Of all the sectors, the pharmaceutical and biological industry has risen by as much as 47% this year, especially in the medical device sector, with an average increase of more than 80%, outperforming the Shanghai and Shenzhen 300 index by 69 points.

Source: wind, Futu Securities consolidation, as of 16:00, July 16, 2020

Minimally invasive Medical, Qiming Medical and Peijia Medical are all held by Hillhouse Capital.Cardiovascular fieldMedical device stocks, we can see that their performance far exceeds the average increase of the same industry. We can't help but wonder why the medical device industry, which is also in the cardiovascular field, has so different rates of increase.

Source: wind, Futu Securities consolidation, as of 16:00, July 16, 2020

This article will briefly introduce cardiovascular disease, the positioning of cardiovascular medical devices, and then introduce the subdivision of the cardiovascular field in detail, and finally summarize the final investment opportunities.

Cardiovascular disease

According to the location and type of disease, cardiovascular disease can be divided into coronary heart disease, thoracic / abdominal aortic aneurysm and peripheral arterial disease, structural heart disease and so on. The following picture shows the main types of cardiovascular disease:

Data source: Alphabet Inc-CL C academic, Futu Securities arrangement

Treatment regimen:

For cardiovascular diseases, clinical treatment options includemedication、Open surgical operation和Interventional therapyWait. At present, drug treatment is only a palliative effect, not a complete cure. Open surgery is risky and traumatic.

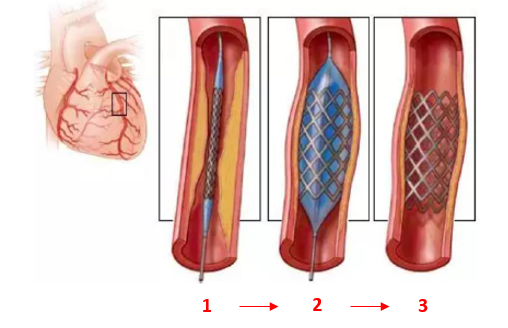

Interventional therapy is a new treatment method between surgery and internal medicine. To put it simply, with the assistance of imaging equipment (angiography, perspective, CT, MR, B-ultrasound), the focus is not exposed by surgery, and the diameter is made on the blood vessels and skin.A few millimetersIt's a tiny channel.

The applicable groups of the scheme are:Patients with vascular stenosis, arteriovenous thrombosis, vascular malformations, heart valves and other problems, the most importantIt is also applicable to people over 70 years old.Low risk。

Source: Qiming Medical prospectus

Positioning of cardiovascular high-value consumables:

Medical devices can be divided into: medical equipment,High value consumables, IVD (in vitro diagnosis), low-value consumables, etc.

Medical equipment: mainly refers to nuclear resonance (1.5T nuclear magnetic resonance price is about 7 million / Taiwan), B-ultrasound, CT and other medical equipment.

High value consumables:High-value consumables are subdivided into orthopaedics, ophthalmology, oral, cardiovascular, intrarenal and neurosurgery, and the value of high-value consumables in the field of central vascular surgery is the highest (red wireframe, which is also the focus of our article).

IVD in vitro diagnosis: products and services that obtain clinical diagnostic information through the detection of human samples (blood, body fluid, tissue, etc.), and then judge the disease or body function. Such as examination of HPV, blood routine, urine routine, etc.

Low-value consumables: refers to the disposable sanitary materials often used by hospitals in the course of medical services, such as disposable syringes, infusion devices, blood transfusions, medical gloves, surgical sutures, etc.

Data source: online public information, Futu Securities collation

Classification of High value Cardiovascular consumables

A further breakdown of the coronary, peripheral vascular, and cardiac structural consumables (red box above) of high-value cardiovascular consumables is shown below.

Source: China Merchants Bank Research Institute

From the perspective of the overall technical barrier, the crownAmong them, the localization of mitral valve and tricuspid valve in China is 0. Next, we can take a closer look at investment opportunities in each segment:

Cardiovascular interventional therapy in China began to develop rapidly around 2010, which requires very high requirements for imaging diagnosis, doctor's experience and domestic cardiovascular high-value consumables, almost synchronously.

