Opinion polls show that Trump's approval rate has hit a semi-new low in recent years; the market capitalization of the Big four of US stocks has reached more than US $1 trillion; Pinduoduo and Bilibili Inc. have fallen 6% and 8% against the trend; NIO Inc. closed up 22%, the highest since March 19; Tesla, Inc. set a new high with a market capitalization of more than US $250 billion; and BABA surged 7%, an all-time high.

Hot news

The Hong Kong Exchange rate is strong, triggering the strong-side convertibility undertaking of HK $7.75

The continued strength of the Hong Kong dollar against the US dollar triggered a strong convertibility undertaking of HK $7.75. after the close of US stocks, the Hong Kong Monetary Authority entered the market on Tuesday morning to take a sell order of US $225 million, injecting HK $1.744 billion into the banking system, plus a total of HK $7.169 billion into the banking system after the close of Hong Kong stocks on Monday.

The A-share and Hong Kong stock markets performed strongly, with a marked influx of money into the two markets.

China International Capital Corporation: the total market value of China's stock market may double in the next 5 to 10 years.

China International Capital Corporation released his latest report on July 6, pointing out that China's capital market is undergoing a new stage of great development. It is estimated that in the next five to 10 years, China's securitization rate will rise from the current 60% to around 100% of the median distribution of different international markets. At the same time, the total market capitalization of China's stock market may double compared with the current market capitalization.

On Monday, both the Shanghai Composite Index and the Hang Seng Index refreshed their highest levels since March, declaring a technical bull market. The Shanghai Composite Index also posted its one-day gain since 2015, with the total market capitalization of A shares exceeding $10 trillion. The turnover in Shanghai and Shenzhen exceeded 1.5 trillion yuan, a five-year high.

The number of COVID-19 cases remains high, and Goldman Sachs Group downgrades the US GDP forecast for the third quarter.

Goldman Sachs Group said the increase in COVID-19 cases will limit the strong economic rebound in the United States in the third quarter.

Goldman Sachs Group's chief economist Jan Hatzius now expects US GDP to grow at an annualised rate of 25 per cent in the third quarter, down from the initial estimate of 33 per cent, mainly because of fears that an increase in COVID-19 cases in states such as Florida, Texas and Arizona will slow the pace of economic reopening.

Affected by blockades to control the spread of the epidemic, GDP in the United States fell by 5% in the first quarter, the biggest quarterly decline since the Great Recession in the fourth quarter of 2008.

Wall Street economists: us stocks may repeat the Great Depression-style slump

Gary Shilling, a prominent Wall Street economist, said the rebound in the S & P 500 was similar to its rebound in 1929, and U. S. stocks were likely to tumble as sharply as they did during the Great Depression.

The stock market could fall 30 per cent and 40 per cent next year as investors realise that it may take longer than expected for the economy to recover from the COVID-19 recession, Shilling said in an interview.

Opinion polls show that Trump's approval rating has hit a new low of nearly half a year.

A Gallup poll shows that US President Donald Trump's approval rating has fallen, the lowest since January last year. According to Gallup Poll (Gallup Poll), Trump's approval rating fell to 38% from 39% in the last poll, while the disapproval rate remained unchanged at 57%. The survey was conducted from June 8 to 30 this year, with an error rate of plus or minus 3 percentage points.

Us ISM services index rises to a four-month high

The Institute for supply Management said on Monday that the non-manufacturing index surged a record 11.7 points to 57.1 last month. A reading above 50 indicates that the industry is expanding. Economists surveyed by Bloomberg expected a median of 50.2.

The services index rebounded following the manufacturing index, indicating that the economy is recovering from the recession associated with the COVID-19 epidemic. But the recent surge in Covid-19 cases is likely to limit the pace of improvement in services, which account for nearly 90 per cent of the US economy.

"New Bond King": the rebound in the dollar and technology stocks is a "real risk" for investors

Geoffrey Ganglak, the "new debt king", believes that the "financial explosion" related to novel coronavirus will eventually lead to the depreciation of the US dollar, and investors do not pay enough attention to this risk.

