If your impression of the property management enterprise still lingers on the cleaning aunt in the community and the security uncle who helps to collect the express delivery, it will be a big mistake.

In the past few years, with the continuous listing of domestic property management companies in Hong Kong stocks, their profit model is gradually being recognized by the market. Both Country Garden Services Holdings and 2869.HK have quintupled their share prices in just a few years of listing.

Overlooking the European and American markets, there are leading brothers like CBRE, with a market capitalization of $20.5 billion, which has risen 12-fold in a decade and ranked 146th among the Fortune 500s in 2019.

Why on earth is this unsexy-looking industry so popular with investors? Guotai Junan Real Estate team recently released the Global Agency property depth report: knowing the Gap from the outside, starting from the analysis of the business model of the international head property management organization, it provides us with a set of mature property value-added service research methodology.

From the outside, we can see the gap, but this is also a huge opportunity for the domestic property management industry.

Top property management companies in the worldHow on earth is it served?

As the world's largest commercial real estate service company, CBRE provides property management services to owners in a variety of forms, from less involved "consultancy services" to more deeply involved "discretionary management". Owners can choose different services according to their own situation and the needs of different stages.

The first mode is property management "consultancy service". CBRE forms a "consultancy service team", which is composed of CBRE property, engineering, security, finance, personnel administration and other system departments. This model only charges a "consultant service fee". The group organizes regular consultant meetings and special meetings every month, provides systematic professional training courses as needed, and submits various documents and consultant reports on a regular basis. For the owners, the cost is low, and the added value of CBRE's brand is not reflected due to the use of the owner's own brand.

The second mode is "consultant + resident manager service". On the basis of the first model, an "overseas senior general property manager" is assigned to work on the project site (responsible for daily property management, supervising the management quality of the project, training project managers, liaising with CBRE and implementing consultancy requirements). In this model, the "consultancy service fee" is still charged to the owner, but the "salary" of the resident manager is borne by the owner.

The third mode is "plenipotentiary management". The developer entrusts the full management of the project to CBRE, whose personnel and property are determined by him, and manages in full accordance with CBRE's system, procedure and culture, which ensures that the project management is completely "CBRE model". CBRE is required to charge "management service fee", property management fee savings, left in the management office, its income will be slightly higher than the "consultancy service fee".

Below, we take the property management service of Raffles Plaza in Changning, Shanghai in 2013 as a case to deeply analyze CBRE's discretionary management service.

In fact, CBRE can achieve institutional property first, not only because of its simple property management business, but because of its one-stop service in this industry chain.

Shanghai Changning Raffles Plaza project as an example, CBRE has been involved in the development of the project, participated in the design, equipment selection, greening layout and equipment installation and other work. And CBRE will not only consult on the selection of equipment from the perspective of property management, but also consider energy conservation, environmental protection and other issues, the most important thing is to put forward suggestions and guidance from the point of view of users.

CBRE will even investigate the management fees of surrounding offices and shopping malls, give reasonable suggestions on the property management fees of the project under the assumption that the occupancy rate is 97%, and then calculate the monthly surplus according to the expenditure items of property management (salary and benefits of management staff, remuneration, insurance, outsourcing service fees, facilities and equipment maintenance fees, energy consumption, management and operation and other expenses, taxes).

In addition to providing professional property services, CBRE has also built an intelligent platform to improve quality and efficiency, using IT intelligent management system and solutions. For example, CBRE launched MRI (related database based on window query) for rental and financial accounting data, and OmniSite (internal network for customers and management) for communication interactive platform.

MRI is the first property management support software built by a management company and a software company in the world. its system module is divided into four modules: business management, supplier management, customer management, general ledger and budget. On the one hand, MRI is similar to a tracking table, providing users with a "real-time summary" of the selected property portfolio data types; on the other hand, similar to dashboards, it can provide graphical snapshots of property performance and dig deep into financial and operational data. MRI has completely rewritten its entire production line to form a more easy-to-operate version based on Microsoft Corp Windows.

