Source: 36Kr Holdings

Author: Peng Qian

BABA logistics army "expansion" or towards the closure of the network.

According to sources, BABA plans to acquire at least 10 per cent and up to 15 per cent of Yunda Holdings Limited (hereinafter referred to as "Yunda"). Rumors of the acquisition spread like wildfire, and Yunda's share price soared. BABA hopes to buy shares from Yunda's powerful shareholder and founder Nie Tengyun and Chen Liying, who hold 52.19% of the shares, according to people familiar with the matter. At current market prices, the shares Ali wants to buy are worth at least 6.7 billion yuan.

At present, neither side has made a clear statement on this matter. However, if the above rumors are true, five of the six major private express companies (Shunfeng, Shentong, Yuantong, ZTO Express, Yunda and Best) will be incorporated into the Ali system, and only Shunfeng will be on its own.

In the past two years, BABA has had an affair with Yunda several times. Many people in the logistics industry told 36Kr Holdings: "BABA's acquisition of Yunda shares can be heard several times a year." Although the alliance between the two has not been decided, the industry unanimously believes that it is "sooner or later".

BABA's intention to take Yunda is not only the last piece of its logistics map, but also its strategic response to its old enemy. Not long ago, JD.com quietly set up Public Mail Express, Pinduoduo or reached a strategic cooperation with the "outsider" Polar Rabbit, and the first shot in the e-commerce logistics war in 2020 has already begun. In addition to e-commerce, express companies are also surging undercurrent, Shunfeng, Tongda department have shown the trend of expansion, intended to absorb more e-commerce.

Can the gossip come true?

BABA's logistics plate is co-ordinated by Cainiao Logistics. The six years after the establishment of Cainiao can be divided into two stages: the period of BABA CPO Tong Wenhong and the period of BABA CEO Zhang Yong.

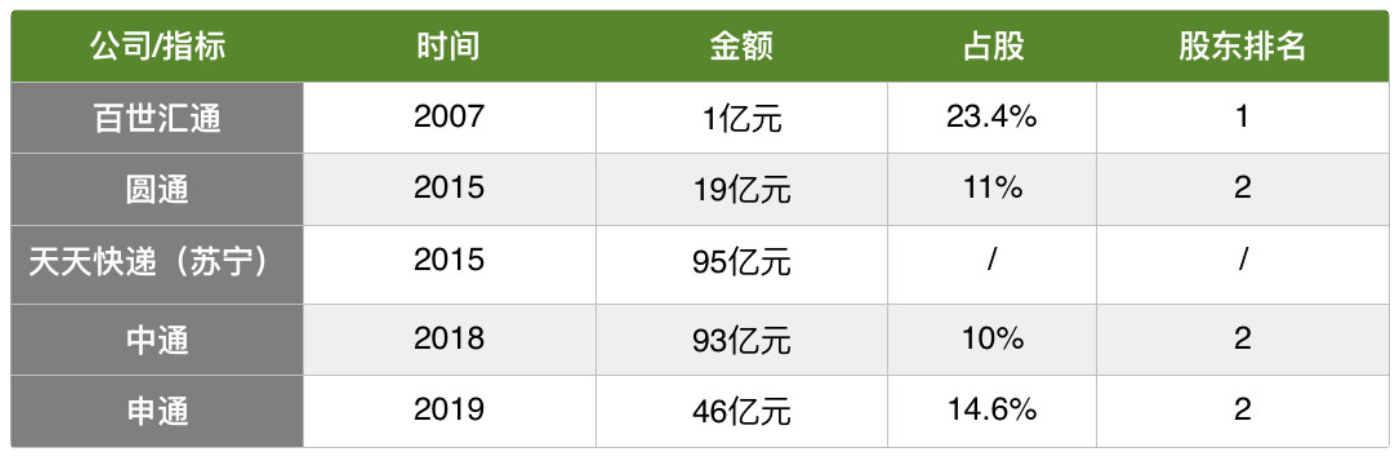

A person in the logistics industry once told the media: "Tong Wenhong attaches great importance to business cooperation, Zhang Yong capital integration, with a different focus." When Tong Wenhong was at the helm, the rookie decided to build a "warehouse intelligent backbone network" and open the entire logistics system to the society. After Zhang Yong took over, BABA Logistics officially started capitalization operation, deepening ties with major social logistics companies by way of shareholding. From the shareholding ratio, we can see that BABA does not seek absolute control over the logistics company, but to build an alliance contract of business ecology.

BABA's logistics investment layout, data from major company announcements, drawing: 36Kr Holdings

Note: Yunfeng Fund and BABA hold 29% of the shares, while Cainiao and BABA hold 17.63% of Yuantong.

But this also makes BABA's control over the logistics company in which he bought shares is limited, and it is difficult to maintain stability and unity in the logistics efficiency and service quality of the access department, especially when it comes to the epidemic, this defect is rapidly magnified. Until March, there were still a large number of merchants holding orders but could not deliver, which greatly affected the turnover of the platform and hurt the user experience.

