Tigermed, who has worked in A-shares for nearly eight years and is highly sought after by Hillhouse Capital, passed a hearing on the Hong Kong Stock Exchange on July 19 and is rumoured to start an offering this week. Everyone says that Tigermed is the leading CRO (pharmaceutical R & D outsourcing service) enterprise in China, but we seem to know that the leading domestic CRO enterprises are Wuxi Apptec and Pharmaron Beijing Co., Ltd.*, but why do we still call Tiger the leading domestic CRO enterprise? In addition, what is so special about Tigermed that Hillhouse Capital buys its shares twice?

As of the first quarter of 2020, Hillhouse Capital held 7.5 million of Tigermed's shares, accounting for 1% of the total equity. As of July 22, Hillhouse's position had a market capitalization of 841 million yuan. In fact, Hillhouse Capital bought 5 million shares of Tigermed for the first time as early as June 2018, and the deal has yielded a lot of money so far.

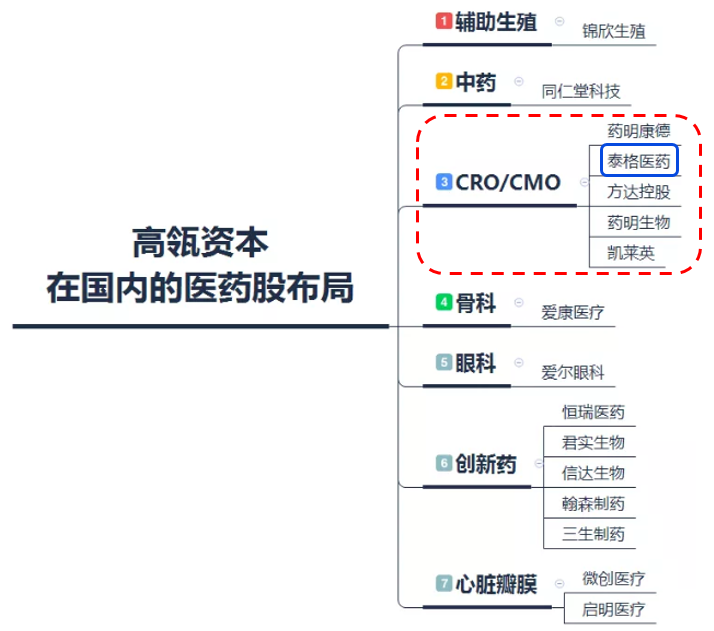

According to incomplete statistics, in the CRO/CMO industry, Hillhouse Capital not only invested in Tigermed, but also invested in Wuxi Apptec, Fangda Holdings, Wuxi Biologics, Kailiying and other similar track companies. In the CRO/CMO industry alone, Hillhouse Capital has so far accumulated a market capitalization of more than HK $15 billion.

Data source: Sina Finance, Futu Securities arrangement

In order to understand more clearly what kind of enterprise Tigermed is, we can start with the pharmaceutical outsourcing industry. Next, we will understand the background of the birth of the pharmaceutical outsourcing industry, the industrial chain and industrial value chain of the industry, so that we can understand whether Tigermed's industry track is worthy of our attention and investment. Finally, we will analyze the situation of Tigermed in detail.

Pharmaceutical outsourcing industry

1) definition of pharmaceutical outsourcing industry

Through contracts for pharmaceutical enterprises, medical institutions, small and medium-sized medical and medical device research and development enterprises, to assist pharmaceutical and biotechnology companies to design, implement and manage their R & D projects and reduce their operational risks, and accelerate the development of safe and effective drugs and medical devices.

2) Pharmaceutical outsourcing industry to solve the pain points of the industry

The main points of new drug research and developmentEarly exploration-preclinical study-preclinical trial phase-approval for listingIn the past, traditional pharmaceutical companies had to complete all four major stages, and it would take 10 years and more than $1 billion to complete this process.