After analyzing the above working mode, let's take a look at the charging mode. Or take the Changning Raffles Plaza project as an example. First of all, CBRE provides pre-consultancy services at a monthly fee of 35000 yuan, which is paid according to the actual monthly service; the service provided in the fourth quarter of 2014 is 35000 yuan per month for one quarter; the service provided in the 2015-2016 delivery period is 50000 yuan per month, and the service is expected to last for 21 months according to the delivery schedule of the project. Since then, the overall delivery of the operation period, a monthly fee of 60000 yuan.

It can be seen that the traditional property management companies take the "property management fee" stipulated by the government as the main source of income, while CBRE receives more income from consultancy service fees and management service fees.

Developers do everything.The era has passed.

In May 2019, Mingyuan Real Estate Research Institute released an article entitled "Real Estate will be split into four Industries" to explain the future of the real estate industry:

Over the past two decades, developers have always liked to do everything in the real estate industry, playing all the roles: investors, developers, operators, service providers and so on.

But in fact, the best outcome of specializing in the technology industry and cooperative development must be the investment of wealthy housing enterprises, the management of housing enterprises with strong project development and management ability, and the late operation of people with strong operational ability. each housing enterprise gives full play to its advantages to do what it is best at, so that it has the highest efficiency, the least risk, and can maximize profits.

Similar to the European and American model, all links of real estate development are jointly completed by different professional companies, and different companies focus on a refined product market according to their expertise.

In the future, China's real estate industry will also be divided into four industries, and real estate enterprises will be subdivided intoInvestors, developers, operators, service providersFour types of enterprises.

The European and American models we are talking about here include the first protagonists in our report today-- the five major banks of global institutional property:

Jones Lang LaSalle (JLL) CBRE (CBRE) DTZ (CWK) High Power International (CIGI) first Peace Davis (Savills)

Different from the highly bound situation of Chinese real estate developers and property management companies, the ownership and management rights of Anglo-American properties are completely separated, and most of them are independent economic entities that are responsible for their own profits and losses.

As the benchmark of global institutional property, the five major banks have been listed as early as many years ago, and the core of their business model is to increase the value of the property assets they manage.

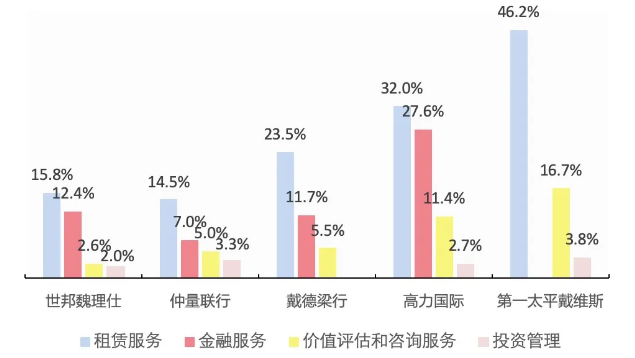

According to the financial results of the five major banks in 2018, their value-added services include leasing services, financial services, value evaluation and consulting services, and investment management. Most of the performance of the five major banks comes from high-margin value-added services.

Among them, Collier International, Savills and DTZ accounted for 75%, 67% and 41% of the total revenue, respectively.

The proportion of revenue from the four major value-added services of the five major banks of ▼ in 2018

Data source: annual report of five major banks, Guotai Junan Securities Research

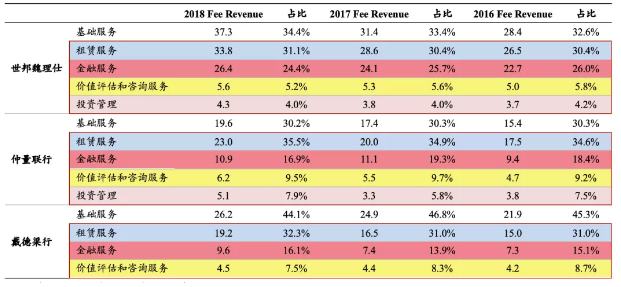

According to the analysis of the financial data disclosed by the three major banks, DTZ accounts for the highest proportion of basic services revenue, but only 44.1%, while value-added services account for 55.9%, more than half.

