Source: Guotai Junan Securities Research

Author: Guotai Junan research team

Recently, a report by the people's Bank of China, "A Survey of the assets and liabilities of Urban households in China in 2019", has attracted much attention in the market.

The housing ownership rate of urban households is 96.0%, the total assets per household is 3.179 million yuan, and each household owns 1.5 units of housing.

The housing ownership rate of urban households is 96.0%, the total assets per household is 3.179 million yuan, and each household owns 1.5 units of housing.

Sets of data are valid but confusing-am I holding the country back again?

Guotai Junan real estate team saw more things from these data.

By combing through the logic behind the data and combining their previous understanding of China's real estate industry, they have come to some more valuable conclusions:

1. The average number of implied households in Beijing and Shanghai is still insufficient, and it is necessary to continue to substantially increase the supply.

2. The asset expansion caused by rising real estate prices has depressed the real asset-liability ratio of Chinese households, and the actual purchasing power of Chinese households has been slightly overdrawn.

3. The proportion of real estate assets of Chinese households is too high, which is much higher than the global average, and even higher than that of the United States and Japan. Less than 10% of investment assets need to be guided by housing speculation.

On the topic of "housing speculation", Guotai Junan macro team recently had further research.

By combing through the government work reports of more than 20 provincial-level local governments, they divide the policy orientation on real estate into six levels, so as to get a glimpse of the local government's different attitude towards the real estate market this year.

一、The average number of households in the country is 1.5.But going northward implies a shortage of housing.

Survey on the assets and liabilities of Chinese Urban households in 2019:

The housing ownership rate of urban households in China is 96.0%.

58.4% of households have one house, 31.0% have two houses, and 10.5% have three or more houses.

Each household owns 1.5 housing units.

Judging from the reported figures alone, 1.5 housing units per household seem to confirm the conclusion of the housing surplus in the market.

But if we do a little calculation, we will see that the current situation of China's housing market is not so simple.

According to the reported data:

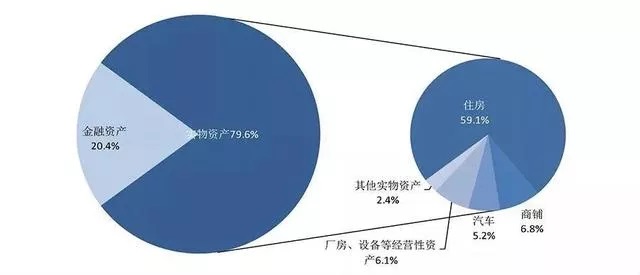

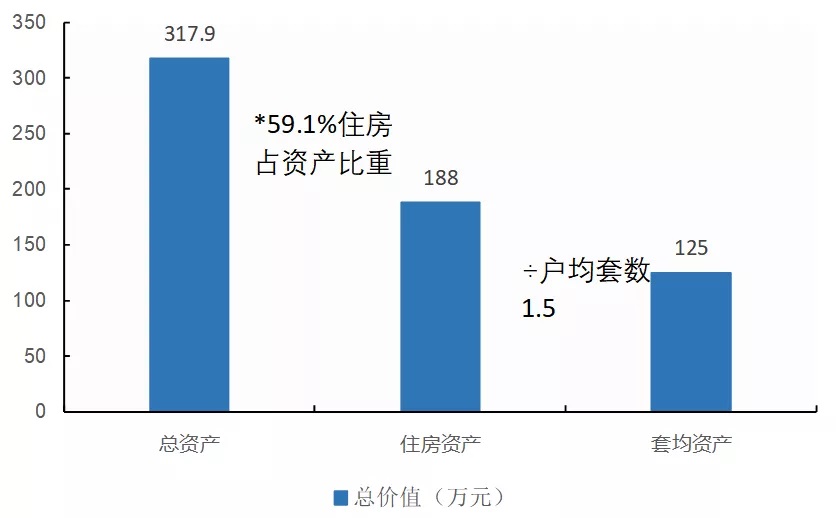

1. In 2019, the average total assets of urban households were 3.179 million yuan. Among them, household assets are dominated by physical assets, with housing accounting for 59%.

Thus, the corresponding housing assets of each household are:

317.9 to 59% = 1.88 million yuan.

Housing accounts for 59% of ▼ household assets.

Data source: 2019 Survey of assets and liabilities of Urban households in China

2. Every urban household in China has a living area of about 100 square meters.

Divide the property value of 1.88 million by 1.5 units per household, and get the value of a single house of 1.25 million yuan.

