There is a prestigious investor on Wall Street who is an aggressive acquirer who makes executives of American listed companies tremble, known as the "corporate predator". He did not act against Buffett in 2014 when Coca-Cola Company issued a huge amount of stock to raise funds to distribute incentives to executives; his annualized return was as high as 31% in the 45 years from 1968 to 2013, compared with Buffett's "only 20%" in the same period.

In March 2019, he ranked 61st on the 2019 Forbes list of the world's richest people with a fortune of $17.4 billion, while Soros was ranked 178th with a personal fortune of only $8.3 billion.

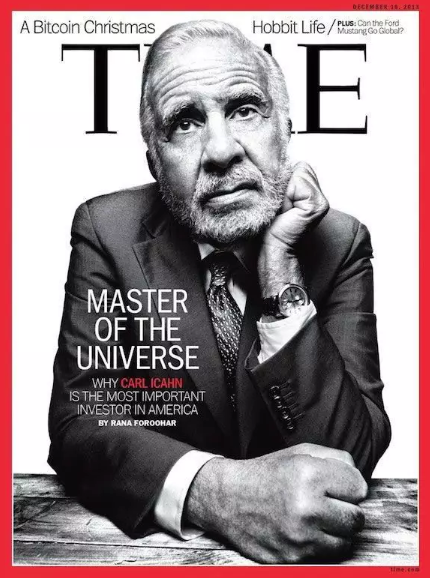

He is the famous grandfather of leveraged buyout.The real wolf of Wall Street-- Carl Icahn。

Speaking of Carl Icahn, although he is called "the most dangerous man on Wall Street" in the United States, he is not well-known at home. After all, domestic investors pay more homage to Buffett, Charlie Munger and Howard. Marx, Peter Lynch and others, many of the ideas of these great investors have indeed helped tens of thousands of investors. In addition, Soros, the financial magnate, is also quite familiar with people because of his influence in the foreign exchange market.

After watching Icahn's speech at the Yale Open course, I was fascinated by the old man's humor and wisdom, and I found his investment philosophy particularly enlightening.

The core logic of his aggressive acquisitions, he claims, is that the management of most companies is so mediocre that they only do things that destroy value.I agree with this very much. From the point of view of the work and life around me, there are too few enterprises with good management.

Next, let's take a look at Carl. Icahn's legendary investment career will bring you a lot of enlightenment.

First, he made a lot of money when he entered the market in 1961, but lost everything the following year.

Icahn graduated from Princeton Medical School in 1957 and joined the army after graduating from college. After winning $20,000 in poker, he entered the stock market in 1961, which coincided with a bull market. He made a lot of money from leveraged investment. He made more money in two weeks than his father made in two years.

At that time, when he was young and rich, he bought a cool convertible sports car and made a beautiful white, rich and beautiful model girlfriend, which seemed to reach the pinnacle of his life at once.

Unfortunately, the good times didn't last long. When the US stock market crashed in 1962, Icahn lost all his money overnight, and the beautiful model girlfriend quietly left him in his sports car.

Lose Jiangshan and lose beauty, I am afraid the most painful thing in the world is this!

The painful failure made Icahn make a profound reflection. After that, Icahn became an option investment expert, specializing in the carry trade.Since then, his investment career has entered a journey.

Second, become an expert in options trading and establish Icahn Company in 1968

After a brilliant initial battle in the stock market, Icahn understood that short-term trading was very dangerous.He thought he could take advantage of his mathematical talent, and after constant study, Icahn became the best expert on options trading on Wall Street. Using options to engage in arbitrage trading, through honest and reliable service, gradually accumulated a large number of loyal customers.

Icahn was so bold that in 1968 he borrowed $400000 from his uncle to set up Icahn hedge fund and bought a seat on the New York Stock Exchange. When doing the carry trade, he borrows a lot of money from the bank, with a maximum leverage of 10 times. Since his carry trade was almost risk-free, he began to make a lot of money, earning $1.5 billion to $2 million a year. (note: it was in the 1960s and 1970s.)

Throughout the 1970s, Icahn focused on risk arbitrage and options trading.At that time, few people on Wall Street knew anything about options, and few people did such transactions, so Icahn accumulated a lot of wealth through option trading.

Icahn's main way to do the carry trade is to buy several convertible bonds while selling short-bid stocks to hedge. The carry trade is still one of Icahn's main businesses.

Third, enter Manhattan, New York, and have a first taste of the sweetness of the acquisition.

1. Buy for the first time, double and leave the court.

Icahn made his first acquisition in 1977, targeting home appliance company Tappan. The company, founded in 1880, mainly produces ovens. Icahn bought a lot at the price of $8, hoping the company would be sold. The company CEO refused at first, after all, it is a three-generation treasure.

