This afternoon, Ant Group Guan Xuan plans to seek simultaneous listings on Science and Technology Innovation Board and the Hong Kong Stock Exchange. According to market sources, Ant Group is said to plan to seek a US $10 billion IPO in Hong Kong.

Earlier, media reported that Ant Group was said to be seeking an IPO valuation of at least $200 billion. Earlier, Ant Financial Services Group was reported to be valued at about $150 billion after completing round C financing in June 2018.

Although there had been rumors in the market that Ant Group was about to go public, Guan Xuan directly ignited the market enthusiasm, and BABA's US stocks rose nearly 5 per cent before the news.

According to BABA's annual report for fiscal year 2020, it directly holds a 33 per cent stake in Ant Group, while Junhan and Junao, which represents employees of Jack Ma, Ali and Ant, hold a 50 per cent stake in Ant Financial Services Group.

As the parent company of Alipay and the world's leading open platform for financial technology, what is the value of Ant Group?

This paper compiles CITIC's research report "the Business part of Ant Financial Services Group's in-depth report: how to evaluate the value of Ant Financial Services Group"From the business level to show you the growth curve and value space of Ant Group.

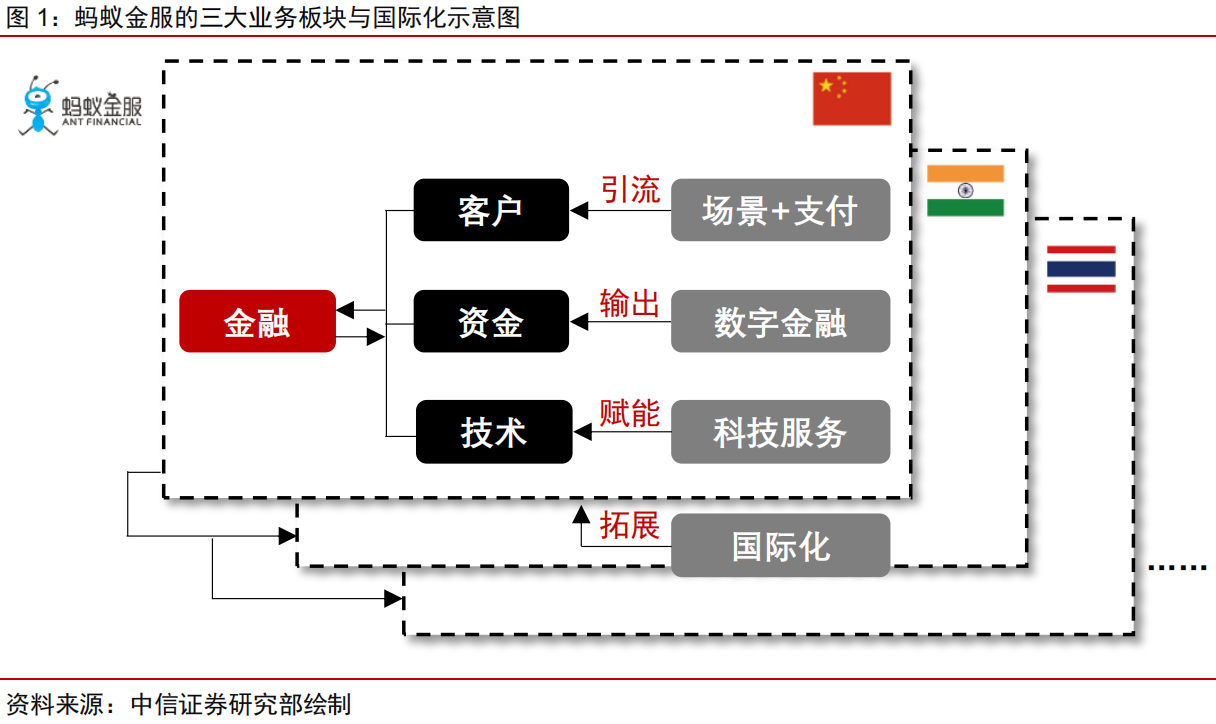

First of all, on the whole, Ant Group perfectly deduces the drainage-realization-enabling logic under the "capability output" business model through three major business sectors-payment, digital finance and technology services. In addition, the company replicates the "capability output" model overseas with the help of international layout.