At present, the average sales price of new housing is about 10,000 yuan, considering that the location of second-hand housing is better, and some of them have a certain premium, so it is estimated that the national average housing price is slightly more than 10,000 yuan.

Therefore, the average area of a single house worth 1.25 million yuan corresponding to 100 square meters is basically reasonable.

▼ urban households across the country have 1.5 apartments, with an average value of 1.25 million yuan.

Source: central Bank report, Guotai Junan Securities Research

3. HoweverIf the situation of Beijing and Shanghai is estimated on the basis of the national average, there is an obvious deviation, and it is estimated that the total amount is still in short supply.

If the asset distribution structure of Beijing and Shanghai is the same as that of the whole country, then according to the total assets of Beijing and Shanghai are 8.92 million yuan and 8.07 million yuan respectively, the per capita housing assets are 5.28 million yuan and 4.77 million yuan respectively.

Based on the current total price of second-hand housing transactions, it is about 5.5 million yuan in Beijing and 4.5 million yuan in Shanghai.In other words, the current average number of households in Beijing is only about 0.96, while that in Shanghai is about 1.06.

▼ estimates that the average residential assets per household in Beijing and Shanghai are 528 and 4.77 million yuan, and the number of implied households is 0.96 and 1.06 respectively.

Source: central Bank report, Guotai Junan Securities Research

This data reflects two possible inferences:

1. The proportion of housing in total assets in Beijing and Shanghai is higher than the national average of 59%.

2. The average number of households in Beijing and Shanghai is much less than 1.5, maybe around 1.

We believe that the average number of implied households in Beijing and Shanghai is still insufficient and there is still a need to continue to increase supply.

二、Rising house prices lead to asset inflationThe actual purchasing power of residents is still not high.

In addition to the number of properties owned by each household, we think that the balance sheet of households in this report is also worthy of attention.

According to the report, the debt level of the national sample of urban households is 9.1%, which is lower than the 12.1% in the United States. It can be said that this is a very low level.

The asset-liability ratio of ▼ Chinese households is 9.1%, which is lower than 12.1% in the United States.

Source: central Bank report, Guotai Junan Securities Research

But the conclusion is not that simple.

According to our understanding, the stock of housing before the housing reform is about 12 billion square meters, and about 18 billion square meters will be built after the housing reform.

Debt situation of ▼ inventory housing

Source: central Bank report, Guotai Junan Securities Research

Therefore, first of all, considering that before the housing reform are basically non-debt welfare housing distribution, this part does not correspond to debt, which correspondingly lowers the level of debt ratio.

Second, the rise in the price of housing assets is the core factor in the decline of Chinese residents' asset-liability ratio.

According to the annual mortgage loan ratio, the new mortgage loan ratio can estimate the transaction amount of new and second-hand housing at about 30%, so we believe that it is the asset expansion caused by the rise in house prices, which has brought the debt ratio to 9.1%.

At the same time, if we consider that most of the non-debt houses are old public housing, although the average number of households has been high, but the quality of housing is still under great pressure, shed reform or old reform will still become a necessary means for residents to improve their living standards.

On the other hand, China's debt-to-income ratio (annual debt / annual after-tax income) reached 1.02, higher than the 0.93 in the United States, reflecting that the low asset-liability ratio is due to rising house prices.

Given that America's debt-to-income ratio is no longer too low, the fact that China's debt-to-income ratio is higher also reflects that households' real purchasing power is still low.

We believe that Chinese households also have a low asset-liability ratio but a relatively high debt income, which is most likely caused by rising house prices and does not have a very solid foundation.

▼ China's debt-to-income ratio is 1.02, which is higher than that of the United States, but the United States is also on the high side.

Source: central Bank report, Guotai Junan Securities Research

At present, however, the national debt-to-income ratio is at a safe level.

In 2019, the per capita disposable income of Chinese urban residents is 42000 yuan. Based on the sample of 3.2 people, the per capita disposable income is 136000 yuan. Calculated according to the debt-to-income ratio of indebted households, the amount of expenditure after debt service is 96000 yuan, which is at a relatively safe level.

At the same time, if the current average house price is 1.25 million yuan, we can also see the ability of Chinese urban households to buy a house again through new savings.Has been basically overdrawn, and then can only rely on the exchange to buy new property.

The ▼ debt service income ratio is in a reasonable range, but there is pressure if you consider buying new houses.

