Original title: the worst is over! Switzerland also said that the recession affects global insurance, but China and other countries will support the recovery of the global insurance market.

The COVID-19 epidemic is triggering a severe recession, and the global economy is expected to contract by about 4 per cent this year, more severe than the recession (- 1.8 per cent) during the global financial crisis of 2008-2009.

This is the latest expected result of Swiss Reinsurance Rui re-Research Institute. Recently, the Swiss re Research Institute released the fourth sigma report in 2020, "World Insurance Industry: weathering the Great Storm of the 2020 epidemic". With the epidemic situation of COVID-19 as the theme, the Swiss re Institute analyzed the macroeconomic environment faced by the insurance industry and the trend of the global insurance market.

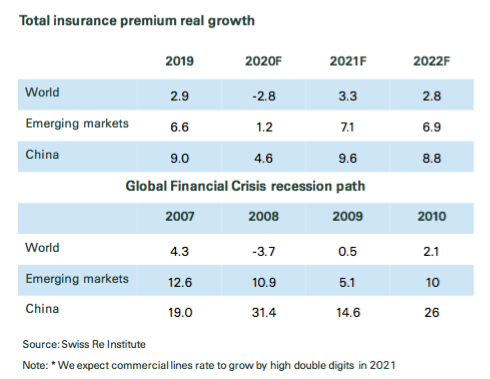

The recession will have an impact on global insurance, but the report believes that the insurance industry can survive this possibly short-term recession, and global insurance premium income is expected to fall 2.8% this year, and then, as the economy enters a more lasting recovery model, it is expected to grow 3.3% in 2021, showing a strong V-shaped recovery, and global premium income will return to pre-COVID-19 levels in 2021.

Everywhere, emerging markets, led by China, will support the recovery of the global insurance market.

The global economy is expected to decline by 4% this year, and the worst is over.

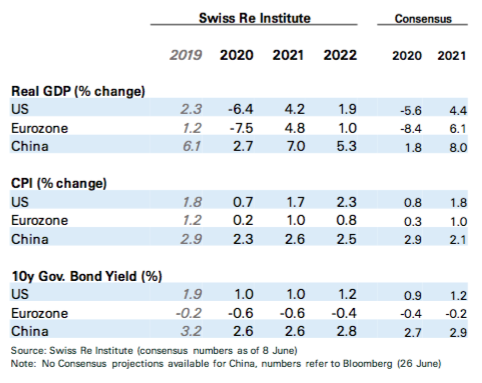

The sigma report predicts that global gross domestic product (GDP) will fall by about 4 per cent in 2020, double the rate during the global financial crisis (- 1.8 per cent), and the vast majority of the world's 30 largest economies are expected to fall into recession.

Of these, China's GDP growth is expected to be 2.7 per cent this year, higher than the market consensus; the Chinese economy is expected to rebound by 7 per cent in 2021. It is pessimistic about the economic outlook of the United States, which is expected to decline 6.4% this year, which is lower than the consensus level of the industry. The situation in the US is likely to be better than that in the eurozone. Among the three major economies of China, the United States and Europe, China's economic outlook will be significantly better than that of Europe and the United States.

Dr. JeromeJeanHaegeli, chief economist of Swiss Reinsurance Group, said that compared with the 2008 financial crisis, the economic contraction this time will double, the recession will be faster, and the recession is expected to be shorter.

"We are going through the worst global recession. Cyclically, the worst is over, and Asian economies will be better able to cope with the crisis than Europe and the US. In the long run, economic resilience needs to be repaired to return growth to its underlying trend. "Anren said politely.

Global insurance will recover V-shaped and return to pre-epidemic in 2021.

A 4 per cent contraction in the global economy will lead to a sharp drop in insurance demand, although Rui re expects the insurance industry to weather a possibly brief recession. As the economy enters a more lasting recovery, premium growth will pick up.

Switzerland again estimates that the COVID-19 epidemic crisis will reduce global premiums (including life and non-life insurance) by 2.8 per cent in 2020 and increase by 3.3 per cent in 2021. In this way, "up and down" forms a V-shaped rebound trend, which is stronger than that during the financial crisis. At the same time, Switzerland expects global premiums to return to pre-outbreak levels by the end of 2021.

An Renli said that in the face of the COVID-19 epidemic, the insurance industry is very resilient. Although the impact of the epidemic on the economy is much greater than that of the global financial crisis of 2008-2009, the loss of insurance premiums in both crises is similar.

At the same time, the sigma report believes that the insurance industry is well capitalized before the outbreak, and the industry can absorb the impact of COVID-19 's epidemic on profits.

The current disadvantages include: it is still uncertain how much claim pressure the epidemic will eventually put on the non-life insurance industry; interest rates will remain low over a longer period of time, investment returns will remain low and higher corporate default rates may lead to losses on investment assets; in life insurance, offline social restrictions lead to a drop in sales, which will be a drag on profits this year.

The favorable factors include: the outbreak of the COVID-19 epidemic coincided with a period of rising property insurance rates, and it is expected that the upward trend in commercial insurance prices will continue; risk awareness and risk protection demand in many industries will increase, and insurance demand will rebound, which will support longer-term profits.

In addition, the impact of the COVID-19 epidemic is also likely to accelerate other paradigm shifts, such as restructuring the global supply chain to mitigate the risk of future business disruptions, thus creating new growth points in property insurance, engineering insurance and guarantee insurance. In addition, the trend towards digitization in personal and working life is expected to intensify to facilitate the launch of new insurance products and services.

