"value center" is the most classic and basic method of value investment, and it is also the first mode that value investors should master. Let's first summarize its core operations:

The core of value investment is very simple, which is to earn money for the growth of enterprise performance. If the expected return on your investment is 20%, then the easiest way is to find a company with a 20% growth and a reasonable valuation, no matter how the stock price fluctuates, Buddha holds shares, and let market forces eventually push up the stock price by 20%. Sitting on 20% profit is Buffett's core approach.

But because the short-term volatility of the stock market is too violent, and no one can guarantee that his research conclusions are accurate, even Buffett is constantly looking for such trading opportunities to buy at low prices and sell at high prices. So there are two basic methods of "value hub":

1. If the fluctuation is within a certain range, we will ignore it and safely make money for performance growth.

2. When we go outside the scope, we will first cash a sum up, in order to improve the efficiency of the use of funds, increase positions downwards, and use high positions to increase earnings.

Retreat can defend, earn the money of performance growth, enter can attack, earn the money of valuation change.

The "value hub" approach is only suitable for white horse stocks whose growth rate is relatively stable and stable within the normal growth range of 25%. But even if this stable company has been held for a long time, you will always encounter the following two situations:

First, break through the value range, you sell all the way, the stock price all the way up without looking back, what to do?

Second, what if you buy all the way down and the stock price falls all the way after breaking through the value range?

These two key issues are "nightmares" that almost all value investors are likely to encounter.

The market of individual stocks whose performance has changed.

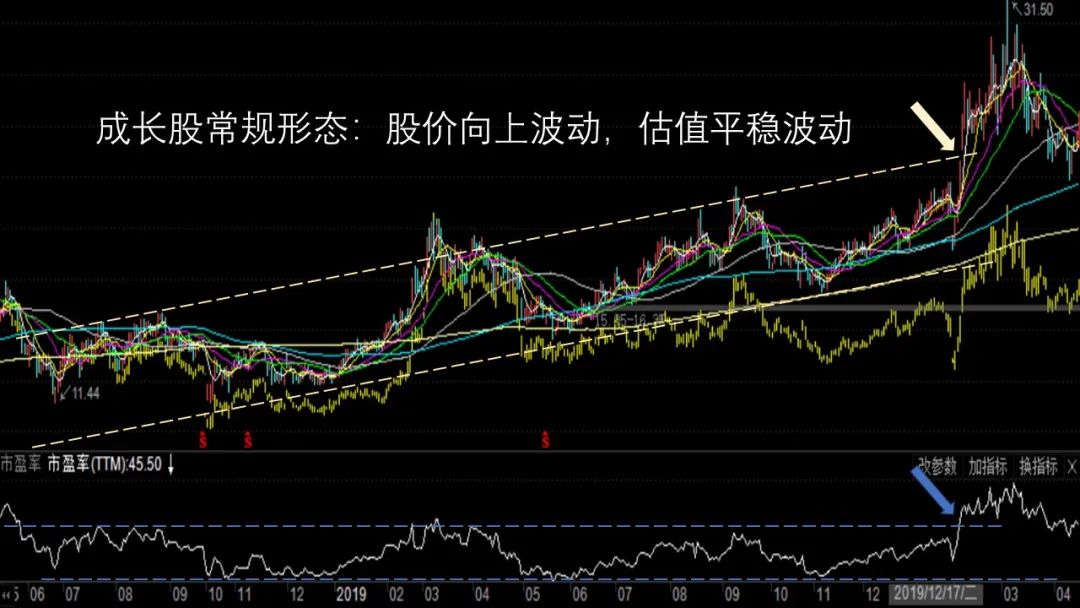

A white horse stock with steady growth in performance, while its share price rises, its valuation (PE) fluctuates within a reasonable range.The sharp rise in share prices is often a breakthrough in the valuation range.

For example, Halo New net, before this market, the emotional highs and lows of PE\ were 46 and 32, but after the Spring Festival, the emotional peak of 46 times PE was broken, reaching a peak of 54.

According to the operating rules of the "value hub", we have already reduced some of our positions in high positions to cash in profits before the breakthrough. So at this time our position has been reduced, we can calmly think about the next step, observe and analyze what internal changes have taken place in the fundamentals of the stock.

Generally speaking, there are two possibilities for a valuation (PE) to break through the normal range:

Stock A quotation: substantial changes have taken place in the company's operation, or changes have taken place in the market's perception of it.

Sector B: the market heat of the sector where the company is located has changed.

These two situations are very different. If the increase of the company far exceeds that of the plate and does not drive the whole plate up, it can be judged as A (individual stock market), otherwise it belongs to B (plate market).