The epidemic fully shows the important role of logistics support capability in the future market competition in the field of new economy. JD.com and Shun Feng, which are mainly self-employed, have played a great advantage in this epidemic, but SF has not yet been able to convert a large number of e-commerce parts, while JD.com can directly channel into the e-commerce platform and separate some orders from Taobao and Pinduo. To this end, BABA will still accelerate the capital layout of the logistics industry to form an effective moat to suppress its e-commerce competitors.

BABA has a strong desire to unify the world, but why has he not been able to include Yunda for a long time?

The success of the acquisition mainly depends on Yunda's attitude. 36Kr Holdings learned from sources close to the logistics industry that although it has the attributes of a family business, Yunda has always been the healthiest in the Tongda department, with good profits and cash flow.

On the face of it, Yunda's 2019 results show that its income does not increase profits. According to KuaiBao's 2019 performance, Yunda business increased by 149.89 per cent year-on-year, while net profit fell 1.57 per cent compared with the same period last year. However, the stagnant profit growth is related to the clean-up of Fengnest shares, and excluding this factor, the net profit of shareholders belonging to the city company increased by 17.68% compared with the same period last year. Even compared with other players in the camp, Yunda's profitability is in the forefront. In 2019, Shentong's net profit decreased by 30% compared with the same period last year, and Yuantong's net profit decreased by 70% year-on-year.

Fierce competition and the sudden attack of the epidemic may change Yunda's attitude.

The round of "price war" is coming to an end. If it is strategically bundled with BABA at this time, Yunda will be able to complete a beautiful ending and get more help in the fierce market competition. What's more, "Capital is now coming in in large quantities, and peers want it, and out of strategic considerations, they will also consider it." A source close to Yunda told 36Kr Holdings.

With a bad start to the new year, Yunda's demand for the introduction of external forces has greatly increased. Affected by the epidemic situation of COVID-19, the express volume of Yunda shares decreased significantly. Data show that in February this year, the revenue of Yunda express service industry was 897 million yuan, down 26.48% from the same period last year; the number of completed business was 297 million, down 13.41% from the same period last year; and the single ticket revenue of express service was 3.02 yuan, down 15.17% from the same period last year. In addition, since the end of 2019, Yunda's market share has almost stagnated, so it is urgent to find new incremental exports and deepen cooperation with BABA, which may be able to obtain more flow and resource tilt.

Not to mention the symbiotic relationship between the two sides. At present, 70% or more of the business volume of the access department comes from e-commerce. Although Pinduoduo is rising fiercely, more of the single volume still comes from BABA and has a strong dependence on BABA. The Department of access lacks relevant resources and is faced with the dilemma of two-front operations: to seek new business increments on the one hand and to maintain the market stock on the other. There are not many partners to choose from. Shun Feng and JD.com both form a school of their own, each has a strong logistics system, especially SF has a direct competitive relationship, there is no more room for cooperation, collective hug BABA has become the best choice.

A new threat is that if Pinduoduo distributes most of the single quantity to polar rabbits, the access system will inevitably be affected, and clinging to BABA will also be a strategic defense.

In addition to the consideration of single quantity, the access Department also attaches great importance to BABA's data ability. Shunfeng has the main advantages and more single volume offline, while the access system mainly lives on e-commerce components, so they have a strong desire to build an intelligent logistics system, and their dependence on Aliyun is gradually deepening. processing data accumulated through electronic orders.

Where is the competition in the industry going?

Under the fierce competition, the situation of the express delivery industry is becoming more and more complicated. Coupled with Pinduoduo bundled with Polar Rabbit, domestic express has shown a quadrupole pattern: Ali system, Jingdong system, Shunfeng system and Panduo system.

Under the newly released quadrupole pattern, BABA, who is constantly expanding the logistics territory, JD.com, who depends on Zhongyou and Jingxi, and Pinduoduo, who has brought in foreign aid, will all increase the competition for e-commerce parts in the express delivery industry. In fact, even SF, which does not make a living by selling goods, is extending more tentacles into this field. In October 2019, Shunfeng reached a cooperation with Vipshop Holdings Limited's Pinjun Express to replace Pinjun Express to provide distribution services to Vipshop Holdings Limited to make up for its shortcomings in the field of e-commerce parts. In addition to business adjustment, Shunfeng is also snatching e-commerce parts by reducing customer unit prices and other forms.

All sides are ready to go, but it is hard to say who will win.

Various disadvantages of the crowdsourcing model broke out during the epidemic, but BABA still has no signs of spending money to build its own logistics. It hopes to stabilize the positioning of the "operating system": what the rookie needs to do is to cooperate with the Tongda department to establish an intelligent logistics backbone network to ensure 24-hour basic services across the country and 72 hours around the world, so as to minimize operational efficiency and save costs.

