Original title: the breakage and solution of perpetual motion machine logic

Author: Yan Xiang

The current "technology + consumption" two-wheel drive of the stock market reflects two important long-term expectations, which can be summarized as follows:First, science and technology independence + brokerage direct financing. Second, the global sustainable low interest rate + consumption leader sustainable and stable growth。

This paper mainly discusses the second expectation. The expectation of "persistently low global interest rates + sustainable and steady growth of consumer leaders" is so strong that it can be called "Perpetual motion machine logicIn theory, profit growth does not need to be very high, as long as the sustainable growth rate, such as 10% to 15%, is greater than the discount rate on the denominator side, which means that the valuation does not converge to infinity.

How will "perpetual motion machine logic" be interpreted or deciphered? One possibility is that the fundamentals of stable growth have been falsified, which is less likely. Coca-Cola Company had a steady growth of about 12% for more than a decade during the beautiful 50 years of US stocks in the 1970s. Another situation that is most likely to break this situation is a sharp rise in inflation (especially the price of resource goods). Once this happens, there will be a very subtle change in the market. first, interest rates will significantly upward affect valuations. second, the more important market will suddenly find that relatively stagflation and relatively low valuations suddenly have a very high profit growth.

The beautiful 50% market of US stocks was dashed in inflation that year. Before the oil crisis, the nominal economic growth rate of the US economy was relatively low. Coca-Cola Company maintained a steady growth rate of 12%. The market felt that it should be held for a long time, and the valuation increased from 30 times PE to 50 times. After the oil crisis, inflation in the United States is high, and Coca-Cola Company still has a steady growth rate of about 12%, which is unacceptable to the market, because at this time, high interest rates and more high-growth investments have emerged.

So the biggest risk of changing the current market style may be the continued upside of PPI. Is this possible? At present, the fluctuation of endogenous aggregate demand in China's economy has been greatly reduced, and it is relatively small to rely on traditional domestic demand such as real estate investment, infrastructure investment and manufacturing investment to cause PPI to continue to rise. However, under the current epidemic situation, the possible "black swan incident" cannot be ruled out, that is, the supply problems caused by the epidemic in some resource goods producing countries, resulting in a significant increase in the price of resource goods.

Resource prices and PPI continue to rise, which is a small probability event, but if it does happen, the impact may be great. There is no continuity in the plate switching caused by simple valuation differentiation.

Two "forward expectations" of current Stock Market pricing

The performance of the A-share market has continued to climb since the beginning of 2019, and major indices have gained a lot. Judging from the driving force of the market, the market gains since the beginning of 2019 have mainly depended on higher equity asset valuations rather than the rapid expansion of EPS. Based on the Wind all-An index, from the beginning of 2019 to July 10, 2020, the Wind all-An index rose by about 64%, of which the price-to-earnings ratio (ttm) of the index rose by about 71%. The increase in the index is entirely made up of higher valuations.

