Editor / Futu Information Bob

Market summary

According to Futu News on July 16, the Hang Seng Index fell 2% to 24970 points, losing the 25000-point mark, with a turnover of HK $199.7 billion on the market.

On the market, almost all the industry stocks fell, semiconductor stocks plummeted, and Semiconductor Manufacturing International Corporation fell more than 25%. Battery stocks, online education stocks, biomedical stocks, automobile stocks, military stocks, mobile game stocks, mobile phone concept stocks and Chinese brokerage stocks plummeted across the board. Byd Company Limited fell nearly 12% and China Shipbuilding Defense fell more than 8%. Hong Kong stock stars fell collectively, with BABA down more than 4%, Tencent down 5.5%, Meituan down 7.7% and XIAOMI down 7.8%.

窝Total transaction of wheeled bull and bear certificate

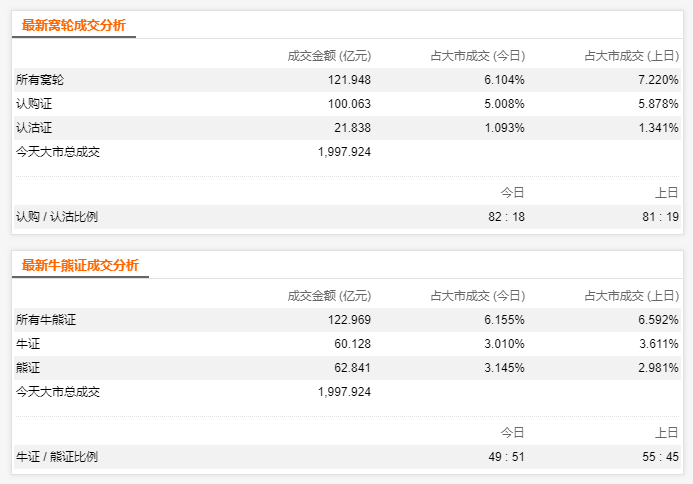

Today, the total turnover of Wharf was HK $12.1948 billion, including HK $10.0063 billion for subscription certificates and HK $2.1838 billion for sell certificates.

The total turnover of the CBBC was HK $12.2969 billion, including HK $6.0128 billion for the CBBC and HK $6.2841 billion for the Bear Certificate.

All the CBBCs totaled HK $24.4917 billion, accounting for 12.2% of the market turnover.

Top Ten Trading list

Among more than 13000 nest wheel bull and bear certificates$Hang Seng Index Bank of China 0 10 bear R.P (55450.HK) $HK $570 million topped the list, followed byHang Seng Index Haitong Ziga bear S.P (55434.HK) $HK $445 million; and$Hang Seng Index Fexing Zero Bear S.P (54578.HK) $440 million Hong Kong dollars.

In addition, a total of 28 nests had a turnover of more than HK $200 million today.

List of the top ten increases

In today's gains list, the Hang Seng Index, star stocks ATMX, Semiconductor Manufacturing International Corporation bearish wheel certificate rose at the top, 8 ATMX bearish wheel certificate rose more than 100%, 7 Hang Seng index bear certificate rose more than 70%, Semiconductor Manufacturing International Corporation bearish wheel card rose more than 70%.。

In the list of top ten increases$Geely Faxing zero seven sales A.P (19958.HK) $The increase of 533% accounted for the first place on the list, followed byXIAOMI UBS zero eight sales B.P (21345.HK) $207% and$Geely Ruitong zero eight sales A.P (20464.HK) $203%. In addition, a total of 18 CBBCs rose by more than 100% (including 100%) today.

Top Ten drop list

Corresponding to the rise list, in today's decline list, the Hang Seng Index, star stocks ATMX and Semiconductor Manufacturing International Corporation saw a sharp decline in the long-round stock, while 18 Semiconductor Manufacturing International Corporation saw the long-round stock drop by more than 70%.$SMIC UBS-SiNiu H.C (53895.HK) $Plunge 94%$SMIC Silver Zero cattle C.C (53772.HK) $Plunge 90%$China soft Motors 07 purchase A.C (19226.HK) $It's down 90%.

In addition, a total of 463 ships fell by more than 50% (including 50%) today.

Hot spot of market

At a press conference held by the State News Office on July 16, Liu Aihua, spokesman for the National Bureau of Statistics, said that China's economy fell first and then rose in the first half of the year, economic growth changed from negative to positive in the second quarter, major indicators recovered, and economic operation recovered steadily. basic livelihood security is strong, market expectations are generally good, and the overall situation of social development is stable. According to preliminary calculation, the GDP in the first half of the year was 45.6614 trillion yuan, which was 1.6 per cent lower than the same period last year at comparable prices. On a quarterly basis, it fell 6.8% in the first quarter from the same period last year, and increased by 3.2% in the second quarter.