Scenario + payment, "entry" logic:Strengthen customer acquisition and stickiness, realize business drainage and data precipitation

Digital Finance, "Cash out" Logic:Empower customers and scenarios in the body to cooperative financial institutions to expand their business scope and improve efficiency, while realizing high-quality income (collaborative revenue)

Science and technology service, "enabling" logic:Export financial-grade technology to solve the pain points of different industries through digital economy

Internationalization, "expansion" logic:We will expand and develop the model of payment-digital finance and science and technology services in overseas countries, and explore the construction of a global network.

Payment: internal fixed scene layout, external expansion of cross-border business

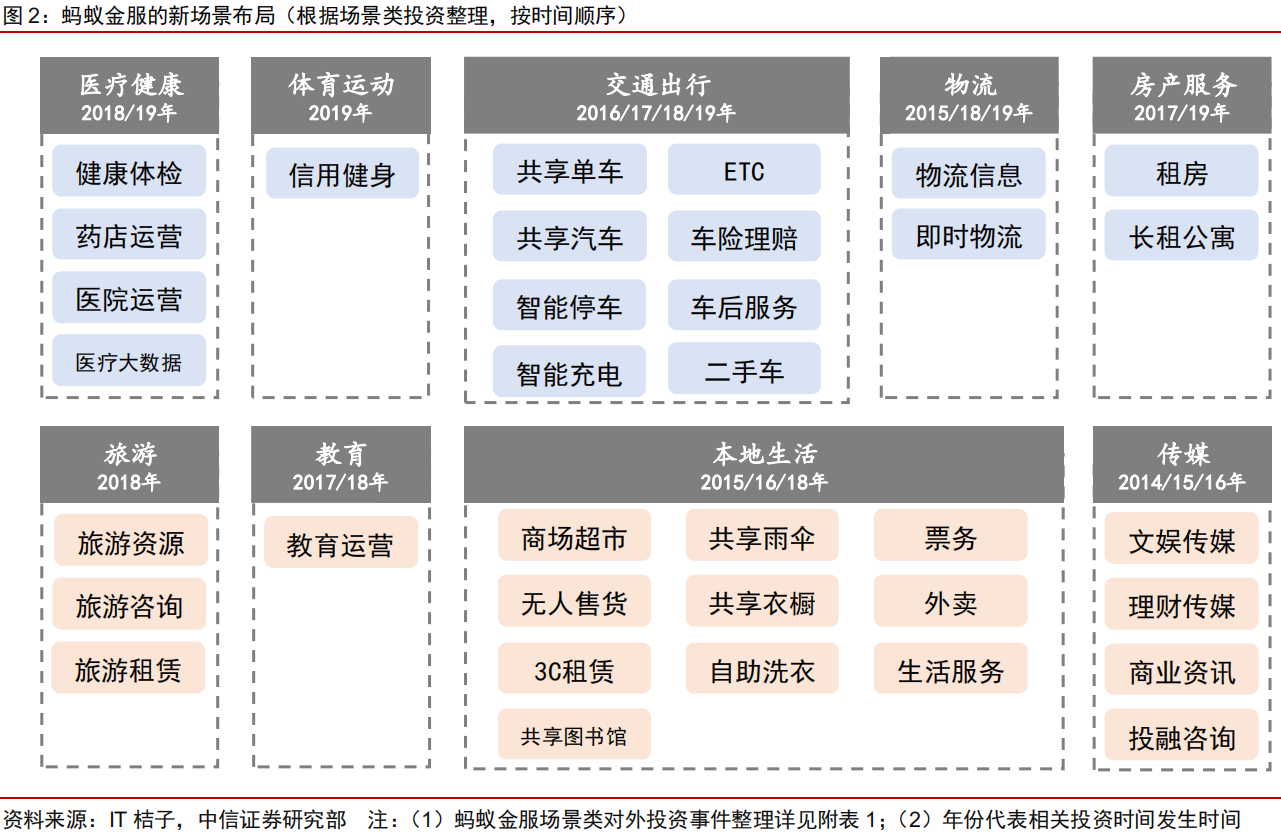

Ant Financial Services Group's continuous layout of the payment scene is mainly realized through foreign cooperation and investment.

