Editor/Futu News Bob

Market Overview

Futu News reported on July 17 that the Hang Seng Index closed up 0.47% to 25089 points, with a market turnover of HK$129.5 billion.

On the market, mainland education stocks and SaaS concept stocks rose more than 21% to a record high; China Education Holdings soared 11%; cinemas resumed opening in an orderly manner; film and television stocks strengthened; Alibaba Pictures surged more than 7%; most sectors such as home appliance stocks, beer stocks, property management stocks, pharmaceutical stocks, and pork concept stocks rose more than 8%; Chinese brokerage stocks were collectively weak, and Everbright Securities fell more than 8%; the Hang Seng Index shares rose by half, the Hong Kong Stock Exchange rose more than 3%, and Tencent rose 1.56%. New economy stocks generally rose; Meituan Dianping closed up more than 3%; Xiaomi, JD, and Alibaba closed up more than 2%; and SMIC closed up 0.87%.

littersTotal trading of the round of bulls and bears

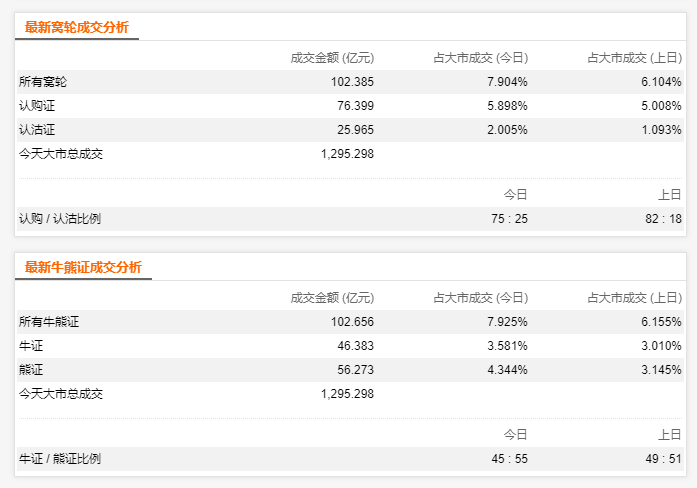

Today, Wolun sold a total of HK$10.238.5 billion, of which HK$7,639.9 billion was purchased for subscription certificates and HK$2,596.5 billion for sale certificates.

The total turnover of bull and bear securities was HK$10.265.6 billion, of which the bull and bear securities were HK$4,6383 billion and HK$5.627.3 billion.

The total turnover of all Wolun Bull and Bear Securities was HK$20.5041 billion, accounting for 15.8% of market transactions.

Top ten trading list

Out of more than 13,000 Wolun bull and bear certificates,$Hang Seng Index Bank of China Zero Ten Bears F.P (55570.HK) $The transaction of HK$561 million topped the turnover list, followed by$Hang Seng Index Motong 10 Bears V.P (55770.HK) $HK$478 million and$Hang Seng Index Haitong Zero Bear S.P. (55434.HK) $HK$457 million.

Furthermore, a total of 23 Wolun Bull and Bear securities with a turnover of over HK$200 million today.

Top ten growth list

In today's growth list, ATMX and Hong Kong Stock Exchange related bullish rounds performed brilliantly. Among them, 10 Tencent, 4 HKEx, 3 Ali, and 1 Xiaomi bull certificate rose more than 100%.

In the list of the top ten gains,$Hong Kong Stock Exchange France Pakistan 19 Bull M.C (54014.HK) $A surge of 340% topped the growth list, followed by$HKCC Goldman Sachs Zero Turtle G.C (53448.HK) $184% of and$Tencent Bank of China Zero B Bull G.C (53759.HK) $Of 184%. Furthermore, a total of 21 bulls and bears have increased by more than 100% today (including 100%).

List of the top ten declines

In today's decline list,$China Securities, McBank, bought A.C. (12706.HK) $A sharp drop of 77%,$Galaxy Credit Suisse Zero Seven Sales A.P (20867.HK) $A sharp drop of 67%,$AIA 2009 A.C. (21789.HK) $A sharp drop of 58%.

Furthermore, a total of 10 rotations dropped by more than 50% (including 50%) today.

Market hot spots

According to data from the market research agency Sensor Tower, “Wang Zhe Rongyao” reached 193 million US dollars in revenue last month, a sharp increase of 50.4% over the previous year, surpassing “PUBG Mobile” (the mainland version of “Peace Elite”) to the top of the list. “PUBG Mobile,” which is also owned by Tencent, retreated to the runner-up, with global revenue reaching 168 million US dollars, an increase of 12.8% over the previous year. “Brawl in the Wild,” which Tencent launched in China in June, also led to a sharp rise in revenue last month. “Brawl of the Wild” was also the second most downloaded mobile game on the App Store in June, with 9.7 million downloads.