Data source: arterial network, Futu Securities finishing

However, with the increasingly fierce competition in the global new drug R & D and sales market, the increasing time cost and expenditure of new drug research and development, and the impact of generic drugs on the original drugs, large pharmaceutical companies begin to find it difficult to obtain high profits. According to Deloitte's 2019 Pharmaceutical Innovation Drug return Evaluation, the rate of return on R & D of new drugs plummeted from 10 per cent in 2019 to 1.8 per cent in 2019, but R & D costs rose to 19.8 per cent from 11.9 per cent in 2010.

In order to shorten the R & D cycle, control costs and reduce R & D risks, large pharmaceutical companies at home and abroad devote more energy to the early stages such as disease mechanism research and new drug target discovery.The pharmaceutical outsourcing company is responsible for。

The main services of CRO institutions include drug compound screening and R & D, data collection and analysis, clinical, commissioned production or processing and other industrial chain links involved in the middle and late stages of R & D and development.

3) characteristics of pharmaceutical outsourcing industry

A) CRO prefers labor-intensive industries.Production capacity and cost are important indicators to measure the operating capacity of CRO enterprises. In recent years, due to the prosperity of the CRO/ CDMO market, the first enterprise orders are in a state of spillover, so production capacity has become an important factor restricting the development of the company.The number of employees as an indirect indicator of CRO/CDMO production capacityThe growth rate tends to show a strong positive correlation with the growth of corporate revenue.

B) it is closely related to the market development of innovative drugs, generic drugs and biological generic drugs.The United States is the largest pharmaceutical market in the world, while China is the second largest market. In recent years, China's pharmaceutical market has developed rapidly. In addition, China has relatively sufficient high-quality medical professionals. The combination of the two makes China's pharmaceutical outsourcing industry develop rapidly.

4) Pharmaceutical outsourcing industry chain & industrial value chain

An overview of overseas outsourcing:The top outsourcing service companies in the world in terms of sales are IQVIA (formerly Quintiles), Covance (Covens) and so on. IQVIA (Quintiles) is the largest CRO organization in the world, and Charles River (Charles River Laboratory) is a leading company in safety evaluation.

An overview of local outsourcing:Domestic well-known outsourcing companies are Wuxi Apptec, Pharmaron Beijing Co., Ltd.*, Tigermed, Boji Pharmaceutical and so on. Among them, Pharmaron Beijing Co., Ltd.* and Wuxi Apptec have large-scale laboratory chemical service capacity, Tigermed and Boji pharmaceutical business focus on clinical drug development services, Kellein and Boteng business focus on process research and development and production business in the CDMO drug development phase (CDMO simply means outsourcing production).

According to the different stages of customer service in the field of new drug R & D, pharmaceutical R & D services are generally divided into contract R & D service (CRO) and contract production business / contract production R & D business (CMO/CDMO). According to the figure below, CRO can be subdivided into drug screening, drug research, drug evaluation, clinical I-III CRO.Among them, clinical CRO is the most critical stage, accounting for about 70% of the cost of new drug research and development.

Data source: Zhaoyan New Drug Company announcement, Futu Securities arrangement

4) the scale of pharmaceutical outsourcing industry

2019年,Clinical practiceContract CROThe market of research institutions accounts for the largest part of the market of drug contract research institutions and accounts for 64.9% of the total market of drug contract research institutions in the world. Similarly, in China,Clinical contract CROThe market of research institutions accounts for 54.4% of the total market of drug contract research institutions in China.

Source: Frost Sullivan report, Futu Securities

According to the above industry analysis, we probably understand that the emergence of the pharmaceutical outsourcing industry is to solve the problems of controlling the cost of new drug research and development, shortening the research and development cycle and so on. We know that in the subdivision of pharmaceutical outsourcing, the highest value of the industrial chain is clinical CRO (Tigermed's field). Next, we will introduce Tigermed in detail.

Tigermed

I. general situation of the company

The company is a company specializing in the research and development of new drugsclinical trialsContract Research Organization (CRO) for full-process professional services, forGlobal medicine和Medical device innovation enterpriseProvide comprehensive clinical research services and solutions to assist global pharmaceutical and medical device companiesReduce the risk of research and development、Shorten the R & D cycle、Save money on research and development,Promote the process of product marketization. (it is not a competitive relationship with pharmaceutical companies, but a win-win relationship of cooperation.)

