With the U. S. stock market after a period of major adjustment last week, the U. S. stock market has rebounded for many days in a row, as of the evening of the 18th, the Nasdaq closed higher for the fourth day in a row.

On the other hand, the US-listed Chinese stocks outperformed the US stock market, with Bilibili Inc., JD.com, Futu Holdings Limited, youdao, Pinduoduo, NIO Inc. and other Chinese stocks hitting new highs. But the most dazzling of them is who he has learned from in the sound of shorting.

First, "eye-catching data" became the fuse, and the long and short sides began to play the game.

According to the financial report released by the company, the company achieved a net profit of 226 million yuan in 2019, an increase of 1050.3% over the 19.65 million yuan net profit for the whole of 2018. In the first quarter of fiscal year 2020, revenue reached 1.298 billion yuan, an increase of 382% over the same period last year, and net profit was 148 million yuan, an increase of 336.6% over the same period last year. But New Oriental Education & Technology Group online and NetEase, Inc youdao, both Internet education companies, saw only double-digit growth over the same period. By contrast, it would give us a sense of unreality to learn from the company's excellent financial data.

Such an unusual "eye-catching performance" has made many short sellers smell money, and many foreign short sellers have begun to issue short selling reports one after another, questioning who learned from the company's business data fraud. On February 25 this year, the short seller Grizzly Research took the lead in launching the attack, pointing out from whom it learned to exaggerate financial data, brushing orders and other problems.

Then, Muddy Waters (MuddyWaters Research), Citron (Citron Research), Scorpio (Scorpio VC) and Grizzlies (Grizzly Research) have joined the short selling team from whom they have learned, and a number of short sellers have issued short selling reports twice. Most recently, on June 17, Scorpio issued a short-selling report, questioning who it learned about VAT fraud. This is not surprising for anyone to learn from, because in the past five months, the company has encountered ten times of short selling, which is unprecedented.

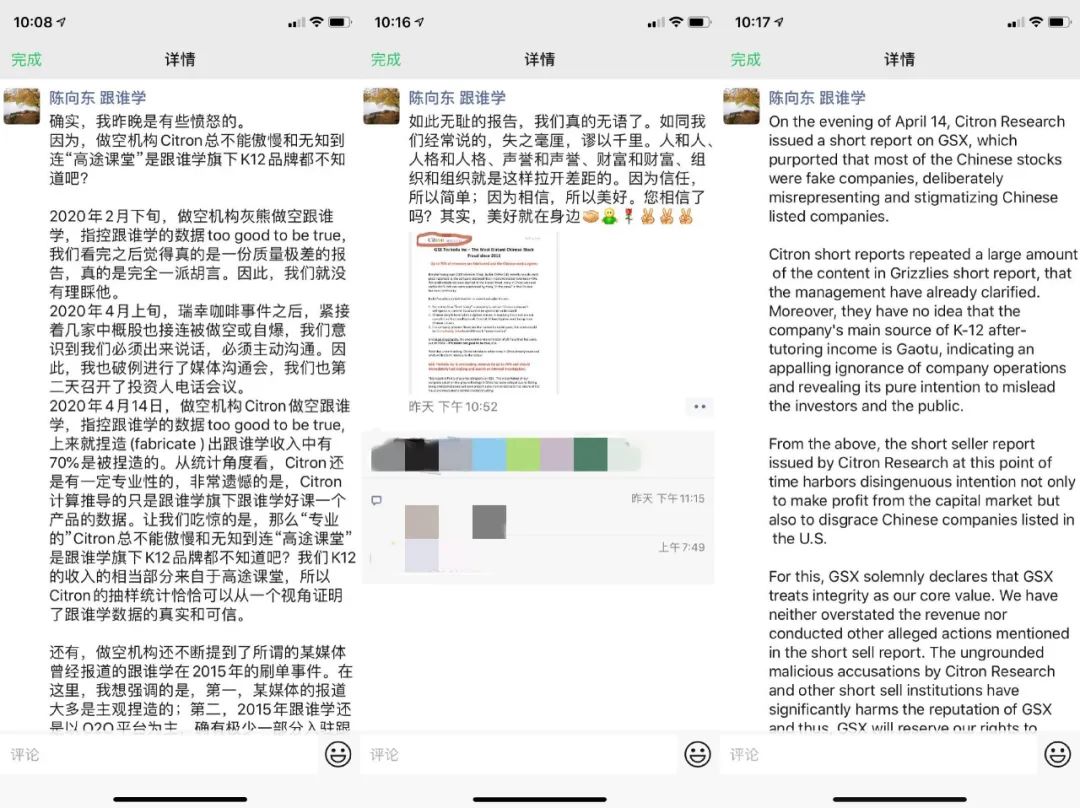

However, for these short sellers, they should not be outdone by learning from others, denouncing them for not knowing the business model they learned from, and in turn accusing them of vilifying their own companies by fabricating data and statements and carrying out P-maps. It is reasonable to follow founder Chen Xiangdong's angry response in moments, but the verbal exchange between the two sides is far less exciting than that of the capital market.