Since its establishment in 2014, scenario investment has been gradually extended to online shopping, retail stores, games, daily payments, catering, remittances, public welfare, credit, financial services, recharge, campus services, transportation and medical services. Overall, the company's scene layout follows two main lines: layout O2O and ringable cultivation.

Cross-border Business: the Best practitioner of Global Localization (Glocal) Strategy

As a technology finance company originated in the e-commerce department, Ant Financial Services Group's cross-border payment business focuses on three aspects: consumers' global purchases, merchants' global sales and users' leaving the country. Ant Financial Services Group's cross-border payment business has become the best practitioner of global localization (Glocal) strategy:

Global localization: has 10 electronic wallets around the world

The prospect of cross-border payment: it is expected to realize the interconnection of cross-electronic wallets.

Business performance: the growth pattern of the industry is stable, and the company's revenue model is clear.

The third-party payment industry has entered a period of steady growth. According to the third-party data released by Analysys think tank, the scale of third-party integrated payment and mobile payment in the industry in the first three quarters of 2019 was 182 trillion / 149 trillion, respectively, and Ant Financial Services Group's market share was 47%. 54%. Under the base effect, the scale of the third-party mobile payment market still maintains a steady growth rate of about 20%.

Based on the large number of customers and traffic business model, the business revenue of the payment sector is expected to maintain an optimistic growth trend:

Domestic payment business enters a period of sustainable growth

Cross-border payment business is expected to grow non-linearly: cross-border payment revenue mainly comes from cross-border payment fees, income from value-added services, exchange differences and other sources. After the wholly-owned acquisition of British cross-border payment company WorldFirst in 2019, the company is expected to increase the layout of cross-border payment business in the future, thus bringing new revenue growth points for the payment business sector.

Digital Finance: external Cooperation, report Strategy upgrade

After completing the financial business license and building the financial ecosystem, Ant Financial Services Group's business layout in the field of digital finance since 2017 has mainly focused on improving customer stickiness and strengthening business coordination.

Foreign investment expands the boundary, cross-selling broadens the product line

Foreign investment has become the main focus of Ant Financial Services Group's non-linear expansion in financial business. Its investment in the financial sector can be divided into two stages:

License layout stage: before 2018, in addition to applying for a third-party payment business license and a micro-loan license, Ant Financial Services Group also established a company through mergers and acquisitions and initiated the establishment of a company. successively laid out the fund (Tianhong fund), fund consignment (several meters fund network), bank (online merchant bank), insurance (Cathay Pacific property insurance), network lending (Internet financial society) and other fields.

From quantity to quality, develop in depth. After 2018, the outbound investment in corporate finance is mainly focused on payment and wealth management: vertical payment enterprises, focusing on public transport and other industries (such as Metro metropolis, Tongka United City, etc.); wealth management industry-wide chain, including investment consultants (pioneer navigation), smart investment (Alpha finance), social investment (snowball) and so on.

The core of retail finance is to increase the customer base (customer acquisition) and strengthen customer realization (stickiness), both of which depend on the richness of the product line and cross-selling ability. After having a full spectrum of financial products (payment, wealth management, financing, insurance, credit, etc.), the focus of ant digital financial business is more focused on the cross and synergy of products:

Payment + Wealth Management: Yu'e Bao payment

Payment + financing: spend and pay

Financing + credit checking, insurance + credit checking: Sesame credit score is used as the access condition of mutual treasure, flower and loan.

From the effect of cross-marketing: by the end of September 2019, the number of domestic users of Alipay reached 900 million. In the five major categories of financial services, namely, payment, financial management, financing, insurance and credit, 80% of users use three or more service categories, and 40% use all five service categories.