But Icahn soon won a seat on the board, eventually forcing the company to accept an offer from outside investors for $18. Icahn's investment of $1.4 million soared to 2.7 million, a huge gain that inspired Icahn to make aggressive acquisitions one after another.

2. 20 times the profit from the acquisition of Huimen

In 1980, Icahn moved his office to Manhattan, New York, and with plenty of money, he became more ambitious.

Icahn was keenly aware that there were opportunities for rapid development in many traditional industries at that time, but the stock prices of many companies were depressed for a long time due to corporate governance and other reasons. Therefore, if enterprises are optimized and integrated by means of capital mergers and acquisitions, there will be amazing returns.

At this time, he found a very good opportunity.

Huimen, a long-standing supplier of auto parts, was on the verge of bankruptcy. Icahn once again demonstrated his determination and raised $80 million to buy the company through his own capital and leveraged financing.

After that, McKinsey and other international professional consultants were heavily hired to provide advice on the strategy and management of the enterprise, transforming it from an extremely chaotic company that "cannot even hand in accurate financial statements" to a modern company with standardized management. A few years later, when Icahn sold it, the profit reached 20 times!

3. Move at Philip Oil Company and make hundreds of millions of dollars again

Icahn is a calm, almost cold guy who buys the company for the sole purpose of making money, and the end result always seems to be what he wants.

In early 1985, Icahn once again fell in love with an investment with a "serious deviation between fundamentals and stock prices": Philips Oil Company. The main reason for Icahn's conclusion is that the company has more than 1 billion barrels of oil reserves, and at a market price of $30 a barrel, the company's assets should not be less than $30 billion, while the company's market capitalization is only $12.6 billion.

In addition, the oil industry was growing well at that time; the whole background was even more positive. When the second oil crisis broke out in 1979, oil production plummeted from 5.8 million barrels per day to less than 1 million barrels per day, while oil prices rose from $15 to $35 per barrel. And with economic development, the demand for oil is increasing at a rate of more than 10% every year!

Such a good opportunity, of course, other bosses noticed, and Icahn did not have enough money to eat the whole Philippe Oil at that time.

Competitors soon arrived, and Icahn was forced to fight when another consortium made a bid for more than $1 billion.After the two sides kept raising the purchase price, Icahn was on the verge of collapse, and if he bought at the market price, the funding gap would be as high as $8 billion.

When Icahn was on the verge of despair, Milken, a famous financier with the title of "king of junk bonds", provided him with the means of financing, adding leverage to the limit for Icahn.

Icahn, who received the funds, further pushed the acquisition war into a white-hot situation. Soon, the competitor found that he could hardly handle it, and Icahn looked as if he was about to win.

Unexpectedly, Icahn finally chose to abandon the acquisition and sold all his shares instead.

Later, when someone asked why, Icahn smiled and said, "what is the use of Philip Oil Company?" The stock price has gone up so much! "In this short transaction of less than half a year, Icahn successfully made a profit of more than 100 million US dollars.。

Fourth, rise to fame and become the "corporate predator" of Wall Street.

Also in 1985, Icahn became famous in the hostile takeover of Global Airlines (TWA) and became Megatron's Wall Street Wolf.

At the time, Icahn found a loophole in the shareholding structure of TWA, which had just been spun off, requiring only 51 per cent of the shares to be acquired, compared with 1.1 per cent of the shares held by management, including CEO.

Icahn moved quickly, buying heavily when the share price was only $10, and when Icahn reached the disclosure threshold of 5%, Icahn raised his stake to 16% in just a few days, and Wall Street investors followed suit, and the company's share price soared to $19.

Icahn then released the news that he had no intention of controlling TWA, and the share price quickly fell back and stabilized. TWA's management sensed the crisis and filed a lawsuit in a New York court. Icahn quickly increased his shareholding to more than 52% while filing a lawsuit, completing the absolute holding.

The hostile takeover ended with a resounding victory for Icahn and his partners. In 1988, Icahn took a 90% stake in the company through a management buyout and privatized TWA. Icahn himself made a profit of about $469 million, but left the company $540 million in debt, and Icahn later sold TWA's most valuable London business for $445 million.

TWA was acquired by American Airlines in 2001, and the established airline, which was founded in 1925, has completely retired from history.

In this acquisition, Icahn is also ruthless enough to invest 80% of his total capital.

Since then, Icahn's image in the media has become a ruthless corporate predator, the media think that he does not care about the long-term development of the enterprise, only concerned about how to make profits from acquisitions and sales, and the management of American listed companies stay away from him.

However,Fortune magazine called him the protector of shareholders' rights: "believe it or not, Icahn makes more money for shareholders than any other speculator on the planet." "

In theory, after malicious acquirers enter the company, actively participate in the management of the company, sell junk assets, replace CEO, buy back shares and other means, can indeed achieve the interests of shareholders.