First, look at the "individual stock market", which can be divided into two situations:

a. Recent performance (or expected performance) has changed, usually before and after the release of the performance forecast.

b. Near-term results will not change, but investors' understanding of the logic of medium-and long-term development has changed, such as the introduction of Gaoling Capital into Gree shares last year, which led to a rise in its valuation.

If subdivided, "a performance change" can be divided into two situations:

A (1) one-time performance impact

A (II) ongoing performance impact

Okay. Let's see how to deal with it-- do you want to keep your stake or sell it?

Before we do anything, we should recall:

Two principles of buying: logical and reasonable valuation (both are valid)

Three principles of selling: the logic has changed, it is more expensive or better (one of the three is OK)

Since it is a "principle", all our actions should at least not be in serious conflict with it. Take the basic rule of "value center" as an example, "hold all the way in the range, neither buy nor sell". This rule is not a slap on the head, but because the stock price is in the range, if the company's operating logic does not change, it will trigger neither the buying condition nor the selling condition.

With these two sets of principles, let's analyze the sharp rise in stock prices caused by the "a (1) one-time performance impact". How on earth should we operate?

Buying must be wrong, because an one-off effect doesn't change the logic of the stock price, nor does it make it cheaper.

Does it need to be sold? At this point, it is indeed possible to trigger the last two "too expensive" and "better" in the "sell three principles".

First, is it too expensive? In the absence of continuous changes in performance, whether the current price is too expensive depends entirely on your study of the certainty of the stock.

If it is a company with strong certainty, such as most consumer white horse stocks, then the so-called too expensive may not be calculated until the valuation is very outrageous; but if it is not so certain, it may exceed the all-time high valuation (not stock price, but PE) by more than 10%. It may be judged to be too expensive.

Second, do you have anything better? This is a very likely condition for reducing positions or selling. For example, you were bullish on a stock before, but because you never had the money to buy it, then you can trade your stock that is a little expensive for the stock you like and have no money to buy.

Let's look at the second case, "a (2) continuous performance impact".

Also review the "buy two principles"-logical and reasonable valuation (both are established), the requirement to build a position is "reasonable valuation", then the requirement to increase the position is "cheaper", why is the price rising, but "cheaper"?

Because of increased performance and sustainable growth, it usually triggers simultaneous upward fluctuations in valuations, which is what we call the "Davis double click", the second in this series of four major profit models.

Review the basic principle of "growth plus position": with the elimination of uncertainty, increase the position while the stock price rises, buy while rising, so that the position always matches the certainty.

But "increase the position" is the basic method, specific at what price to increase the position, how much, or to adjust the valuation range, if the rise of the reasonable valuation range exceeds the increase of the stock price itself, that is, "the more rise, the cheaper". You should increase your position.

In the Yanjin store in the picture below, in the first quarter when GDP fell 6.8%, the forecast results actually increased by 75% Murray 110% compared with the same period last year, greatly exceeding the market's most optimistic expectations, so the stock price continued to give a limit after a big rally.

If the current actual EPS (TTM) is calculated based on the median of the forecast results in the first quarter, the actual TTMPE has dropped to more than 50 times, and after the stock price has soared by 50%, the valuation has returned to the range of historical valuations. This is the charm of growing stocks.

However, if you use the previous reasonable valuation range, this position can not be bought, and if it goes up again, it will be sold, and exactly what price is suitable for buying depends on whether you need to adjust its reasonable valuation range.

The reason why we should consider adjusting the reasonable valuation is that not only the performance of Yanjin store has changed, but also the growth logic may have changed, the latter is "situation b"-investors' understanding of the long-term development logic has changed.

The market of individual stocks whose valuation has changed.

In the past, Yanjin's main products were snack foods such as dried bean curd preserves. Snack food in the food and beverage sector is not a particularly good track, because the industry barriers are not very deep, the competition is very fierce.

The core logic of Yanjin store is the category breakthrough-the category that led to a big increase in performance is the medium shelf life bread, that is, using bread with a shelf life of about two months to achieve the taste of bread with a short shelf life of seven days.

As a matter of fact, PICC bread is a new category between short-guaranteed bread and snack food. it not only pays attention to the taste of snacks, but also can be used as a staple food. Therefore, it is a category between mass consumption and snack food, and the difference between these two categories is at least 5-10 times PE, especially under the influence of the epidemic, the leader of mass consumption is sought after by the market.

So the key to valuation depends on how you position the new category of PICC bread.

If you still think of it as snack food, the current valuation level is too high, it is like the market gives you a buy one get one free gift package, then you should cash it, let alone buy it back at a high position.