II. The course of development

Tigermed in2004年Begin to set up2012年In A-shareGembe listed,2020年In JulyHong Kong listing. In 2014, Fonda Holdings Frontage Labs (which provides pharmaceutical and pesticide laboratory services) was acquired, and Fonda Holdings listed in Hong Kong in 2015. It acquired Dream CIS, South Korea's largest contract research institution, in 2015, and Dream CIS listed on the Korean Stock Exchange in May 2020.

Over the past 16 years, Tigermed has improved his clinical CRO business through continuous acquisitions and establishment of related subsidiaries. As of the 2019 annual report, Tigermed has a total of 66 subsidiaries, of which important subsidiaries have absolute control.

III. Core business

According to the figure below, we can know that Tigermed's positioning is the largest "clinical CRO" in the subdivision field.

Data source: Dongguan Securities Research Institute, Futu Securities arrangement

Tigermed's clinical CRO business is further subdivided into clinical trial technical services and clinical trial related services and laboratory services.

Data source: Tigermed prospectus, Futu Securities arrangement

Both businesses are growing faster.The company's revenue from clinical research-related services and clinical trial technical services accounted for 51% and 48% respectively in 2019. From 2017 to 2019, revenue from clinical research-related services rose from 820 million yuan to 1.446 billion yuan, compared with 32 percent of CAGR. Revenue from technical services increased from 820 million yuan to 1.347 billion yuan, with CAGR accounting for 28%.

Source: wind, Futu Securities

1) Consulting services related to clinical trials

It mainly includes data management and statistical analysis, clinical trial site management SMO and subject recruitment, medical imaging and laboratory services provided by subsidiary Fonda Holdings. From 2014 to 2019, the revenue of related consulting services rose from 334 million yuan to 1.446 billion yuan, with CAGR of 34.06%. In recent years, the gross profit margin of clinical trial-related consulting services has remained at around 48%.

In the future, with the increase in clinical orders, the increase in the amount of analytical data and the increase in demand capacity for SMO management, related consulting services are expected to maintain a growth rate of more than 30%.

2) Clinical technical service

Clinical trial technical services include phase I to IV clinical trials, clinical research of medical devices, medical registration, BE and so on. From 2014 to 2019, revenue from technical services increased from 277 million yuan to 1.347 billion yuan, with CAGR of 37.21%.The gross profit margin of clinical trial technology in 2019 was 43.80%, up 5.23% from the same period last year, breaking the 40% level for the first time in recent years. (gross profit margin is an important reference indicator of the company's core barrier)

Tigermed's technical service growth rate is higher than that of the clinical CRO industry. With the impact of positive factors such as the promotion of consistency evaluation and the increase in the number of clinical trials of innovative drugs, technical services are expected to maintain high growth in the future.

IV. Financial analysis

The company's revenue and net profit are growing rapidly.In 2019, the company's total revenue was 2.803 billion yuan, an increase of 22% over the same period last year. From 2010 to 2019, the company's revenue increased from 123 million yuan to 2.803 billion yuan, with a CAGR of 41.53%.Revenue growth has outpaced the growth rate of the CRO industry for a long time.

In 2019, the company's net profit was 842 million yuan, an increase of 78.24% over the same period last year. From 2010 to 2019, the company's net profit increased from 32 million yuan to 842 million yuan.Has achieved a tenfold increase in profits.

The proportion of domestic revenue has increased, the domestic consistency evaluation has brought a large number of orders for clinical trial demand, and the proportion of domestic revenue and profits has increased rapidly in recent years.From the perspective of revenue, in 2019, domestic revenue was 1.6 billion yuan, year-on-year + 29.66%; foreign revenue was 1.2 billion yuan, year-on-year + 12.85%, the domestic growth rate was significantly higher than the foreign growth rate. From a profit point of view, 2019DomesticRealize profits respectively with foreign countries.1.234 billion yuanAnd 1.066 billion yuan, respectively, compared with the same period last year+70.91%和+10.47%。

Due to the great increase in domestic clinical demand for BE trials and innovative drugs, the increment of domestic business is expected to maintain high growth in the future, while foreign business is expected to maintain steady growth. From 2014 to 2019, the domestic revenue share increased from 35.41% to 57.08%, and the profit share increased from 29.76% to 53.65%.Overall, domestic business performance has accounted for more than half.