There are many cases of such acquisitions. Between 2000 and 2006, Icahn bought four casinos and bought Golden Nugget Hotel and Casino in Las Vegas for $300m. In February 2008, he sold it for $1.2 billion.

After Icahn bought time Warner for billions of dollars in 2006, backed by the deep-pocketed United Arab Emirates, time Warner's shares rose for six months in a row, and Icahn sold his time Warner shares at a profit of $880 million.

Icahn's targets share the same characteristics: companies with sound fundamentals but poor management and business chaos that lead to depressed share prices.

Icahn said bluntly: "people rarely realize how bad the management of American listed companies is, and most corporate CEO should get out of here!" "not only did he say so, but he did so.

From my life and work experience, Icahn's views and practices I absolutely agree that the management of most enterprises is really chaotic.

V. enter into high-tech companies in a new era

Since 2006, Icahn has targeted listed companies in the technology industry. Time Warner, Motorola, Apple Inc, Microsoft Corp, Yahoo and eBay are all his goals.

Technology stocks are usually more valued, and Icahn has rewarded handsomely after switching to hunting technology companies. His Icahn Enterprises shares soared more than 50 per cent a year, and Icahn returned more than 30 per cent in 2013.

Next, let's take a look at Icahn's masterpiece in the technology industry:

1. Take ownership of Motorola and make a profit of 1.34 billion US dollars by divesting the mobile phone business.

In 2008, Icahn took advantage of Motorola's 18% drop in sales and its share price to hover at its lowest ebb to increase its holdings for five consecutive years, eventually becoming the largest shareholder with 11.36% of its shares. After that, he strongly advocated the break-up of the mobile phone department and called on shareholders to support the four candidates nominated by him to the board of directors to form a new management team.

Motorola's share price soared. In October, Motorola sold its mobile phone business to Alphabet Inc-CL C at a 63 per cent premium. Icahn himself made a profit of $1.34 billion from the $12.5 billion deal.

2. Operate Netflix Inc and Apple Inc respectively and earn a total of more than 4 billion US dollars

In October 2012, Icahn bought a stake in NetFlix10% for $58; here's an interesting story:After Icahn bought Netflix Inc lavishly, he wanted to fire the management. At that time, Netflix Inc management took Icahn to see House of Cards, which was filmed independently by Netflix Inc, and the old Icahn immediately changed his mind and fully supported the management.

It can be seen that Icahn is not an investor who indiscriminately insults management.

Since then, the release of "House of Cards" triggered Netflix Inc's registered members to soar, and Netflix Inc's share price also skyrocketed. When Icahn sold half of the shares a year later, Netflix Inc's share price rose nearly 500% compared with Icahn's purchase price, and Icahn made a profit of more than $800m.

In 2014, Icahn reduced his stake in Netflix Inc twice, making a profit of 450 million US dollars. In June 2015, he cleared Netflix Inc's stock and made a further profit of 870 million US dollars.Icahn made a total profit of more than $2.12 billion from Netflix Inc, making it one of its most profitable deals.(since Ican cleared the stock, Netflix Inc's share price has risen by about 210%.)

While reducing his holdings and clearing Netflix, Icahn began to buy Apple Inc shares in 2013. In January 2014, after Apple Inc released disappointing results, Icahn publicly said that Apple Inc's share price was undervalued. He bought another $500m of Apple Inc shares, with a total position of $2 billion.

Icahn cleared Apple Inc's stock in April 2016, and Icahn reportedly made at least $2 billion on Apple Inc's stock. Interestingly, after Icahn chose to sell, Buffett, the stock god, began to build a position on Apple Inc and has held it so far.Apple Inc's share price has risen by about 190 per cent in the three and a half years since April 2016.

3. Become the second largest shareholder of Dell, trying to stop the founder from being privatized cheaply but failed

In august 2013, Icahn bought 8.3% of Dell's shares to become the second-largest shareholder, trying to stop founder Michael Dell from offering $24.4 billion to take the company private, arguing that the offer undervalued Dell.

Crazy Icahn even planned to raise his own money to buy Dell, although his plan eventually failed, but the success of raising Dell's share price still brought huge returns to Icahn.

4. Acquire eBay and propose to break up PayPal Holdings Inc, which was reconciled and finally successfully split.

After buying a large number of 46 million shares of eBay in January 2014, Icahn asked PayPal Holdings Inc, the payment subsidiary of eBay to go public independently, and asked Mark Anderson, a director of eBay and a well-known Silicon Valley investor, to resign.