In the future, with the aging of China's population, the number of potential patients with cardiovascular disease is very large. Second, at present, the localization of peripheral vascular intervention and cardiac intervention valves is low, 5% and 0% respectively, and the price is too expensive. With the development of technology and the inclusion of national health insurance, the price of cardiovascular intervention products will be more friendly to the people. Finally, doctors will have more and more clinical experience in interventional therapy in the future, and the cardiovascular interventional therapy industry will show a rapid exponential growth in the future.

The following picture shows the localization process of each segment and the current domestic market size distribution. the subdivision with the greatest growth potential in the future short term is the inferior artery stent field. at present, there is only one company in China, Xinmai Medical (minimally invasive Medical subsidiary).

Data source: online public information, Futu Securities collation

1) Coronary stent

The domestic coronary intervention market has been relatively mature. In 2019, interventional surgery accounted for more than 90% of the total coronary surgery, and the penetration rate was very high.

Data source: Alphabet Inc-CL C photos, Futu Securities collation

Because the barriers to coronary stents are relatively low.Domestic coronary stents have mainly experienced three technological revolutions:

The first revolution: the balloon catheter was delivered to the coronary artery stenosis, and the narrow blood vessel was dilated by inflating the balloon (PTCA) to restore its vascular function. However, some patients will face the problem of restenosis after vascular dilatation.

The second revolution: using stainless steel, cobalt alloy and other metal materials to make bare metal stents, but the compatibility is poor, after implantation to stimulate vascular proliferation, or will encounter the problem of re-stenosis.

The third revolution:Covering the surface of the stent with drugs such as rapamycin and paclitaxel (an anticancer drug) can significantly reduce stent stimulation to vascular endothelium and reduce proliferation, but there is a risk of stent fracture.

The fourth revolution: using biodegradable materials to make stents, which are completely absorbed after supporting blood vessels. This reduces the problem of thrombosis and restenosis.

From the first generation to the fourth generationThe problem we're all dealing with is reducing proliferation and restenosis.. At present, the first and second generations have been eliminated. At this stage, it is mainly the third generation of coronary stents, with a market share of 99%. The fourth generation biodegradable stent Lepu Medical was approved to go on the market in December 2019.

Coronary stent competition pattern:

At present, the domestic replacement rate of coronary stents has reached 70%.The technical barrier of coronary stent is relatively low, and the industry scale is large. At present, the proportion of the third generation of coronary stents is as high as 99%, and the competition pattern is stable, and the concentration of the market is also steadily increasing.According to the picture below, we can see that minimally invasive coronary stent has always maintained the leading position of coronary stent, but there is not a big gap with the second and third place.

Data sources: Sainuo Medical, Huajing Intelligence Network, Futu Securities

The future competition for coronary stents will be in the fourth generation of biodegradable materials.February 27, 2019Lepu Medical's independently developed blockbuster product "NeoVas" (the first degradable coronary stent in China) has officially obtained the medical device registration certificate approved by the State Drug Administration. In March 2020, Shandong Huaan Biological Xinsorb polylactic acid (PLA) total degradation was approved and listed on the market. It is expected that the biodegradable materials of minimally invasive medicine will be approved and listed in China in 2023.

It is suggested that we should pay attention to the target companies of the fourth generation products: Lepu Medical and minimally invasive Medical.

2) Peripheral vascular intervention

According to different applicable sites, peripheral vascular stents are mainly divided intoAortic covered stent和Peripheral vascular stent。

a)Peripheral blood vessels-Aortic covered stent

The technology of peripheral vascular-aortic covered stent is relatively mature.且Policy supportThe import substitution rate is close to 60%, and the market size is about 1 billion yuan.First health science and technology, heart pulse medical treatmentIt already accounts for 50% of the domestic market.