Business logic: transformation from operating balance sheet to operating income statement

Under the background of strong supervision in the field of mutual funds and the acceleration of digital transformation of financial institutions, we speculate that Ant Financial Services Group's active transformation strategy will weaken financial exposure and strengthen capacity output. Corresponding to the digital financial business, realize the transformation from the "scale" strategy of operating balance sheet to the "income" strategy of operating income statement.

Balance sheet business model: introduce capital and carry out financial business independently based on its own customers, scenarios and technology. the essence of the business is to enlarge the size of the balance sheet to expand the scale of profits (capital occupation and risk exposure are also constantly enlarged)

Income statement business model: output capacity (including technology, customers and scenarios) to help partner institutions develop their financial business, while achieving income in the enabling process (no risk exposure, no capital).

The core of the profit statement management model is to strengthen the opening and coordination. Open platform positioning is conducive to the coordination of financial business, but also in line with the general direction of financial control supervision, while taking into account the growth. Ant Financial Services Group's collaborative business is mainly concentrated in three areas:

Financing business: transform the traditional proprietary loan model into a "credit joint venture" model, highlight its own advantages in scenarios, customers, data, and cooperate with external banks in capital, capital and risk control. Before that, there are more than 100 external bankers cooperating with flower, loan and online merchants.

Wealth management business: with the help of the platforms of Ant Wealth (for C-end customers) and Yu Li Bao (for B-end customers), drain for asset management organizations and sell all kinds of asset management products such as public funds, financial management insurance, trust products, precious metals and so on. At present, Ant Financial Services Group cooperates with more than 120 external asset management institutions.

Insurance business: facing about 100 insurance institutions, agents charge more and more insurance, medical insurance, serious illness insurance, old-age insurance and other insurance products. Take Mutual Bao products as an example, nine months after its launch, the stock of its members exceeded 80 million (as of August 2019).

Science and technology services: start with finance, not just finance

Ant Financial Services Group's third largest business segment is technology research and development and technology export.

On the one hand, rely on its own technical strength and BABA Group's technical team to increase core technology research and development; on the other hand, through foreign investment and cooperation, absorb specialized technology. In the profit model, the company exports systematic technology products and technology solutions and charges for products and services. at present, the customers covered are expanding from the financial sector to the non-financial sector.

Technology Research and Development: focus on "BASIC"

Science and technology is the starting point of Ant Financial Services Group. The company focuses on "BASIC" basic technologies, namely Blockchain (blockchain), AI (artificial intelligence), Security (security), IoT (Internet of things) and Cloud computing (cloud computing), focusing on blockchain and distributed technologies:

Technology investment: make up the deficiency by extension and serve the main line of business.

The direction of Ant Financial Services Group's technology investment reflects the evolution of the company's customer focus:

To C-side technology is the main technology (2014-2016): at this stage, ant's investment in technology enterprises is mainly focused on biometrics (especially face recognition) and electronic payment PaaS applications, with the aim of improving the security and efficiency of electronic payments.

To B technology development (2016-2018): under the idea of Techfin, increase investment in cloud services and financial information security enterprises of financial institutions, and strengthen their own science and technology output capacity.

To G technology test (after 2019): since 2019, under the background of the company's strengthening government business layout, Ant Financial Services Group has continuously laid out a number of technology enterprises in the field of e-government and finance and taxation information.

Technology output: building a core profit model

In 2018, Ant Financial Services Group officially launched the financial technology platform, which will upgrade Ant Financial Cloud to Ant Financial Services Group | Financial technology, providing an operating platform for technology export. Under the comprehensive open development strategy of "one mature and one open", Ant Financial Services Group's technology output embodies the dual characteristics of "cross-technology" and "cross-industry".

Cross-technology: positioning solutions, emphasizing the integration of multi-technologies. Rich underlying technology and basic products provide sufficient ammunition for Ant Financial Services Group's customized solution.