Semiconductor Manufacturing International Corporation and Science and Technology Innovation Board rose 202% on the first day of listing, with a turnover of nearly 48 billion yuan. Guosheng Securities pointed out that as a leader in domestic chip manufacturing, Semiconductor Manufacturing International Corporation ranks fourth in the world and first in the mainland in the field of pure wafer foundry. At the technical level, Semiconductor Manufacturing International Corporation provides customers with integrated circuit wafer foundry and supporting services from 0.35um to 14nm technology nodes and different process platforms. By the end of 2019, the company's wafer production capacity has reached 450000 wafers per month, with a global market share of about 5%, representing the most advanced level of Chinese mainland. In the future, with Semiconductor Manufacturing International Corporation landing science and technology, A-share semiconductor industry to welcome the return of giants, the leading market value of the industry has reached a new high, and the attractiveness of allocation continues to improve.

Guoxin Securities believes that Semiconductor Manufacturing International Corporation is more precious than Guizhou Moutai. In terms of substitutability, Semiconductor Manufacturing International Corporation is as irreplaceable and impossible to copy as Guizhou Moutai. At the same time, because of the scarcity, Semiconductor Manufacturing International Corporation has the same bargaining power as Guizhou Moutai. From the perspective of social necessary labor time, the value of Semiconductor Manufacturing International Corporation exceeds that of Guizhou Moutai. Maotai existed 800 years ago, but it is not until today that we have Semiconductor Manufacturing International Corporation's advanced 14nm process.

Big line point of view

JPMorgan Chase & Co: new economy stock selling pressure reappears, pay attention to Tencent buying 15405, selling 15905; Hong Kong delivery 28415, selling 15316

New economy stocks also showed selling pressure again after a slight rebound yesterday, with Tencent, Meituan, BABA and XIAOMI falling by 4-8 per cent. The market focused on SMIC's performance on the first day of the company's return to Kechuang board. Although SMIC's A shares rose more than twice as much, its H shares plummeted more than 25%. Other shares that announced plans to return to Science and Technology Innovation Board earlier, such as Geely and Shiyao, also showed significant vomiting.

In terms of securities capital flows, JPMorgan Chase & Co shows that city capital flows (as of 02:30), investors tend to deploy Tencent, HKEx and Ping an long positions. As for Tencent, friends tend to choose Tencent subscription cards with an exercise price of more than HK $600,000. for example, Tencent purchase (15405) with an exercise price of HK $618.18, with an actual leverage of about 6.9 times, or another Tencent purchase with a higher price (15905), with an exercise price of HK $600.46, with an actual leverage of about 9.4 times.

HKEx fell more than 5% to lose 10 antennas. If investors think that the underlying shares are close to 20 antennas and about HK $335 are supported, Bo rebound can consider Hong Kong purchase (28415), the exercise price is HK $400.04, the actual leverage is about 6.86 times, and the last trading day is December 17, 202. the exercise price is 305.05 Hong Kong dollars, the actual leverage is about 4.7 times, and the last trading day is January 25, 2021.

Goldman Sachs Group: new economy stocks give back deeply, and discounted products are suitable for deployment and rebound. Please pay attention to BABA's purchase of 13621 and Meituan's purchase of 15088.

The Hang Seng Index fell after opening slightly higher this morning, while the New economy stocks, which are the focus of the market, gave up more deeply. Among them, BABA (9988), who rebounded by about 1.2% yesterday, opened about 0.2% lower in the morning and the decline widened. Meituan, which returned to HK $200 yesterday, fell more than 7 per cent. Some brokerages point out that Meituan can benefit from the strong development of the takeout industry in the long run, and expect profit per order to rise. The bank raised Meituan's target price to HK $240, giving it a "buy" investment rating.

Capital flow: observe the capital flow of individual stock rotation certificates. Although BABA's subscription certificate was sold yesterday, if calculated in the past five trading days, a total capital inflow of about HK $54 million was recorded, while the bull certificate was transferred to deployment yesterday. For Meituan, the subscription certificate recorded capital inflows in the past four trading days, totaling about HK $23 million.

If investors plan to take advantage of the low position of BABA, the subscription certificate can pay attention to the high sensitivity of BABA, which is about 10% out of price, to buy 15841. The choice of discount can be noted for a period of about 5 months. BABA, who is also a highly sensitive buyer, buys 13621. For highly leveraged options, you can pay attention to BABA, which has an out-of-price margin of about 5%, to buy 15284. If investors plan to deploy bull certificates, they can pay attention to BABA Niu 59576 at this stage. There is a gap between the recovery price and the current price of about HK $16.50.

If investors plan to take advantage of the low position of Meituan, the discount option in the subscription certificate can pay attention to Meituan purchase 15088 with a maturity of about 5 months. For out-of-price options, please pay attention to Meituan 16145 with a maturity of about 6 months. If investors plan to deploy bull certificates, they can pay attention to Meituan Niu 54060 at this stage. There is a gap of about HK $13 between the recovery price and the current price.

Risk Tip: industry insiders said that due to high leverage and time loss, Wheel and CBBC are ultra-high-risk trading products, which may lose all principal and are not suitable for all investors. Investors should pay attention to risks and do not overload their positions.