $528 million.