Icahn's argument is that Anderson, who was part of the consortium, persuaded eBay to sell Skype at a low price of $2.75 billion. And during his tenure as a director of eBay, Anderson has invested in at least five companies that compete with eBay, including PayPal Holdings Inc's rival mobile payment companies Dwolla and Boku. From the point of view of directors' interest avoidance, Icahn's reason is completely valid.

The plan to spin off PayPal Holdings Inc was suspended and Icahn reached a settlement with management in April 2014, but Icahn said at the time that a future split would be beneficial. In October 2014, PayPal Holdings Inc's business was officially spun off.

In July 2015, PayPal Holdings Inc went public with a total market capitalization of US $45 billion. By November 2019, the total market capitalization reached about US $120 billion, an increase of 166%, while before the split, the market capitalization of eBay was less than US $50 billion. The spin-off listing has really realized the value of the company and the interests of shareholders.

It is clear that Icahn also made a lot of money from the deal.

VI. Force against Buffett's inaction

In 2014, Coca-Cola Company issued new shares at a discount, raising as much as $24 billion, mainly to give equity incentives to executives. As Coca-Cola Company's largest shareholder, Buffett only abstained from voting although he did not approve of the plan.

Carl. Icahn lashed out at Coca-Cola Company's stock offering plan in Barron Weekly and criticized Buffett for not voting against the company's move because Berkshire Hathaway is Coca-Cola Company's largest shareholder and Buffett is also a member of Coca-Cola Company's board of directors.

"too many board members regard the board as a fraternity or a club, where you must not criticize others. "Carl Icahn wrote," it is this unoffending attitude that contributes to the mediocrity of management. "

As we all know, Buffett has always hated giving equity incentives to senior executives. Buffett's response is: he has given up voting, but he is opposed to the plan, and he has calmly talked to the management. the equity incentives paid to management are too high and should be reduced, but Buffett does not want to "go to war" with Coca-Cola Company on this issue.

From here we can see that even a respected investment boss like Buffett will allow the management to misbehave for various reasons, not to resolutely resist the Coca-Cola Company management's practice of harming the interests of shareholders, but chose to compromise.It can be seen that at the level of corporate governance, listed companies need to improve too much!

7. How to evaluate Karl. Icahn? A greedy devil and a kind angel.

For Icahn's evaluation, the outside world is not unified:

There are not only "active investor", "activist investor" and other commendatory titles, but also "vampire", "corporate predator" and other condemnation labels.

In the eyes of his critics, Icahn is only concerned about making a profit from acquisitions and sales, but never about the development of the enterprise.

Not only that, as the board of directors often consider the issue of corporate strategy, but Icahn is concerned with short-term benefits, its improper interference is bound to endanger the long-term development of the company.What's more, Icahn sometimes hurts CEO who shouldn't have been attacked. (refer to Netflix Inc's management who almost got out of class but dodged a bullet tactfully)

The Wall Street Journal commented: "he introduces the fear of God into management to get people to do what he wants, which may be useful for quickly raising a company's share price, but it may not be the best way for a company to make a lasting profit." "

But on the other hand, Icahn is also the staunchest defender of shareholders' interests.

Icahn: "I have to start with the interests of the shareholders, and I am the largest shareholder." "

Due to the asymmetry of information, identity and power, it is impossible for scattered minority shareholders to negotiate with the existing management, and for a large shareholder who owns a majority stake in the company, it is possible to use formal procedures of corporate governance to put pressure on managers.

Therefore, objectively speaking, active investors like Icahn use their appeal to unite minority shareholders and supervise the behavior of enterprise management with the role they represent, which effectively promotes the management to focus on creating value for shareholders.

Data show that the market value of the companies Icahn has "touched" has increased by more than $50 billion in recent years, and Icahn says his actions have benefited more minority shareholders.

In 1988, Icahn said impassively at the annual shareholders' meeting of the oil company Texaco.Many people died fighting against tyranny. At least I can vote no.」

Summary:

Fortune magazine called Icahn "the hottest investor in the United States."Believe it or not, the real Icahn is a complex and versatile man-he may make more money for shareholders than any other speculator on the planet. "

The companies that Icahn "plundered" are basically enterprises with serious problems in management.Icahn transformed the management structure into a valuable enterprise by improving its management structure. This ability to turn decay into magic is exactly what those bureaucrats in large enterprises lack.

Icahn has had a profound impact on corporate governance in the United States, especially in terms of shareholder equity: prompting more and more active directors to challenge corporate executives.

So what are the implications of Icahn's story for ordinary investors?

There are two things we need to understand:

First, the management of the vast majority of listed companies are very decadent and incompetent, they are often good at drilling relationships, rather than effective management of enterprises, most CEO most often do is to destroy value rather than create value

Second, we can't be the people who control the management of listed companies like Icahn, so for most companies, the best option is to avoid.

Edit / Ray