Data source: Xianjian Technology official website, Futu Securities collation

Xianjian Technology and Cardiac Medicine have a leading advantage in the domestic aortic covered stent market, and their market share has been increasing in recent years, ranking first and second respectively in China. The market share of Xianjian Technology and Xinmai Healthcare (a subsidiary of minimally invasive Healthcare) rose from 36% in 2016 to 57% in 2018.

b)Peripheral blood vessels-Lower extremity arterial stent

The technical barrier of peripheral blood vessels is high (it needs to meet multiple functions such as pressing, squeezing, conversion, distortion, etc.), and the market scale is large (about 3 billion yuan at present, which will continue to expand in the future).But the domestic market share is only 5%.。

Data source: introduction material of a company, China Merchants Bank Research Institute

The sites of arterial lesions in lower extremities are usually long and complex by external forces, so it is difficult to develop related interventional products. At present, the lower limb arterial stents are still dominated by foreign brands such as Medtronic PLC, Johnson & Johnson, Abbott Laboratories and so on. Domestic only cardiovascular medical lower limb vascular stent products were approved to market in 2019.

It is recommended to pay attention to the companies that target peripheral blood vessels:

The field of aortic stents covered with membrane-pioneer technology,Heart pulse medical treatmentLower extremity arterial stentHeart pulse medical treatment、 Medtronic PLC 、 Johnson & Johnson 、 Abbott Laboratories

3) Cardiac interventional valve

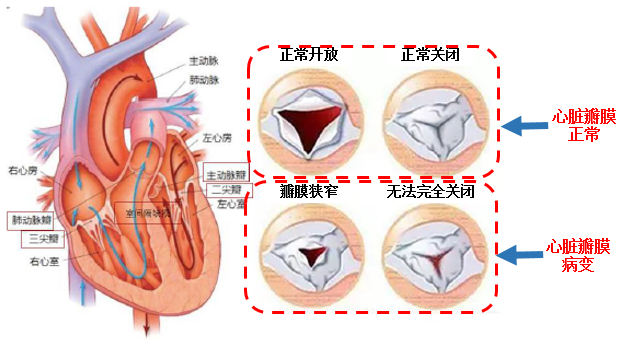

The heart has four chambers, namely, the left atrium, the left ventricle, the right atrium and the right ventricle. The chambers and blood vessels are separated by the heart valve, which acts as a "valve" of blood flow. Previously used mechanical and biological valves (porcine aorta and bovine pericardium), interventional valves sprang up in 2007 (minimal trauma, short recovery cycle for patients, suitable for age ≥ 70). The interventional flap can be divided into different parts according to its applicable position.Aortic interventional valve、Mitral valve和Tricuspid valve。

Data source: Alphabet Inc-CL C academic, Futu Securities arrangement

Cardiac interventional valveMarket competition pattern

In the field of cardiac aortic intervention, Edward Life Sciences was listed overseas in 2007, accumulated nearly 10 years of clinical experience, and Sapien 3 was approved to enter the Chinese market in June 2020. In the domestic market, Qiming Medical began to be approved in 2017, and in 2019, Micro Chuangxintong (a subsidiary of minimally invasive medicine) was approved. The price of domestic aortic interventional valve is 10-200000 yuan, which is about 100000 cheaper than imported products.

In the field of bicuspid and tricuspid valve intervention, Abbott Laboratories is currently approved by the State Drug Administration for listing.

Summary

High-value cardiovascular consumables can be divided into coronary, peripheral and structural heart disease consumables. Although there are great differences in the development stages of different track products, they all have the shadow of "minimally invasive medical treatment". This is why the stock of minimally invasive Healthcare can be realized far more than the same industry this year. At present, domesticCoronary stentThe market penetration in the field is high and the market pattern is stable. Perhaps the future competition pattern will change in the fourth generation of products.Peripheral vascular stentWith the rapid growth of domestic market and the initial appearance of aortic covered stent bibcock, the pattern of lower limb arterial stent is far from settled.Cardiac interventional valveDuring the initial period of the market, imports will occupy part of the market in the short term, but domestic products will catch up in the future.

It is recommended to pay attention to the target of investment:

The field of coronary stent: Lepu Medical, minimally invasive Medical treatment

The field of peripheral blood intervention: first health science and technology, heart pulse medical treatment (minimally invasive medical subsidiary)

Fields of cardiac valve intervention: Kai Ming Medical, minimally invasive Xintong (minimally invasive Medical subsidiary), Abbott Laboratories, Edward Science

Edit / elisa