(note: consistency evaluation refers to the principle that the quality and efficacy of generic drugs that have been approved for sale are consistent with those of the original drugs.)

The profitability has improved steadily and the three fees have been properly controlled.In 2019, the company's gross profit margin reached 46.48%, year-on-year + 3.37%; 2019 net profit margin reached 34.79%, year-on-year + 12.76%. The increase in gross profit margin and net profit margin was mainly due to a big increase in revenue and investment income.

In terms of the three fees, the sales expense rate in 2019 is 2.89%, the management expense rate is 12.49%, and the financial expense rate is 0.36%. The overall level of the three fees is 0.57% lower than that in 2018, mainly due to the decline in the management expense rate. Clinical CRO is a labor-intensive industry, and the labor cost accounts for the highest proportion of management expenses. In 2019, the number of employees increased by 27% compared with the same period last year, but the rate of management expenses decreased, indicating that the company's manpower management level has improved significantly. )

Tigermed compares with the same industry

According to the figure below, the companies with clinical CRO business in the following domestic companies are Wuxi Apptec, Tigermed and Boji Pharmaceutical. We will compare the relevant industry data of these three companies. Although all three companies have clinical CRO business, their business is different.

Among them, Wuxi Apptec's business ranges from preclinical CRO to CDMO, providing all-round and integrated new drug R & D and production services. Tigermed only focuses on clinical CRO business, has industry-leading strong quality control standards, and the quality management system covers every stage of the project. Boji Pharmaceutical's business includes preclinical safety evaluation and clinical CRO.

In terms of operating income, Wuxi Apptec's revenue scale is the largest (pre-clinical CRO growth is obvious). Tigermed's revenue in 2019 was 2.8 billion yuan, a year-on-year growth rate of 22%. At present, the revenue scale of Boji Pharmaceutical is very small and growing fast.From the analysis of deducting non-net profit, Tigermed performed best, with a year-on-year growth rate of 56%, while Wuxi Apptec and Boji Pharmaceutical had negative growth rates.

Source: wind, Futu Securities

Tigermed's gross profit margin and net profit margin are the best among the three companies, and their improvement is mainly due to a big increase in revenue and investment income.

Source: wind, Futu Securities

As we mentioned earlier,CRO tends to be labor-intensive industries.Therefore, production capacity and cost are important indicators to measure the operating capacity of CRO enterprises. The number of employees as an indirect indicator of CRO/CDMO production capacity, its growth rate often shows a strong positive correlation with corporate income growth.

We can see from the chart below that Tigermed's employee growth rate is the fastest, which indirectly reflects the order growth of his company in the next few years and the company's confidence in the future development. Tigermed's per capita income declined slightly in 2019 (right), which we believe is mainly due to the adjustment of income structure caused by the decline in fees.

Source: wind, Futu Securities

Summary

Hillhouse Capital has a cumulative market value of more than HK $15 billion in this CRO/CMO gold track, and the pharmaceutical outsourcing industry was born to solve the problems of controlling the cost of new drug research and development and shortening the research and development cycle. China is the second largest pharmaceutical market in the world, and it also has relatively sufficient medical professionals. The combination of the two makes China's pharmaceutical outsourcing industry develop rapidly. In addition, the pharmaceutical outsourcing industry is mainly divided into preclinical CRO, clinical CRO, CDMO and so on.Among them, clinical CRO is the most critical stage, accounting for about 70% of the cost of new drug research and development.。

After understanding the whole pharmaceutical outsourcing industry chain, we know that Tigermed is a leading domestic CRO (pharmaceutical R & D outsourcing service) enterprise, but he is only a leader in a subdivision of CRO.And is in the field of clinical CRO with the highest value in the industrial chain.. Tigermed only focuses onClinical practiceCROTo improve its clinical CRO business through continuous acquisition and establishment of related subsidiaries. That's why we see the best gross profit margin, net profit margin, deducted non-net profit and employee growth in the same industry.

Edit / elisa