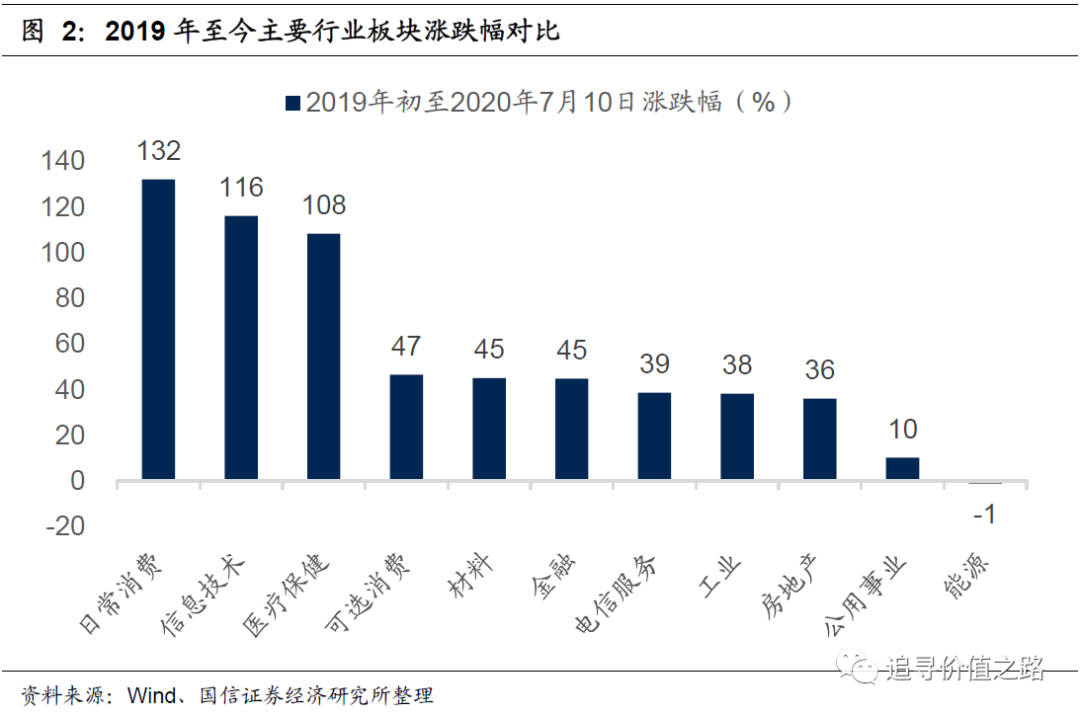

Behind the valuation of Sengba is actually the change of the market environment. From the structural performance of the plate, we can clearly see that consumption (including medicine) and science and technology lead the rise, while the plate varieties that go along the economic cycle obviously lag behind. From early 2019 to July 10, 2020, daily consumption, information technology and health care increased by 132%, 116% and 108%, respectively.

This paper believes that the current pricing behavior of the stock market ("technology + consumption" two-wheel drive) actually reflects two important long-term expectations, which can be summarized as follows: first, science and technology independence + brokerage direct financing. Second, the global sustainable low interest rate + consumption leader sustainable and steady growth. Both of these long-term expectations are very powerful.

Asset valuation cannot converge under the assumption of low interest rate perpetual motion machine.

This paper focuses on the second of the above-mentioned two long-term expectation logic, namely, "global persistently low interest rates + sustainable and stable growth of consumption leaders".

The expectation of "persistently low global interest rates + sustainable and steady growth of consumer leaders" is very frightening. We know that any financial valuation model is essentially a discounted summation of the future cash flow of an enterprise, and the consumption leader is growing continuously and steadily, which is comparable to the expectation of a perpetual motion machine and superimposed with the expected assumption of persistently low interest rates. it means that the growth rate at the numerator end is higher than that at the denominator end. From the financial valuation model, this situation corresponds to the infinite valuation which is not convergent in theory.

Although there is no doubt from historical experience that nothing will be sustainable and this long-term expectation may eventually be falsified, it is indeed the strongest forward expectation in the market at present. Whether it is analysts' earnings forecasts or intuitive instincts, consumer leading companies will grow by about 10% in the next five or even 10 years, which everyone thinks can be accepted and cannot be overturned. 10% of the relative sustainable growth (for 10 years later, the perception of investors can only be linearly extrapolated), if the superimposed long-term low interest rates, it can also lead to the current consumer stock leading companies stable growth is not very high, but the valuation is relatively high pricing results.

We believe that this hypothetical expectation of "persistently low interest rates + sustainable and stable growth" is an important reason for the extreme divergence of current market valuations.

Of course, there will be a view that, from the domestic situation, the expected assumption of "persistently low interest rates" does not seem to have been broken, because domestic interest rates have risen to a certain extent since about May.

But the problem is that the current global low interest rate environment has not changed significantly. So far, the maturity yield of 10-year bonds in the United States is still below 1%, while that in Japan is still around zero. The maturity yield on German 10-year bonds is still negative.

The result of ultra-low interest rates around the world is a steady inflow of foreign capital in order to be able to look for search the yield. Therefore, in the short term, in the context of the continuous global low interest rate environment, although domestic interest rates have risen to a certain extent, it is probably very difficult to completely change the expectation of long-term low interest rates in the future.

The possibility of falsification of fundamentals is small, and the biggest variable comes from the fluctuation of nominal economic growth.