But if you agree with the logic that the market now sees it as mass consumption, you should buy back the positions you have sold.

The above is the stock price break through the valuation range caused by the two individual stock prices, and finally analyze the stock price breakthrough caused by the "plate market" (case A), as is the case in the previous article.

Stock price breakthrough caused by plate market

Before this market, the emotional highs and lows of PE on Sinnet were 46 and 32. After the Spring Festival, the emotional peak of 46 times was broken, and the highest was 54 times. (the most reasonable valuation method for IDC enterprises is EV/EBITDA, but in the short term, you can use PE to observe the valuation range and then correct it. )

But in the first few days, instead of immediately increasing the range, I first reduced some of my positions, then analyzed the changes and thought about the next step, because the logic of the halo itself relative to other stocks has not changed. but the market's view of the sector as a whole has changed.

Because of heavy assets, long investment cycle and inflexible performance, IDC enterprises are not in line with the mainstream aesthetics of institutions. In the past, the market often did not regard them as technology stocks, but foreign investors who pay attention to the certainty of profitability prefer to buy.

But the rise of cloud office after the epidemic. Let everyone realize that IDC, as a network infrastructure construction, plays an important role as a "new infrastructure" in the entire technology stock market. The burst of 5G traffic makes the performance certainty of IDC better. In addition, due to policy regulatory factors, there is a supply bottleneck in this industry, which is likely to enter an ultra-long business cycle.

This is the reason for the surge in cloud computing companies, and the market is beginning to be optimistic about the valuation of the IDC industry. Therefore, although the short-term performance of Sinnet will not be affected, the valuation has broken through the original range.

Therefore, after seeing the market's view clearly, I judged that the valuation range as a whole would rise to a higher level, and did not continue to reduce positions in the rise, but slowly added back the positions that had been lost later after falling to the lower edge of the new valuation range.

It is worth noting that based on the rise in sector valuations, the stock price is often not as strong as the rise based on its own performance and logic, and there is a good chance that it will be bought back at a lower price (but not necessarily lower than your sell-off price at that time). So you don't have to chase it up.

Dare to buy back the stocks that have been sold

Review several fundamental changes in the upward departure of the stock price from the normal valuation range:

Stock A quotation: substantial changes have taken place in the company's operation, or changes have taken place in the market's perception of it, which can be divided into:

A.a. Recent performance (or expected performance) has changed, which can be divided into:

A.A. (1) one-time performance impact

A.A. (2) ongoing performance impact

A.b. Near-term performance will not change, but investors' understanding of the logic of medium-and long-term development has changed.

Sector B: the market heat of the sector where the company is located has changed.

Under normal circumstances, the "value hub" is empirical data, making money for performance growth, and cutting off a handful of leeks from retail investors chasing the rise and fall; but when the fundamentals change, the competition is your understanding of the fundamentals of the company and your judgment of market trends. insight into the behavior of other participants in the market.

In the "value hub" model, it is not exactly "buy and sell", but "adjust the position", because a good company needs to hold for a long time, and the adjustment of the position is only to grasp the initiative of capital and opportunity.

Therefore, we must face the problem of mentality adjustment of "selling out".

As mentioned earlier, when the stock price breaks through the original reasonable valuation range, we'd better sell some of our positions to cash in profits, but the problem is that if we sell off, most non-professional investors are reluctant to buy it back above the selling price.

It is called "cost anchoring psychology" in investment psychology. Retail investors can put up with a 10% hold-up, but they cannot accept the operation of "selling for 50 yuan and buying for 55 yuan." they think that they have "suffered a loss", even if they are bullish, they must wait until the stock price falls below the previous selling price before they are willing to start again, and just watch the Daniel stocks they have studied painstakingly go away and never look back.

This mentality will also lead to another bigger evil consequence, in order not to let oneself regret in the future, simply do not go to high cash part of the profits, and to find themselves a "long-term shareholding" reason. In fact, most of the gains are not supported by fundamentals and will fall back and waste the money given to you by Mr. Market.

Do not pay attention to the temporary gains and losses of a single stock, but to make the risk-return ratio of the entire position of the account in a most reasonable state in order to make a long-term stable profit.

So, no matter what your purchase price is at that time, when we re-understand the logic of a company, we should treat a new company like a new company, not "anchored" by historical costs, and bravely buy the stock back at a higher price.

If this is a company that can take three years, why should you care about losing 10% of your profits?

Edit / Ray

1、如果波动在一定幅度范围内,我们就置之不理,安安稳稳地赚个业绩增长的钱;

1、如果波动在一定幅度范围内,我们就置之不理,安安稳稳地赚个业绩增长的钱;