The performance growth of the three major banks of ▼ mainly comes from value-added services (unit: us $100 million)

Data sources: annual reports of the three major banks, Guotai Junan Securities Research.

# the largest revenue from leasing services is CBRE, which provides strategic advice and implementation on office, industrial and retail space leasing for landlords, investors and tenants.

# the strongest financial service is also CB Richard Ellis, which ranks first among the top five banks with revenue of $2.64 billion in 2018, providing financial services such as real estate sales, mortgages and structured financing services. # the largest revenue from value assessment and consulting services is Jones Lang LaSalle, which provides services for clients, including valuation, construction and housing consulting, and environmental consulting. # the largest investment management is also Jones Lang LaSalle. It reached US $530 million in 2018, providing investment management services for institutional and retail investors (including high net worth individuals) to invest in real estate and securities.

The improvement of property value is also directly reflected in the rent level. Rents for properties managed by the five major banks or consultancy services are generally higher than those for other properties.

The property management rents of the five major ▼ banks are generally higher than those of other properties.

Data source: 100 floor Jia, Guotai Junan Securities Research

Property management in ChinaStill stay in the value-addedLow stage

China's modern property management industry was born after the reform and opening up.

On March 10, 1981, Shenzhen property Management Company was officially established and began to implement unified property management for foreign-related commercial housing in Shenzhen Special Economic Zone, which is the first step in China's property management industry.

After nearly 40 years of development, China's property management industry has also formed a more obvious Chinese characteristics.

About 76% of the property management enterprises are backed by real estate developers.景。

China's property management generally exists the current situation of "who develops, who manages", which is managed by the property management company under the commercial housing developer.

According to the 2019 Research report of China's Top 100 property Service Enterprises, 76% of the top 100 enterprises have a developer background.

▼ at the present stage, the scale expansion of property enterprises mainly depends on the development of housing enterprises.

Data source: middle finger research report, Guotai Junan Securities Research

However, the property company under the developer has both advantages and disadvantages.

The advantage is that the domestic property companies with the background of real estate enterprises can take advantage of the project resources brought about by the development and expansion of housing enterprises to undertake a large number of high-quality projects, so as to achieve rapid scale expansion. The sales data of related developers of listed property companies are generally good, which can effectively protect their managed area and drive a substantial increase in performance.

In 2018, the number of enterprises with development background in the top 100 enterprises accounted for 76%. About 50% of the management area of these enterprises came from brother development enterprises, down 10% from 2017, but it was still the basic means of scale-up.

The sales data of affiliated developers of ▼ listed property companies are generally good.

Source: CRIC sales data, Guotai Junan Securities Research

But the disadvantage is that, compared with the high-margin real estate development business, property management was often regarded as a cost center by real estate enterprises, not for profit, and has been engaged in the most basic four-guarantee business (warranty, cleaning, green and security). Lack of motivation for efficiency optimization and management innovation. At the same time, property management enterprises have made slow progress in exploring diversified businesses and increasing sources of income.

90% of the income of domestic property management companies comes from basic services.

The main business of most domestic property management enterprises still stays at the low end of the property management value chain, belonging to labor-intensive services, low technical content, high staff turnover rate, lack of strict access, training and assessment mechanism.

Low added value, resulting in low profit level

Homogenized services also make the property management industry fierce competition, the net profit of the industry is still at a low level, and does not form a positive cycle from asset appreciation to rent increase.

Referring to the data of the middle index, the average net profit margin of the top 100 property companies in 2018 was only 8.2%.