Photo: Chen Xiangdong's moments respond.

On the one hand, foreign short sellers make bearish reports and repeat the bearish propaganda on whom to learn the fundamentals on various occasions, on the other hand, they continue to increase their efforts to short whom they learn.

Figure: from whom to learn the proportion of short selling transactions

According to data from Futu Securities, the number of short-selling shares is increasing, with the proportion of short-selling rising sharply from 5.18% at the beginning of April to 16.46% at the end of May. On May 29th, the number of short selling shares had reached 39 million, while the total number of outstanding shares on the market was only 59.5154 million, accounting for nearly 70% of the total outstanding shares.

However, in the process of long-short game, there is no chance for menacing short sellers. As some investors choose "short selling", they not only bear the cost of short selling, but also need to endure the rising stock prices from whom to learn.

On June 15, the short sellers were badly beaten, and the stock price soared all the way, closing at 52.00 yuan, an increase of 20.82%.

On that day, the total number of short stocks traded on the market was several times higher than in previous days. The 20% surge has crushed countless short sellers, with many investors opting to close their positions, turn off lights and eat noodles. However, judging from the number of short shares traded on June 16th and 17th, many investors have chosen to continue to increase their short selling efforts and continue to fight against the multi-armed forces.

Figure: GSX Techedu Inc

Figure: GSX Techedu Inc

But the rally is still fierce, with the share price rising another 8.46% on June 18, reaching an all-time high of $57 per share, with a total market capitalization of more than $13.4 billion. The bulls once again succeeded in forcing short sellers, and the air force suffered heavy losses.

II. A review of Volkswagen's classic case of forcing empty space in the century.

There are similar cases in history of such a classic battle, that is, the case of Volkswagen acquired by Porsche in 2008.

The incident began when Porsche borrowed billions of euros in cash and used aggressive leverage to acquire a much larger Volkswagen company, which pushed up Volkswagen's share price to some extent. Volkswagen's valuation is higher than a reasonable level.

Volkswagen's unreasonable valuation attracted greedy short sellers, and some hedge funds began to short Volkswagen shares.

The original script followed the script of short sellers, and Volkswagen's share price plummeted from 400 euros to around 210 euros in late October due to the financial crisis and other factors. The air force wins.

At this time, however, optimistic hedge funds began to blindly attack, stepping up their efforts to short VW, making it equivalent to 12.9% of Volkswagen's total equity by selling short positions directly and derivatives.

At the same time, Porsche secretly increased its stake in Volkswagen at the same time, and by October 26, Porsche suddenly announced that it had a 43% stake in Volkswagen and an option equivalent to 31%. Porsche's control of Volkswagen's stake rose to 74.2% from just over 50% at the end of June. As a result, Volkswagen shares on the market account for only 5.8% of the total share capital, but short positions are as high as 12.9%, which means that many short sellers will not be able to buy shares to close their positions and will automatically burst their positions on the delivery date.

So to prevent a bust, all short sellers snapped up Volkswagen shares at the start of trading on October 27th, and Volkswagen's shares rose to a high of 1005 euros on October 28th, up from 210euros on the previous trading day.

It wasn't until October 29th that Porsche announced that it would settle 5% of Volkswagen stock options, declaring the epic classic close-to-air battle over Porsche. In this incident, countless short sellers suffered heavy losses, among which the famous German billionaire Adolf Merkel chose to lie on the rail to commit suicide in 2009 because of his wrong investment in Volkswagen stock.

Although many armies have the upper hand, the result is still in suspense.

Of course, compared with the Porsche short case, although the stock price trend of who has been staging a battle against the air, which is similar to the case at that time, there are still many differences in the details.

First, although many investors who learn from short sellers lose money, the "short legions" led by many famous short sellers are still very strong, many armies are not sure of victory, and investor morale has not dissipated. Some investors are even prepared to "learn from" stock prices to rise to $80-$100, so it may not be so easy to rely on a rise alone to defuse the momentum of short sellers.

Second, too "excellent" performance and institutions continue to brainwash short reports, investors who learn from the existence of fraud is already a deep-rooted impression, once from whom there is the slightest sign of fraud, multi-army will be routed. Lucky is the best example.

Maybe it's like what founder Chen Xiangdong himself said: "there are two results in shorting." One kind of company can't bear it if it is shorted nine times, and the other is that I can carry it so many times, and then I will become more and more good and make him lose money. "

As for the final outcome of this air-forcing war, it may also take time to answer.

Edit / charliexie