According to the CITIC Securities Research Report, at the current point, Alibaba's e-commerce business is significantly leading in scale, efficiency, and profitability. The margin of competition is expected to stabilize, cloud business space is large, performance visibility is high, and efficiency improvements can be given appropriate valuation premiums to maintain the “buy” ratings of US stocks and H shares. The target market value is 800 billion US dollars, corresponding to PE (non-GAAP) 35x in FY2021.

According to the “Rider Employment Report for the First Half of 2020” released by Meituan, the number of single riders on the Meituan platform reached 2,952 million in the first half of 2020, an increase of 415,000 over the first half of 2019, an increase of 16.4% over the previous year. The report also shows that since March, the number of new single riders added to the Meituan platform has increased dramatically. The number of new single riders added in the first half of 2020 was 1.386 million. The “Report” shows that in the first half of 2020, riders were responsible for the delivery of some medical supplies, meals for medical staff, and the daily lives of residents in various regions. 20.8% of riders delivered more than 50 kilometers per day. According to the questionnaire survey, 45.7% of riders earn between 4,000 yuan and 8,000 yuan a month, and 7.7% of riders earn over 10,000 yuan a month.

Bank of China's views

Credit Suisse: The Hang Seng Index weighs 25,000. Pay attention to the Hang Seng Index bulls 56922 and bears 55753

After a sharp decline on Thursday, Hong Kong stocks stabilized slightly on Friday. The Hang Seng Index once rose more than 230 points. At one point it reached the level of 25,200 points, then remained stable above 25,500. There is still a need to return to the 25,500 point level upwards, and the reference 50 antenna is about 24,500 points.

As of Thursday, the recovery price for the Niuzheng Street goods concentration area was 24,500 to 24,599 points, while the recovery price for the Xiongzheng Street goods intensive area was 26,800 to 26,899 points.

On the other hand, the recovery price of the main inflow of capital from bull securities is 24,500 to 24,599 points; while the main inflow of bear securities is 25,728 to 25,799 points.

Hong Kong stocks have consolidated at 25,000. The rebound is wait-and-see. Optimistically, watch out for Hang Seng Index bull stock 56922. The recovery price is 24,800 points, the strike price is 24,700 points, the leverage ratio is about 58.1 times, and the exchange ratio is 12,000. Or Hang Seng Index subscribed to 24,237. The strike price was 26,900 points. Expires in September 2020, and the actual leverage is about 16.5 times.

If you are worried that the Hang Seng Index still has a chance to fall back, look out for the Hang Seng Index bear stock of 55753. The recovery price is 25,500 points, the exercise price is 25,600 points, the leverage ratio is about 40.3 times, and the exchange ratio is 12,000. Or it always indicates selling 23,425, the strike price is 24,500 points. The expiration date is October 2020, and the actual leverage is about 7.9 times.

J.P. Morgan Chase: Only 3 of ATMX entered the technical adjustment zone yesterday. Watch out for Tencent's purchase of 15405 and sale of 14957

The Shanghai Composite Index plummeted more than 4% yesterday, the biggest one-day decline in five months. The Hang Seng Index also tested the 25,000 point psychological threshold. The market is concerned about whether the selling pressure on new economy stocks such as ATMX will continue. Investors are paying attention to the performance period of peripheral technology stocks, which may have a reference effect. Netflix, which took the lead in announcing quarterly results after the US stock market closed, met Waterloo. The forecast for new users added for the quarter far fell short of market expectations, or hurt the overall tech stock climate.

In terms of technology trends, among ATMX's top 4 new economy stocks, Alibaba, Xiaomi, and Meituan all closed prices yesterday fell more than 10% from last week's highs. Technically, they entered the adjustment zone, while Tencent fell about 9%. Although Tencent made relatively few adjustments, Tencent still tended to take the lead in the backlash from friends entering the market, as Tencent made relatively few adjustments. Tencent has recorded a net capital inflow of 87 million in the stock market, the highest in the individual stock round.

If investors believe that Tencent's short-term adjustments have been completed, they should pay attention to Tencent Buy (15405), which has an exercise price of HK$618.18 and actual leverage of about 7.2 times. The last trading day is December 24, 2020; undercut, pay attention to Tencent Gu (14957). The exercise price is HK$438.38, and the actual leverage is about 6 times. The last trading day is December 24, 2020.

Risk warning: Industry insiders said that due to high leverage and time loss, Wollers and Bull and Bear Securities are extremely high-risk trading products and may lose all of their principal. They are not suitable for all investors. Investors should be aware of risks and never take heavy positions.