The net profit of ▼ property management company is still at a low level.

Data source: middle finger research report, Guotai Junan Securities Research

Give priority to residential propertyThe space of non-residential property is gradually opened

For property management companies, the share of residential property revenue fell to 45.8% in 2018 from 59.7% in 2017, while non-residential services are on the rise.

▼ residential property services account for half of the industry.

Data source: middle finger research report, Guotai Junan Securities Research

In 2018, the listing process of property management companies accelerated, with one new A-share and five new Hong Kong shares. And five new ones will be listed in 2019.

The listing process of ▼ property service enterprises has entered an accelerated stage.

Source: WIND (total market capitalization on December 31, 2019), Guotai Junan Securities Research

At present, there are five property enterprises with a market capitalization of more than 10 billion yuan, among which Country Garden Services Holdings ranks first with HK $70.6 billion, and the top three companies with valuation are Country Garden Services Holdings (43.1x), AVIC Shanda (40.4x) and Greentown Service (40.2X). The companies in the bottom three are Lai Life (9.7x), Kaisa Beauty (17.5x) and Blu-ray Garbo (18.3X).

Real estate fission and new rivers and lakes

From the perspective of the domestic pattern, foreign property, Chinese property, and Internet giants are converging into the three most important forces.

The five major foreign banks have been in the bureau for a long time. The Asia-Pacific region is an important region for the five major banks to start their global layout. at present, the revenue of the five major banks in the Asia-Pacific region accounts for an average of about 20%.

In terms of revenue in the Asia-Pacific region in 2018, the top three were Jones Lang LaSalle ($3.25 billion), CBRE ($2.21 billion) and DTZ ($1.5 billion). The top three were Savills (33.35%), Jones Lang LaSalle (19.91%) and Collier International (18.70%).

However, like domestic enterprises, at present, the proportion of value-added services in the Asia-Pacific region is low, while that of basic services is relatively high.

Compared with the three major banks in Europe and the United States, ▼ accounts for a slightly lower proportion of value-added services and a higher proportion of basic services in the Asia-Pacific region (in US $100 million).

Data source: annual reports of the three major banks, Guotai Junan Securities Research

On the other hand, domestic industry leaders are speeding up to catch up.

Take the industry leader China Shipping property as an example. While the company continues to expand the scale of property management, it is also increasing its investment in value-added services. the company's value-added services maintain a high growth rate, and its revenue in 2019 has risen sharply by 50.7% compared with 2018 to HK $1.35 billion. Among them, the revenue of engineering services led by "Xinghai Alliance of things" and the operating platform of community assets and services led by "you Interconnection" have increased significantly. 75% of ▼ revenue comes from property management services and the proportion of value-added services is increasing year by year

Data source: company announcement, Guotai Junan Securities Research

In addition, as an important entrance to offline traffic, smart community has also become an area for Internet giants to add code one after another.

Ant Financial Services Group's Alipay smart community in 2016 and Tencent's Haina community in 2017 have been in full swing.

▼ property enterprises can seize the entrance of smart community traffic only with the help of Internet transformation.

Source: "intellectual property under the Smart Community"

At present, the overall route of AT is still an open platform, gathering the forces of all ecological parties to seize community traffic, while property companies can seize the entrance to smart community traffic only by making use of the Internet transformation for digital operation.

In the future, as more and more property service enterprises carry out cross-border integration with the help of new technologies such as Internet of things, Internet of things, big data, cloud computing, artificial intelligence, virtual reality and so on, especially with the advent of the 5G era, the development of the Internet of things will bring a more "smart" side to the intelligent community and promote the gradual transformation of China's property industry from inefficient labor-intensive dynamic output to efficient and intensive modern service mode. ▼ innovative technology can not only reduce the cost of property enterprises, but also improve work efficiency and service quality.

Data source: middle finger research report, Guotai Junan Securities Research

Edit / Edward