Mr Ganglak said the collapse of the dollar could easily lead to the "gradual disappearance" of US financial dominance. He also said the record rebound in US stocks in the second quarter was actually driven by six so-called "Super 6" technology companies, including Facebook Inc, Amazon.Com Inc, Apple, Alphabet, Netflix and Microsoft.

"without 'Super 6', there would be no earnings growth in the US stock market," Ganglak said. There has been no profit growth in US stocks over the past five years. If you remove them, there will be nothing left. "

Bank of Canada says business confidence falls to its lowest level since 2009

Business confidence in Canada has fallen to its lowest level since the 2008-2009 recession because of slowing sales and high uncertainty about future growth, according to a survey of senior executives released by the Bank of Canada on Monday.

The Bank of Canada conducted a survey of businesses between May 12 and June 5 to assess business confidence during the outbreak. The results show that even if the provinces start to reopen their economies, many companies are still struggling with weak demand.

Review of US stocks

The Dow closed up 460 points, and the Nasdaq hit another record high.

U. S. stocks closed higher on Monday, led by technology stocks. The Dow closed up about 460 points and the Nasdaq closed at an all-time high. The sharp rise in the Chinese stock market and expectations of a strong economic recovery and a new stimulus package have boosted risk appetite.

Pinduoduo and Bilibili Inc. plummeted against the trend

Pinduoduo, which has recently reached record highs, has risen as much as 140 per cent this year, but opened high and went low last night, rising nearly 6 per cent at one point and approaching the $100th mark, but ended the day down 6.45 per cent. Similarly, Bilibili Inc. rose more than 6 per cent at the beginning of the session, but by the close, the high opening had fallen, closing down 8.39 per cent.

It is contrary to the overall trend of Chinese stocks.

NIO Inc. Automobile shares soared 22.71%, the highest since early March 2019.

Close on Monday$NIO Inc. (NIO.US) $Shares rose 22.71% to close at $11.51, nearing the $12 mark and a market capitalization of $13.495 billion, the highest since early March 2019.

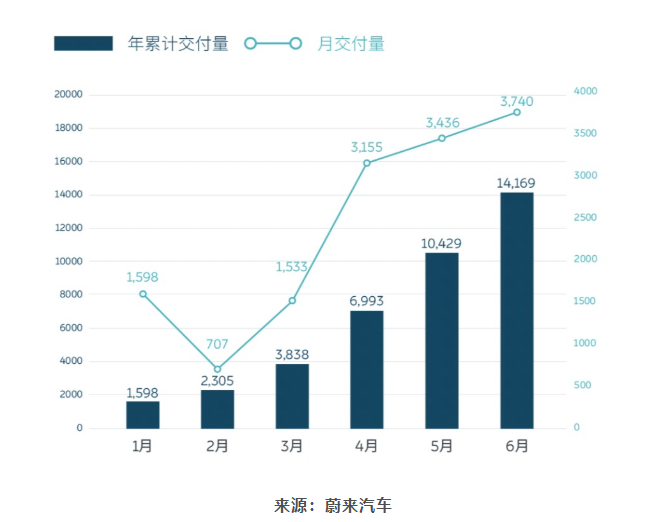

Last Thursday, NIO Inc. released delivery data for June and the second quarter of 2020. In June, the company delivered 3740 cars, up 179.1% from a year earlier, a monthly high after breaking the record in May. The company's delivery volume has risen month-on-month for four consecutive months since March.

In the second quarter of this year, NIO Inc. delivered 10331 vehicles, an increase of 190.8% over the same period last year and 169.2% from the previous quarter. This is the first time that the company has delivered more than 10,000 vehicles in a single quarter, and exceeded its previous delivery forecast of 9500 to 10000 vehicles announced in the financial report.

BABA surged 7%, reaching a record high

BABA's share price opened high and closed up 7.33%, reaching an all-time high. Prior to BoCom International issued a report, said to maintain the leading rating of the Internet industry, the first choice to buy BABA.

Sina, which has been listed for 20 years, wants to be privatized and delisted.After receiving the privatization offer, the share price rose more than 10%, and Weibo Corp rose nearly 18%.

On the evening of July sixth$Sina (SINA.US) $The company has received a non-binding offer to privatize its holding company New Wave MMXV Limited (hereinafter referred to as "New Wave") held by its chairman and CEO, Chao Guowei, according to a notice on its official website. At present, Sina has set up a special committee to evaluate and consider the proposal.

