When Sina received an offer to go private, its share price rose more than 10 per cent, while Weibo Corp rose nearly 18 per cent; Pinduoduo closed down 6.45 per cent, rising more than 5 per cent at one point in intraday trading; and Bilibili Inc. bucked the trend and fell more than 8 per cent.

Chinese stocks were hot on Monday and closed higher. A total of 23 stocks rose, 1 closed flat and 4 closed down in the Futuo hot Chinese stocks sector.

The specific performances of popular US-listed stocks are as follows:

Among the large-scale US-listed stocks:BABA rose 7.33%, Baidu, Inc. 7.81%, JD.com 3.01%, NetEase, Inc 2.12%, Sina 10.55%, Weibo Corp 17.97%, iQIYI, Inc. 0.50%, NIO Inc. 22.71%, TAL Education Group 1.67%, New Oriental Education & Technology Group 6.05%.

For other Chinese stocks, those who have increased significantly are as follows:Qutoutiao rose 21.10%, Momo Inc 15.68%, HUYA Inc. Live 15.35%, Autohome Inc 7.11%, Tencent Music 11.17%, Noah Holdings 15.89%, Mogu Inc 33.96%, Qudian 30.23%, Puxin 25.93%, Niu Technologies 21.15%, Finance 15.02%, Viomi Technology 11.60%.

On the other hand, the larger decreases are as follows:Bilibili Inc. fell 8.39%, Pinduoduo fell 6.45%, GDS Holdings Limited fell 1.64%, Xinoxygen fell 0.88%, ZTO Express fell 3.17%, and Toubao fell 1.14%.

Focus review

NIO Inc. rose 22.71%, the highest level since early March 2019.

NIO Inc. closed up 22.71% at $11.51 on Monday, with its share price approaching the $12 mark and a market capitalization of $13.495 billion, the highest since early March 2019.

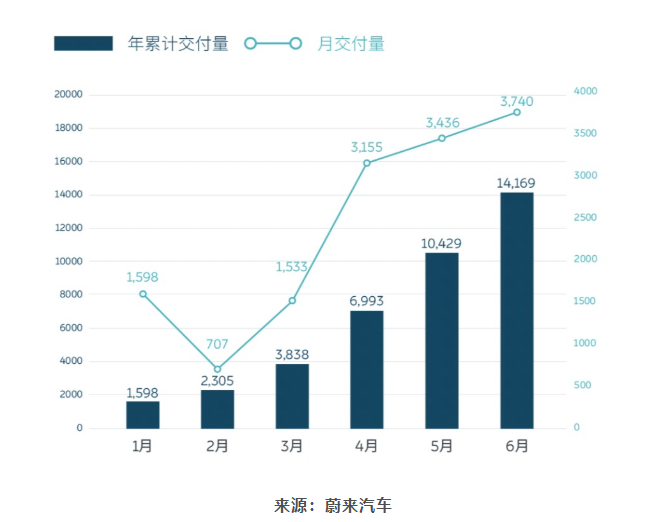

Last Thursday, NIO Inc. released delivery data for June and the second quarter of 2020. In June, the company delivered 3740 cars, up 179.1% from a year earlier, a monthly high after breaking the record in May. The company's delivery volume has risen month-on-month for four consecutive months since March.

In the second quarter of this year, NIO Inc. delivered 10331 vehicles, an increase of 190.8% over the same period last year and 169.2% from the previous quarter. This is the first time that the company has delivered more than 10,000 vehicles in a single quarter, and exceeded its previous delivery forecast of 9500 to 10000 vehicles announced in the financial report.

SinaAfter receiving the privatization offer, the share price rose more than 10%, and Weibo Corp rose nearly 18%.

On the evening of July 6, Sina announced on its official website that it had received a non-binding offer to privatize its holding company, New Wave MMXV Limited (hereinafter referred to as "New Wave"), held by its chairman and CEO, Charles Chao. At present, Sina has set up a special committee to evaluate and consider the proposal.

The price of the acquisition is $41 for US stocks, with a total price of about $2.7 billion. The purchase price per share represents a premium of about 20 per cent to the average closing price of the previous 30 trading days.

New Wave said it planned to fund the acquisition in the form of a combination of debt and equity and expected to make a final commitment when an agreement affecting the acquisition was signed. At the same time, New Wave said it is only interested in Sina outstanding shares that are not held by buyers and has no intention of selling the company to any third party.

Bilibili Inc. bucked the trend and fell by more than 8%.

On Monday, Bilibili Inc. rose more than 6 per cent at the start of the session, but closed down 8.39 per cent.

Bilibili Inc. is one of the best-performing Chinese stocks this year, up 152 per cent this year. In the domestic video market, "Aiyou Teng" was once the Big three, and now Bilibili Inc. has actually become a player in the center of the video market. Bilibili Inc., who is no longer satisfied with the secondary market in 2020, actively launched content upgrading to achieve user breakage and let the market give it the title of "Chinese version of YouTuBe".

Pinduoduo closed down 6.45% and rose more than 5% at one point in intraday trading.

Pinduoduo, which is favored by capital this year, has risen as much as 140 per cent this year, but opened low last night, rising nearly 6 per cent at one point close to the $100,000,000 mark, but ended the day down 6.45 per cent.

Previously, Huang Zheng once overtook Jack Ma on the Forbes rich list. Pinduoduo was founded in 2016, when BABA and JD.com had become "duopolies" in the market, and both were actively infiltrating offline retail. When almost everyone thinks that there is no war in e-commerce, Pinduoduo has succeeded in rising under the noses of giants. It is worth noting that after seeing the explosive growth of Pinduo, BABA and JD.com also began to bet on sinking the market, although some gains, but still failed to stop the rise of Pinduoduo.

BABA rose 7%, and the share price hit a new high.

BABA's share price opened high last night, rising more than 7%, and the stock price hit an all-time high. Prior to BoCom International issued a report, said to maintain the leading rating of the Internet industry, the first choice to buy BABA.

BoCom International pointed out in the report that the State Council requires the e-commerce platform to register cosmetics operators under their real names and assume management responsibility at the same time.

BABA continued to strengthen support for merchants, including support for foreign trade factories and assistance to farmers:

1) Taobao special edition launched the foreign trade channel, which has gathered 2000 foreign trade factories from 145 industrial belts in China.

2) sign a strategic cooperation agreement with the Ministry of Agriculture and villages to help farmers' cooperatives realize digital upgrading.

3) five major digital agricultural production warehouses and 20 + land sales warehouses were arranged during the year. At present, Guangxi and Yunnan production warehouses have been put into operation.

Edit / charliexie