Data sources: central Bank report, National Bureau of Statistics, Guotai Junan Securities Research

III. The actual wealth of Chinese residentsSlightly overestimated

Considering the price expansion of real estate in China, we believe that most of the assets of Chinese residents are concentrated in real estate, so the actual wealth value is slightly overestimated.

According to the central bank report, Chinese households account for 72% of real estate and 59% of housing, more than half of their assets. At the same time, the proportion of investment assets is only 9.7%, which is too low as a whole.

▼ China accounts for a relatively high proportion of real estate assets and a low proportion of investment assets.

Source: central Bank report, Guotai Junan Securities Research

▼ housing accounts for the largest proportion, reaching 59.1%.

Source: central Bank report, Guotai Junan Securities Research

We have calculated the proportion of non-financial assets in various countries according to the Global Wealth report. Among them, China's non-financial assets account for about 63%, which is higher than the global average of 52% and much higher than the 36% of the United States.

If residents can invest their future new income in other types of assets, then the proportion of non-financial assets will decline significantly.

The proportion of China's non-financial assets in ▼ is too high, which is 1.4 and 1.7 times that of Japan and the United States, respectively, but the risk is not great.

Source: global Wealth report, Guotai Junan Securities Research

Therefore, in order to balance the asset allocation distribution of Chinese citizens, it must be achieved through "housing speculation".

Fourth, stable expectations are still the core of real estateThere is more room for loosening the demand for improvement.

Up to now, 29 of the 31 provinces (cities) have held the "two sessions", and their government work report is the best guide to the wind direction of real estate policy in 2020.

Taking the government work reports of these 29 provinces (cities) as samples, the macro team of Guotai Junan analyzed the statements of real estate policies of various provinces (cities), and we can see that six echelons have been formed from tight to loose:

1. The strictest echelon: emphasize and reiterate that "housing is not speculation"-Beijing, Hunan, Zhejiang, Jilin, Shanxi.

The strictest echelon of ▼: 5 provinces (cities) only emphasize "housing without speculation"

Data sources: provincial government work reports, Guotai Junan Securities Research

2, the second echelon: emphasize "housing speculation", and mention "three stability" (stabilize housing prices, stabilize land prices, stabilize expectations)-- Shanghai, Ningxia, Hebei, Hainan, Jiangsu.

▼ 5 provinces (cities) emphasize "housing speculation", and also put forward the "three stability" (stabilize housing prices, land prices and expectations)

Data sources: provincial government work reports, Guotai Junan Securities Research

3. Loosening echelon: only emphasize the "three stability"-Fujian, Hubei, Jiangxi, Chongqing.

The four provinces (cities) of ▼ only emphasize "three stability".

Data sources: provincial government work reports, Guotai Junan Securities Research

4. Big flexibility of loosening: emphasizing differential regulation and implementing policies based on cities-Guangdong, Anhui and Gansu.

The three provinces (cities) of ▼ emphasize differential regulation and implementation of policies based on the city.

Data sources: provincial government work reports, Guotai Junan Securities Research

5. Big room for loosening: only emphasize "steady and healthy development"-Henan, Guangxi, Inner Mongolia, Liaoning and Xinjiang.

▼ 5 provinces (cities) "stable and healthy development", etc.

Data sources: provincial government work reports, Guotai Junan Securities Research

6. Real estate is not mentioned: Guizhou, Shandong, Tianjin and Tibet.

If we add the first two categories together, emphasize that "housing is not speculation" a total of 10 provinces (cities), defined as loose space is relatively limited, it accounts for 32%.

Taken together, the remaining four categories account for 68% if there is more room for loosening real estate policy.

In other words, there are 21 provinces and cities, nearly 70% of the provinces (cities) have room for loosening their real estate policies.

Therefore, we believe that although the central level will maintain the tone of "housing speculation" in 2020, there is more room for loosening at the local level. In addition to relaxing the financing policy of developers, policies to support and improve demand may be introduced at the local level.

However, it should be noted that as Beijing, Shanghai and other benchmarking provinces (cities) belong to the emphasis on "housing speculation" list. Under such circumstances, it is difficult for policy loosening at the local government level to produce a demonstration effect similar to that of the 2014-2016 round of house price increases.

Edit / Jeffy

城镇居民家庭的住房拥有率为96.0%、户均总资产317.9万元、户均拥有住房1.5套……

城镇居民家庭的住房拥有率为96.0%、户均总资产317.9万元、户均拥有住房1.5套……