The price of the acquisition is $41 for US stocks, with a total price of about $2.7 billion. The purchase price per share represents a premium of about 20 per cent to the average closing price of the previous 30 trading days.

New Wave said it planned to fund the acquisition in the form of a combination of debt and equity and expected to make a final commitment when an agreement affecting the acquisition was signed. At the same time, New Wave said it is only interested in Sina outstanding shares that are not held by buyers and has no intention of selling the company to any third party.

Tesla, Inc. closed up more than 13% and reached an all-time high, with a market capitalization of more than $250 billion.

$Tesla, Inc. (TSLA.US) $Shares closed up 13.48% at $1371.58 on Monday, an all-time high with a market capitalization of $254.3 billion.

After Musk announced that he would build new plants outside China to expand production in Asia, Tesla, Inc. announced on Thursday that 90650 electric vehicles were delivered in the second quarter, far exceeding market expectations.

The market capitalization of the four major technology companies in US stocks has exceeded one trillion US dollars.

$Alphabet Inc-CL C (GOOG.US) $The market capitalization of parent company Alphabet returned to more than $1 trillion on Monday, reaching $1.02 trillion, marking the top four technology giants in the United States.$Apple Inc (AAPL.US) $、$Amazon.Com Inc (AMZN.US) $、$Microsoft Corp (MSFT.US) $They all have a market capitalization of more than $1 trillion, a milestone last reached before the COVID-19 epidemic in the United States at the end of January.

As of Monday's close, Apple Inc's market capitalization was $1.64 trillion, Microsoft Corp's market capitalization was $1.61 trillion and Amazon.Com Inc's market capitalization was $1.52 trillion.

Uber confirms acquisition of takeout company Postmates for $2.65 billion

$UBER TECHNOLOGIES INC (UBER.US) $It was announced that it would buy takeout service competitor Postmates for $2.65 billion, a deal conducted in an all-stock manner.

Postmates works closely with small and medium-sized restaurants, especially the most popular local restaurants, which drive users' attention to the Postmates brand. Uber said Postmates was a "pioneer" in distribution services, complementing Uber's ongoing efforts to distribute groceries, necessities and other goods.

The Prospect of Hong Kong City

There was a net inflow of 11.187 billion southward funds on Monday.

Bank of America Merrill Lynch: Shengten.com Holdings Target Price to HK $612, maintaining "Buy" rating

Bank of America Merrill Lynch issued a report saying that it will$Tencent (00700.HK) $The target price has been raised from HK $522 to HK $612, maintaining the "buy" rating. It is reported that Tencent will announce its quarterly results on August 12, and its second-quarter earnings are expected to be still driven by games such as "Arena of Valor", "PUBG" and "Game for Peace". At the same time, the corporate activities of traditional advertisers have not yet fully recovered, and advertising revenue growth may slow.

Interim income is expected to decrease by 20%, and Haidilao International Holding expects a net loss in interim results.

$Haidilao International Holding (06862.HK) $According to the announcement, the group expects revenue for the six-month period ended June 30, 2020 to fall by about 20% compared with the same period in 2019, and profit attributable to company owners who made about 911 million yuan in the same period in 2019. The group is expected to make a net loss during that period.

Geely Automobile: sales in June were 110100, an increase of about 21% over the same period last year.

$Geely Automobile (00175.HK) $According to an announcement today, the group sold 110100 units in June 2020, an increase of about 21 per cent over the same period last year and about 1 per cent over the previous month. Cumulative sales in the first half of the year were 530000, down 19 per cent from a year earlier and reaching 38 per cent of the annual sales target.

Zhongan Online's medium-term shareholders' consolidated net profit is expected to increase by more than 100%.

$Zhongan Online (06060.HK) $According to the announcement, the Group expects the unaudited consolidated net profit attributable to the company's shareholders for the six months ended June 30, 2020, to be no less than 100 per cent higher than the net profit of about RMB 94.538 million for the same period in 2019.

Focus today

Key words: Semiconductor Manufacturing International Corporation Science and Technology Innovation Board applied for new shares

Edit / Ray