China leads the global insurance market, with premiums expected to exceed 5 trillion yuan in 2021.

From a regional perspective, an Renli said, it is expected that emerging markets, especially China's insurance market, will be the core force driving the growth of the global insurance industry. "We are more firmly predicting that China will become the world's largest insurance market by the mid-2030s. "

Ruizai expects emerging market premiums to grow by 1.2 per cent in 2020 and 7.1 per cent in 2021, while Chinese premiums are expected to grow even more strongly, with growth of 4.6 per cent in 2020 and 9.6 per cent in 2021.

Ruizai expects emerging market premiums to grow by 1.2 per cent in 2020 and 7.1 per cent in 2021, while Chinese premiums are expected to grow even more strongly, with growth of 4.6 per cent in 2020 and 9.6 per cent in 2021.

China's premium income is expected to rebound quickly in the second quarter of 2020, with a real growth rate of 5 per cent in 2020 and 10 per cent in 2021. China's total premiums are expected to exceed Rmb5tn ($743 billion) by 2021.

Chen Donghui, president of Swiss Reinsurance China, said that he personally experienced the impact of the epidemic on the international and domestic insurance industry. The main concern of the domestic insurance industry lies in the upcoming 14th five-year Plan, product innovation, and sustainable business growth, and the impact of the epidemic seems to have faded. But overseas, the situation is completely different. If you only look at developed markets or Europe or North America, the situation is bleak.

Chen Donghui, president of Swiss Reinsurance China, said that he personally experienced the impact of the epidemic on the international and domestic insurance industry. The main concern of the domestic insurance industry lies in the upcoming 14th five-year Plan, product innovation, and sustainable business growth, and the impact of the epidemic seems to have faded. But overseas, the situation is completely different. If you only look at developed markets or Europe or North America, the situation is bleak.

The opportunity of China's insurance industry lies in "three new"

Chen Donghui said that the impact of the epidemic on China's insurance industry is temporary, and it will be more obvious if it is put into the development stage and fundamentals of the industry. Comparing the analysis of 2019 and 2011, Chen Donghui shows that profound and fundamental changes have taken place in China's insurance market in the past 10 years.

In terms of scale, total premium income tripled from 1.4 trillion in 2011 to 4.3 trillion in 2019, with an average annual compound growth rate of 13 per cent, while GDP grew at an average annual compound growth rate of about 8 per cent over the same period.

Structurally, there are three outstanding changes: first, the rapid growth of health insurance. The share of health insurance has risen from 5% in 2011 to 17% in 2019 and is expected to rise in the future. The second is the return of life insurance business. Under the guidance of the regulatory authorities, the general life insurance with guaranteed function is growing rapidly, and the proportion of new life insurance with investment and savings function is declining rapidly. Third, the growth of auto insurance has relatively slowed down, from 24% in 2011 to 19% in 2019. The golden period of auto insurance has become history.

At the same time, non-auto insurance has always accounted for 8% of the industry in this process, and although the industry is increasing the development of non-auto insurance, non-auto insurance has only been "not left behind" in the past decade. He expects high growth in the next stage of non-car insurance in the future, in which liability insurance, rural insurance, and engineering insurance will maintain high growth in the short term, while enterprise property insurance and family property insurance will be very optimistic in the medium and long term.

"from a fundamental point of view, the industry is in a background where the business structure is becoming more and more balanced and the business scale is growing. Relative to this background, the impact of COVID-19 's epidemic situation is a temporary and relatively small impact. "Chen Donghui said. The domestic insurance industry is in the stage of rapid S-curve climbing, and various industries of China's economy may face some uncertainties in the future, but there is no uncertainty in the insurance industry. The rapid growth of China's insurance industry in the next five to ten years is a deterministic event.

At present, China's insurance industry faces many opportunities and challenges, such as economic recovery and low interest rate environment, changes in underwriting cycle, catastrophe protection gap, comprehensive car insurance reform, sustainable development of health insurance, digital insurance and so on. But the opportunities far outweigh the challenges.

He believes that in the long run, the opportunities for the insurance industry lie in the "three new": new infrastructure, new economy, and new consumption. The new momentum generated by these trends will accelerate the digital transformation of the insurance industry and bring new ideas for the further development of innovative products and solutions and service market segments.

For example, in terms of new infrastructure, engineering insurance is in strong demand, and China is already leading the global trend. IDI residential quality assurance insurance has been welcomed by the market and developed rapidly with the support of some local governments in recent years. Furthermore, in addition to doing residential IDI, domestic IDI has also been creatively extended to municipal engineering, farmland and water conservancy projects, leading the international trend and arousing the interest of foreign insurance industry. In addition, China has also taken the lead in the new insurance opportunities brought about by new energy vehicles and renewable energy.

However, Chen Donghui also said that although the macro expectations of China's insurance industry in the future are very optimistic and will become the world's largest insurance market in the mid-2030s, this does not represent the optimism of every company in the micro industry. In fact, there is a contrast between macro optimism and micro operating difficulties in the insurance industry.

Chen Donghui said that although the macro outlook of the industry is still optimistic, the stage of extensive development of the industry has passed, and it is unrealistic for insurance companies to expect rapid growth with the help of the tuyere. Small and medium-sized insurance enterprises, in particular, must find areas that are very good at having their own unique advantages, or have shareholder resources, customers, and channels, or have strong technical capabilities, or good claims processing and service capabilities. always have their own characteristics in one aspect in order to be able to operate well.

Edit / lydia