So what might change the perpetual motion logic of "persistently low global interest rates + sustainable and steady growth of consumer leaders"? Logically, there are only two possibilities, either "sustainable and stable growth of consumer leaders" or "persistently low global interest rates" are falsified.

The first possibility is that the "sustainable and steady growth of consumption leaders" is falsified, that is, what we often call fundamental falsification. At present, this situation does not seem to be very likely.There are two main reasons. first, the logical basis of the current market judgment on the profit of consumer leaders has shifted from short-term periodic demand fluctuations to long-term trend supply judgments. we are optimistic about the logic of consumer leaders not because of good short-term demand, but because there will be long-term logic of industrial concentration and consumption upgrading in the future. This determines that even if the performance of the leading consumer companies in one or two quarters is slightly lower than expected, market investors may not find it a problem, because after all, these varieties are understood to be long-term trends rather than short-term fluctuations.

Second, from the international historical experience, consumer leading companies in a relatively long period of time, to maintain a sustained and stable profit growth, has indeed happened. Coca-Cola Company did maintain a steady profit growth rate of 12% to 13% for a long time in the beautiful 50 market in the United States in the 1970s (see figure 5).

As can be seen from figure 5, it is certainly not Coca-Cola Company's expectation of long-term steady profit growth that has been falsified, but that the external environment of the market has changed. This external environment is inflation.

For leading consumer companies, such as Coca-Cola Company, in an environment of low inflation and low nominal economic growth, steady profit growth of 12% to 13% is commendable, and interest rates as a whole are relatively low. However, when the nominal economic growth rate increases with inflation, the profit growth rate of consumer leading companies may not be able to match the upward trend (see figure 6). In other words, the correlation between the profit growth rate of consumer leading companies and nominal economic growth is relatively low. this is also the main logic that consumer leading companies have valuation premium when nominal economic growth is low.

In this case, when inflation rises and nominal economic growth increases, the market will find that there are many investments with higher profit growth, superimposed interest rates will rise, and high valuations will be under pressure. So at this time, if we talk about the logic of sustained stable profit growth of 12% to 13%, it will not be recognized by the market, that is, around 1974 to 1975, we saw that Coca-Cola Company's profit growth rate remained basically unchanged. But the main reason for the sharp decline in valuation.

In fact, if you compare the price-to-earnings ratio (ttm) of Coca-Cola Company at that time with the year-on-year growth rate of PPI in the US economy at that time, we can find that from 1972 to 1974, the two were almost highly negatively correlated, and Coca-Cola Company's valuation almost declined significantly with the uptrend of PPI.

Inflation may be the biggest risk point for changing the current market style

So, it can be said thatFor the perpetual motion machine logic of "persistently low global interest rates + sustainable and steady growth of consumer leaders", the biggest risk may be the upward inflation, especially the sharp rise in the price of resource goods. Once this happens, on the one hand, it will lead to a general rise in interest rates to restrain high valuations, and on the other hand, more importantly, there will be a number of competitive varieties with high profit growth.

Going back to the current A-share market, if inflation does rise, there will be a particularly wonderful scenario, that is, the current relatively small gains and relatively low valuations suddenly show high earnings growth. We believe that the emergence of this situation is the main force that is likely to completely change the style of the market. As for the valuation differentiation and valuation differences between different varieties, it can not change the style of the market from the trend. Under the slight adjustment of high valuation, the slight increase of low valuation, and the update of earnings after the financial report, the valuation difference will converge. After convergence, the fundamental situation behind the market has not changed, and the style characteristics of the market will not have essential changes.

So is it possible for inflation to rise? At present, the possibility is relatively small, but if it happens, the influence will be great.

We believe that the current fluctuation of endogenous aggregate demand in China's economy has been greatly reduced, and it is relatively small to rely on traditional domestic demand such as real estate investment, infrastructure investment and manufacturing investment to cause PPI to continue to rise. However, under the current epidemic situation, the possible "black swan incident" cannot be ruled out, that is, the supply problems caused by the epidemic in some resource goods producing countries, resulting in a significant increase in the price of resource goods.

All the stocks involved in this report are only a statistical summary of public information and do not constitute any profit forecasts and investment ratings.

Risk hints: macroeconomic is less than expected, overseas markets fluctuate sharply, and historical experience does not represent the future.

Edit / lydia