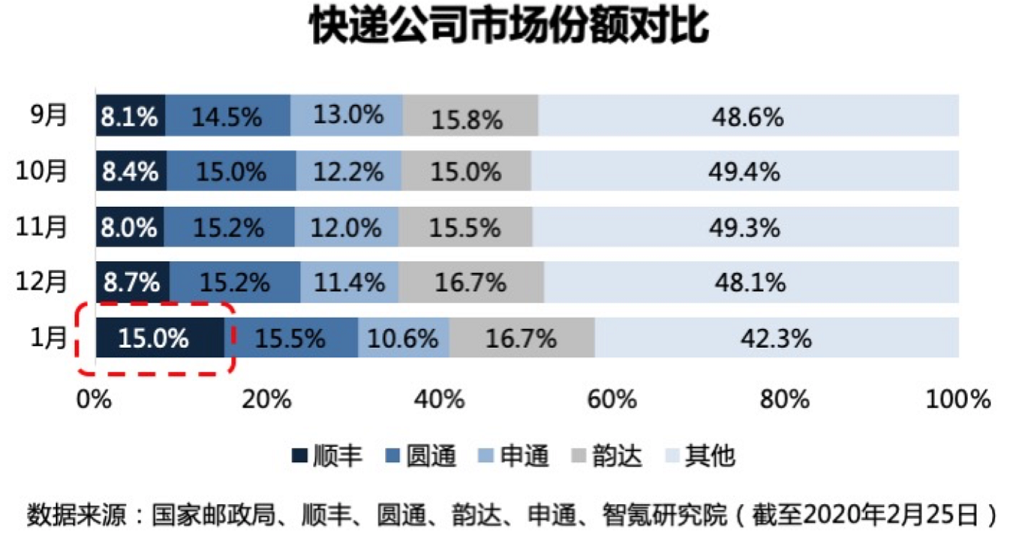

However, Tongda is now facing the comprehensive attack of public mail express delivery and extreme rabbit, and its market share has also been eroded by Shun Feng. During the epidemic, Shunfeng's market share almost doubled, while Tongda declined to varying degrees, especially in Zhongtong. Under the existing model, if Ali wants to firmly grasp the access system, the investment is not enough, to improve the sales and volume of e-commerce business in order to maintain the morale of the army.

The market share of the major express companies has changed. The picture is from Zhi Krypton Research Institute.

The unit volume and sales volume of JD.com e-commerce has obviously lagged behind BABA, and logistics has become an important battle. At present, JD.com is an e-commerce player with relatively complete logistics-- there are not only self-operated JD Logistics, Inc., but also crowdsourced mass mail delivery, and also crowdsourced Dada. The attack of the epidemic has pushed JD Logistics, Inc. to a new level. The emergence of public mail makes the layout of JD Logistics, Inc. in the country gradually clear: JD.com Mall is the diversion of JD Logistics, Inc., while Zhongyou and Jingxi sink together, forming a combined boxing effect.

The logistics potential energy accumulated by JD.com over the years has been able to grow rapidly in a relatively short period of time. At present, Zhongyou Express has more than 180 distribution centers, more than 1500 trunk lines, more than 4700 vehicles and more than 10000 tripartite cooperation outlets, basically achieving 99% of the country's level 4 address coverage, and has become a mature express delivery enterprise.

Spending a lot of money on self-logistics, JD.com is not content to do his own business, external merchants, personal parts, and truckload of goods are all its goals. Since opening to the outside world in 2018, external order revenue is gradually becoming an important source of income for JD Logistics, Inc.. Among them, JD Logistics, Inc. CEO Wang Zhenhui once revealed that JD.com 's personal parts business currently accounts for 40 per cent of JD Logistics, Inc. 's total revenue.

Although JD.com has not yet admitted his direct relationship with Zhongyou Express, he has stamped his identity as an ecological partner, and Zhongyou can also bring him more external orders. CSC FINANCIAL CO.,LTD estimated that JD Logistics, Inc. 's Q3 revenue in 2019 was about 40 billion yuan, of which external order revenue reached 16 billion yuan, an increase of 94 percent over the same period last year.

The possible strategic cooperation between Pinduoduo and Ji Rabbit is a new variable in this competition. Pinduoduo has been reducing logistics costs to the extreme through the advantage of flow. In an extreme example, "the single price sent to the whole country in Yiwu is as low as 8 Mao." in addition, Pinduoduo has built the second largest electronic noodle order system, which is very attractive to merchants.

Pinduoduo has gradually revealed his ambition in the field of logistics, both the electronic noodle sheet and the extreme rabbit show his desire to get rid of the dependence on social logistics, especially BABA's access system. However, cost and infrastructure work are still two difficulties facing the extreme rabbit.

The construction of the logistics system is not a day's work, as an outsider, it is very difficult for Ji Rabbit to complete the national layout in a short period of time, and capital can not help in the pursuit of efficiency. However, a businessman told 36Kr Holdings that with the epidemic or accelerating the integration of the industry, Pinduoduo and Ji Rabbit also have the opportunity to attract local logistics companies.

In 2020, the competition for e-commerce parts will enter a new level. BABA may still choose to solve the problem of logistics layout by means of capital, but JD.com and Pinduoduo are pressing step by step, and BABA's pace has to be faster.

Edit / Jeffy