Source: Sina Finance

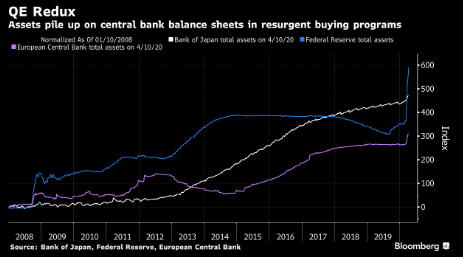

In the latest wave of asset purchases, the central bank's balance sheet expanded to record levels, raising questions about how far the "expansion" can go and whether these assets can be sold back to the market.

In the decade after the financial crisis, policymakers were unlucky to cut their portfolios aggressively. Today, the epidemic has put unprecedented pressure on government budgets, companies in various industries are under threat of bankruptcy, and they have to provide funds again.

"the strength of the central bank's asset purchases shows how much support the economy needs to provide when the economy shuts down," said Torsten Slok, chief economist of Deutsche Bank. Looking back on how long it took to shrink the table after the financial crisis of 2008-2009. Now, central banks are buying assets many times faster than they did then. "

Central banks of the Group of Seven countries bought a total of $1.4 trillion in financial assets in March, nearly five times the previous monthly record set in April 2009, according to an analysis by Bloomberg Economic Research. Analysts at Morgan Stanley estimate that when the dust settles, the balance sheets of the Federal Reserve, the European Central Bank, the Bank of Japan and the Bank of England will collectively expand by $6.8 trillion.

The Fed took the lead, promising unlimited purchases of Treasuries and mortgage-backed securities and providing trillions of dollars in further loans to companies and municipalities through temporary debt purchases. In the week ended April 15, the Fed's balance sheet expanded at a rate of about $41 billion a day.

Central banks in the eurozone, Japan and England, which are no strangers to QE, are also accelerating asset purchases, while Canada, New Zealand and Australia have joined the QE camp for the first time, including Sweden, one of the smaller economies. There are even rumors that some emerging markets, such as Thailand, may be involved.

"they are all moving in the same direction," said Aditya Bhave, an economist with Bank of America Corporation. At some point, unconventional easing will no longer be unconventional. "

In the coming months, as market liquidity is replenished, monetary authorities will focus on keeping borrowing costs low, boosting economic recovery and making it easier for governments to finance their budgets. While this may involve a slowdown in the pace of asset purchases, it certainly does not mark a reversal. As a result, the substantial expansion of the balance sheet will continue to move forward.

Edit / Jeffy