Cross-industry: financial-level technology, multi-industry application. The original intention of serving the financial industry makes Ant Financial Services Group's technology and products meet the characteristics of high concurrency, high reliability and high security requirements.

The core profit model of Ant Financial Services Group's technology export is taking shape. At present, Ant Financial Services Group Financial Technology's distributed technical services have formed a mature operation charging model, and the company's website shows that more than 40 products have adopted the paid deployment model (including financial district business and non-financial district business).

Overseas layout: building a global network from point to area

Ant Financial Services Group's overseas business development can be regarded as simultaneous extension in three dimensions, namely, breadth (covering countries and regions), depth (covering types of financial formats) and density (business cooperation and coordination between different countries and regions).

Global layout: pay first, go out to sea with BABA

With the global digital economic expansion of BABA Group, Ant Financial Services Group's overseas layout goal is "global purchase of customers, global sales of merchants, and overseas travel of users." Up to now, merchants in 56 countries and regions can accept offline payment business, 10 countries and regions have local e-wallets (i.e. Glocal strategic model), and the AAU of 10 local digital wallets is close to 1.2 billion.

In-depth development: diversified licensing, replication of financial ecology

Whether it's investing directly in diversified financial companies (e.g. Indonesian consumer installment company Akulaku in 2019) or applying for new business licenses with the help of established local payment institutions (e.g. Indian payment platform Paytm began to lay out consumer lending products Paytm Postpaid), Ant Financial Services Group is replicating Alipay's "from scene to payment to finance" process overseas.

From point to face: build a global network through cross-border payment

In 2018, the world's first blockchain cross-border remittance (Hong Kong version of Alipay Alipay HK and Philippine Wallet GCash) was Ant Financial Services Group's first test in the cross-border and cross-e-wallet payment business. After acquiring a 100% stake in WorldFirst, the world leader in cross-border payments in 2019, the company has further acquired the license and business access to connect 1 to 9 e-wallets.

Generally speaking, at present, the company already has the technical basis, business access and license for cross-border payment. In the future, Ant Financial Services Group is expected to build a global payment network by relying on the local e-wallet as the "node" and cross-border payment as the "channel". And then form a global service network.

The Future: sharing the nonlinear growth of Global Digital Finance

Business development in terms of valuation: after three rounds of financing, the company's valuation is on the order of trillion. Ant Financial Services Group completed round A (about US $1.85 billion) / round B (about US $4.5 billion) / round C (about US $14 billion) in 2015, 2016 and 2018 respectively.

Ant Financial Services Group was valued at about $150 billion, or about 970 billion yuan, after completing round C financing in June 2018, according to Bloomberg.

Business outlook: it is expected to share the nonlinear growth of global digital finance.

Ant Financial Services Group's business layout has changed from the "scale" strategy of the operating balance sheet to the "income" strategy of the operating income statement. The company gives priority to the development of "collaborative financial products" and "science and technology output products" to ensure sustainable revenue growth, while sharing the non-linear growth future of the global digital society "from scenario to payment to finance to income" through "extension development".

Outlook for the future: company value comes from growth potential

Increase in industry scale and market share of existing business: including payment business, financial synergy income, science and technology export income, etc.

Payment revenue mainly benefits from industry growth, of which many businesses are expected to maintain growth of more than 20%, and individual businesses may exceed 50%.

Digital financial services also benefit from industry expansion and increased market share, especially business such as asset management and consignment with platform effect.

With the rising period of the growth of science and technology investment in financial institutions, science and technology export income is also expected to achieve a growth rate of more than 30%.

From a longer-term perspective, after fully tapping the industry potential and share potential, it is speculated that the company may improve its pricing power based on monopoly advantages, such as the company's room for improvement in the proportion of charging customers, rates and so on after the completion of the layout of the payment network.

Risk factors:

Supervision. Some innovative businesses are developing rapidly, and changes in regulatory conditions are not ruled out.

Industry scale. Financial technology business model is flexible, does not rule out the possibility that the growth of some segments of the industry is lower than expected.

Edit / Ray